The Realities of VC Warm Introductions:

VC warm introductions are often the key differentiator between startups securing meetings with top venture capitalists and those lost in a sea of unread emails. Venture capitalists prioritize trust signals far more than cold metrics, and there is no stronger trust signal than a warm introduction.

When a mutual contact personally introduces you to a VC, endorsing your credibility and potential, it establishes immediate trust and facilitates direct, meaningful conversations. Founders seeking investors, sales professionals targeting new clients, and professionals aware of the power of a robust network recognize that investor warm introductions open critical doors.

Ultimately, gaining direct access to high-level decision-makers through VC warm introductions significantly enhances the likelihood of success. Instead of cold outreach, leveraging a trusted mutual connection provides essential context and urgency that increases engagement

However, it's important to understand that VC warm introductions are not solely dependent on your network. They also require careful planning and execution on your part. Here are some key factors to consider:

How you ask: Craft a compelling message that clearly communicates the value you bring and why the executive should meet with you.

When you ask: Timing is crucial. Find out when the executive is most likely to be available and receptive to your request.

Making it easy for them: Respect their time by offering flexible options for meeting formats (in-person, phone call, video conference) and providing specific dates/times that work for you.

By mastering these elements of warm introductions, you'll increase your chances of getting VC meetings with busy executives..

Where do most deals actually come from?

Here’s the insider scoop:

Portfolio founder referrals: Founders who’ve been funded often recommend fellow entrepreneurs.

Fellow investor recommendations: VCs lean on their trusted peers for deal flow.

Operator and advisor intros: Experienced industry insiders connect promising founders.

Accelerators, scouts, and syndicates: These networks act as gatekeepers and amplifiers.

Cold outreach or social DMs? Rarely effective unless perfectly executed.

Why Warm Intros Work?

There are several key reasons why investor warm introductions are highly effective:

Time-efficient filtering mechanism: Avoid endless inbox scans.

Social vetting and reputational risk-sharing: Your introducer's credibility is at stake.

Reduces cognitive load when scanning decks: Trusted sources result in fewer headaches.

Prioritizes deals from already trusted sources: No time for strangers.

Understanding these dynamics reveals the underlying behavior of investors and strategic approaches to gaining access. It’s not just who you know, but who knows you that matters.

However, securing a meeting with a top-tier VC requires more than warm introductions alone. It is essential to grasp the broader context of startup innovation to strengthen your pitch. For example, insights into emerging technologies like the impact of quantum computing on startup innovation and security can highlight relevant areas of growth and technological advancement that appeal to investors.

By leveraging these resources and insights from experts like spectup, who guide startups through every stage—from ideation to fundraising & growth—you can position your startup in a way that attracts investors and facilitates scaling your business effectively.

The Cognitive Psychology Driving Investor Behavior

“VC Warm introductions beat cold emailing and cold calling. There’s faster time to revenue because trust is there. The conversions are higher due to better follow-through. And, the value of the conversations is higher because we’re working together in our partner ecosystem.” - Rich Patterson, VP of Sales at MasonHub

1. Social Proof (Default Trust Shortcut)

When someone they trust vouches for a founder, it fast-tracks interest

Reduces need for early validation — “if they trust them, I can trust them”

Used heavily in the absence of traction or metrics, a key example of social proof in venture capital.

This is where platforms like spectup come into play, providing investors with a curated selection of high-potential startups.

2. Pattern Recognition (Familiarity Bias)

VCs look for founder, market, or model similarities to past successes

Warm intros imply “this is someone like those I already invest in”

Familiarity increases perceived safety

In such scenarios, resources like this guide on validating startup ideas can be invaluable.

3. Loss Aversion (Fear of Missing Out)

VCs hate missing hot deals their peers back

A warm intro from a respected founder creates subtle FOMO

It raises the cost of inaction: “What if I pass and they blow up?”

4. Anchoring (First Impression Bias)

The source of the intro sets an emotional anchor

Strong intro = high credibility floor

Weak or low-trust intro = harder to recover from, even with metrics

In the ever-evolving landscape of investment opportunities, understanding these cognitive biases can significantly impact decision-making. For instance, the art business sector is ripe with potential for innovative startups. Similarly, with the rise of technology, exploring AI startup ideas could lead to lucrative investments.

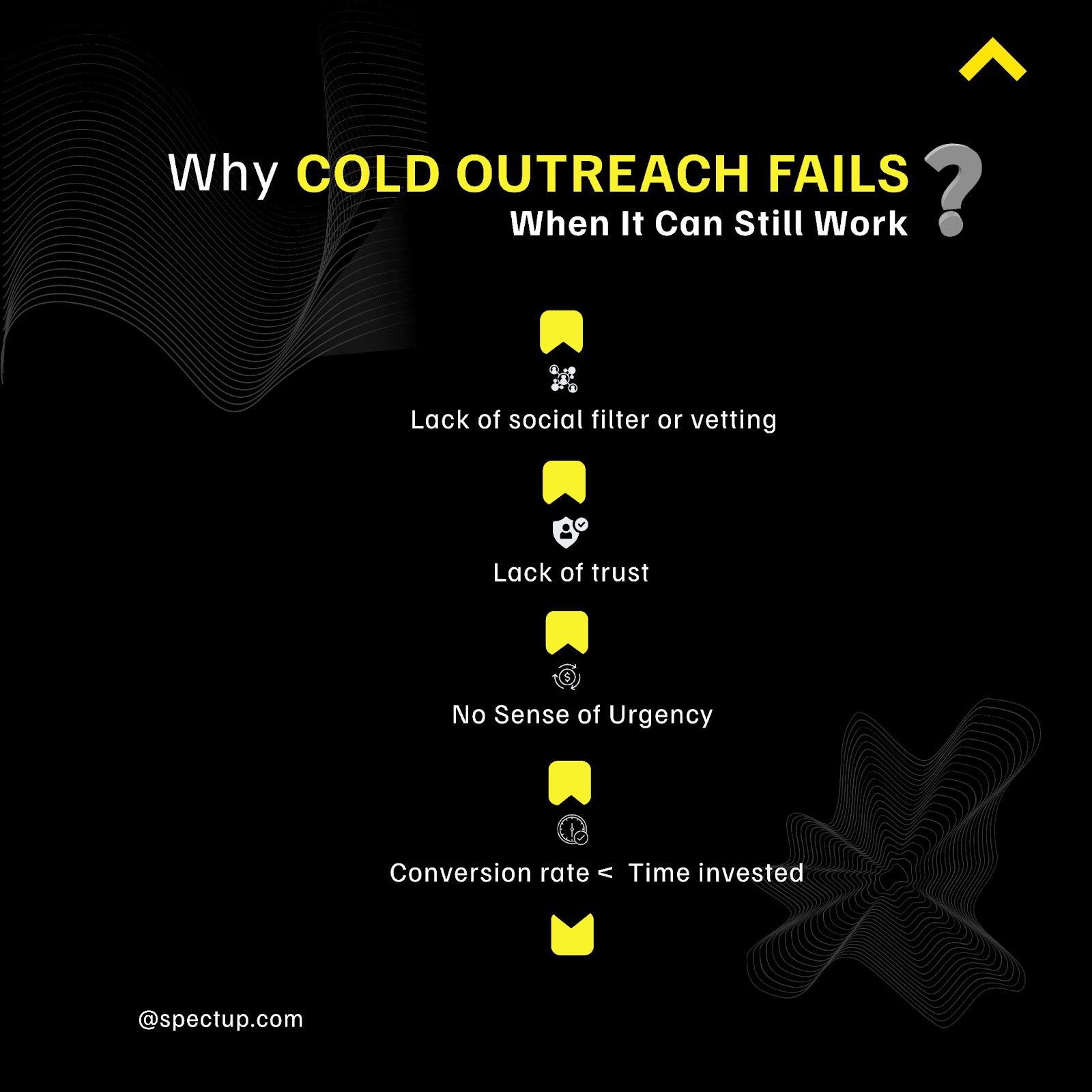

Why Cold Outreach Fails and When It Can Still Work?

Cold outreach often gets ignored for several reasons. But before we break it down, let’s briefly look at cold outreach vs warm intro dynamics to understand why one consistently outperforms the other.

However, there are certain circumstances when cold outreach can still yield positive results. Crafting an exceptionally crisp subject line and personalizing messages can capture attention. A clearly targeted ask based on the investor's thesis increases relevance, while embedding social proof or traction in the email adds credibility. Implementing a follow-up strategy with 1–2 well-timed nudges (avoiding spam) can also improve chances of conversion.

The psychology behind investor trust plays a significant role in cold outreach success. By understanding investor psychology, founders can tailor their approach to reduce risk perception and increase trust. For instance, employing a founder intro strategy where VC warm introductions are leveraged can be more effective than cold outreach.

While cold outreach may seem daunting, it's essential to remember that with the right strategies - such as understanding the innovative revenue models for startups or tapping into the potential of green tech startups - it can still convert and open doors to valuable opportunities.

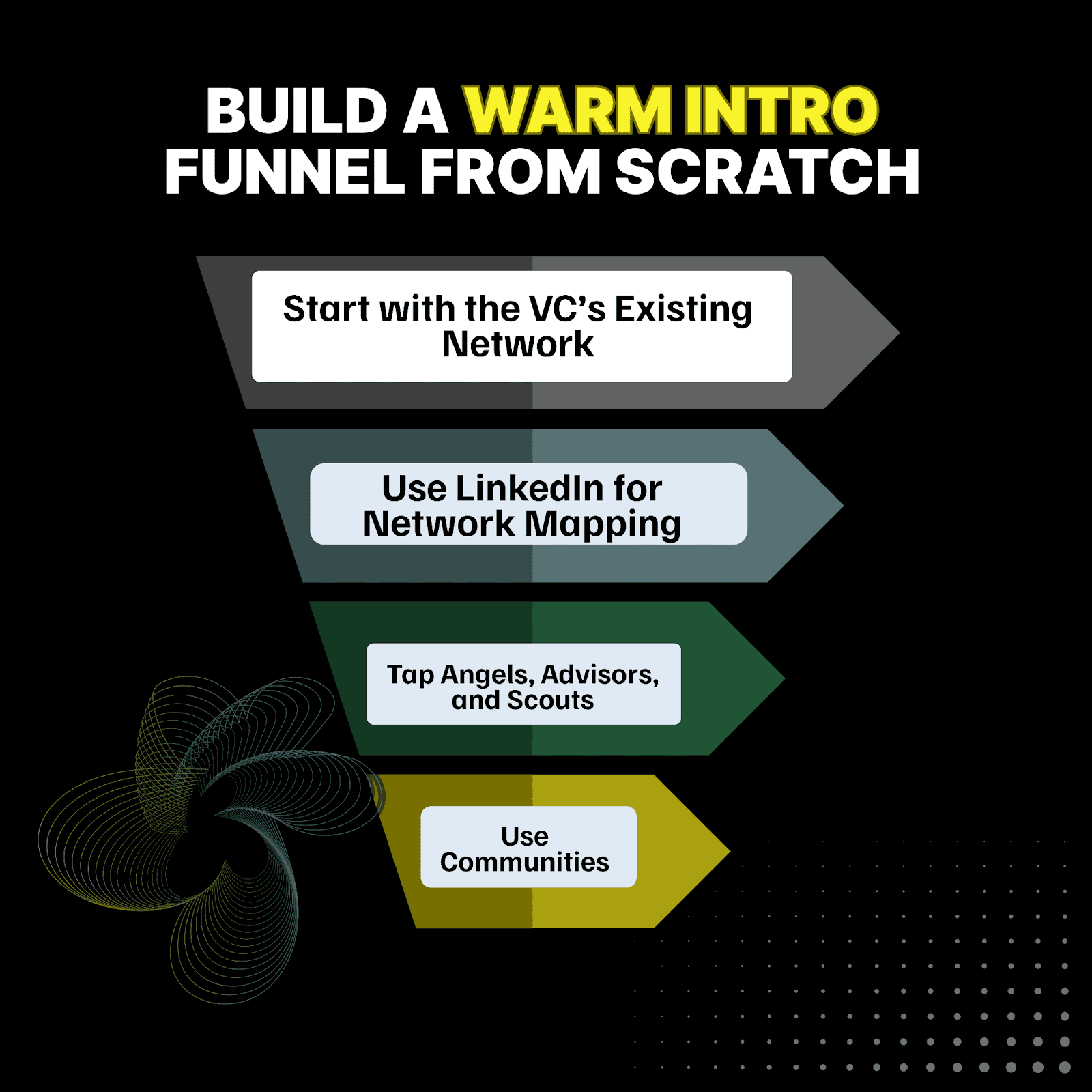

How to Build a Warm Intro Funnel from Scratch?

If you’re wondering how to get investor intros that actually lead to meetings, it starts with leveraging existing relationships within your network. Obtaining warm intros can significantly enhance your chances of securing funding. Here are some best practices for warm intros:

1. Start with the VC’s Existing Network

Identify portfolio founders from the firm's site or Crunchbase.

Reach out with thoughtful, non-pitchy DMs or emails.

Offer value: feedback, user intro, collaboration.

Ask for a conversation before requesting an intro.

2. Use LinkedIn for Network Mapping

Search mutual connections with VCs you’re targeting.

Use 2nd-degree connection data to reverse-engineer paths.

Engage publicly before asking privately.

Prepare forwardable intro blurbs to make it easy.

3. Tap Angels, Advisors, and Scouts

Many angels co-invest and have VC access. This is where startup advisors can play a crucial role. They not only provide strategic insights but also have valuable networks. Here’s how to effectively utilize them:

Ask your existing advisors who they know in your target list.

Give context, milestones, and intro goals.

4. Use Syndicates and Communities

Engaging in founder Slack groups, operator communities, or Twitter spaces can be beneficial. Some of these platforms even offer backdoor access to VCs via pitch sharing. Consistent participation builds visibility before you need a favor.

In addition to these strategies, understanding the difference between a business plan and a business model is essential for entrepreneurs when seeking funding. While a business plan outlines your strategy for achieving specific objectives, a business model explains how you will make money.

Moreover, if you're considering applying for a startup business loan with no revenue, remember that securing such loans requires strategic networking and understanding the financial landscape.

Lastly, when it comes to pitching your startup idea, knowing how long your pitch deck should be can significantly impact its effectiveness. Tailoring your content to meet the expectations of your specific audience is key in this process. With these strategies in mind, you're well on your way to building a successful warm intro funnel from scratch.

Engineering Trust Before the Intro Happens:

Building investor trust is like prepping a stage before the big performance. If you want startup fundraising tactics with warm intros to work their magic, you need to engineer trust well before that intro email hits an inbox.

1. Make the Referrer Confident

Your referrer is your champion. Equip them with everything they need to feel comfortable and excited about making the intro:

Share your traction highlights, key milestones, or recent wins that make your startup stand out.

Give them a crisp pitch summary and story highlights — something short and punchy enough to forward easily.

Clearly explain your target investor and why now is the perfect time for this conversation.

Offer to draft the actual intro email or follow up yourself, so they don’t have to do extra legwork.

This approach shows respect for their time while increasing their confidence in recommending you.

2. Prioritize High-Trust Sources

Not all intros carry equal weight. Focus on connections that have real credibility with your target VC:

Look for 1st-degree connections within your network or portfolio founders who have direct relationships.

Avoid vague “friends of friends” intros or mass-forwarded emails that lack personalization.

Use the investor’s existing portfolio companies as a map — these founders already have earned trust by association.

A high-trust source acts like a social stamp of approval, smoothing out many of the doubts investors naturally have.

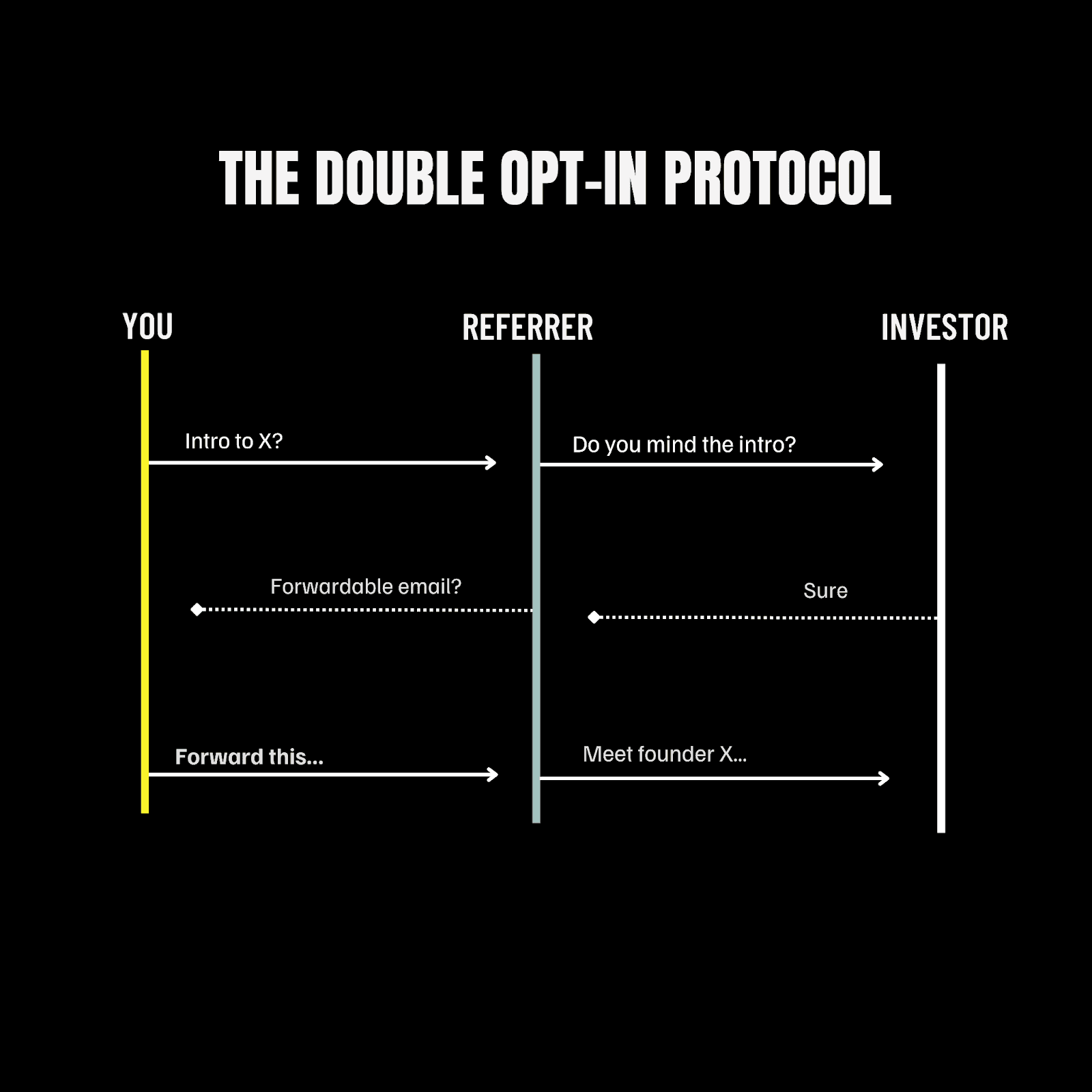

3. The Right Way to Ask for an Intro

Asking for an intro isn’t just about dropping a deck in someone’s lap. The way you frame this request matters:

“Would you feel comfortable introducing me to [Investor Name]? I’ve put together a quick blurb about my company and why now is the right time. Happy to share more context or help draft the message.

Being explicit about what you want, providing context, and offering help makes it easier for your referrer to say yes — and sets clear expectations on next steps.

You’re not just asking for a favor; you’re inviting someone into a partnership where everyone’s success depends on building solid trust from day one.

Understanding Your Startup Type:

Before reaching out to investors, it's essential to understand what type of startup you are running. What Are the Types of Startups? This knowledge can help tailor your pitch and make it more appealing to potential investors.

1. Building Your Team: Moreover, while gearing up for funding, don't forget about how to hire employees for your startup. Hiring the right employees is critical for your startup's success.

2. Emotional Intelligence in Leadership: Lastly, as a startup leader, developing emotional intelligence can significantly enhance your decision-making abilities and overall leadership effectiveness. This skill will not only help in building trust but also in fostering stronger relationships with both your team and potential investors.

3. After the Intro: What Founders Often Get Wrong: Navigating the fundraising landscape can be challenging for founders. However, with the right fundraising guidance these challenges can be mitigated. Here are some common pitfalls and how to avoid them:

4. Prep for the First Call:

Study the investor’s portfolio, style, and thesis

Know your metrics, market, and momentum story cold

Have your “why now, why us” story tightly rehearsed

5. Be Respectful of the Referrer:

Send a thank-you message immediately

Keep them updated on how the meeting went

Don’t ghost them if it goes south

6. Close the Loop Professionally:

Send a thoughtful follow-up to the investor

Summarize key points, offer more data if needed

Ask about next steps without pressure

Update both parties if anything progresses (or doesn’t)

In addition to these strategies, exploring some of the best software startup ideas could provide valuable insights and opportunities. Leveraging spectup consultancy services can also significantly enhance your startup's growth trajectory.

Building Your Long-Term Access Strategy

1. Build an Investor CRM

Track intros, interactions, follow-ups, and notes

Use Notion, Airtable, Affinity, or similar

Keep warm leads in motion during off-fundraising cycles

2. Send Periodic Updates

Monthly or quarterly “Founder Updates” to a small group

Include product, traction, hiring, and asks

Ask if they’d like to stay on your update list

3. Become the Referrer

Introduce others when relevant, be the signal for someone else

Build your own credibility by curating quality deals through deal publication platforms in venture capital

VCs will remember you as a connector and operator

Conclusion: Warm Intros Aren’t Luck, they’re Leverage

The importance of warm intros in fundraising success can't be overstated. These connections unlock doors not just because they open conversations, but because they carry trust baked in.

Remember why warm intros work, it’s all about The investor psychology Behind Winning Trust:

Social proof speeds up investor interest.

Pattern recognition makes you familiar and safer.

Loss aversion adds subtle pressure to act.

Anchoring sets the tone before you even pitch.

Building genuine relationships over time turns cold outreach into warm opportunities. Think of warm intros as your secret leverage, not luck, but a strategic, human-powered advantage.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.