While many people think venture capital comes only from individuals or traditional VC partnerships, corporations reflected mainly as Corporate Venture Capital Firms are actually significant players in this investment space too. 2025 onwards, we have seen Corporate venture capital investments reached $18.7 billion in the first quarter, comprising 15-20% of global VC funding , underscoring the increasing influence of strategic investors in shaping the entrepreneurial ecosystem.

While traditional venture capital (VC) previously dominated funding activities, CVC firms are now establishing themselves as key players by offering more than just capital. These entities provide industry expertise, established networks, and opportunities for strategic partnerships that can significantly accelerate a startup's growth trajectory. At spectup, this evolution has been observed firsthand through our work supporting startups in their fundraising efforts. As a result, a comprehensive understanding of corporate venture capital has become critical for founders seeking suitable investment partners.

The advantages of corporate venture capital extend well beyond financial investment. Unlike traditional VC investors, CVC funds enable startups to access established distribution channels, technical resources, and enhanced market credibility from the outset. Strategic partnerships fostered through these investments frequently lead to pilot programs, joint ventures, or acquisition opportunities, thereby allowing startups to scale rapidly and enter new markets more efficiently. For founders, an in-depth understanding of both corporate venture capital and traditional venture capital dynamics is essential to making informed decisions about potential funding sources.

What Is Corporate Venture Capital?

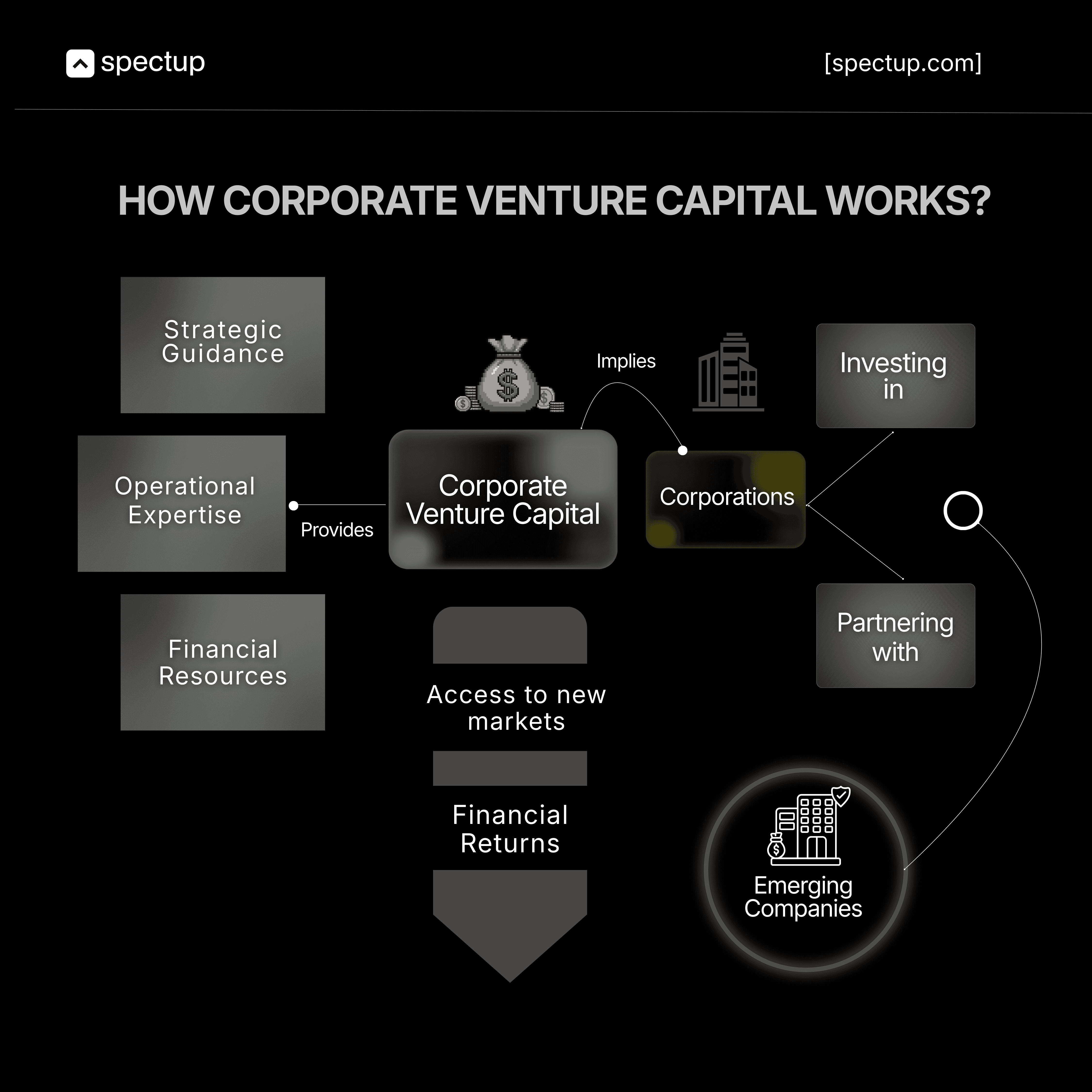

Corporate venture capital (CVC) represents a powerful funding model where established corporations invest directly in promising startups. Traditional venture capital focuses primarily on financial returns. In contrast, corporate venture capital funds pursue strategic advantages alongside profits. These advantages include access to cutting-edge technologies, entry into untapped markets, and partnerships that fuel mutual growth. Therefore, both startups and corporations benefit from this arrangement.

How Corporate Venture Capital Firms Function?

Corporate venture capital firms function as strategic extensions of their parent companies. However:

They invest with a unique, purpose-driven approach.

They deliver more than capital alone.

Instead, they provide mentorship, valuable industry connections, and critical resources that help startups scale efficiently.

The corporate venture capital structure cleverly balances financial objectives with broader corporate goals. As a result, this model requires careful alignment between startup agility and strategic vision. Recent corporate venture capital trends reveal a significant shift in corporate behavior. More companies are launching dedicated CVC arms to capture emerging technologies early.

This proactive approach differs substantially from traditional venture capital models. Specifically, corporate venture capital strategy tightly integrates investment decisions with corporate innovation roadmaps. Consequently, CVC serves a dual purpose. It injects essential capital into startups while simultaneously building robust innovation pipelines for corporations. This symbiotic relationship continues to reshape the startup funding landscape.

Increasing Trend of Corporate Venture Capital in startups fundraising in 2025

Corporate venture capital (CVC) activity in 2025 has demonstrated both resilience and significant structural change. According to data from CB Insights and Aranca, CVC-backed funding reached approximately $18.7 billion in the first quarter of 2025, a 22% decrease compared to the previous quarter, reflecting a more selective investment environment that prioritizes quality over quantity.

Despite a reduction in overall funding, deal sizes have increased markedly, with the global median rising to $10 million from $8.9 million in 2024. While the year commenced with caution, by mid-2025, corporate investors had participated in nearly 2,500 funding rounds. The total value of corporate-backed startup deals doubled relative to early 2024 levels, indicating renewed confidence and greater liquidity in subsequent quarters.

By the third quarter of 2025, global venture capital investment totaled $120 billion, with corporate venture capital funds representing a substantial share of large-scale transactions, particularly within artificial intelligence (AI), robotics, and climate technology sectors. The Americas, led by the United States, accounted for approximately 70% of CVC funding as corporations directed capital toward transformative AI ventures such as Anthropic and xAI.

Major Transformation Center of Corporate Venture Capital Firms in 2025:

Throughout 2025, major corporations repositioned their venture arms as strategic innovation drivers by:

Prioritizing fewer but larger investments,

Adopting off-balance-sheet fund structures to enhance operational independence and agility.

This evolution signifies a transition from rapid capital deployment toward deliberate, sustainable, innovation-led investing practices.

Key Trends Driving Corporate Venture Capital in 2025

Corporate venture capital (CVC) has transformed rapidly in recent years, fundamentally reshaping how startups access funding and strategic resources. Unlike traditional venture capital, corporate venture capital firms bring more than capital to the table. Instead, they combine financial backing with deep industry expertise, operational resources, and market access. This dual approach creates powerful synergies between established corporations and innovative startups. As a result, the benefits of corporate venture capital extend far beyond simple investment returns. Companies gain early visibility into disruptive technologies, while startups secure not just funding but also validation, distribution channels, and technical guidance from industry leaders.

The corporate venture capital structure continues to evolve as organizations refine their investment approach.

Key developments of Corporate Venture Capital Funds include:

Strategic alignment over pure returns: CVCs increasingly prioritize investments that complement their core business objectives rather than focusing solely on financial performance

Dedicated fund structures: More corporations are establishing independent corporate venture capital funds with clear governance frameworks and decision-making autonomy

Hybrid investment models: Leading firms now blend minority stakes, strategic partnerships, and acquisition pipelines to maximize both innovation access and competitive positioning

Longer investment horizons: Corporate venture capital strategy has shifted toward patient capital, recognizing that breakthrough innovations require extended development timelines

These trends signal a maturing ecosystem where corporate venture capital vs venture capital debates miss the broader point. Both models now coexist and complement each other, creating a richer funding landscape for entrepreneurs at every stage.

Here’s what’s making waves in the world of corporate venture capital funds this year:

1. Increased CVC Participation in Early-Stage Rounds

Corporate venture capital firms are shifting their investment strategy dramatically. Previously, most corporate venture capital deals targeted later-stage startups with established market traction. However, CVCs now actively pursue early-stage funding opportunities with greater intensity. This strategic pivot allows them to influence emerging technologies and business models from inception. Moreover, early engagement provides corporate investors with significant competitive advantages. They can shape innovation trajectories while cultivating promising ventures that align with their strategic objectives. Consequently, this trend reflects a fundamental change in how corporate venture capital funds deploy their resources and execute their corporate venture capital strategy.

CVCs moving from late-stage to early-stage investments

Early involvement enables shaping of technologies from the ground up

Strategic positioning creates long-term competitive advantages

Reflects evolution in corporate venture capital structure and approach

2. AI-Driven Investment Analysis and Portfolio Management

Artificial intelligence is fundamentally transforming how corporate venture capital firms evaluate and manage investments. Consequently, organizations now leverage sophisticated AI tools throughout the entire investment lifecycle. These technologies streamline deal sourcing, enhance risk assessment accuracy, and optimize portfolio performance across diverse asset classes. Moreover, AI-powered platforms enable corporate venture capital funds to process vast amounts of market data in real time. This capability significantly improves decision-making speed and precision.

Key AI Applications in Corporate Venture Capital:

Predictive Analytics – Identifies high-potential startups before competitors

Automated Due Diligence – Reduces evaluation time by 60-70%

Risk Scoring Models – Quantifies investment risks with greater accuracy

Portfolio Monitoring – Tracks performance metrics across all investments continuously

As a result, corporate venture capital firms can now identify startups that precisely align with their strategic objectives. Additionally, AI-driven insights optimize resource allocation within complex corporate venture capital structures. This technological advantage proves especially valuable when managing multiple funds simultaneously. Furthermore, the integration of machine learning algorithms helps investors spot emerging market trends earlier than traditional methods allow. Ultimately, this shift toward AI-powered investment analysis represents a critical competitive advantage in today's fast-moving venture landscape.

3. Corporate–Startup Partnerships for Sustainability and ESG Impact

Sustainability has evolved from a corporate buzzword into a strategic imperative that shapes investment decisions. Consequently, corporate venture capital strategy now prioritizes startups developing innovative solutions for environmental, social, and governance (ESG) challenges. These partnerships create mutual value: corporations accelerate progress toward their sustainability targets, while startups gain critical resources to scale their impact-driven innovations. Moreover, this alignment addresses growing stakeholder pressure for measurable ESG outcomes.

Key Benefits of ESG-Focused Corporate Venture Capital:

Accelerated sustainability goals – Corporations meet regulatory requirements and stakeholder expectations faster through proven startup technologies

Innovation access – Companies tap into breakthrough climate tech, circular economy solutions, and social impact innovations without lengthy internal R&D cycles

Enhanced brand reputation – Strategic investments in ESG startups strengthen corporate credibility with consumers, investors, and regulators

Risk mitigation – Early exposure to sustainability trends helps corporations adapt to evolving environmental regulations and market demands

Furthermore, these partnerships often extend beyond capital. Startups receive mentorship, distribution channels, and pilot opportunities that validate their solutions at scale. Therefore, corporate venture capital funds focusing on ESG create ecosystems where sustainable innovation thrives while delivering measurable business returns.

4. Rising Interest in Cross-Border CVC Funds

Globalization continues to drive corporate expansion strategies. Consequently, cross-border corporate venture capital funds have emerged as powerful tools for accessing innovation beyond domestic markets. Corporations now actively seek transformative ideas from diverse international ecosystems to maintain competitive advantages. This strategic approach delivers multiple benefits:

Access to emerging markets with untapped customer segments and growth potential

Exposure to regional innovation hubs like Southeast Asia, Latin America, and Africa

Diversified technology portfolios spanning different regulatory and market environments

Strategic partnerships with local players who understand regional dynamics

Moreover, these international investments foster valuable collaboration across borders. They enable corporations to understand foreign market nuances while building relationships with promising startups worldwide. Additionally, cross-border corporate venture capital strategy helps companies establish footholds in new territories before competitors arrive. As a result, forward-thinking organizations increasingly allocate portions of their corporate venture capital funds to international opportunities. This trend reshapes how corporate venture capital firms approach global innovation sourcing.

5. Integration of Internal R&D with Startup Innovation

More companies now merge their internal research and development efforts with startup innovations sourced through corporate venture capital activities. Consequently, this integration enhances organizational agility while maintaining the disciplined rigor of established corporate processes. Furthermore, it creates fertile ground for co-development projects where both parties learn and evolve together. Traditional venture capital firms typically focus solely on financial returns. In contrast, corporate venture capital firms pursue strategic advantages alongside monetary gains. This fundamental difference shapes investment decisions, portfolio management, and post-investment support structures. Moreover, corporate venture capital trends demonstrate how strategic investors combine long-term vision with investment expertise to reshape startup funding landscapes.

Key Investment Focus Areas of Corporate Venture Capital Firms across the Globe:

Autonomous Driving Technology: Advanced AI systems, sensor technologies, and self-driving software platforms

Mobility Solutions: Ride-sharing platforms, electric vehicle charging infrastructure, and fleet management systems

Smart City Innovations: Connected infrastructure, traffic optimization systems, and sustainable urban planning technologies

Strategic Positioning: Early access to disruptive innovations and partnership opportunities with breakthrough startups

These corporate venture capital firms demonstrate how CVC merges financial backing with strategic objectives. Startups gain access to substantial capital. Moreover, they benefit from industry expertise and established market channels. This combination creates exceptional value for growing companies.

The unique corporate venture capital strategy sets it apart from traditional venture capital models. Furthermore, this strategic approach explains why startups increasingly seek corporate partners alongside conventional investors. Hence, understanding corporate venture capital structure helps founders make informed decisions. Additionally, it clarifies why this funding model continues reshaping the startup ecosystem. Corporate venture capital trends show accelerating growth in this space. Consequently, more entrepreneurs now prioritize strategic fit alongside financial terms when evaluating investment opportunities.

Examples of Leading Corporate Venture Capital Firms

Google Ventures (GV) - Google's Strategic Investment Arm:

GV, formerly known as Google Ventures, stands as one of the most influential corporate venture capital firms in the technology landscape. Founded in 2009, this investment arm operates with remarkable independence while drawing upon Google's extensive technical resources and industry expertise. The firm maintains a deliberately broad investment thesis that spans artificial intelligence, healthcare innovation, cybersecurity, and consumer technology. This diversified approach allows GV to identify transformative opportunities across multiple sectors.

Moreover, the firm has deployed billions of dollars into hundreds of startups, creating a portfolio that includes notable successes like Uber, Stripe, and Slack. Consequently, GV has established itself as a premier destination for founders seeking both capital and strategic guidance.

Key Strategic Advantages GV Offers Startups:

Technical Infrastructure Access: Portfolio companies can leverage Google's cloud computing resources, machine learning tools, and data analytics capabilities without compromising their independence

Talent Network: Startups gain introductions to Google's engineering talent pool and access to specialized recruitment support for critical technical hires

Market Intelligence: GV provides founders with insights into emerging technology trends, competitive landscapes, and product development strategies informed by Google's market position

Operational Freedom: Unlike traditional corporate venture capital structures, GV maintains a hands-off approach that preserves startup autonomy and prevents conflicts with Google's core business interests

Distribution Opportunities: Select portfolio companies receive potential partnership pathways with Google's platforms, though these connections develop organically rather than through mandated integration requirements

This balanced model demonstrates how corporate venture capital firms can deliver strategic value while respecting entrepreneurial independence. Furthermore, GV's success has influenced how other technology giants structure their investment operations.

Intel Capital:

Intel Capital stands as one of the most influential corporate venture capital arms in the technology sector. Since its establishment in 1991, the firm has invested more than $19.5 billion in approximately 1,660 companies across 59 countries. Moreover, Intel Capital strategically focuses on semiconductor startups, artificial intelligence ventures, and emerging technologies that align directly with Intel's core business objectives. This approach creates a robust pipeline of innovation while simultaneously identifying potential acquisition targets and partnership opportunities. Furthermore, the investment strategy enables Intel to maintain its competitive edge in rapidly evolving markets where technological disruption occurs constantly.

Benefits of Intel Corporate Venture Capital Structure:

The benefits of this corporate venture capital structure extend far beyond financial returns. Intel Capital's investments serve multiple strategic purposes that strengthen the parent company's market position:

Technology Access: Intel gains early visibility into breakthrough innovations in chip design, AI processing, and quantum computing before these technologies reach mainstream markets

Ecosystem Development: By funding complementary startups, Intel builds a stronger ecosystem around its products, which increases demand for Intel's core semiconductor offerings

Talent Pipeline: Portfolio companies often become acquisition targets, providing Intel with access to specialized engineering teams and intellectual property

Market Intelligence: Investment activities provide real-time insights into emerging trends, competitive threats, and shifts in customer requirements across global technology markets

Consequently, Intel Capital demonstrates how corporate venture capital firms can create strategic value that extends well beyond traditional venture capital returns. This model has proven particularly effective in the semiconductor industry, where innovation cycles are long and capital requirements remain substantial.

Salesforce Ventures:

Salesforce Ventures stands as a prime example of how corporate venture capital firms strategically deploy capital to strengthen their core business ecosystem. Since its establishment, the venture arm has invested in over 400 companies across the cloud computing landscape. Moreover, the firm focuses on backing startups that integrate seamlessly with Salesforce's platform. This approach creates a win-win scenario. Portfolio companies gain access to Salesforce's massive customer base and technical infrastructure.

Meanwhile, Salesforce expands its platform capabilities without building every solution in-house. The strategy has proven remarkably effective. Notably, early investments in Zoom and Snowflake demonstrate how corporate venture capital strategy can identify future industry leaders while simultaneously enhancing platform value for existing customers.

The benefits of corporate venture capital extend far beyond financial returns in Salesforce's case.

Each strategic investment strengthens the company's competitive moat by expanding what developers and customers can accomplish within its ecosystem.

Furthermore, these partnerships provide Salesforce with early visibility into emerging market trends and technologies.

The company gains invaluable insights into customer needs through its portfolio companies' innovations. Additionally, successful exits from investments like Zoom, which went public in 2019, deliver substantial financial returns that fund further ecosystem development. This creates a self-reinforcing cycle of growth and innovation.

Key Strategic Advantages of SalesForce Capital Funds:

Ecosystem Expansion: Portfolio companies extend Salesforce's platform capabilities across video conferencing, data analytics, and enterprise applications

Market Intelligence: Direct access to emerging technologies and customer pain points through portfolio company relationships

Customer Value Creation: Integrated solutions provide customers with comprehensive business tools within a unified platform

Competitive Positioning: Strategic investments prevent competitors from capturing key integration opportunities

Financial Returns: Successful exits like Zoom generate capital for continued ecosystem investment and development

Amazon Alexa Fund:

Voice technology has fundamentally transformed how consumers interact with devices and services. Therefore, the Alexa Fund represents a strategic approach to corporate venture capital in the voice-first ecosystem. Amazon established this fund to support startups developing innovative voice experiences and Alexa-integrated solutions.

Moreover, the fund focuses on companies creating AI-driven voice applications across multiple sectors. These sectors include healthcare, automotive, smart home technology, and enterprise software. Consequently, portfolio companies gain access to Amazon's extensive voice technology infrastructure. They also benefit from technical resources and integration support that accelerate product development.

The strategic value of this corporate venture capital structure extends beyond traditional funding models. Initially, startups receive capital to scale their voice technology innovations. Additionally, they gain direct access to Alexa's vast user base and ecosystem. Furthermore, Amazon benefits from expanding its voice platform's capabilities through these partnerships. This creates a symbiotic relationship where innovation flows in both directions. As a result, the fund has backed numerous successful companies that have shaped the voice technology landscape.

Key Investment Focus Areas of Amazon Alexa Corporate Funds:

Smart home devices with native Alexa integration capabilities

Healthcare solutions leveraging voice-activated patient care systems

Automotive technologies enabling hands-free driver experiences

Enterprise tools utilizing voice commands for workplace productivity

Accessibility innovations making technology more inclusive through voice interfaces

BMW i Ventures:

BMW i Ventures stands as a prime example of how corporate venture capital firms strategically position themselves at the forefront of industry transformation. Launched in 2011, the fund demonstrates BMW's commitment to innovation beyond traditional automotive manufacturing. Moreover, the investment arm focuses on three critical areas that define the future of mobility. These include autonomous driving technologies, smart city infrastructure, and next-generation mobility solutions.

Furthermore, BMW leverages these investments to gain early access to breakthrough innovations that could disrupt the automotive sector. Consequently, the company maintains its competitive edge while traditional automakers face increasing pressure from tech-driven competitors.

The strategic approach BMW takes through its corporate venture capital structure delivers multiple advantages beyond financial returns.

First, the fund provides direct insights into emerging technologies before they reach mainstream adoption.

Additionally, BMW gains the ability to test and integrate cutting-edge solutions within its existing product ecosystem.

The company also builds valuable partnerships with startups that complement its long-term vision for sustainable urban mobility. Therefore, this proactive investment strategy allows BMW to shape industry standards rather than simply react to market changes. Ultimately, BMW i Ventures exemplifies how corporate venture capital strategy transforms traditional corporations into innovation leaders capable of navigating rapid technological disruption.

Corporate Venture Capital vs. Traditional Venture Capital

Corporate venture capital is fundamentally transforming how startups secure funding and grow their businesses. Unlike traditional venture capital firms that prioritize financial returns above all else, corporate venture capital firms operate with dual objectives. They seek both financial gains and strategic advantages that align with their parent company's long-term goals. This distinction creates a unique investment landscape where startups receive more than just capital infusions. Instead, they gain access to established distribution channels, proprietary technologies, and decades of industry expertise.

Moreover, corporate venture capital investments often come with built-in customer relationships, as the parent corporation may become an immediate buyer or partner. Consequently, this approach reduces market entry barriers and accelerates product validation in ways traditional venture capital simply cannot match.

Structural differences between CVC and TVC:

The structural differences between these two investment models reveal even deeper contrasts in their operational approaches. Traditional venture capital funds typically operate independently, managing pooled capital from institutional investors and high-net-worth individuals. Their primary obligation is delivering strong financial returns within a 7-10 year fund lifecycle.

Corporate venture capital funds, however, function as strategic arms of larger corporations with different performance metrics. They evaluate opportunities through the lens of strategic fit rather than pure ROI calculations. Additionally, their investment timelines tend to be more flexible since they are not bound by rigid fund structures. This flexibility allows corporate venture capital investors to support portfolio companies through longer development cycles.

Furthermore, they can provide operational support that traditional VCs cannot offer, including manufacturing capabilities, regulatory expertise, and global market access. These advantages explain why corporate venture capital trends show consistent growth, with CVCs participating in over 25% of all venture deals globally in recent years.

Key Distinctions of Corporate Venture Capital firms:

Investment motivations: Traditional VCs focus exclusively on financial returns, while corporate venture capital strategy balances financial gains with strategic corporate objectives

Value proposition: CVCs offer industry expertise, distribution networks, and operational resources beyond capital, whereas traditional VCs primarily provide funding and financial guidance

Timeline flexibility: Corporate venture capital funds operate with longer, more flexible investment horizons compared to the fixed 7-10 year cycles of traditional VC funds

Success metrics: Traditional VCs measure success through IRR and multiples, while CVCs evaluate both financial performance and strategic value creation for the parent company

Portfolio support: Corporate venture capital firms provide hands-on operational assistance including manufacturing, R&D collaboration, and market access that traditional VCs cannot replicate

Key Differences between Corporate Venture Capital Firms and Traditional Venture Capital Firms:

Here’s a quick snapshot comparing corporate venture capital vs traditional venture capital:

Aspect | Corporate Venture Capital | Traditional Venture Capital |

Primary Goal | Strategic alignment + financial returns | Purely financial returns |

Investor Type | Corporations (e.g., Google Ventures, Intel) | Independent VC firms |

Investment Focus | Startups that complement or disrupt parent firm | High-growth startups across industries |

Value Add Beyond Capital | Industry expertise, customer access, partnerships | Network, fundraising support |

Decision Process | Influenced by corporate strategy | Driven by fund performance metrics |

Typical Investment Stage | Often early to growth stages | Early to late stages |

Exit Horizon | Longer-term strategic partnerships possible | Exit through IPOs or acquisitions for return |

Benefits and Challenges between Corporate Venture Capital Firms and Traditional Venture Capital Firms

The debate between corporate venture capital and traditional venture capital has intensified as more startups evaluate their funding options. Traditional venture capital firms offer pure financial backing with a singular focus on maximizing returns. In contrast, corporate venture capital firms bring strategic value beyond capital, including market access, industry expertise, and potential customer relationships. However, this strategic alignment comes with trade-offs.

Corporate investors may impose restrictions that limit a startup's flexibility to pivot or work with competitors. Meanwhile, traditional VCs typically allow founders greater autonomy in their business decisions. The structure also differs significantly, corporate venture capital funds often have longer investment horizons aligned with parent company objectives, while traditional funds operate on fixed timelines with pressure to deliver returns to limited partners.

Startups must carefully assess which model aligns with their growth trajectory and strategic goals. Key considerations include:

Speed and flexibility: Traditional VCs often move faster on deals and impose fewer operational constraints

Strategic resources: Corporate venture capital provides direct access to distribution channels, technical infrastructure, and industry relationships

Exit pathways: Corporate investors may complicate future acquisitions if they compete with potential acquirers, whereas traditional VCs maintain neutrality

Term sheet complexity: Corporate deals frequently include strategic provisions like right of first refusal or joint development agreements

Network effects: Traditional VCs offer broader connections across multiple industries, while corporate VCs provide deeper relationships within specific sectors

The choice ultimately depends on whether startups prioritize strategic partnership and market validation or prefer maintaining independence with financial-only investors. Both corporate venture capital strategy and traditional VC approaches have proven successful, yet the optimal path varies based on the startup's stage, industry dynamics, and long-term vision.

Conclusion:

Corporate venture capital offers startups more than just funding, it unlocks industry expertise, faster development, and global market access. However, maximizing these benefits requires careful planning to align innovation with corporate mandates. This is where spectup comes in: we help you structure CVC deals more efficiently, ensuring you secure strategic partnerships that accelerate growth without compromising your independence

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.