Summary

You've got a brilliant idea. Maybe even a working product. Now you need money to prove its worth and that means one thing: you need a pitch deck.

But here's where most founders trip up. They think a pitch deck is a slideshow about their company. Wrong. A pitch deck is your startup's story, compressed into 10-15 slides that either open doors or close them.

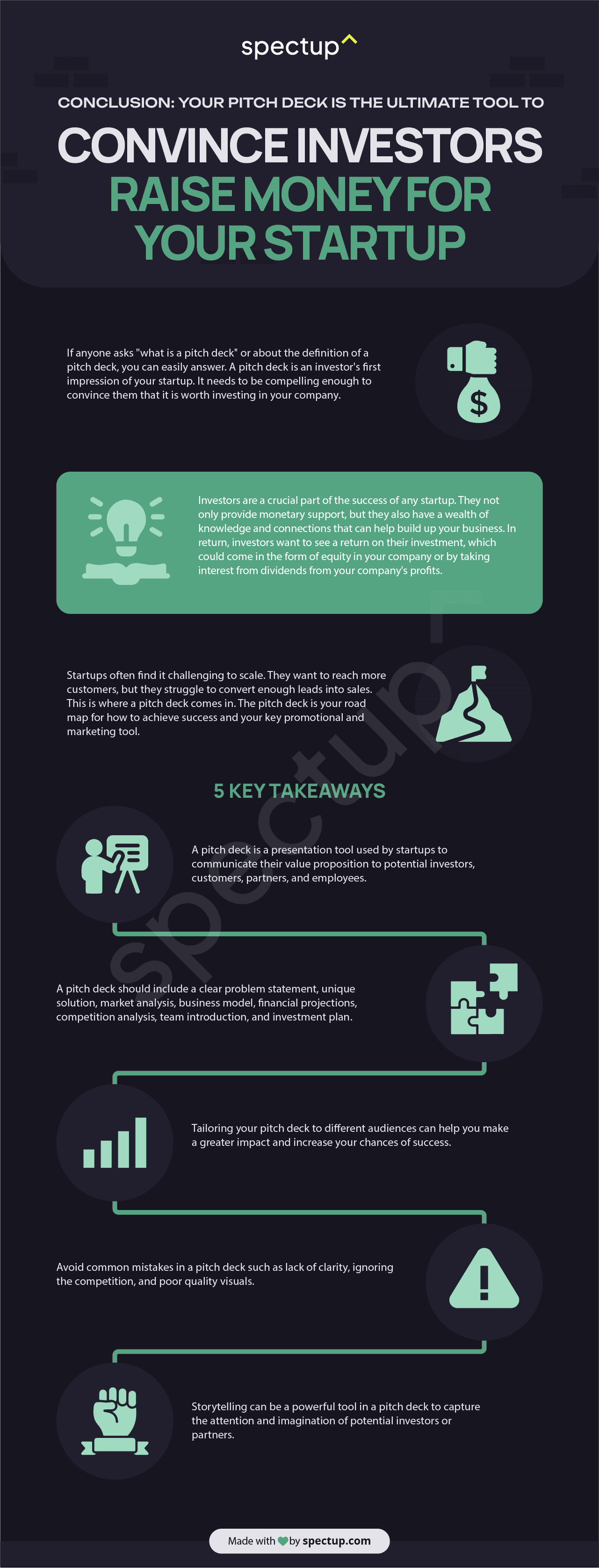

TL;DR: A pitch deck is a visual presentation that tells your startup's story to investors, covering your problem, solution, market, traction, team, and funding ask. It's not about pretty slides. Rather, it's about a compelling narrative that makes investors want in. Often, it's the single deciding factor between "let's talk" and "pass" during capital raising. At spectup, we help founders turn messy ideas into investor-ready narratives and offer pitch deck design services.

What Is a Pitch Deck? And Why It Makes or Breaks Your Raise

A pitch deck is a concise visual presentation, typically 10-15 slides, that tells investors who you are, what problem you solve, why your solution wins, and what you need to make it happen. It's not a business plan or a product demo. It's your startup's story, distilled into a format that can be consumed in minutes and forwarded in seconds.

Think of it as your startup's trailer. A movie trailer doesn't show you everything, it just hooks you, creates intrigue, and makes you want more. Your pitch deck does the same. It earns you the meeting, that leads to capital raising.

An average VC sees between 1,000 to 4,000 pitch decks per year. Top-tier firms? Even more. That's 20 to 80 decks landing in inboxes every single week. Hence, most get less than three minutes of attention. Many get less than one.

Out of those thousands, a typical VC invests in maybe 1-3% of what they see. Some firms close fewer than 10 deals a year from thousands of submissions.

Your deck isn't competing against your direct competitors. It's competing against every other startup fighting for that same investor's attention, across every sector, every stage, every geography.

When and Why You Need a Pitch Deck?

A pitch deck isn't just for fundraising. It's your startup's Swiss Army knife, useful in more situations than most founders realize.

Raising Capital

This is the obvious one. Whether you're pitching angels at pre-seed, VCs at Series A, or growth equity at Series C, you need a deck. No deck, no meeting. It's that simple.

But, there is this misconception that One pitch Deck can do all jobs. That is not the case. Different investors need different decks.

An angel investing $50K cares about different things than a VC writing $5M. Same story, different emphasis. One size fits none.

Applying to Accelerators

While applying to accelerators, Y Combinator, Techstars or 500 Global, pitch deck is required. It's often the first filter, before they read your application, before they watch your video, before they decide if you're worth 10 minutes on a call.

A weak pitch deck here doesn't just cost you the program. It costs you:

Network

Mentorship

Credibility that comes with the badge.

Closing Big Clients or Partnerships

Fundraising isn't the only sale you'll make.

Enterprise clients want to know you're legit before signing contracts.

Strategic partners want to understand your vision before aligning their brand with yours.

A sharp pitch deck, adapted for the audience, can close deals that have nothing to do with investors. Same storytelling muscle, different outcome.

Recruiting Key Talent

Top candidates have options. They want to join a rocket ship, not a sinking boat. A compelling deck shows them the vision, the traction, and why this is the opportunity they shouldn't pass up.

Your pitch deck isn't just for people with checkbooks. It's for anyone you need to believe in what you're building.

In other words, we can say a pitch deck is your startup's story, but packaged for impact. You'll use it more often than you think, in more situations than you expect. Build it once. Build it right but you can adapt it as much as needed.

Key Components of a Pitch Deck

Here are the 12 components that make investors lean in:

1. Introduction Slide

Lets picture this, your pitch deck first slide is like your opening act, the first glance that either hooks your audience or makes them reach for their phone. You've got seconds, due to less attention span.

Your company name, logo, and tagline should set the stage. But don't stop there. Add something unforgettable:

Scroll-stopping fact

A jaw-dropping stat

One-liner that nails what you do with flair.

Or a bold claim that demands attention

Make them sit up and think, "Now this is interesting."

Here is how you should be adding details in pitch deck:

Company name and logo front and center

One-line description that a stranger would understand

A hook

Pro Tip: Start with a compelling story or shocking statistic that grabs attention before you've even introduced yourself.

2. Problem Statement - Phrase it like a Villain

Every blockbuster trailer or film needs a villain. Yours is the problem you're solving. Think of it as showing a crack in the foundation that only you know how to fix.

Be blunt.

Be clear.

Toss in a relatable story or vivid image that makes investors feel that crack deep in their bones.

You're not just pointing out a gap, it's like making them see the chasm.

Define the problem in human terms.

Use real examples or statistics that make it tangible

Make them feel the pain before offering the cure

Pro Tip: If investors don't feel the problem viscerally, they won't care about your solution. Spend time here.

Solution Overview - Reveal Your Hero

Now you're the hero swooping in to save the day. The villain's been established—time to reveal your secret weapon.

Don't show like a feature dump. Instead, be creative as it's your origin story moment.

Lay out your unique selling points and make them pop.

Use sharp visuals and crisp descriptions to show how your product isn't just a band-aid.

It's a game-changer.

Explain your solution in one clear sentence

Highlight what makes you different from everything else out there

Show, don't tell.

One picture is worth a Thousand Words

Pro Tip: If you can't explain your solution to a stranger in 10 seconds, it's too complicated. Simplify until it clicks.

If you are unsure and have little design sense, outsource this to best pitch deck design agency to make sure your deal is not falling apart due to design issues.

4. Market Opportunity - The stakes

This is where investors start leaning forward. They want to see the gold at the end of the rainbow.

How big is the battle you're fighting?

Is the prize worth winning?

You need to make sure that the market size is worth-betting. Use these angles:

Spell out the market size.

Break it into chunks.

Show forecasts.

Paint a picture of a market that's ripe and ready for picking. It's not just about big numbers, it's about proving you've done your homework and know exactly where to dig for treasure.

TAM, SAM, SOM, but make it meaningful, not jargon soup

Segment your target market clearly

Use credible sources, investors will check

Pro Tip: A huge market means nothing if you can't show how you'll capture a piece of it. Be specific about your entry point.

5. Product or Service Overview

Here's your chance to show what the hero is carrying into battle. Go deeper than the solution slide, this is where features become superpowers.

Don't just tell; show.

Use demos, screenshots, testimonials.

Make your product leap off the screen and into their hands.

Investors should finish this slide thinking, "I get it, and I want it."

Key features framed as benefits, not specs

Demos, screenshots, or short video clips

Customer quotes that prove real-world value

Pro Tip: One killer feature explained well beats ten features explained poorly. Focus on what matters most.

6. Business Model

This is the nitty-gritty. You've shown them the treasure exists. Now show them the map to get there. How do you actually make money?

This isn't the time for complexity. Draw a clear line from user to revenue.

Subscription

Transaction fees

Licensing

Freemium to paid

Spell it out so simply that your grandmother could explain it back to you.

Revenue streams clearly defined

Pricing model explained

Path from free user to paying customer (if applicable)

Pro Tip: If your business model needs a flowchart with 15 boxes, simplify it. Confusion kills deals.

Investors want to see a well-oiled machine. Make sure to illustrate it like that and not a jumbled mess.

7. Traction and Milestones

Talk is cheap. This is where you show receipts. The trailer moment where the explosion already happened, proof that this isn't just a pitch, it's a reality.

Users.

Revenue.

Growth rate.

Retention.

Partnerships.

Press.

Whatever proves momentum, put it here. Investors love potential but above all, they want to see the evidence that claims that you are rolling in market smoothly.

Key metrics: users, revenue, MRR, growth rate

Major milestones hit: product launches, partnerships, press

Trajectory, show the trend line, not just a snapshot

Pro Tip: No traction yet? Show momentum. Waitlists, LOIs, pilot programs, user feedback. Something is always better than nothing.

8. Marketing and Sales Strategy

Even best ideas can fail, if they are relying on 'We will go viral' strategy. You've got a great product. Now how do you get it into customers' hands? Investors want to see an organized army, ready to do branding for you.

It's like we are living in digital era and if you are missing aspects, you are leaving money on stakes.

Lay out your channels.

Explain your funnel.

Show that you understand how to acquire customers and at what cost.

This is where you prove the machine can scale.

Customer acquisition channels identified

CAC and conversion rates (or targets if early)

Sales process mapped, from lead to close

Pro Tip: "We'll go viral" isn't a strategy. Show specific, repeatable tactics that you've tested or plan to test.

9. Competitive Analysis

Every hero has rivals. Pretending you don't have competitors is a red flag. Investors want to see you understand the battlefield, and why you win.

Map out the landscape.

Show where competitors fall short.

Position yourself clearly.

This isn't about trash-talking, instead it's about proving you've studied the game and found your edge.

Competitor landscape mapped (matrix or positioning chart works well)

Your key differentiators highlighted

Why customers choose you over alternatives

Pro Tip: "We have no competitors" tells investors you haven't done your research. Every solution competes with something, even inaction.

10. Team of Avengers

Execution is everything. Everyone can dream and have big mouth, but only a few can scale by taking action and doing required strategies. This is where you show investors the squad that's going to make it happen.

Highlight relevant experience.

Show complementary skills.

Prove this team has what it takes to navigate the inevitable chaos of building a startup.

Investors bet on people first, ideas second.

Founders with relevant background and domain expertise

Key hires that fill critical gaps

Advisors or board members that add credibility

Pro Tip: First-time founders aren't disqualified, but you need to show you've assembled people who've been in the trenches before.

11. Financial Projections

Now for the crystal ball. Alot of founders find numbers dry and boring. That is why, they stuck while capital raising. Where is this thing headed? Investors want to see you've modeled the future, and that your assumptions aren't fantasy.

Keep it realistic. Hockey sticks with no logic get laughed out of the room. Show you understand your own numbers. If you are unclear, hire top financial modeling experts.

3-5 year revenue projections

Key assumptions clearly stated

Burn rate and runway visibility

Pro Tip: Investors don't expect you to predict the future perfectly. They expect you to think rigorously about it.

Investment Ask — The Call to Action

This is the slide missed by alot of founders. They either feel shy or reluctant to add this, but they forget that they are standing in front of podium for capital raising. Being shy will not make your idea work. The trailer has ended and the screen went blank.

You need to make sure that 'Coming Soon' arrives early and is not buried in startup graveyard.

This is your version. Be bold and clarly ask:

How much are you raising? What does it buy? What milestones does it unlock? Be specific. Vague asks get vague responses, or no response at all.

Funding amount clearly stated

Use of funds broken down

Milestones the capital will unlock

Pro Tip: Tie your ask directly to value creation. "$2M gets us to $1M ARR and Series A readiness" beats "$2M for growth."

When you're done, ask yourself: would this trailer make someone buy a ticket? If the answer is "maybe," keep editing. The goal isn't to inform, it's to excite.

A forgettable deck gets forgotten. A compelling deck gets meetings. Make every slide earn its place.

Types of Pitch Decks

Just like human beings come with variations in terms of every trait. So, do pitch decks. One deck doesn't fit all battles. The pitch deck you email isn't the one you present. The deck for investors isn't the one for customers. Smart founders build an arsenal, each weapon designed for a specific fight.

Here's your armory:

Email Pitch Decks are like the Blueprint

This deck travels without you. It lands in inboxes, gets forwarded to partners, sits in folders waiting to be read at 11pm. It needs to stand completely alone.

More detail, more context, more explanation

Key metrics front and center

Self-explanatory slides, no presenter required

Usually 15-20 slides with supporting data

When to use it: Cold outreach, warm intros, follow-ups after meetings, accelerator applications.

Presentation Pitch Decks perform on your Behalf

This is your live show. You're in the room, the deck is your sidekick, not the star. Heavy text kills the vibe. Let visuals do the work while you do the talking.

Minimal text, maximum impact

High-quality images and clean design

Each slide sparks conversation, not reading

Usually 10-12 slides you can cover in 10-15 minutes

When to use it: In-person meetings, demo days, pitch competitions, video calls where you're presenting live.

Elevator Pitch Decks are Snapshot of your Story

You've got 60 seconds. Maybe less. This deck distills everything into a few punchy slides that hit hard and fast.

3-5 slides maximum

Core problem, solution, traction, ask—nothing else

Big fonts, bold statements, zero fluff

Designed to spark curiosity, not close deals

When to use it: Networking events, chance encounters, quick intro meetings, the literal elevator.

Sales Pitch Decks must act like Closers

This isn't for investors, instead your ICP here are 'Customers'. The goal isn't funding; it's conversion. You're turning interest into action, curiosity into commitment.

Problem → Solution → Value prop → Features → Demo → Pricing

Narrative arc that leads to a decision

Case studies and social proof heavy

Clear call to action at the end

When to use it: Sales meetings, enterprise pitches, partnership discussions, closing calls.

Product Pitch Decks are The Deep Dives

Launching something new? This deck goes deep. Features, roadmap, go-to-market strategy, customer benefits, all laid out in detail.

Detailed product descriptions and feature highlights

Development timeline and future updates

Market positioning and customer use cases

Technical enough to satisfy, clear enough to inspire

When to use it: Product launches, internal alignment, strategic partner discussions, press briefings.

Competition Pitch Decks are like The Arena Fighter

Startup competitions are a different beast. Judges see dozens of pitches in a day. You need to stand out, score points, and be memorable.

Innovation and scalability front and center

Market impact quantified and visualized

Competitive edge crystal clear

Designed to captivate in strict time limits (usually 3-5 minutes)

When to use it: Demo days, pitch competitions, accelerator showcases, startup battles.

Pitch decks are like the family, that comes with variations and diversity. Each document has it's own role and it fulfils its job accordingly.

Common Mistakes to Avoid

Crafting a pitch deck is like walking a tightrope. One wrong step and, whoops, you’re tumbling down. Here are some common mistakes to steer clear of:

Overloading slides with information: Less is more, my friends.

Neglecting the visual design: Pretty matters. It really does.

A lack of focus on the key message: Keep your eyes on the prize.

Using too many slides: Quality over quantity.

Avoid these pitfalls to keep your pitch deck clear and punchy, ensuring your audience gets your message without feeling lost or overwhelmed. Still unsure? Look out for pitch deck experts.

Learning from the Best Pitch Decks that got Funded:

Ever tried following a recipe from a top chef? Sometimes, seeing how the pros do it makes all the difference. The same goes for pitch decks. Some of the biggest names. Airbnb, Uber, Buffer, WeWork. nailed their presentations and have a lot to teach us.

Airbnb

Airbnb's pitch deck is like the Cinderella story of startups. They zeroed in on the high cost of hotels, presenting affordable lodging with local hosts as the perfect slipper. Their solution was simple yet game-changing, catering to a massive travel market. By showcasing rapid user adoption, they clearly highlighted a solid market fit.

Investors saw the immense opportunity waiting to be seized.

Conclusion: Airbnb's success lay in identifying a universal problem and presenting a straightforward, scalable solution.

Pro Tip: Focus on how your solution addresses a widespread issue and make sure your market fit is crystal clear.

Uber

Uber tackled a universal headache:

Unreliable

Pricey transportation.

Their on-demand ride-sharing model was a breath of fresh air. The pitch deck laid out a huge urban transportation market just waiting for disruption. By illustrating their expansion into multiple cities and a growing user base, Uber painted a vivid picture of a service the public was eager to embrace. They didn’t just promise change, they proved it was happening.

Conclusion: Uber's pitch deck effectively communicated their disruptive potential and rapid market adoption.

Pro Tip: Demonstrate how your business is already making an impact and show clear evidence of market demand.

Hiring Pitch Deck Consultants

Sometimes, even the best need a bit of help. That’s where pitch deck consultants come in. These experts can add a layer of polish and professionalism that might just give your deck the edge it needs. Let’s look at when to call in the pros, the benefits they bring, and how to pick the right one.

When to Consider Hiring a Consultant

Knowing when to bring in a pitch deck consultant is crucial. If you’re wrestling with a lack of in-house expertise, running short on time, or facing a high-stakes investor pitch, a consultant can step in. They’re particularly handy when you’ve got investor pitches lined up but your deck still needs that professional touch.

Benefits of Professional Assistance

Here’s what a good consultant brings to the table:

Expert design and storytelling skills

Enhanced credibility for your pitch deck

Comprehensive market research

Refined brand messaging

Accurate financial projections

Tailored strategies for different funding stages

These elements make your deck more persuasive, boosting your chances of securing investment. Look out for top pitch deck design experts to help you out.

Your Pitch Deck is more than just a bunch of slides

It's a strategic tool that captures your business's essence and potential. By mastering the key components, tailoring your deck for different funding stages, and sidestepping common pitfalls, you can create a pitch deck that stands out.

Now, with these insights in your toolkit, you’re ready to craft a pitch deck that not only tells your story but turns listeners into believers and believers into investors. Still need help? spectup is just a mail away to help you out.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.