Summary

A winning pitch deck is a crucial component of any startup's fundraising efforts. It is a well-designed and persuasive presentation that has a clear and compelling story, a clever structure, and the ability to showcase your startup's potential to investors. A pitch deck is essentially a visual representation of your business plan, highlighting key aspects of your startup such as your target market, competition, and financial projections.

When crafting your pitch deck, it's important to remember that investors are often inundated with pitches from other startups, so it's crucial to make a strong first impression. This means that your deck should be visually appealing and easy to navigate, with a clear and concise message that grabs the investor's attention from the get-go.

In order to achieve this, you'll need to carefully consider the components of your pitch deck and the order in which they appear. A solid pitch deck outline typically includes slides that cover your company's problem statement, solution, market size, competition, revenue model, team, and financials. However, the exact content and structure of your pitch deck will depend on your specific startup and the audience you're presenting to. It is important to follow the Pitch Deck Structure as well as create a Pitch Deck Outline to guide you in creating a winning pitch deck that will help you secure funding for your startup.

So, whether you're a seasoned entrepreneur or a first-time founder, this lesson will guide you through the process of creating a winning pitch deck that will leave investors excited about your startup's potential. If you don’t want to do all the work yourself, but you’re unsure if you can afford a professional helping you out, take a look at How Much Does A Pitch Deck Cost?

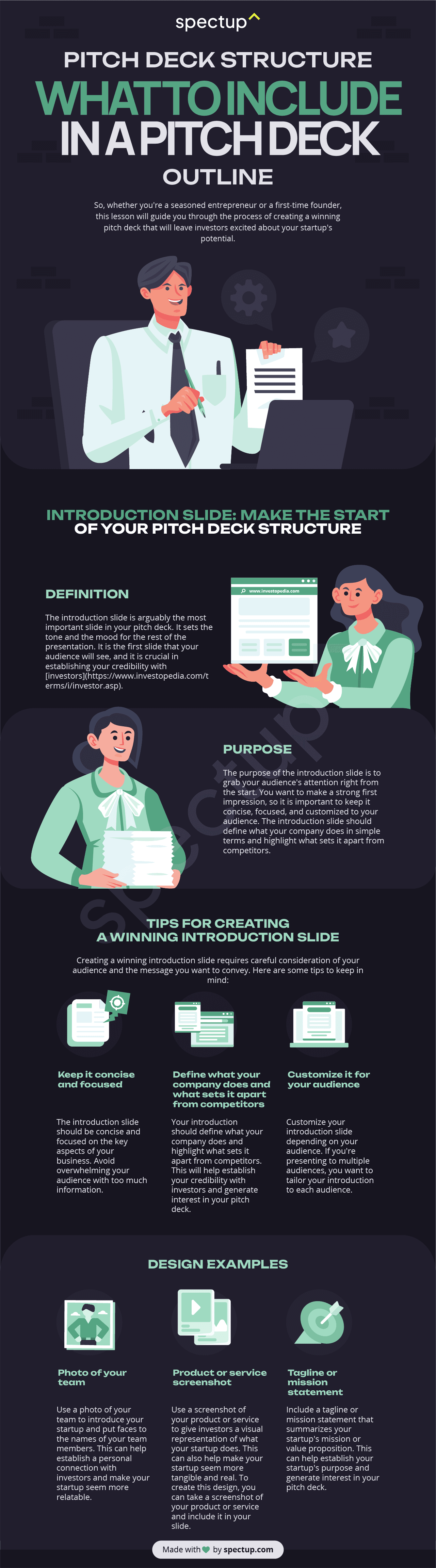

Introduction Slide: Make the Start of your Pitch Deck Structure

Definition

The introduction slide is arguably the most important slide in your pitch deck. It sets the tone and the mood for the rest of the presentation. It is the first slide that your audience will see, and it is crucial in establishing your credibility with investors.

The introduction slide provides an overview of your business and its opportunity, and is often the first impression investors will have of your startup. It includes a brief background on the founders, any founding partners, CEO or senior managers, as well as any other key executives who may be involved in making decisions related to the business's success. It can be helpful to have a fundraising consultant review your introduction slide to ensure it is tailored to your target audience and effectively conveys your startup's potential.

Purpose

The purpose of the introduction slide is to grab your audience's attention right from the start. You want to make a strong first impression, so it is important to keep it concise, focused, and customized to your audience. The introduction slide should define what your company does in simple terms and highlight what sets it apart from competitors.

A well-designed introduction slide can establish your credibility with investors and generate interest in your pitch deck. It is an opportunity to showcase your startup's potential and persuade investors to take a closer look at your business.

Tips for Creating a Winning Introduction Slide

Creating a winning introduction slide requires careful consideration of your audience and the message you want to convey. Here are some tips to keep in mind:

Keep it concise and focused: The introduction slide should be concise and focused on the key aspects of your business. Avoid overwhelming your audience with too much information.

Define what your company does and what sets it apart from competitors: Your introduction should define what your company does and highlight what sets it apart from competitors. This will help establish your credibility with investors and generate interest in your pitch deck.

Customize it for your audience: Customize your introduction slide depending on your audience. If you're presenting to multiple audiences, you want to tailor your introduction to each audience.

Design Examples

Photo of your team: Use a photo of your team to introduce your startup and put faces to the names of your team members. This can help establish a personal connection with investors and make your startup seem more relatable.

Product or service screenshot: Use a screenshot of your product or service to give investors a visual representation of what your startup does. This can also help make your startup seem more tangible and real. To create this design, you can take a screenshot of your product or service and include it in your slide.

Tagline or mission statement: Include a tagline or mission statement that summarizes your startup's mission or value proposition. This can help establish your startup's purpose and generate interest in your pitch deck.

Market Challenges and Problems: The Core of Your Pitch Deck

Definition

The problem slide is typically the most important slide in a pitch deck and also for the Pitch Deck Outline. It encapsulates all of your content and most likely the core message you want to convey.

This section of a Pitch Deck has the goal of raising awareness about a specific set of problems. It usually has three parts: A description of the problem, what it is costing the company, and what actions are being taken to solve it. The Problem Slide should be short enough to capture attention but long enough to provide all the necessary information.

Purpose

The purpose of the problem slide in your pitch deck outline is to showcase the market challenges and problems that your startup aims to solve, and how solving these problems can benefit your target audience. This slide serves as an opportunity to demonstrate the relevance of your startup and generate interest in your pitch deck.

Tips for Creating a Winning Problem Slide

Be specific: The problem slide should be specific to the market challenges and problems that your startup aims to solve. Avoid using generalizations that do not apply to your target audience.

Highlight the cost of the problem: Your problem slide should highlight the cost of the problem to your target audience, whether it is financial, social, or environmental.

Think from the other perspective: When creating a problem slide, try to think from the perspective of your target audience. What would be the biggest pain points for them? By putting yourself in their shoes, you can make the problem seem even more urgent and important to solve.

Make the problem huge: Highlighting the potential consequences and impact of not solving the problem can help make it seem even larger and more pressing. This can help motivate investors to take action and invest in your startup.

Design Examples

Before and After Comparison: Use a split-screen image to show the current state of the problem on one side and what it could look like after your solution has been implemented on the other side. This can help emphasize the value of your startup and the importance of solving the problem.

Infographic: Use an infographic to visually represent the market challenges and problems that your startup aims to solve. This can help investors understand the problem and generate interest in your pitch deck.

Real-life Examples: Use real-life examples to illustrate the problem you are solving. This can help make the problem seem more urgent and important to solve. To create this design, you can use images or videos that showcase the problem in action.

Statistics: Use statistics to illustrate the scope and impact of the problem you are solving. This can help investors understand the market potential of your startup. To create this design, you can use data visualization tools like Tableau or Excel to create charts and graphs.

Solution Slide: Highlighting Your Unique Approach to Problem-Solving

Definition

The solution slide is a vital component of a pitch deck and should never be missing from a Pitch Deck Outline. It summarizes the key elements of a business and provides a map for investors to understand your company's vision. It is a concise and visual representation of your product or service, designed to capture the audience's attention and generate interest in your offering. A well-designed solution slide can be further enhanced with investor outreach services to help attract potential investors and secure funding for your startup.

Purpose

The purpose of the solution slide in your pitch deck is to showcase your startup's unique and innovative approach to solving problems. It is an opportunity to communicate how your product or service solves the customer's problem and provides a solution that is not currently available in the market.

Tips for Creating a Winning Solution Slide

Focus on your Value Proposition: Clearly articulate the benefits that customers will receive from using your product or service, and how it solves their problem.

Make it unique: Highlight what sets your product or service apart from competitors. This will help establish your credibility with investors and generate interest in your pitch deck.

Provide examples: Help investors understand how your product or service works in everyday life by providing relatable examples. This can make the solution seem more practical and applicable to the real world.

Communicate clearly: Keep your pitch concise and focused on the key features of your product or service. Avoid overwhelming your audience with too much information.

Design Examples

Process Diagram: Use a step-by-step diagram to visually represent how your product or service solves the customer's problem. This can help investors understand the process and the value of your solution.

Product Screenshot: Include a screenshot of your product or service to give investors a visual representation of what your company does. This can also help make your solution seem more tangible and real.

Infographic: Use an infographic to visually represent the key features of your product or service. This can help investors understand the value proposition of your solution and the benefits it provides to the customer.

Demo Video: Include a demo video of your product or service to give investors a visual representation of how it works. This can help make your solution seem more tangible and real, and can also help investors understand how it solves the customer's problem.

Pitch Deck Structure: Opportunity Slide to Showcase Your Startup's Potential

Definition

The opportunity slide is a critical component of a pitch deck outline. It presents a summary of the unique opportunity that your startup is positioned to capture. This slide communicates the market potential for your solution and provides an overview of what makes your opportunity unique. To make sure that your opportunity slide delivers the message in a clear and compelling way, you may want to consider using professional presentation services to perfect your pitch deck.

Purpose

The purpose of the opportunity slide is to showcase how your startup has a unique opportunity to disrupt the market and provide a high-growth opportunity for investors. This slide should demonstrate how your startup is uniquely positioned to capture this opportunity and how you plan to execute your strategy.

The opportunity slide should detail any recent success stories and how they are making an impact in the industry. Finally, it should detail where the company is headed in terms of future goals and detailed plans for achieving them.

Tips for Creating a Winning Opportunity Slide

Show the potential: Clearly articulate the market potential for your solution, including the market size and potential for growth.

Explain why now: Investors need to know why now is the right time for them to invest in your business.

Identify market trends: Include market trends to showcase the potential for growth in your market and demonstrate how your startup is uniquely positioned to capture the opportunity. Additionally, discuss any emerging market trends that may benefit your startup in the future.

Design Examples

Market Size Infographic: Use an infographic to visually represent the market potential for your solution. This can help investors understand the size of the market and the potential for growth.

Customer Persona Image: Use an image of a fictional customer to represent your target audience. This can help investors understand who your product or service is designed for and generate interest in your pitch deck.

Pitch Deck Components: Product Slide to Showcase Your Startup's Solution

Definition

The product slide is the centerpiece of a pitch deck, where you showcase the unique value proposition of your startup's solution or product. This slide should communicate the features and benefits of your product in a visually compelling way and show how it addresses the pain points of your target audience.

Purpose

The purpose of the product slide is to showcase how your startup's solution or product provides a unique value proposition and solves a real problem or addresses a real opportunity. This slide should communicate the features and benefits of your product in a clear and concise way and show how it addresses the pain points of your target audience.

The product slide should also demonstrate how your startup is uniquely positioned to deliver this solution and how you plan to execute your strategy.

Tips for Creating a Winning Product Slide

Focus on benefits: Clearly articulate the benefits of your product or solution, and how it addresses the pain points of your target audience.

Showcase features: Highlight the key features of your product that make it stand out from competitors.

Provide evidence: Include data or customer testimonials to demonstrate the effectiveness of your solution or product.

Design Examples

Product Showcase Video: Use a video to showcase the features and benefits of your product in action. This can help investors or potential customers visualize your product and generate interest in your pitch deck.

Prototype Showcase: Use a prototype or demo to showcase your product in action. This can help investors or potential customers visualize your product and generate interest in your pitch deck. You could also consider using a video or screen recording to showcase the prototype or demo, making it easy for investors or potential customers to see the product in action from the comfort of their own computer.

Remember to keep your product slide focused, clear, and engaging, with a strong narrative that tells a story about your startup's solution or product.

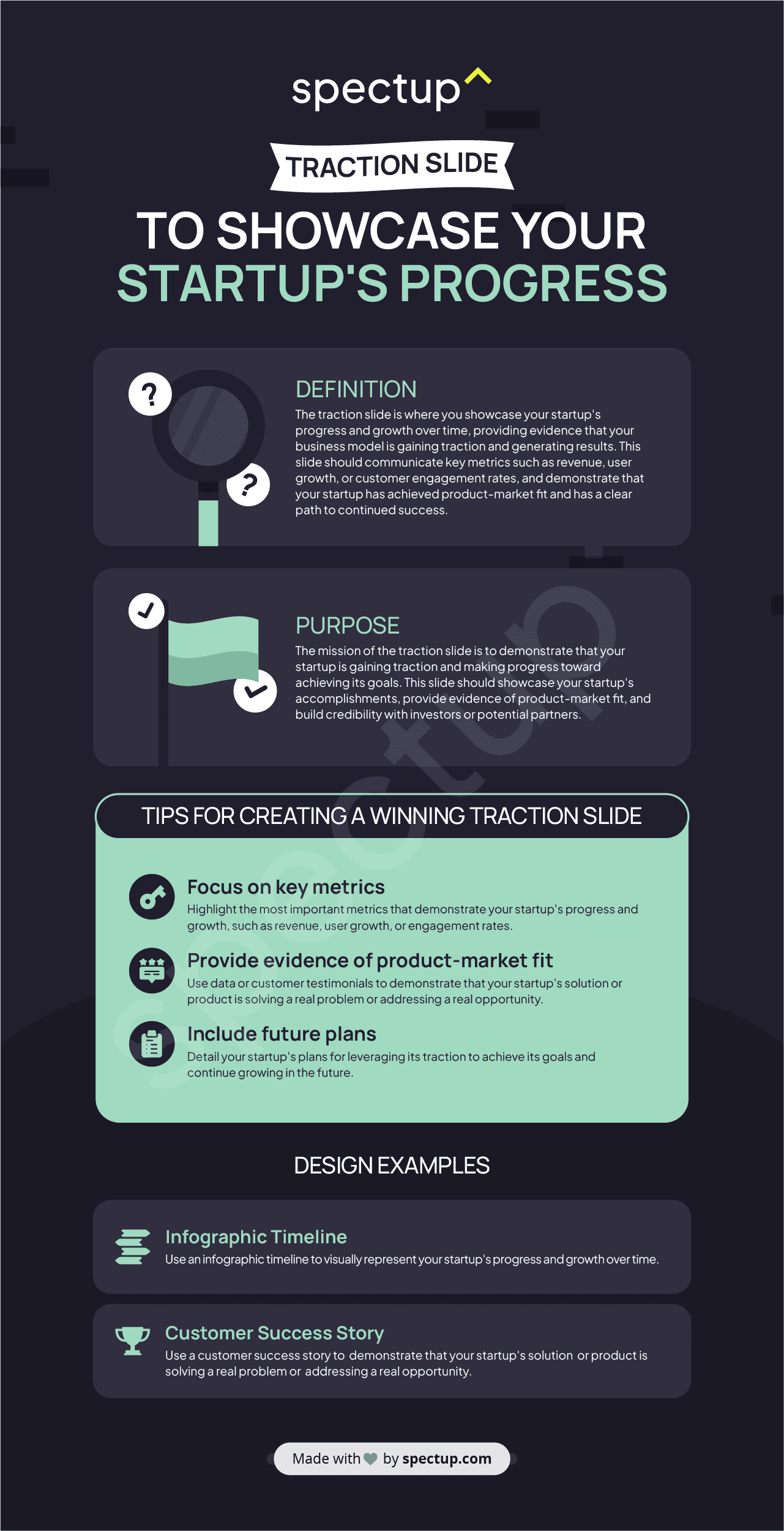

Traction Slide to Showcase Your Startup's Progress

Definition

The traction slide is where you showcase your startup's progress and growth over time, providing evidence that your business model is gaining traction and generating results. This slide should communicate key metrics such as revenue, user growth, or customer engagement rates, and demonstrate that your startup has achieved product-market fit and has a clear path to continued success.

Purpose

The mission of the traction slide is to demonstrate that your startup is gaining traction and making progress toward achieving its goals. This slide should showcase your startup's accomplishments, provide evidence of product-market fit, and build credibility with investors or potential partners.

The traction slide should also demonstrate how your startup plans to leverage this traction to achieve its goals and continue growing in the future.

Tips for Creating a Winning Traction Slide

Focus on key metrics: Highlight the most important metrics that demonstrate your startup's progress and growth, such as revenue, user growth, or engagement rates.

Provide evidence of product-market fit: Use data or customer testimonials to demonstrate that your startup's solution or product is solving a real problem or addressing a real opportunity.

Include future plans: Detail your startup's plans for leveraging its traction to achieve its goals and continue growing in the future.

Design Examples

Infographic Timeline: Use an infographic timeline to visually represent your startup's progress and growth over time. This can help investors or potential partners understand the trajectory of your startup and build confidence in your business model.

Customer Success Story: Use a customer success story to demonstrate that your startup's solution or product is solving a real problem or addressing a real opportunity. This can help investors or potential partners understand the impact of your startup and generate interest in your pitch deck.

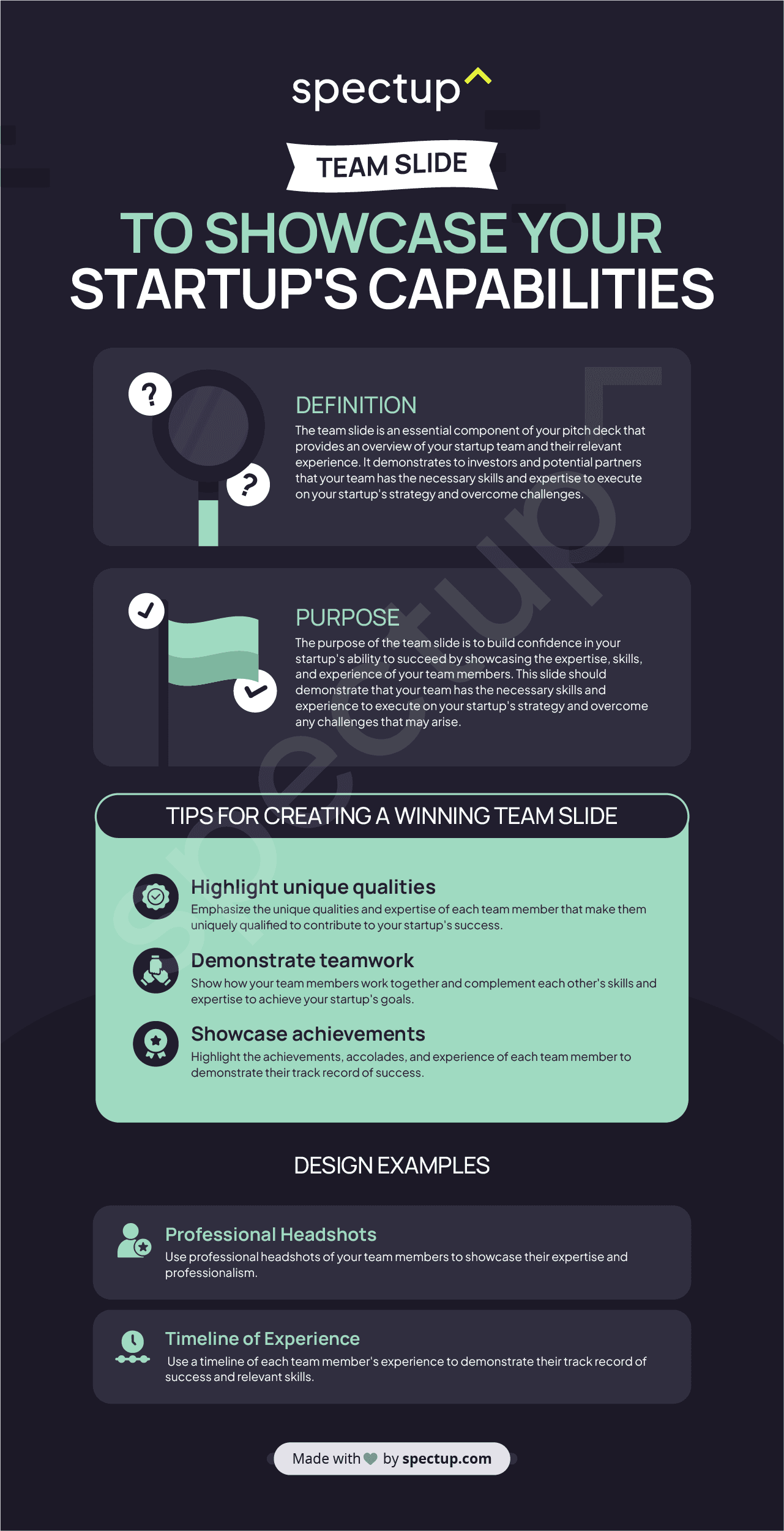

Team Slide to Showcase Your Startup's Capabilities

Definition

The team slide is an essential component of your pitch deck that provides an overview of your startup team and their relevant experience. It demonstrates to investors and potential partners that your team has the necessary skills and expertise to execute on your startup's strategy and overcome challenges.

Purpose

The purpose of the team slide is to build confidence in your startup's ability to succeed by showcasing the expertise, skills, and experience of your team members. This slide should demonstrate that your team has the necessary skills and experience to execute on your startup's strategy and overcome any challenges that may arise.

The team slide should also communicate how your team members work together and complement each other's skills and expertise. This can demonstrate your startup's strong organizational culture and its ability to attract and retain top talent.

Tips for Creating a Winning Team Slide

Highlight unique qualities: Emphasize the unique qualities and expertise of each team member that make them uniquely qualified to contribute to your startup's success.

Demonstrate teamwork: Show how your team members work together and complement each other's skills and expertise to achieve your startup's goals.

Showcase achievements: Highlight the achievements, accolades, and experience of each team member to demonstrate their track record of success.

Design Examples

Professional Headshots: Use professional headshots of your team members to showcase their expertise and professionalism.

Timeline of Experience: Use a timeline of each team member's experience to demonstrate their track record of success and relevant skills.

Competition Slide: Evaluating Your Competitors and Identifying Your Competitive Advantage

Definition

The competition slide's mission is to evaluate your competitors and identify your competitive advantage. This slide showcases your startup's understanding of its competitive landscape, highlighting your unique value proposition, and building credibility with investors and potential partners.

Purpose

The pitch deck competition slide provides an overview of your startup's competitive landscape and how it plans to overcome challenges and obstacles presented by competitors. This slide demonstrates your startup's ability to adapt and innovate to maintain a competitive advantage in the future.

Tips for Creating a Winning Competition Slide

Identify your competitors: Provide an overview of your key competitors and their strengths and weaknesses, demonstrating your understanding of the competitive landscape.

Differentiate your startup: Clearly articulate how your startup differentiates itself from its competitors and why it has a unique value proposition that sets it apart.

Communicate future plans: Detail your startup's plans for maintaining a competitive advantage in the future and how you plan to stay ahead of your competitors.

Design Examples

Comparison Chart: Use a comparison chart to visually compare your startup's strengths and weaknesses to those of your competitors. This can help investors or potential partners understand how your startup differentiates itself and why it has a unique value proposition.

Competitor Analysis Matrix: Use a competitor analysis matrix to evaluate your competitors' strengths and weaknesses across different dimensions. This can help you identify areas where your startup can differentiate itself and gain a competitive advantage.

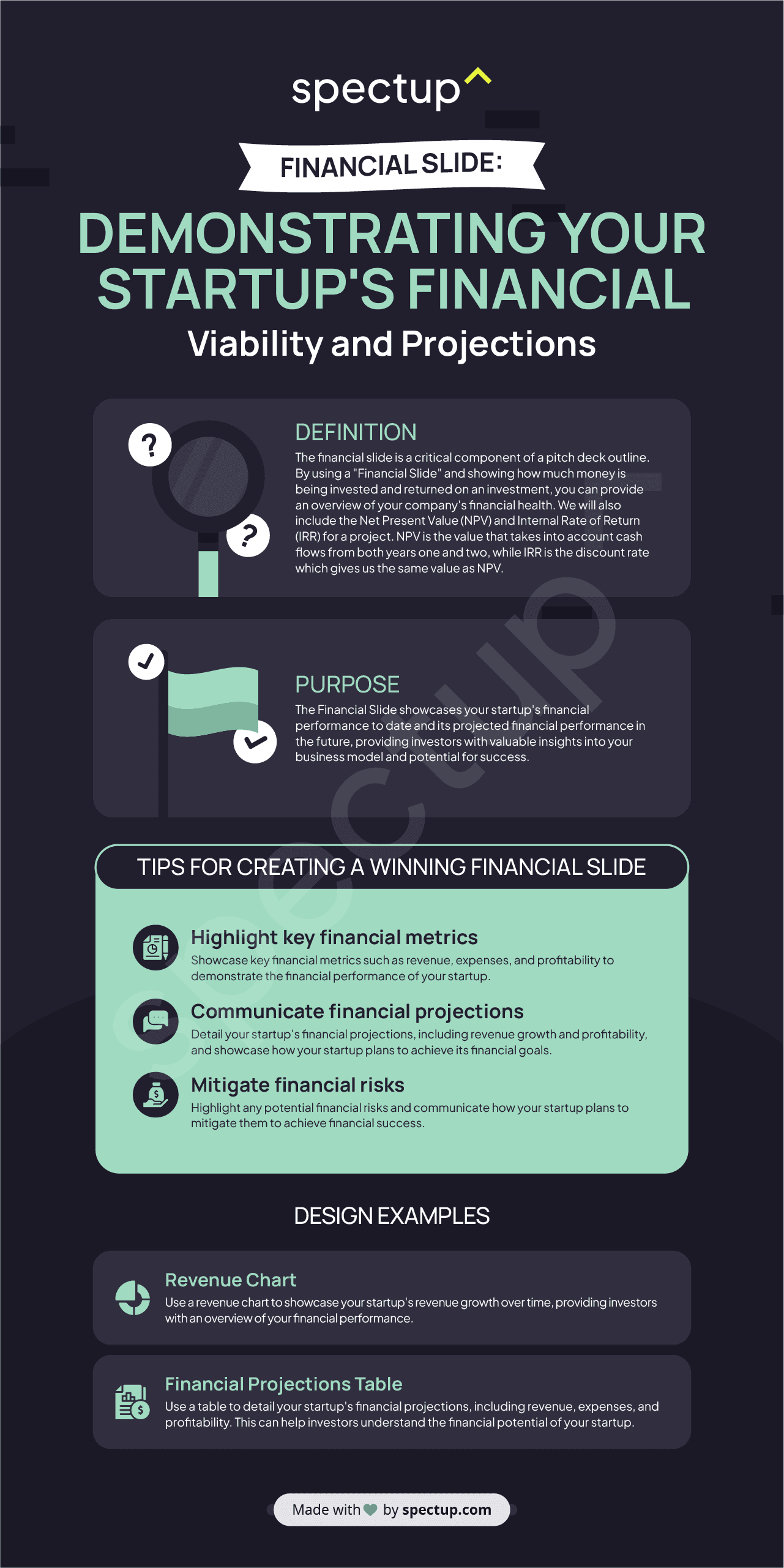

Financial Slide: Demonstrating Your Startup's Financial Viability and Projections

Definition

The financial slide is a critical component of a pitch deck outline. By using a "Financial Slide" and showing how much money is being invested and returned on an investment, you can provide an overview of your company's financial health. We will also include the Net Present Value (NPV) and Internal Rate of Return (IRR) for a project. NPV is the value that takes into account cash flows from both years one and two, while IRR is the discount rate which gives us the same value as NPV.

Purpose

The Financial Slide showcases your startup's financial performance to date and its projected financial performance in the future, providing investors with valuable insights into your business model and potential for success.

Tips for Creating a Winning Financial Slide

Highlight key financial metrics: Showcase key financial metrics such as revenue, expenses, and profitability to demonstrate the financial performance of your startup.

Communicate financial projections: Detail your startup's financial projections, including revenue growth and profitability, and showcase how your startup plans to achieve its financial goals.

Mitigate financial risks: Highlight any potential financial risks and communicate how your startup plans to mitigate them to achieve financial success.

Design Examples

Revenue Chart: Use a revenue chart to showcase your startup's revenue growth over time, providing investors with an overview of your financial performance.

Financial Projections Table: Use a table to detail your startup's financial projections, including revenue, expenses, and profitability. This can help investors understand the financial potential of your startup.

Investment Usage Slide: Communicating Your Startup's Funding Strategy

Definition

The Investment Usage Slide is where you communicate how your startup plans to use the funding it receives from investors to drive growth and achieve its strategic goals. This slide showcases your startup's financial acumen and ability to allocate resources effectively.

Purpose

The Investment Usage Slide provides investors with transparency regarding how their investment will be used and the potential outcomes. By showcasing your startup's investment strategy and demonstrating how funding will be used to achieve strategic goals, this slide helps build investor confidence and generate interest in your business.

The Investment Usage Slide also demonstrates your startup's potential for growth and the value of investing in your business. By communicating a clear vision for growth and the steps you plan to take to achieve it, this slide helps investors understand how their investment can contribute to your startup's success.

Tips for Creating a Winning Investment Usage Slide

Clearly articulate your startup's investment strategy and how funding will be used to achieve strategic goals.

Communicate a clear vision for growth and the steps you plan to take to achieve it.

Provide transparency regarding how funding will be allocated and the potential outcomes for investors.

Design Examples

Pie Chart: Use a pie chart to visually represent how funding will be allocated across different areas of your business. This can help investors understand where their investment is going and the potential outcomes.

Timeline Infographic: Use an infographic timeline to showcase your startup's growth strategy and how funding will be used to achieve it. This can help investors understand how their investment can contribute to your startup's long-term success.

Conclusion

Creating a winning pitch deck is essential for any startup looking to attract investors, partners, or customers. By following the tips and design examples outlined in this guide, you can create a pitch deck that showcases your startup's unique value proposition, demonstrates its potential for growth and success, and builds credibility with investors and potential partners.

Remember to tailor your pitch deck to each audience, focusing on the most important elements of your startup and communicating them clearly and concisely. With a well-designed pitch deck, you can generate interest in your startup, secure funding, and achieve your strategic goals.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.