The landscape of startup funding has undergone a dramatic transformation in recent years, and tech investors stand at the epicenter of this evolution. These financial visionaries are not merely writing checks; they are fundamentally reshaping how innovative companies secure capital. Moreover, it makes sure that startups scale operations, and navigate the competitive waters of modern business. According to recent data from PitchBook, Global venture capital funding in the technology sector for 2025 through Q3 reached approximately $345-366 billion across sources. This investment in the tech sector is driven heavily by AI investments that captured 45-50% of totals, demonstrating the unwavering commitment of tech venture capital firms to drive innovation forward.

Furthermore, artificial intelligence-powered fundraising platforms have revolutionized traditional models, connecting startups with top tech investors more efficiently than ever. Such a shift goes beyond a mere trend, it signals a full reimagining of the startup funding ecosystem. At spectup, we have observed that angel investors for tech startups now demand more than compelling pitches and promising projections. Instead, they seek data-driven insights, scalable business models, and founding teams that demonstrate adaptability in rapidly changing markets. Moreover, the tech investing trends 2025 reveal a strategic pivot toward artificial intelligence, climate technology, and healthcare innovation, sectors that promise substantial returns alongside meaningful societal impact. As the funding landscape continues to evolve, understanding how these investors operate becomes essential for any startup seeking to secure capital and build lasting success.

How Tech Investors are reshaping Startup Funding Ecosystem?

Tech investors are fundamentally reshaping how startups secure funding in 2025. Moreover, this transformation reflects deeper shifts in what venture capitalists value most. The tech startup funding landscape now demands more than compelling pitch decks and ambitious growth projections. Here are some key areas where we can see this evolution taking place:

Deeper Evaluation: Investors are going beyond surface-level evaluations and conducting thorough assessments of a startup’s technology and business model.

Sustainability Focus: There is an increasing emphasis on sustainability in investment decisions, with investors seeking out companies that prioritize environmental and social responsibility.

Data-Driven Approach: Startups that can provide tangible data and evidence of their growth potential are more likely to attract funding.

Three Critical Shifts Defining Modern Tech Investing Trends 2025

Rigorous Due Diligence Has Become Standard Practice

Best tech investors now conduct comprehensive evaluations that extend far beyond initial impressions. Therefore, startups must prepare for intensive scrutiny of their technology stack, unit economics, and competitive positioning. Furthermore, investors examine founding team dynamics and market timing with unprecedented detail. This thorough vetting process helps tech venture capital firms for startups identify ventures with genuine staying power rather than fleeting market appeal.

Environmental and Social Responsibility Drives Investment Decisions

Sustainability has evolved from a nice-to-have feature into a core investment criterion. Consequently, angel investors for tech startups actively seek companies demonstrating measurable environmental impact alongside financial returns. Additionally, social responsibility metrics now influence valuation discussions and term sheet negotiations. Research from PitchBook shows that 68% of venture capital firms now incorporate ESG factors into their investment thesis, marking a significant departure from purely profit-driven models.

Evidence-Based Growth Metrics Separate Winners from Hopefuls

Data transparency has become non-negotiable in today's funding environment. As a result, startups must present concrete evidence of product-market fit, customer acquisition efficiency, and retention rates. Tech investors for startups funding particularly value demonstrable traction over theoretical projections. Platforms like Spectup help founders showcase these critical metrics effectively, connecting them with qualified investors who appreciate data-driven storytelling. Subsequently, startups that leverage such tools often secure funding 40% faster than those relying on traditional outreach methods.

Understanding these evolving priorities positions your venture for meaningful investor conversations. Therefore, adapting your fundraising strategy to align with these expectations significantly improves your chances of securing the right capital partners for long-term success.

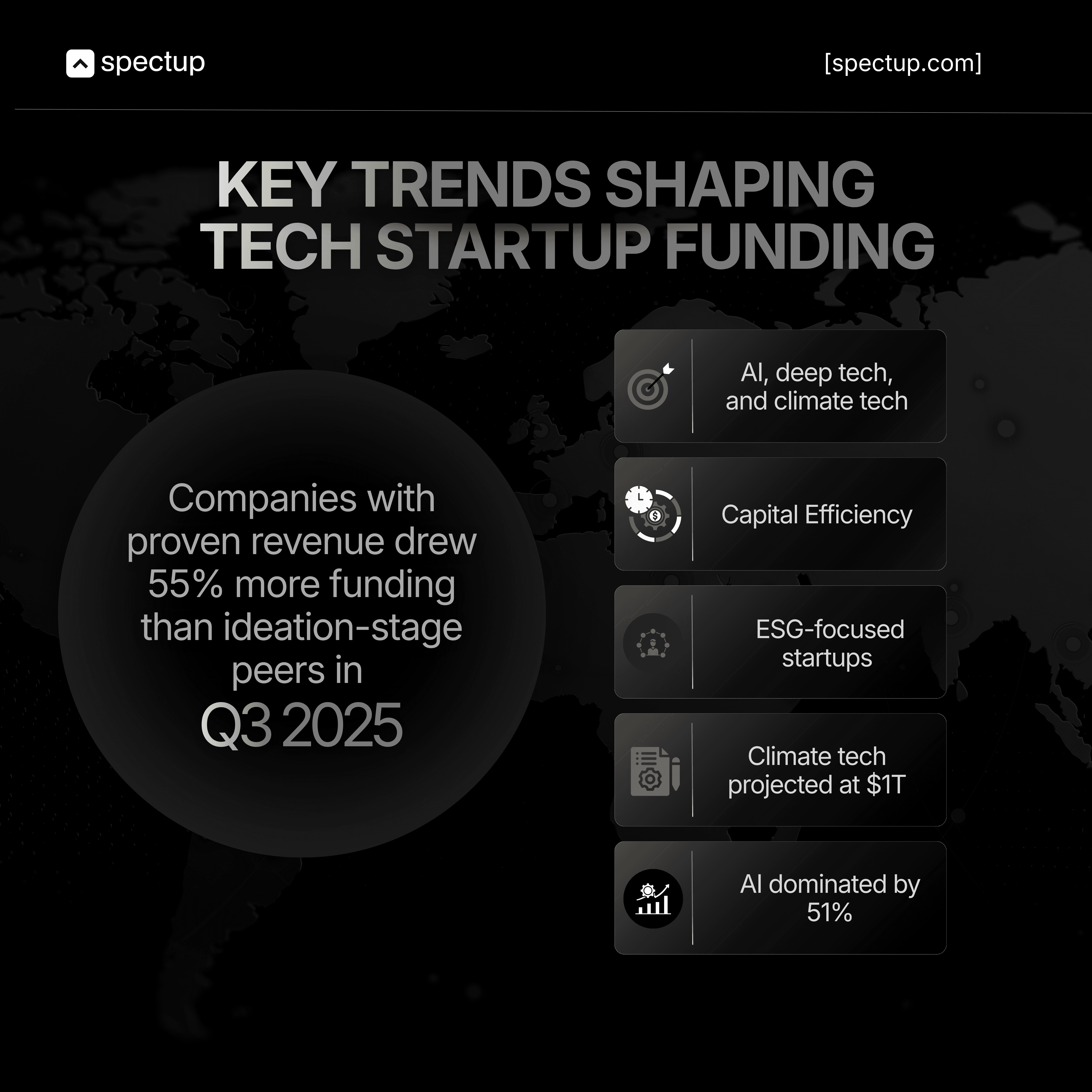

The New Era of Tech Investing in 2025

The landscape of tech investing is shifting dramatically. Tech investors are moving away from pure growth-at-all-costs models. Instead, they're embracing data-driven strategies that prioritize sustainability alongside innovation. This marks a significant maturity milestone in the market. Moreover, profitability and capital efficiency now rank equally important as breakthrough innovation.

Key trends shaping tech startup funding

Several powerful forces are reshaping how tech venture capital flows into startups today. Some key trends that are influencing how money is being invested in tech startups include:

Focus on AI, deep tech, and climate innovation: These industries are attracting the top tech investors who are eager to support technologies with the potential to bring about significant change.

Increasing interest in profitable startups that use capital efficiently: Investors are now looking for businesses that can grow without spending too much money.

Preference for founders with strong technical skills and ability to execute: Angel investors who support tech startups value leaders who have practical experience and a deep understanding of the product.

Incorporation of impact and ESG factors in investment choices: Sustainability and social impact are becoming more important in how funds are allocated by tech venture capitalists.

AI and Infrastructure Lead the Charge

Artificial intelligence, semiconductors, and cloud computing are attracting massive government support and private investment. Additionally, the global B2B IT market is projected to reach $6.7 trillion by 2025, with a 10% annual growth rate. These sectors are dominating tech startup funding conversations. Data center expansion has become critical infrastructure powering AI workloads. Consequently, the best tech investors are actively seeking companies that support this foundational layer.

Profitability Now Matters

Angel investors for tech startups have shifted their priorities dramatically. They're no longer tolerating endless burn rates. Instead, they demand clear paths to profitability and efficient capital deployment. By October 2025, the Information Technology sector gained 23%, outperforming the S&P 500's 15% return.However, only companies demonstrating strong unit economics are capturing these returns.

Founder Quality Drives Decisions

Tech investors are scrutinizing founders more carefully than ever. They want leaders with deep technical expertise and proven execution capabilities. Furthermore, practical experience now trumps visionary rhetoric alone.

Emerging Tech Creates New Opportunities

Investment in cloud computing, bioengineering, and space technologies increased despite broader market volatility.Meanwhile, synthetic biology and robotics automation are approaching critical inflection points. Quantum computing breakthroughs are opening transformative possibilities in drug discovery, cybersecurity, and energy technology. These represent frontier opportunities for angel investors for tech startups.

ESG Integration Becomes Standard

Sustainability considerations are no longer optional add-ons. Tech venture capital firms now integrate environmental, social, and governance factors into core investment thesis development. This reflects both regulatory pressure and genuine market demand.

What This Means for Your Startup?

These shifts fundamentally change what success looks like for tech startups. You need alignment with current tech investing trends 2025 to attract the right partners. The best tech investors want to see three things immediately.

First, a clear path to profitability with realistic unit economics.

Second, technical depth from your founding team.

Third, innovation that solves real problems efficiently.

If you're launching in this environment, start by understanding these dynamics deeply. Then, position your company accordingly before approaching tech investors.

What Tech Investors Are Looking for in Startups?

Technology investors have become increasingly adept at identifying startups that demonstrate both innovative potential and a robust foundation for long-term success. In 2025, leading tech investors are focused on distinguishing between short-lived concepts and ventures with sustainable business models. The following outlines the key attributes that make a startup particularly attractive to venture capitalists and angel investors within the technology sector.

1. Strong Technical Founders

The backbone of any promising tech startup starts with its founders. According to tech investing trends 2025, investors now prioritize founders who bring technical credibility alongside business skills. This shift matters because founders with deep technical knowledge can navigate product complexities and pivot when markets demand it.

Tech investors scrutinize three critical areas before writing checks.

Founder’s Technical Credibility

Product Development Roadmap

Early Proof of Innovation or IP Advantage

Founders Technical Credibility Sets You Apart

Have you built products before? Do you hold relevant degrees, patents, or certifications? Can you speak fluently with engineers and developers? These markers signal to best tech investors that your team can execute without getting lost in translation. A 2024 Crunchbase report found that startups with technical co-founders raised 40% more in seed funding than those without. Your technical background acts as social proof. It shows you understand the mechanics of what you're building, not just the marketing story around it.

Product Roadmaps Guide Investment Decisions

A clear development plan isn't optional anymore, it's essential for securing tech startup funding. Investors want to see defined stages of product evolution, realistic timelines, concrete milestones, and efficient resource allocation. Think of your roadmap as GPS for investors. It shows where you're headed and exactly how you'll get there.

Vague plans signal risk. Detailed roadmaps signal preparedness. Furthermore, they demonstrate you've thought through potential obstacles and have contingency strategies ready.

Intellectual Property Creates Competitive Moats

Angel investors for tech startups pay close attention to early-stage innovations that could disrupt markets. Patents, proprietary algorithms, or unique hardware designs protect your competitive position. According to PitchBook data, startups with filed IP raised Series A rounds 3.2 times faster than those without.

Your IP advantage doesn't need to be perfect from day one. However, showing progress toward securing intellectual property demonstrates forward thinking. It proves you're building defensible technology, not just another me-too product.

The Bottom Line on Founder-Market Fit

Imagine pitching without showcasing these three elements. You might have brilliant ideas, but you'll lack the credibility to attract top-tier tech investors for startups. Your technical depth isn't a checkbox exercise, it's the foundation of successful fundraising.

Tech venture capital operates on calculated risk, not blind hope. Investors back teams who demonstrate data-backed confidence in their ability to build scalable solutions. When you align your pitch with what sophisticated investors seek, you transform from "just another startup" to a compelling opportunity in today's competitive landscape of tech investing for startups.

The startups that secure funding fastest combine visionary thinking with technical execution. Consequently, they stand out in crowded markets and attract the capital needed to scale.

2. Clear Market Differentiation

Tech investors in 2025 demand more than innovative concepts. They seek startups with demonstrable competitive advantages in saturated markets. Recent tech investing trends 2025 reveal a shift toward evidence-based investment decisions, making market differentiation essential for securing support from the best tech investors and angel investors for tech startups.

Understanding True Market Differentiation

Market differentiation begins with comprehensive competitive analysis. Successful founders map their competitive landscape thoroughly and articulate precisely why their solution outperforms existing alternatives. This requires identifying three core elements that tech venture capital firms evaluate rigorously.

Competitive positioning

Barriers to entry

IP protection

Competitive positioning defines how your solution addresses market problems more effectively than alternatives. Tech investors want to understand your unique value proposition clearly.

What capabilities does your product offer that competitors cannot replicate easily?

This advantage must be specific, measurable, and defensible.

Barriers to entry demonstrate your startup's sustainability. Strong barriers include patents, proprietary technology, exclusive partnerships, or regulatory approvals that prevent market replication. These protections signal long-term viability to investors evaluating tech startup funding opportunities.

The higher your barriers, the more attractive your investment proposition becomes.

Intellectual property protection serves as your competitive moat. Tech venture capitalists prioritize startups that safeguard their innovations strategically. Patents, trademarks, and trade secrets create tangible value that extends beyond current revenue streams. Moreover, robust IP portfolios often justify higher valuations during funding rounds.

Demonstrating Scalability Potential

Beyond differentiation, tech investors scrutinize your growth trajectory carefully. Scalability potential indicates whether your business model can expand without proportional cost increases. Investors need confidence that you can enter new markets, optimize operations, and boost revenue efficiently.

Therefore, your pitch should outline clear expansion pathways.

Can you serve additional customer segments without rebuilding infrastructure?

Do you have unit economics that improve with scale?

These questions matter significantly when best tech investors evaluate opportunities worth millions.

Furthermore, demonstrating capital efficiency strengthens your case considerably. Show how you will deploy funds strategically rather than burning through resources rapidly. This financial discipline resonates strongly with angel investors for tech startups who balance risk against potential returns.

Why Differentiation Is Non-Negotiable?

Today's technology landscape moves rapidly and competition intensifies daily. Consequently, vague positioning or incremental improvements rarely attract serious funding. Tech investors expect founders to articulate competitive advantages using data, market intelligence, and strategic foresight.

When you communicate differentiation effectively, you align with the priorities driving tech venture capital decisions. This alignment increases your likelihood of securing the resources needed to build tomorrow's leading technology companies. Ultimately, clear differentiation transforms your startup from one of many to one worth backing.

3. Scalable Business Models

Tech investors have shifted their focus dramatically. They now prioritize startups that demonstrate efficient, sustainable scaling capabilities. This transformation reflects broader tech investing trends 2025, where profitability and capital efficiency have replaced the "growth at all costs" mentality of previous years. Consequently, the best tech investors and angel investors for tech startups now evaluate whether businesses can grow intelligently rather than simply grow rapidly.

Understanding what "scalable" truly means becomes essential in this context. A scalable business model allows you to expand your customer base and revenue streams without proportionally increasing operational costs. Consider the ability to onboard thousands of new users while maintaining relatively stable expenses, this represents the ideal scenario that captures investor attention.

Here are the metrics that matter most when showcasing your scalable business model:

Customer Acquisition Cost (CAC): How much are you spending to win each customer? Lower CAC means you’re finding cost-effective ways to grow.

Lifetime Value (LTV): What’s the total revenue you expect from a single customer over time? A high LTV compared to CAC signals healthy profitability potential.

Gross Margin: This shows how much money you keep after covering production costs, a solid margin indicates room for reinvestment.

Burn Multiple: How efficiently do you turn cash into revenue growth? A lower burn multiple means you’re managing cash wisely while scaling.

The Metrics That Define Investment-Ready Scalability

Customer Acquisition Cost (CAC) measures your spending per new customer, with lower figures indicating cost-effective growth strategies. Meanwhile, Lifetime Value (LTV) calculates total revenue expected from individual customers throughout your relationship. Tech venture capital firms particularly value strong LTV-to-CAC ratios, as they signal sustainable profitability potential.

Gross Margin demonstrates how much revenue remains after covering direct production costs.

- Higher margins provide crucial reinvestment capital for continued expansion.

- Additionally, Burn Multiple reveals how efficiently you convert cash expenditure into revenue growth.

- Lower burn multiples indicate prudent cash management during scaling phases, a quality that distinguishes promising tech startup funding candidates from riskier ventures.

These financial metrics tell a deeper story than surface-level statistics like user counts or valuation headlines. Tech investors scrutinize these numbers because they reveal underlying business health and long-term viability. Furthermore, demonstrating both repeatable sales processes and operational efficiency positions your startup favorably within competitive funding landscapes.

Evaluating Your Current Position

Before approaching investors, audit your business model against these scalability criteria.

Calculate your actual CAC, LTV, gross margin, and burn multiple.

This analysis often uncovers hidden strengths worth highlighting during pitches. Alternatively, it may reveal improvement opportunities that strengthen your position before seeking tech startup funding. Either way, understanding these metrics transforms fundraising conversations from abstract discussions into concrete demonstrations of your growth potential.

Tech venture capital funds and savvy tech investors pay close attention to these numbers because they tell the story behind your growth prospects beyond flashy user counts or lofty valuations. If you can demonstrate a repeatable, profitable sales process combined with operational efficiency, you’ll stand out in the crowded field of tech startup funding opportunities.

4. Strong Product-Market Fit: The Foundation Tech Investors Cannot Ignore

Product-market fit remains the single most critical factor that separates funded startups from those that struggle to secure capital. Tech investors evaluate hundreds of pitches monthly, yet they commit resources only when they identify companies solving real problems for paying customers.

Strong product-market fit demonstrates that a startup has moved beyond theoretical value propositions into tangible market validation. Tech venture capital firms prioritize this metric because it directly correlates with reduced investment risk and predictable growth trajectories. Similarly, angel investors for tech startups recognize that PMF serves as the clearest indicator of future success.

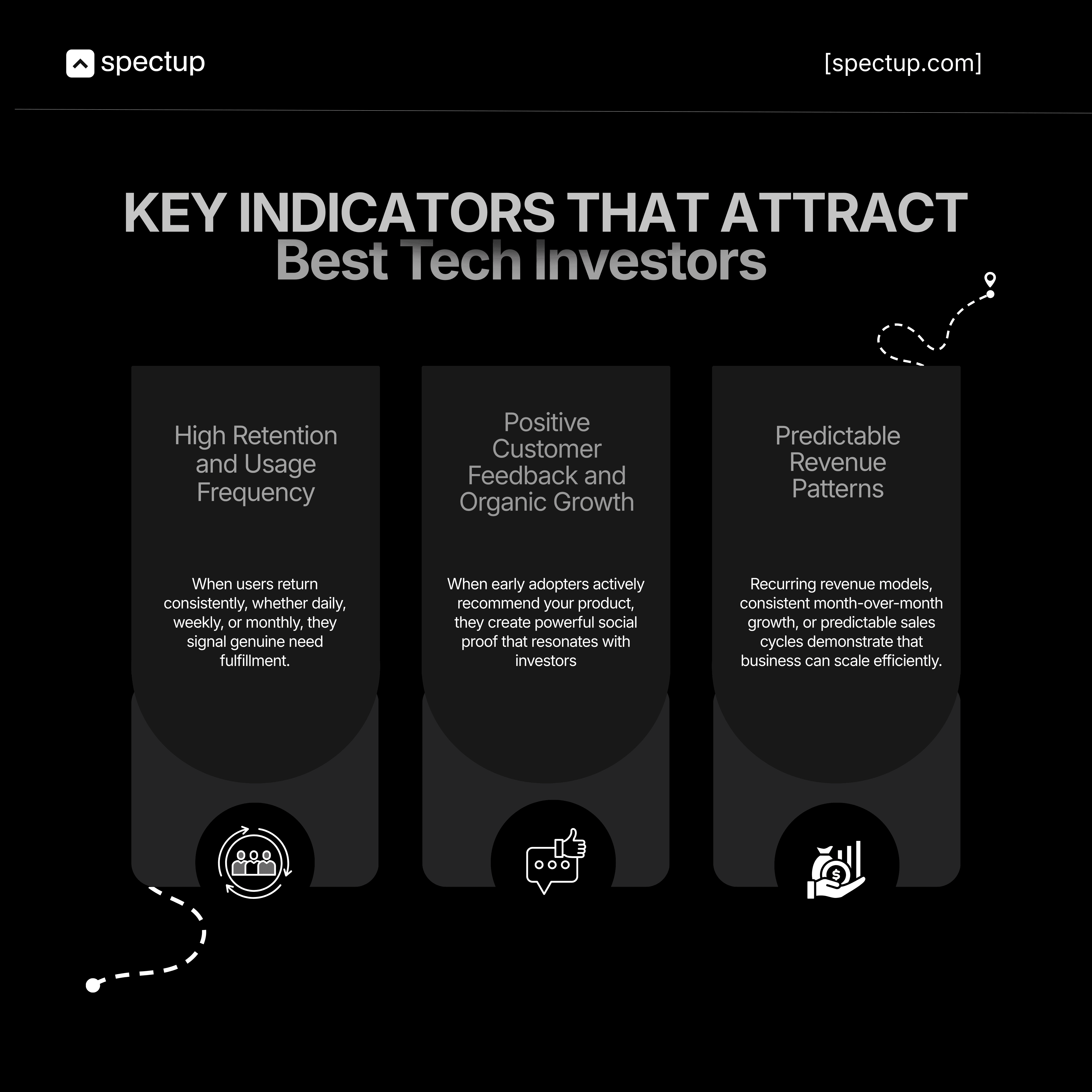

High retention or usage frequency

Positive customer feedback loops

Predictable revenue growth

Key Indicators That Attract Best Tech Investors

High Retention and Usage Frequency

Customer behavior reveals authentic product value. When users return consistently, whether daily, weekly, or monthly, they signal genuine need fulfillment. Consider a project management platform that teams access multiple times per day or a fintech app that users engage with for every transaction. This behavioral stickiness provides concrete evidence that your solution has become embedded in customers' workflows. Tech startup funding decisions increasingly weigh these engagement metrics as primary validation points.

Positive Customer Feedback and Organic Growth

The most compelling validation comes directly from your market. When early adopters actively recommend your product, they create powerful social proof that resonates with investors. Furthermore, customer feedback generates valuable product insights that drive continuous improvement. This creates a virtuous cycle where satisfied users fuel both growth and product development. Tech investing trends 2025 show increased emphasis on community-driven growth metrics as alternatives to expensive customer acquisition strategies.

Predictable Revenue Patterns

Financial sustainability separates promising startups from investment-worthy businesses. Recurring revenue models, consistent month-over-month growth, or predictable sales cycles demonstrate that your business can scale efficiently. Best tech investors analyze revenue data to forecast long-term viability and calculate potential returns. They seek businesses where growth follows clear patterns rather than depending on unpredictable variables.

Why Product-Market Fit Matters More Than Ever

Current tech investing trends 2025 reflect a fundamental shift toward evidence-based investment decisions. Tech venture capital firms now demand comprehensive PMF validation before committing significant capital. This approach reduces portfolio risk while increasing the probability of substantial returns.

Startups that establish strong product-market fit create competitive advantages across multiple dimensions. They spend less on customer acquisition because satisfied users drive referrals. They iterate faster because customer feedback provides clear development priorities. They scale more efficiently because their unit economics improve with volume.

Additionally, proven PMF strengthens every other aspect of your investor pitch. Market differentiation becomes more credible when backed by customer traction. Business model assumptions gain validation through actual revenue data. Technical capabilities prove their worth through measurable user outcomes.

For founders seeking tech startup funding, demonstrating strong product-market fit should be the primary focus before approaching investors. Angel investors for tech startups specifically look for this validation because early-stage investments carry inherent risks. PMF evidence significantly reduces those risks while increasing confidence in your ability to execute.

Building authentic product-market fit requires patience and responsiveness to market signals. However, achieving this milestone transforms your startup from an interesting concept into a compelling investment opportunity that tech investors actively pursue.

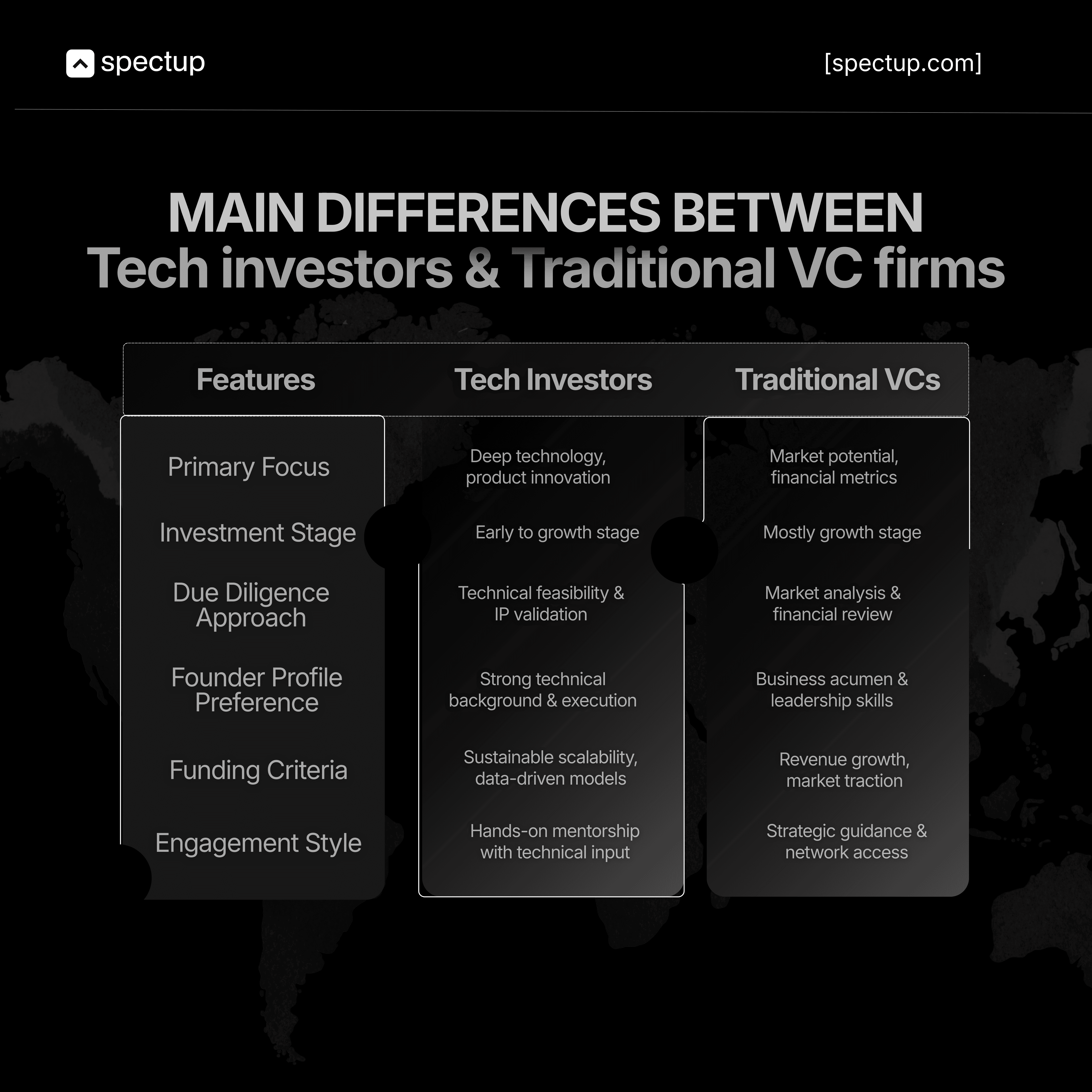

How Tech Investors Differ from Traditional VCs

Tech investors are redefining the landscape of startup funding, particularly in anticipation of Tech Investing Trends 2025. In contrast to traditional venture capitalists, these investors place a greater emphasis on technological innovation and data-driven decision-making. Their involvement extends beyond providing capital; they frequently leverage their technical expertise and professional networks to support founders in developing advanced solutions.

Key distinguishing characteristics of tech investors include:

Technical Expertise: Many possess direct experience in technology development or product management, enabling them to conduct more rigorous assessments of prospective startups.

Investment Criteria: The primary focus is on validating the underlying technology, evaluating scalability potential, and ensuring alignment with emerging sectors such as artificial intelligence (AI) and climate technology.

Differentiation from Traditional VCs: Unlike conventional venture capitalists who may prioritize market size or financial projections, tech investors are more discerning regarding technical merit and innovation.

Angel investors specializing in technology startups also play a critical role. Typically engaging at earlier stages, they often contribute hands-on expertise that can significantly shape a founder's strategic vision. While these investors may demonstrate a higher tolerance for risk, their expectations regarding technical accuracy and innovative capacity are correspondingly elevated.

The table below outlines the main differences between tech investors and traditional VC firms:

Understanding these differences can help you tailor your approach when seeking funding from top tech investors.

Key Sectors Attracting Tech Investors in 2025

Tech investors are focusing their capital on industries that deliver measurable results. Moreover, the best tech investors in 2025 have shifted their strategy. They now prioritize sectors where innovation solves pressing real-world problems rather than chasing trendy concepts.

This strategic pivot is reshaping tech startup funding across the board. Additionally, both tech venture capital firms and angel investors for tech startups are converging on five primary sectors. These industries are capturing the majority of investment dollars in the current market.

1. Artificial Intelligence (AI) and Machine Learning

AI attracted one-third of all venture capital investment in 2024, reaching $131.5 billion globally, a remarkable 52% jump from the previous year. Furthermore, AI companies drove over 70% of all VC activity in the first quarter of 2025. Startups developing:

Natural language processing

Predictive analytics

Automation tools are particularly attractive.

These technologies offer scalable solutions that enhance operational efficiency across multiple industries. Consequently, if your startup leverages machine learning capabilities, you're addressing what tech investors consider the most critical investment sector. The momentum continues to intensify. In the fourth quarter of 2024, over half of all global VC funding went to AI-focused companies, doubling the share from the same period in 2023. Therefore, tech investing trends 2025 clearly indicate that AI dominance will persist throughout the year.

2. Climate Tech

Climate change has transformed from a distant concern into an immediate business priority. Climate tech startups raised approximately $13.2 billion in the first half of 2025, demonstrating sustained investor interest despite market fluctuations. Startups providing:

Sustainability solutions

Energy efficiency technologies

Carbon capture system

Renewable energy innovations are securing substantial funding.

These companies attract tech investors who seek both financial returns and measurable environmental impact. Climate tech represents the intersection of profitability and responsibility, a compelling proposition that resonates with forward-thinking investors. Interestingly, venture deal counts in clean energy and power companies reached a record of 382 in 2024 Silicon Valley Bank. This surge reflects growing demand from technology companies requiring massive energy supplies for data centers and computing infrastructure.

3. Fintech

Fintech recorded quarterly funding increases in early 2025 as investors diversify beyond core infrastructure plays. The sector continues revolutionizing financial services through:

Digital banking

Payment platforms

Blockchain applications.

Tech investors are seeking startups that enhance financial inclusion while delivering seamless user experiences. Regulatory compliance remains crucial. Therefore, fintech companies that balance innovation with regulatory requirements attract the most attention from tech venture capital firms. The sector's appeal stems from its practical disruption of traditional financial systems. Additionally, fintech solutions often achieve profitability faster than other tech sectors, making them attractive to risk-conscious investors.

4. Health Tech

Digital health sectors recorded quarterly funding increases throughout early 2025. The healthcare industry continues its technology-driven transformation through diagnostic tools, telemedicine platforms, and biotechnology breakthroughs. Investors prioritize startups that improve patient outcomes while reducing healthcare system costs. The pandemic accelerated digital health adoption permanently. Consequently, angel investors for tech startups recognize that health tech represents a mature, high-demand sector with strong growth potential.

Telemedicine platforms

Wearable health monitors

Data analytics tools that enhance clinical decision-making are receiving significant investment attention.

Furthermore, startups combining healthcare expertise with technical innovation create particularly compelling investment opportunities.

5. Deep Tech

Deep Tech and Robotics firmly established itself as the dominant sector with 6.7% of investment votes in Q2 2025, marking the first time it surpassed traditional AI and Machine Learning over four consecutive quarters. Deep tech ventures including:

Robotics

Semiconductors

Quantum computing carries substantial risk but offers transformative potential.

Quantum computing attracted headline-making deals in Q3 2025, including $1 billion for PsiQuantum and $594 million for Quantinuum, representing some of the largest funding rounds in the sector's history.

These startups require patient capital and specialized technical expertise. However, they possess the capability to redefine entire industries fundamentally. Tech startup funding for deep tech often comes from specialized micro funds or strategic corporate investments rather than traditional venture firms.

Understanding these sectors helps you align your startup with current tech investing trends 2025. By recognizing what excites tech investors today, you can refine your pitch strategy and target partners who share your vision and understand your market potential.

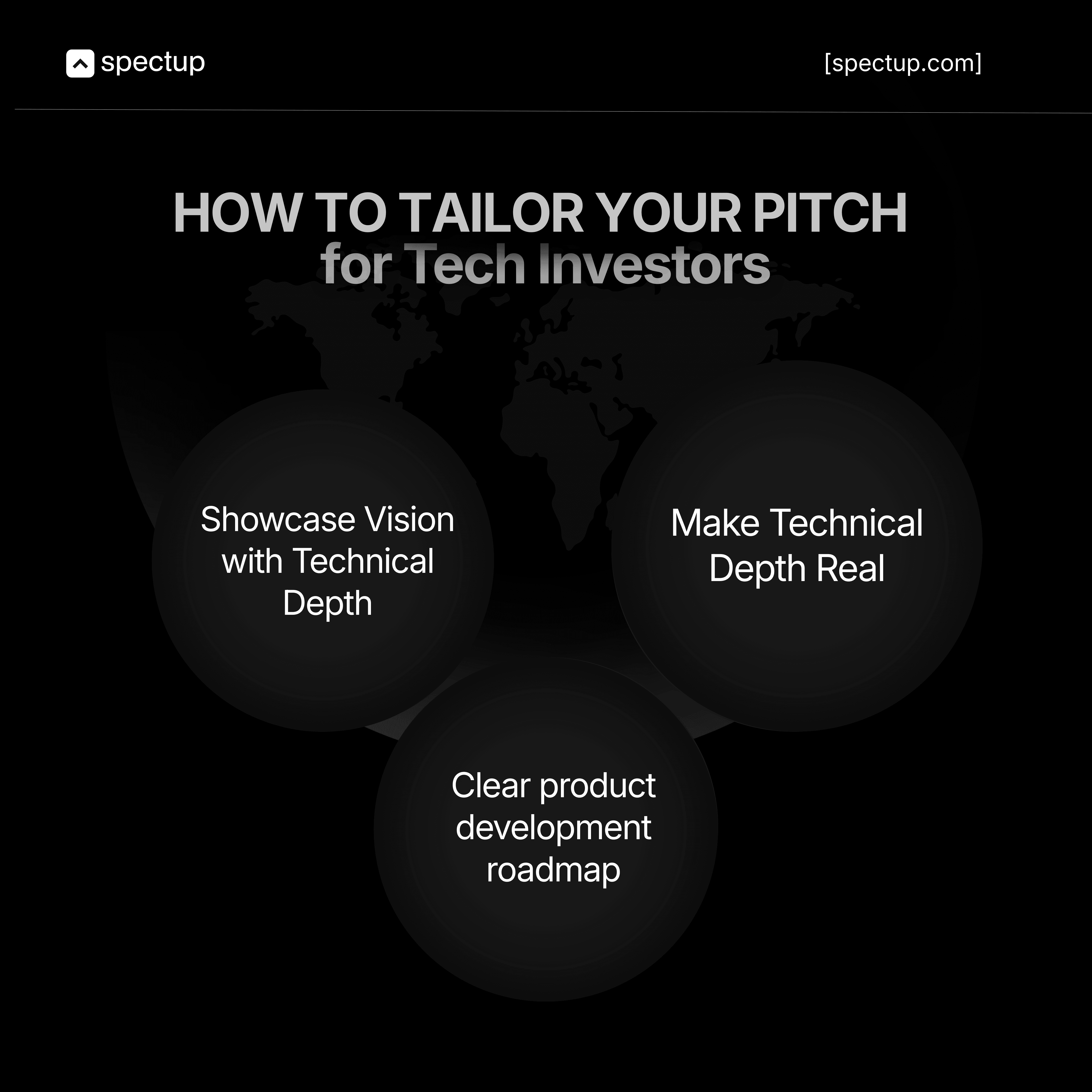

How to Tailor Your Pitch for Tech Investors

Showcase Vision with Technical Depth

When presenting to technology investors, superficial enthusiasm is insufficient. These individuals possess a comprehensive understanding of technological principles and industry developments. To align with anticipated technology investment trends for 2025, it is essential to demonstrate in-depth knowledge and articulate clear pathways for innovation. Investors require evidence that your concept is both technically robust and capable of scaling effectively.

Therefore, it is advisable to prioritize showcasing the underlying technical framework and operational feasibility of your proposal, rather than focusing solely on its external appeal.

Here’s what tech investors want to see:

Technical credibility of the founder(s)

Clear product development roadmap

Demonstration of innovation or IP advantage

Technical credibility of founders:

Investors want founders who speak tech fluently. They're not interested in visionaries alone. Instead, they seek people with hands-on experience or solid technical backgrounds. If you're leading the team, highlight your technical skills. The same goes for your co-founders.

Have you built prototypes?

Filed patents?

These details build trust.

Clear product development roadmap:

Map out your plan like a GPS route.

What milestones will you hit?

When exactly?

How do you move from MVP to full-scale launch?

Include timelines for:

Key feature releases

Testing phases

User feedback iterations

Tech venture capital providers appreciate transparency. They want to know their money funds an executable plan, not vague promises.

Innovation or IP advantage:

Demonstrate how your startup stands apart. Generic apps won't cut it anymore.

Do you have proprietary algorithms?

Unique hardware?

Exclusive datasets?

These elements create competitive barriers. They make your startup more attractive to angel investors for tech startups and VCs.

Make Technical Depth Real

Let's say you're pitching an AI health diagnostic tool. Don't just claim "it's smarter." Instead, explain how your machine learning model uses novel data inputs competitors can't access. Show how this improves diagnostic accuracy by specific percentages.

Numbers backed by data make your vision tangible.

Here's how to bring technical depth to life:

Use smart visuals. Diagrams and flowcharts help investors grasp complex systems quickly. Even non-technical backers can follow architecture overviews.

Highlight achieved milestones. Show prototype success, beta testing results, or codebase maturity. These prove progress, not just potential.

Explain scalability technically. Can your platform handle millions of users? What cloud infrastructure supports growth? These questions matter to the best tech investors.

Why This Matters Now?

Tech startup funding in 2025 rewards founders who blend vision with execution. Top tech investors don't want promises alone. They want proof your technology stands on firm ground.

Practice discussing technical details confidently

Use simple terms, but maintain clarity.

A savvy investor should understand why your product matters without wading through jargon.

By combining technical depth with big-picture vision, you show understanding of what tech venture capital demands right now. That makes all the difference when seeking funding from the best tech investors.

Align with Market Timing

When you're pitching to tech investors, timing is everything. The best tech investors don’t just back a great idea; they back ideas that fit the moment. Tech investing trends 2025 show a clear appetite for startups that align with current market needs and emerging technologies. Knowing when your startup fits into this timeline can make or break your chances of securing funding.

Think about it: tech venture capital flows where innovation meets demand.

If you’re developing a product that tackles a fresh problem or capitalizes on new regulatory changes, you’re already ahead of the curve.

Angel investors for tech startups and major VC funds alike are hunting for opportunities that sync up with macro shifts, whether that's AI advancements, climate tech solutions, or fintech disruptions.

Ask yourself:

Is your technology solving an urgent problem right now?

Are you entering a market poised for rapid growth in the next 12-24 months?

Does your timing leverage recent breakthroughs or policy changes?

Tech startup funding isn’t just about cool tech; it’s about relevance. Investors want to see a startup riding the wave of current industry momentum rather than trying to create one from scratch without clear signals.

By aligning your pitch with these market rhythms, you demonstrate not only awareness but strategic foresight. This shows tech investors you're not just dreaming big, you’re playing smart. Aligning with tech investing trends 2025 means tapping into where capital is flowing today and where it’s expected to flow tomorrow.

Keep in mind: even the best technical founders need to prove their timing matches investor appetite. Nail this, and your pitch will resonate louder in the crowded world of tech venture capital.

Back Every Claim with Data

When pitching to tech investors, words without numbers fall flat. These professionals live in data. They need proof your startup's potential isn't wishful thinking but backed by solid evidence.

Here's the reality: tech venture capital gets smarter every year. The best tech investors dig deep into metrics that validate your story. Flashy presentations alone won't work.

Essential Data Points to Present

User engagement and growth

Show how fast your user base expands. How often do they interact with your product? Growth velocity matters enormously to angel investors for tech startups.

Financial metrics that matter

Present these key numbers:

Customer acquisition cost (CAC)

Lifetime value (LTV)

Monthly burn rate

Revenue growth trajectory

These metrics reveal whether your business model actually works.

Market validation proof

Highlight concrete evidence:

Pilot project results

Letters of intent from customers

Partnership agreements

Pre-orders or waitlist numbers

Real-world demand beats theoretical projections every time.

Technical performance benchmarks

For AI or deep tech innovations, bring specifics. What's your accuracy rate? Processing speed? System uptime? Relevant KPIs matter.

ESG and impact metrics

More tech investors now factor environmental, social, and governance criteria into funding decisions. If applicable, present measurable outcomes in these areas.

Why Data Changes Everything?

Without data, your pitch sounds like science fiction rather than investment opportunity. Tech investing trends 2025 emphasize precision and transparency above all.

Investors want numbers that tell a story, not just dreams. Your confidence in the data backing your startup makes all the difference when facing savvy tech investors seeking the next breakthrough in tech startup funding.

How solid is your data foundation? That question determines whether you secure funding or walk away empty-handed

Present a Clear Funding Utilization Plan:

Tech investors want to see exactly how you plan to use their money. A well-defined funding utilization plan shows you understand your startup’s needs and are ready to deploy capital efficiently. It signals discipline, focus, and respect for investor resources, qualities that top-tier tech venture capitalists prize.

Here’s what a clear funding utilization plan should cover:

Breakdown of Expenditures: Specify how much capital goes to product development, marketing, hiring, infrastructure, and operational costs. Tech investing trends 2025 highlight the importance of transparency here.

Milestones Linked to Spending: Connect each budget item with concrete business milestones like MVP launch, user acquisition targets, or scaling infrastructure. This helps angel investors for tech startups track progress and assess risk.

Capital Efficiency Focus: Showcase plans for lean operations that maximize output per dollar spent. Best tech investors increasingly favor startups demonstrating smart burn multiples over reckless cash consumption.

Contingency Planning: Account for unexpected expenses or pivots. Tech startup funding isn’t always linear, having buffer strategies reflects mature planning.

You don’t need a complex financial model; clarity and realism win over flashy projections every time. Remember, tech investors want to back founders who treat funds as strategic tools, not just runway fuel. Presenting this plan clearly can distinguish you in the crowded funding arena dominated by sophisticated tech venture capital players.

A thoughtful breakdown aligned with your growth strategy boosts confidence and helps build lasting investor partnerships crucial for long-term success in the fast-evolving landscape of tech investing trends 2025.

What Your Funding Plan Should Include?

Breakdown of expenditures

Specify dollar amounts for:

Product development

Marketing and customer acquisition

Hiring key personnel

Infrastructure and technology

Operational costs

Tech investing trends 2025 highlight transparency as non-negotiable. Don't hide where money goes.

Milestones linked to spending:

Connect each budget item with concrete business milestones. Examples include:

MVP launch date

User acquisition targets

Revenue benchmarks

Scaling infrastructure capacity

This helps angel investors for tech startups track progress and assess risk accurately.

Capital efficiency focus:

Best tech investors increasingly favor startups demonstrating strong unit economics and efficient burn multiples over companies consuming cash recklessly.

Show plans for lean operations that maximize output per dollar. \

Efficiency beats spending power.

Contingency planning:

Account for unexpected expenses or necessary pivots. Tech startup funding rarely follows a straight line. Buffer strategies reflect mature planning that experienced investors recognize and value.

Keep It Simple and Real:

You don't need complex financial models. Moreover, clarity and realism win over flashy projections every time.

Remember: tech investors want to back founders who treat funds as strategic tools, not just runway fuel. Presenting this plan clearly distinguishes you in the crowded funding arena dominated by sophisticated tech venture capital players.

Further, a thoughtful breakdown aligned with your growth strategy builds confidence. It creates lasting investor partnerships crucial for long-term success in the fast-evolving landscape of tech investing trends 2025.

When you show respect for capital through smart planning, you earn respect from the best tech investors in the market.

The Future of Tech Venture Capital

The landscape of technology venture capital is undergoing rapid transformation. Moreover, leading tech investors in 2025 are utilizing advanced tools and innovative strategies to maintain their competitive edge in tech startup funding.

AI-Powered Investing

Artificial intelligence (AI) has evolved beyond being a mere industry trend and is now integral to deal sourcing and due diligence processes. AI algorithms are capable of analyzing vast numbers of startup proposals, processing extensive datasets, and identifying high-potential investment opportunities with notable accuracy.

This methodology offers several key advantages:

Significant reduction in evaluative bias.

Acceleration of assessment timelines.

Enhanced ability for investors to identify promising startups ahead of competitors.

Tech Venture capital firms employing AI-driven tools are thus able to make more informed and timely investment decisions. As a result, these firms are increasingly successful in securing advantageous deals within the highly competitive technology startup sector.

Corporate Startup Partnerships

Collaboration between technology corporations and venture capital (VC) funds is increasing, resulting in a synergistic partnership that combines substantial corporate resources with the agility of startups. This convergence is instrumental in fostering robust innovation ecosystems, delivering mutual advantages across stakeholders.

The key mechanisms of this collaboration are as follows:

Startups benefit from access to industry expertise, established distribution channels, and extensive datasets provided by corporate partners.

Investors gain from shared risk exposure and enhanced insights into emerging market trends.

These strategic alliances frequently result in mutually beneficial outcomes. Consequently, a growing number of angel investors in the technology sector are actively seeking partnerships with corporations to optimize their investment returns.

Embracing Diversity

Simultaneously, diversity and inclusion in technology founder funding are receiving increased attention. Leading technology investors have acknowledged that diverse teams contribute to enhanced innovation and improved performance.

Additionally, investment funds dedicated to supporting underrepresented founders are experiencing significant growth. These funds are broadening the talent pool by extending opportunities beyond conventional networks. As a result, technology investment trends for 2025 indicate a pronounced movement toward inclusive investment strategies.

The emphasis on diversity is not solely motivated by social responsibility; it is also driven by financial considerations. Empirical data demonstrates that portfolios with greater diversity consistently outperform homogeneous portfolios across various performance metrics.

Specialized Micro Funds

Additionally, micro funds specializing in deep technology sectors such as quantum computing and biotechnology have become increasingly prevalent. These specialized investors offer both technical expertise and patient capital, which are essential for supporting the extended development timelines characteristic of these fields.

Furthermore, micro funds serve as vital intermediaries between the early stages of scientific discovery and access to mainstream venture funding. In doing so, they address a significant gap in the technology venture capital landscape that traditional venture capital firms frequently neglect.

Notably, these micro funds possess an in-depth understanding of complex technologies. This expertise enables them to make well-informed investment decisions in areas where other investors may be reluctant to engage.

A Shift in Mindset

The future of technology investment trends in 2025 will be defined by a departure from traditional strategies, with a strong emphasis on continuous innovation. Key areas of focus include the integration of artificial intelligence (AI) into operational processes, the formation of strategic partnerships, and the adoption of novel approaches to inclusion and industry specialization. The prevalence of change within this sector necessitates ongoing adaptation.

For founders seeking to attract progressive technology investors, a comprehensive understanding of these evolving trends is critical. Aligning pitches to reflect these developments enhances competitiveness within the dynamic landscape of technology startup funding.

Hence, successful technology investors are distinguished by their ability to adapt rapidly to emerging trends. Remaining informed about these transformations is no longer optional; it is essential for achieving success in the continually evolving field of technology venture capital.

Final Thoughts

Successfully engaging with tech investors in 2025 requires a comprehensive understanding of prevailing investment trends and priorities. Investors are increasingly focused on areas such as sustainability, artificial intelligence (AI)-driven innovation, and entrepreneurial teams that demonstrate both technical expertise and strategic vision. Leading tech investors serve not only as sources of capital but also as strategic partners who encourage startups to pursue sustainable, intelligent growth.

To differentiate your company within the competitive landscape of tech startup funding, it is essential to go beyond traditional presentations. Effective engagement with tech venture capital firms necessitates presenting a compelling narrative supported by data-driven, scalable business models that address tangible market needs. Angel investors for tech startups are demonstrating heightened selectivity, favoring founders who can clearly articulate market differentiation and present robust execution plans alongside innovative concepts.

Aligning your financial operations with these growth objectives is critical. Utilizing Fractional CFO Services from Spectup can provide enhanced financial clarity, streamline operational efficiency, and support sustainable expansion strategies.

spectup helps founders like you refine their pitch, identify investor-fit opportunities, and accelerate fundraising success in 2025. Landing a funding is a strategy and we are experts in creating these.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.