Raising capital for a startup requires more than a compelling business idea or impressive growth metrics. The investment environment in 2025 has evolved significantly. Investors have become increasingly selective, favoring opportunities with lower valuations and demonstrating heightened scrutiny in their decision-making processes. As a result, competition among startups has intensified. Investors seek evidence of business stability, regulatory compliance, and well-defined plans for future expansion. This is achieved through investor due diligence, a comprehensive review of the company’s financial statements, legal frameworks, operational processes, and other critical components.

At Spectup, we have observed that investor due diligence is essential when preparing for discussions with potential investors. This process enables both parties to assess compatibility and streamlines communications by ensuring preliminary questions are addressed in advance.

For founders, a thorough understanding of the VC due diligence process is vital. This process allows founders to respond confidently to challenging inquiries, systematically organize all required documentation within a due diligence data room, and align with investor expectations throughout the fundraising cycle.

This blog post outlines the fundamental components of a startup due diligence checklist, provides an overview of the VC due diligence process, and examines trends shaping the 2025 investment landscape, including increased selectivity and a focus on growth-oriented and AI-driven startups.

What Is Investor Due Diligence?

Investor due diligence is termed as a comprehensive evaluation of a startup prior to securing funding. This process involves a systematic review by investors, often guided by an investor checklist for startups, to validate all aspects of the business. Areas examined include financial statements, legal compliance, market potential, and the capabilities of the founding team. Through this rigorous assessment, investors gain critical insights into the operational integrity and growth prospects of the startup.

The significance of investor due diligence for both founders and investors is underscored by several key factors:

Verification of Credibility and Compliance: Investors confirm that the startup operates as a legitimate and well-structured entity. They review incorporation documents, check the accuracy of financial reports, and ensure that contracts are enforceable.

Identification of Risks Prior to Investment: Due diligence is designed to reveal potential issues such as unresolved legal matters, questionable intellectual property ownership, or unrealistic financial projections. Early identification ensures both parties have a clear understanding of any risks involved.

Enhancement of Founder-Investor Trust: Providing transparent and organized documentation in a due diligence data room demonstrates professionalism and preparedness. This transparency fosters greater confidence among investors regarding the startup’s management and future prospects.

A thorough understanding of investor expectations enables founders to better prepare for funding discussions. Utilizing a comprehensive startup due diligence checklist facilitates the collection and organization of necessary documentation, ranging from detailed financial records to product development roadmaps, streamlining the VC due diligence process.

Additionally, it is crucial to validate your startup idea through effective methods to reduce risk and improve success rates. Engaging experienced startup advisors can also provide valuable strategic guidance, further enhancing the likelihood of achieving long-term success.

Why Investor Due Diligence is Important in 2025

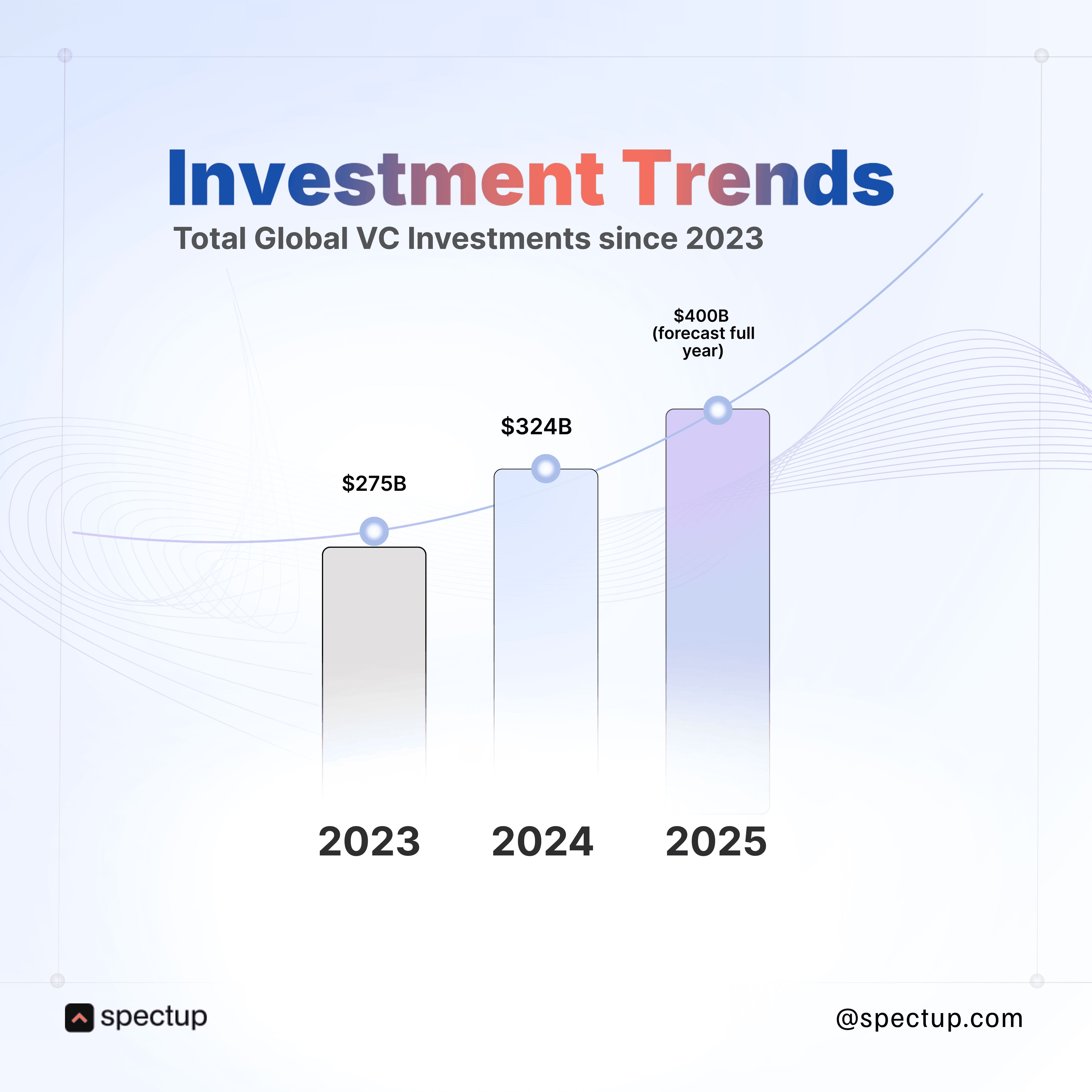

Investor funding increased by 3% in 2024 compared to 2023. A total of $314 billion was invested, with 11 companies each raising close to $1 billion. By the third quarter, a heightened investor focus on artificial intelligence (AI) was evident, contributing to more favorable policy rates. As a result, an increase in the number of secured deals and elevated company valuations was observed.

In contrast, the outlook for 2025 demonstrates notable changes. Despite 7,551 startups receiving funding in the first quarter, investors have become more selective in their approach. Additionally, lower valuations are prevailing, with primary investment concentrated on AI-driven and growth-stage startups.

Investor due diligence is more important than ever in 2025 because new trends are making investing riskier and more complicated. Here’s why it matters so much right now:

More Complexity and Risk: Global regulations, political tensions, and economic changes are all on the rise. Things like shifting tax laws and international rules mean investors need to thoroughly understand and manage risks before investing their money.

Fast-Changing Technology: Breakthroughs in AI, blockchain, and other advanced tech are shaking up industries but also making investments harder to evaluate. Investors now need technical know-how to assess things like intellectual property, whether technology can grow with demand, and if startups are following the rules.

AI-Powered Due Diligence: Artificial intelligence and machine learning help speed up due diligence by quickly analyzing large amounts of data, spotting unusual patterns, and tracking risks in real time. This means investors expect faster and more thorough checks than ever before.

Closer Look at Founders and Teams: Investors are digging deeper into founders’ backgrounds, reputations, and team skills. With more fraud and startup failures happening, checking references and leadership track records has become a key way to lower the risk of things going wrong.

Focus on ESG Standards: Environmental, social, and governance (ESG) practices are now a must-have when evaluating investments. Investors look closely at ethical behavior and sustainability as important factors for protecting value and reputation.

Better Organization Needed: Startups are expected to keep their documents organized, accurate, and easily accessible online. Missing or inconsistent information is a big warning sign that can delay or stop investment decisions.

Economic Uncertainty and Inflation: With rising inflation and interest rates changing, financial due diligence goes beyond looking at past numbers, it now includes judging how well a company can handle tough times to help avoid losses.

The VC Due Diligence Process Explained

Investor due diligence goes beyond a simple checkbox exercise. It actively examines the core of the startup. Venture capitalists thoroughly evaluate a startup’s business model, financials, legal standing, and growth potential before committing funds.

Stages of VC Due Diligence

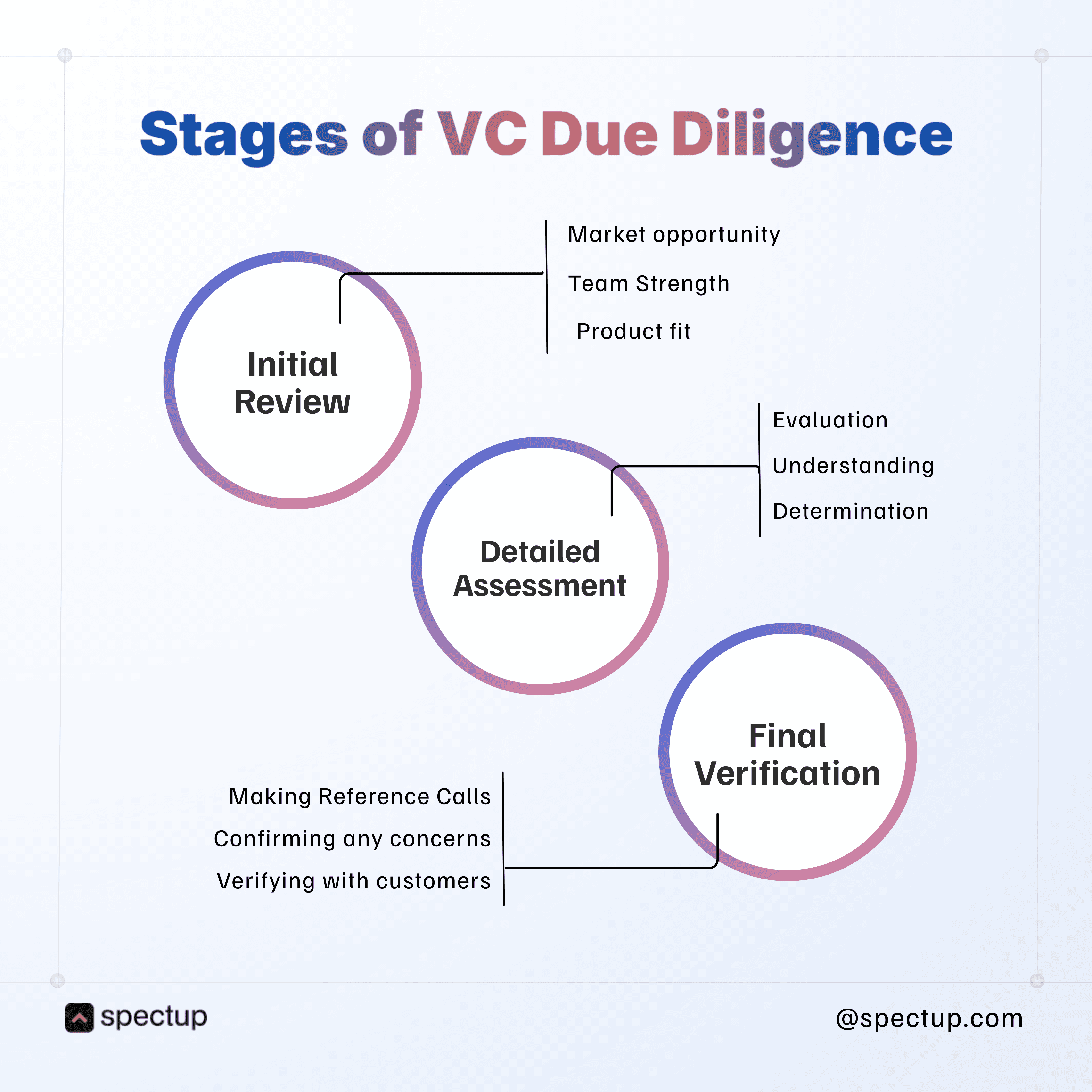

1. Initial Review

This phase is the first step in the screening process. When a venture capitalist (VC) shows interest, they conduct an initial evaluation based on the pitch deck and executive summary submitted by the entrepreneur. During this stage, the VC looks at important factors such as:

Market opportunity: The potential size and growth trajectory of the target market

Team strength: The experience, expertise, and cohesion of the founding team

Product fit: Alignment between the proposed solution and identified market needs.

This initial analysis helps the VC decide if they need to do more in-depth research and ask for additional information.

2. Detailed Assessment

At this stage, investors start a thorough review by requesting a startup due diligence checklist, which usually includes financial statements, customer contracts, incorporation documents, and intellectual property filings. These materials are examined to:

Evaluate the company's financial stability.

Understand the accuracy in documents and legal compliance

Determination of operational effectiveness, and technology infrastructure.

To make this process easier, it is standard practice to set up a secure due diligence data room that systematically organizes all important documents for investor assessment.

3. Final Verification

Prior to finalizing any agreement and disbursing funds, venture capital firms conduct a thorough review of all relevant documentation to ensure accuracy and compliance. This process may include:

Making reference calls to business partners.

Confirming any previously identified concerns.

Additionally, in certain instances, venture capitalists verify product authenticity and market demand by directly consulting with customers.

These measures are designed to validate both the necessity for the product and the qualitative strengths of the business. The primary objective is to ensure comprehensive alignment across all aspects before committing capital, thereby mitigating potential issues in subsequent stages.

Timeline Expectations

This process usually takes 4 to 8 weeks, but it can vary based on factors such as the size of the funding round and the development stage of your company. Early-stage startups may go through this process more quickly with fewer complexities compared to late-stage rounds that require thorough checks.

Knowing about this process allows you to understand what investors expect during meetings and customize your investor checklist for startups accordingly. This makes preparation less overwhelming and more strategic.

Navigating Startup Financing

A comprehensive understanding of startup financing is fundamental to effective preparation for the due diligence process. Familiarity with various funding options, including bootstrapping and venture capital, enables founders to develop informed strategies aligned with their business objectives.

Furthermore, in the post-due diligence phase, expertise in startup term sheets becomes critical. Access to authoritative guidance on valuation and negotiation tactics equips founders with the tools necessary to safeguard their startup’s interests during negotiations.

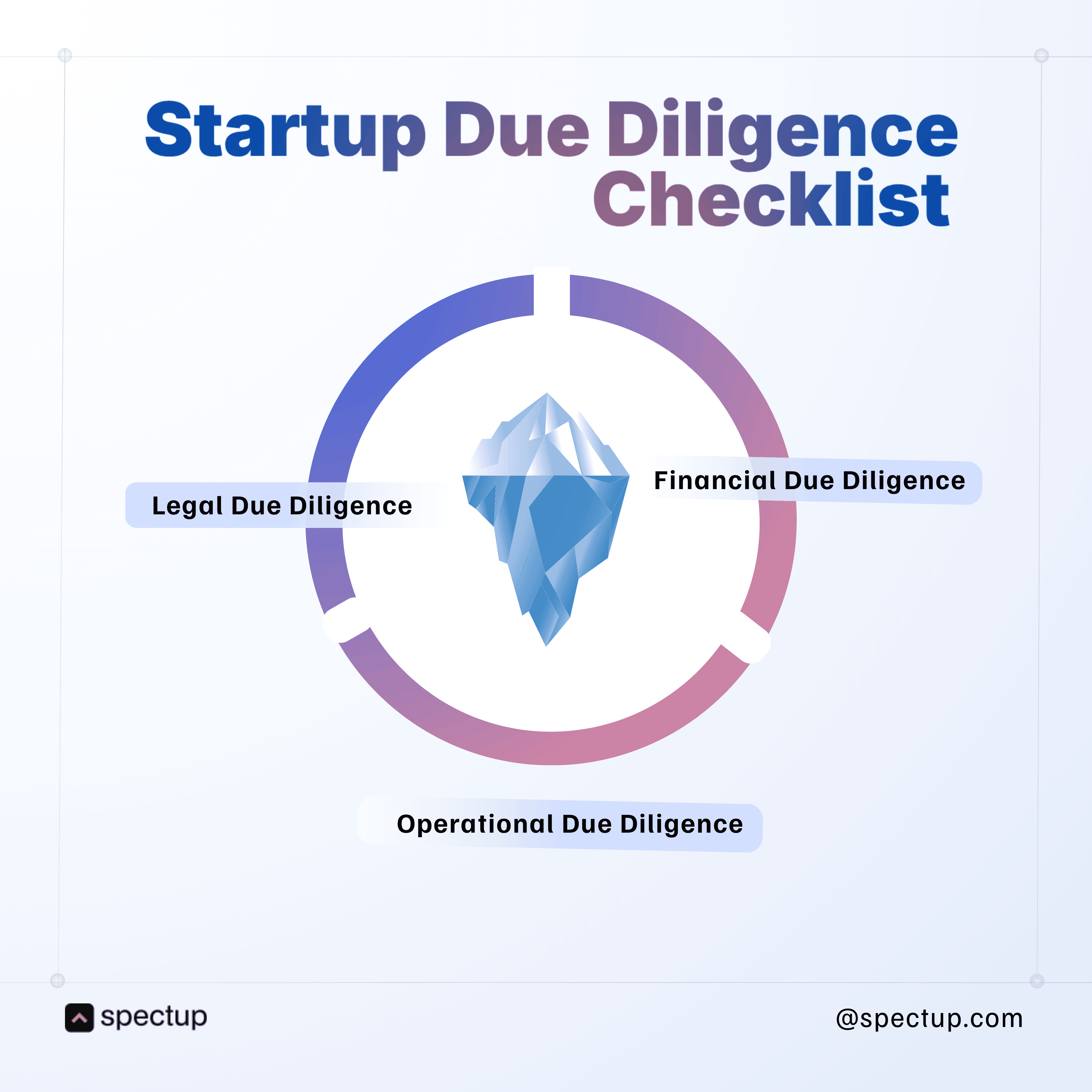

Startup Due Diligence Checklist

Before meeting with potential investors, it is important to have a thorough startup due diligence checklist ready. This document acts as a structured guide during the venture capital (VC) due diligence process, ensuring everything is organized and showing your dedication to the business. Essentially, the checklist serves as a roadmap for being prepared for investors, outlining all the required materials and documents that need to be gathered and uploaded into the specific due diligence data room.

Financial Due Diligence

Investors require comprehensive information regarding both historical financial performance and future growth potential. It is essential to prepare the following documentation:

Historical financial statements, including profit and loss (P&L) statements, balance sheets, and cash flow reports.

Revenue projections supported by clear and reasonable assumptions. It is advisable to evaluate innovative revenue models that may enhance your startup’s financial prospects. For further insights, refer to innovative revenue models.

Customer contracts, with particular emphasis on those generating recurring revenue or structured as subscription agreements.

Capitalization table (cap table) detailing current ownership stakes and records of previous fundraising rounds.

Legal Due Diligence

Legal documentation is essential for establishing credibility with investors. The following documents should be prepared and readily available:

Incorporation papers and company bylaws, which define the legal structure and governance of the business.

Shareholder agreements, as well as minutes from board meetings, to demonstrate transparency and proper corporate oversight.

Intellectual property filings, including documentation of patents, trademarks, or copyrights, to substantiate ownership of key assets.

Employment contracts and agreements with contractors to ensure clarity regarding roles, responsibilities, and terms of engagement.

Ensuring the completeness and accuracy of these documents significantly contributes to investor confidence.

Operational Due Diligence

Investors seek a comprehensive understanding of your daily operations. It is advisable to prepare the following information:

A product roadmap that details forthcoming features and associated timelines.

A go-to-market (GTM) strategy outlining customer acquisition methods.

Key performance indicators (KPIs) and traction metrics that illustrate business momentum.

An overview of the technology stack, emphasizing scalability potential.

Team biographies, including core competencies and future hiring plans.

What Investors Look for in Startups During Due Diligence

When going through a startup due diligence checklist or working with venture capital (VC) investors, knowing what investors care about most can give you a big advantage. Investors aren’t just looking for exciting ideas or trends, they want solid proof that your startup is a wise and scalable investment.

That’s why they carefully evaluate different parts of your business, like how strong your business model is, the skills and experience of your leadership team, and how well-organized and complete your due diligence data room is. Essentially, this process acts as an investor checklist for startups, where investors are searching for clear signs that their money will go into a business with real growth potential and reliable management.

During due diligence, investors usually focus on key areas such as:

1. A scalable business model with clear market opportunity

The growth potential of a startup depends on two factors: market demand and the ability to expand operations while maintaining stability. Investors want to know that the target market is big enough to allow for significant growth. Using strategies from the Lean Startup methodology can be helpful in confirming market demand and establishing scalable business practices.

2. Strong founder-market fit and leadership team

It is essential for you and your team to possess a comprehensive understanding of the target market. Investors typically seek founders who demonstrate both passion and subject matter expertise, as effective leadership is a key determinant of organizational success.

Startups with two founders raise 30% more investment, show three times higher customer growth, and achieve better success rates than single-founder startups, highlighting the impact of a strong founding team

Evaluating the management team’s skills, motivation, and cohesion reveals critical insights that impact strategic decision-making and risk mitigation.

3. Defensible intellectual property or unique advantage

What distinguishes your business from competitors? Investors seek well-defined barriers that protect your market position and prevent others from replicating your achievements. It is advisable to address the following points:

Patents: Legally protected inventions or processes signal that your core technology is safeguarded, creating a significant hurdle for new entrants.

Proprietary Technology: Custom-built software, algorithms, or hardware, especially those developed in-house demonstrate innovation that’s difficult to reverse-engineer.

Trade Secrets: Confidential business practices, such as unique manufacturing techniques or specialized formulas, provide ongoing competitive advantages when kept secure.

Exclusive Partnerships: Strategic alliances or exclusive supplier agreements can lock out competitors and ensure market access.

Brand Authority: Strong brand recognition and customer loyalty are intangible assets that differentiate you from less established rivals.

By highlighting these distinctive advantages in your pitch materials and data room, you provide potential investors with assurance that your business possesses robust barriers to entry and is not readily susceptible to disruption from competitors or larger industry incumbents.

4. Clear path to profitability

Investors are increasingly focused on evaluating whether a startup’s revenue can scale effectively in the near future. Accordingly, presenting a detailed roadmap that projects both revenue growth and cost reduction is critical for instilling investor confidence in the long-term viability of your business model.

Key elements that investors expect to see include:

Revenue Projections: Clearly lay out expected sources of revenue, and explain the key assumptions behind each one, such as how many customers you expect to gain, your pricing strategy, and how long it typically takes to make a sale.

Cost Structure: Break down your main expenses into fixed costs (like salaries, rent, and software subscriptions) and variable costs (such as marketing or production). Highlight any planned cost-saving measures or efficiencies that will help lower your per-unit costs as the business grows.

Milestone-Based Growth: List major milestones like launching new products, entering new markets, or landing big customer contracts that are expected to significantly improve your finances. This helps investors see when and how you plan to become profitable.

Cash Flow Management: Describe how you'll manage incoming and outgoing cash to avoid running short. Show calculations for your financial runway based on current spending rates, and explain how any new funding (including startup loans) will be used to keep the business growing sustainably.

Interesting Fact: Startups that share quarterly updates on their progress toward profitability are 50% more likely to retain investor interest during fundraising rounds.

Actionable Tip:

When pursuing external financing, it is essential to prepare detailed use-of-funds statements that clearly specify how the borrowed capital will enhance revenue generation or reduce critical expenses. Investors value founders who can articulate not only the expected timeline for profitability but also the precise mechanisms by which profitability will be achieved.

Incorporating these specifics into pitch materials and data room documentation enables potential investors to understand the logical progression from initial growth phases to long-term sustainability and profitability.

5. Transparent and organized documentation

Disorganized files or missing documentation can signal potential issues to investors and may hinder the due diligence process. Conversely, maintaining clean and consistent data across all materials including pitch decks, financial models, and contractual agreements demonstrates reliability and fosters investor trust, thereby expediting review procedures.

By aligning your preparation with these key investor expectations, you enhance the likelihood of a seamless venture capital due diligence experience and are better equipped to address challenging questions during meetings.

Preparing for Investor Meetings and Data Room Setup

Preparing for investor meetings represents a critical opportunity to demonstrate your commitment to your startup’s future. The startup due diligence checklist encompasses more than simply collecting documentation; it also evaluates your ability to effectively address challenging questions posed by investors. The following practices have consistently proven effective:

Preparing for Investor Meetings:

Prepare for tough questions: Figure out where your business might be vulnerable and get ready with clear, honest answers. Investors appreciate transparency and are more likely to trust you if you address issues openly instead of trying to hide them.

Be open about weaknesses: No one expects your business to be perfect. Admitting challenges and showing a solid plan to tackle them demonstrates maturity and strategic thinking.

Keep your data consistent: Double-check that all numbers in your pitch deck, financial models, and supporting documents match up. Any inconsistencies can seriously hurt investor trust.

Building a Due Diligence Data Room

A data room should be regarded as a digital extension of your organization—professional, secure, and intuitively structured. To ensure it is optimized for investor review, consider the following best practices:

Cloud-Based Security: Choose well-known platforms like Google Drive, Dropbox, or trusted virtual data room services that have strong permission settings to protect sensitive data.

Clear Organization: Sort documents into specific, clearly named folders (such as financial statements, legal documents, and operational materials) to make it easy to find and review information quickly.

Consistent File Naming: Use clear and consistent file names so documents are easy to locate and investors don’t get frustrated searching for what they need.

Upload Only Final Documents: Only upload documents that are finished, reviewed, and approved. Avoid including drafts or incomplete files, as these can hurt your credibility and cause concern.

Version Control and Duplicate Management: Keep track of document versions carefully and regularly remove old files so investors always see the latest information without confusion.

Adopting this approach not only streamlines the VC due diligence process, but also demonstrates a clear understanding of investor expectations. An organized data room, coupled with thorough meeting preparation, distinguishes your startup from others that may overlook these critical elements.

What Investors Look for in Startups: ESG Factors and Ethical Considerations in Investment Decisions in 2025

In 2025, investor priorities in startups are increasingly defined by the integration of ESG (Environmental, Social, and Governance) factors as a central component of investment decision-making. Investors now assess not only the potential for financial returns but also the extent to which startups adhere to broader sustainability and ethical standards.

This evolution in investor behavior is underpinned by the recognition that startups with robust ESG commitments are typically:

More resilient in the face of market and operational challenges

Better positioned to attract and retain high-quality talent

Less likely to encounter regulatory obstacles

Key ESG considerations:

The following factors are influencing Environmental, Social, and Governance (ESG) considerations during the due diligence process:

Environmental: Evaluation of a startup’s carbon footprint, resource efficiency, and overall environmental impact.

Social: Assessment of diversity policies, labor standards, and contributions to social well-being.

Governance: Scrutiny of transparency measures, ethical business practices, and effective governance structures.

Startups that actively follow ESG (Environmental, Social, and Governance) principles are more likely to build lasting advantages and attract a wider range of investors. This includes impact investors and development finance institutions, many of whom require strong ESG standards before providing funding.

More and more investors see thorough ESG practices as signs of good risk management and long-term success. With new rules like the EU’s Sustainable Finance Disclosure Regulation, startups that ignore ESG may face big challenges when trying to raise money or grow their business.

The growing focus on ESG also reflects changing expectations in society; both consumers and investors now prefer companies that act ethically and show social responsibility. Startups that openly track, report, and include ESG goals in their strategies are more likely to earn investor trust and secure the funding they need.

Startups that prioritize ESG are seen as not just financially appealing but also as helping drive sustainable development. Meeting ESG standards has become essential for attracting investment in 2025.

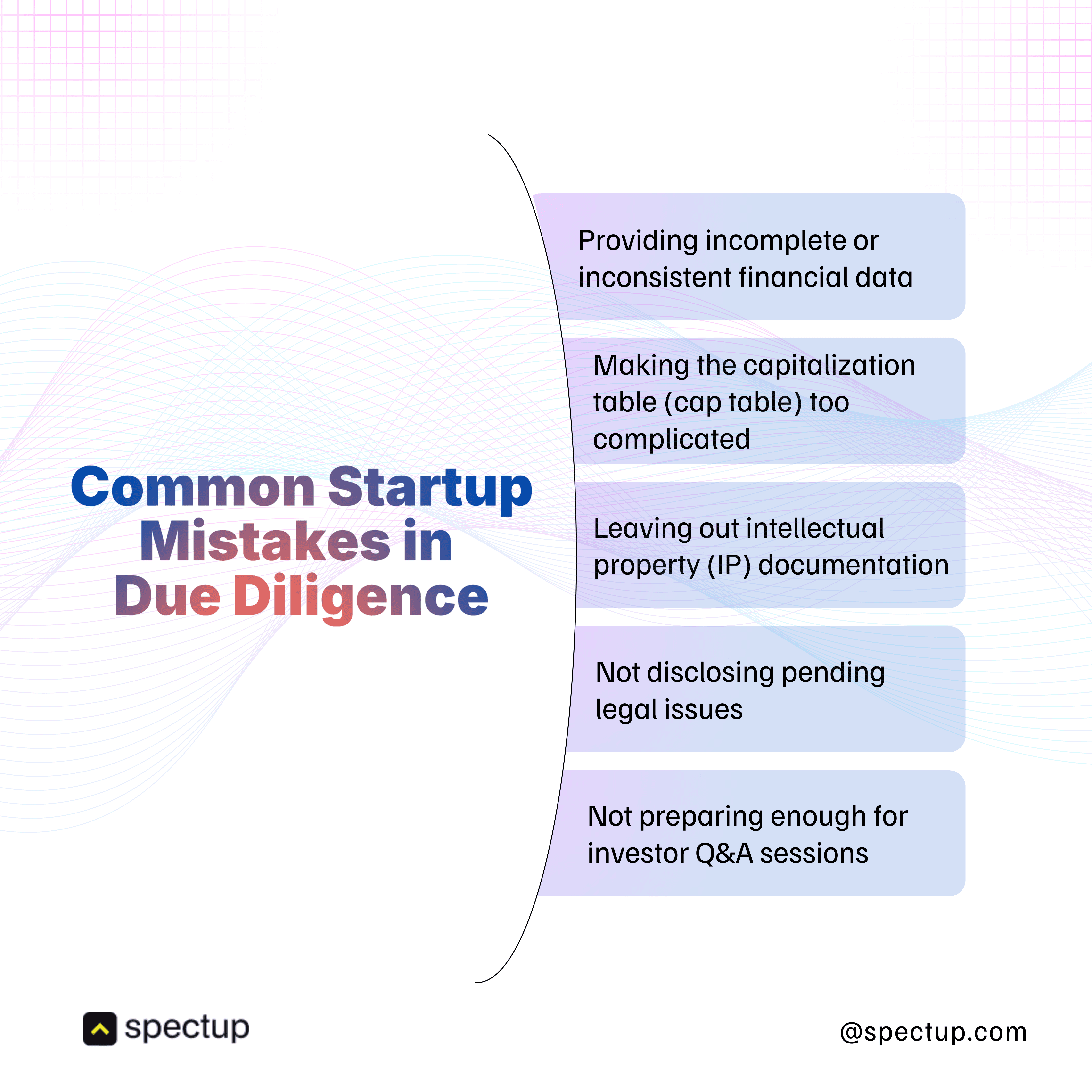

Common Founder Mistakes in Due Diligence

Navigating the startup due diligence checklist requires careful attention to detail. Investors thoroughly assess a company's operations to find any inconsistencies, gaps, or potential risks. If important aspects are overlooked or necessary documents are not provided during the VC due diligence process, it can lower investor confidence and put potential funding opportunities at risk. One common mistake is putting too much emphasis on preparing the pitch while neglecting to organize the due diligence data room and anticipate the specific information needs of investors.

The following are common pitfalls to avoid when completing an investor checklist for startups:

Providing incomplete or inconsistent financial data: Financial statements, projections, and cash flow numbers need to be accurate, complete, and consistent. Mistakes or missing information can worry investors and lead them to look more closely at your business.

Making the capitalization table (cap table) too complicated: A confusing or unclear cap table with uncertain ownership percentages can raise concerns about company management and make it harder to raise money in the future.

Leaving out intellectual property (IP) documentation: For many startups, IP is a major advantage. If you don’t have clear records showing who owns your IP or proof of proper filings, investors may doubt whether your business can maintain its edge.

Not disclosing pending legal issues: Hiding information about lawsuits, compliance problems, or contract disputes damages your credibility. It’s always better to be open, concealing these issues can destroy investor trust.

Not preparing enough for investor Q&A sessions: If you can’t confidently answer questions about your market fit, competition, or key business metrics, it suggests you don’t fully understand your own business model or strategy.

These risks may be mitigated by conducting a comprehensive review of your startup due diligence checklist, ensuring all data presented is consistent and well-organized, and preparing thoroughly for investor inquiries prior to meetings. A streamlined and transparent due diligence process enhances investor confidence and increases the likelihood of securing investment.

Final Thoughts

You have reviewed the key components of the startup due diligence checklist, examined the intricacies of the VC due diligence process, and gained insight into what investors seek in startups. While preparing for investor meetings may seem daunting, approaching this process with proper preparation and a strategic mindset transforms it from an obstacle into an opportunity for growth.

Your due diligence data room should be regarded as the professional profile of your startup. It must be meticulously organized, comprehensive, and easily navigable. Investors expect to find transparent financial statements, robust legal documentation, and evidence of operational proficiency consolidated in a single location. The absence of critical documents or inconsistencies within the provided information can quickly prompt investor concern and diminish credibility.

Should you encounter uncertainty regarding these requirements, it is important to recognize that assistance is available. Spectup offers expertise in structuring financial, legal, and operational materials, enabling you to concentrate on scaling your business while ensuring all due diligence obligations are met efficiently.

Effective due diligence not only facilitates investment but also attracts partners who share confidence in your long-term vision. This approach creates mutually advantageous relationships that extend beyond initial funding.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.