Summary

Over 55% of early-stage capital seekers chose convertible notes while fundraising. You get cash now, argue about equity later. Given that investors are pickier now in terms of capital investment, you need speed.

TL;DR - Read This:

Convertible notes for capital seekers work like buying a concert ticket before the band gets famous, you pay today's price but get VIP access when they hit stadiums. Investors loan you money that turns into shares later. No valuation fights today, that happens when you are capital raising like Series A stage. You get: faster closes (weeks vs months), lower legal fees ($5K vs $25K for priced rounds), and investor-friendly terms (discounts + valuation caps reward early risk). The catch: convertible notes for startups accrue interest, have maturity dates, and can dilute you more than expected if you're not careful. Best for: pre-seed/seed rounds of startups, bridge funding between rounds, or when you need cash fast. Avoid if: you can't predict your next fundraise timeline or can't handle potential repayment pressure. If you are looking for investor outreach help, you should check out spectup.

What is meant by Convertible Notes for Capital Seekers?

Think of it like a gift card that upgrades itself.

You know how a gift card gives you $100 of store credit?

A convertible note for startups is like that, except when the store becomes super valuable, your $100 card automatically turns into ownership shares and you get more shares than people who bought in later.

Here's the real-world version for Convertible Notes for startups:

Imagine you're opening a food truck.

Your friend loans you $10,000 to buy equipment.

Now, Instead of paying them back in cash, you agree: "When I open my second location and bring in real investors, your $10,000 will turn into ownership. And because you believed in me when it was just a rusty van, you'll get a better deal than those later investors."

That's a convertible note for startups.

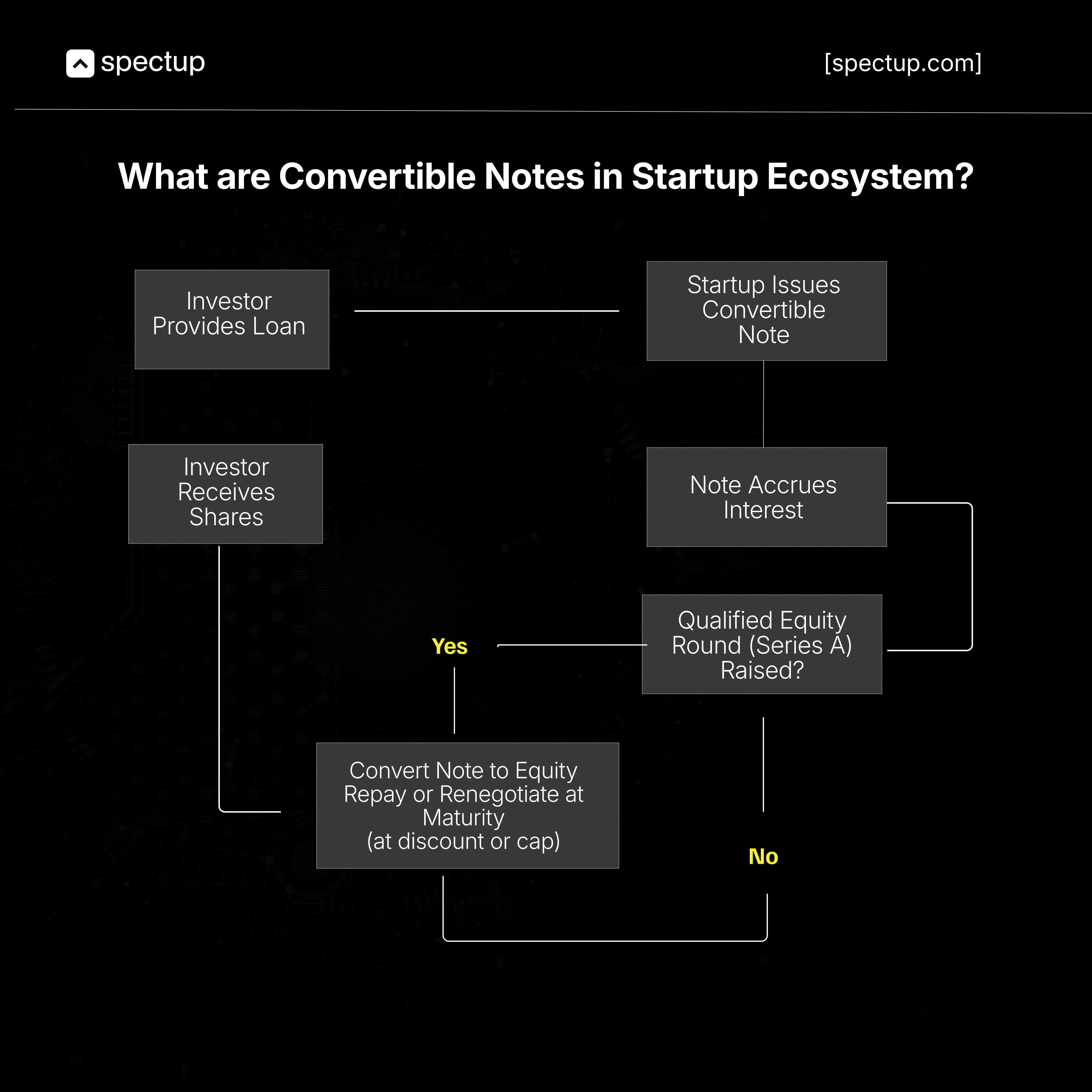

How Convertible Notes work for capital seekers:

Investor gives you $100K today (the loan)

You sign a note that says "this will turn into equity when we raise our next big round" (the promise)

When you raise Series A, that $100K (plus some interest) converts into shares (the payoff)

Investor gets equity without anyone arguing about valuation today (the shortcut)

Why founders love Convertible Notes?

Like buying a house before the neighborhood gets hot, you lock in today's price, benefit from tomorrow's value.

Faster

Cheaper fundraising

Delay complex valuation discussions until a later equity round

Quick access to seed capital with less initial dilution

Why investors love Convertible Notes?

Like getting concert tickets before the band goes platinum.

Guaranteed good seats at a discount.

Notable investors such as Y Combinator, Sequoia Capital, and First Round Capital frequently use convertible notes as part of their early stage funding instruments to finance startups, allowing for:

Greater flexibility

Simplicity in the investment process.

If you are stuck during the process or are unable to understand how it can help you in growth, you should connect with us. We are providing specialized fundraising consultancy services.

The Market Reality of Convertible Notes for Startups

The funding landscape got tighter, think of it like musical chairs where someone just removed 20% of the seats.

What's happening in Venture Capital Market?

Pre-seed startups raised $737M across 5,119 convertible instruments in Q1 2025

That's down from $923M across 6,251 instruments in Q4 2024

Translation: 21% fewer chairs, everyone scrambling faster

But here's the interesting part: While overall deals dropped, median raise amounts for convertible notes in bridge rounds increased to $2.5M in Q1 2025.

Investors are like venture capital bouncers, they're letting fewer startups through the velvet rope, but the ones who get in are getting bigger drinks.

Convertible notes for startups acts like backstage pass.

They help you skip the line while everyone else is arguing with the bouncer about cover charges (valuations).

Key Features of Convertible Notes for Startups (The Parts That Actually Matter)

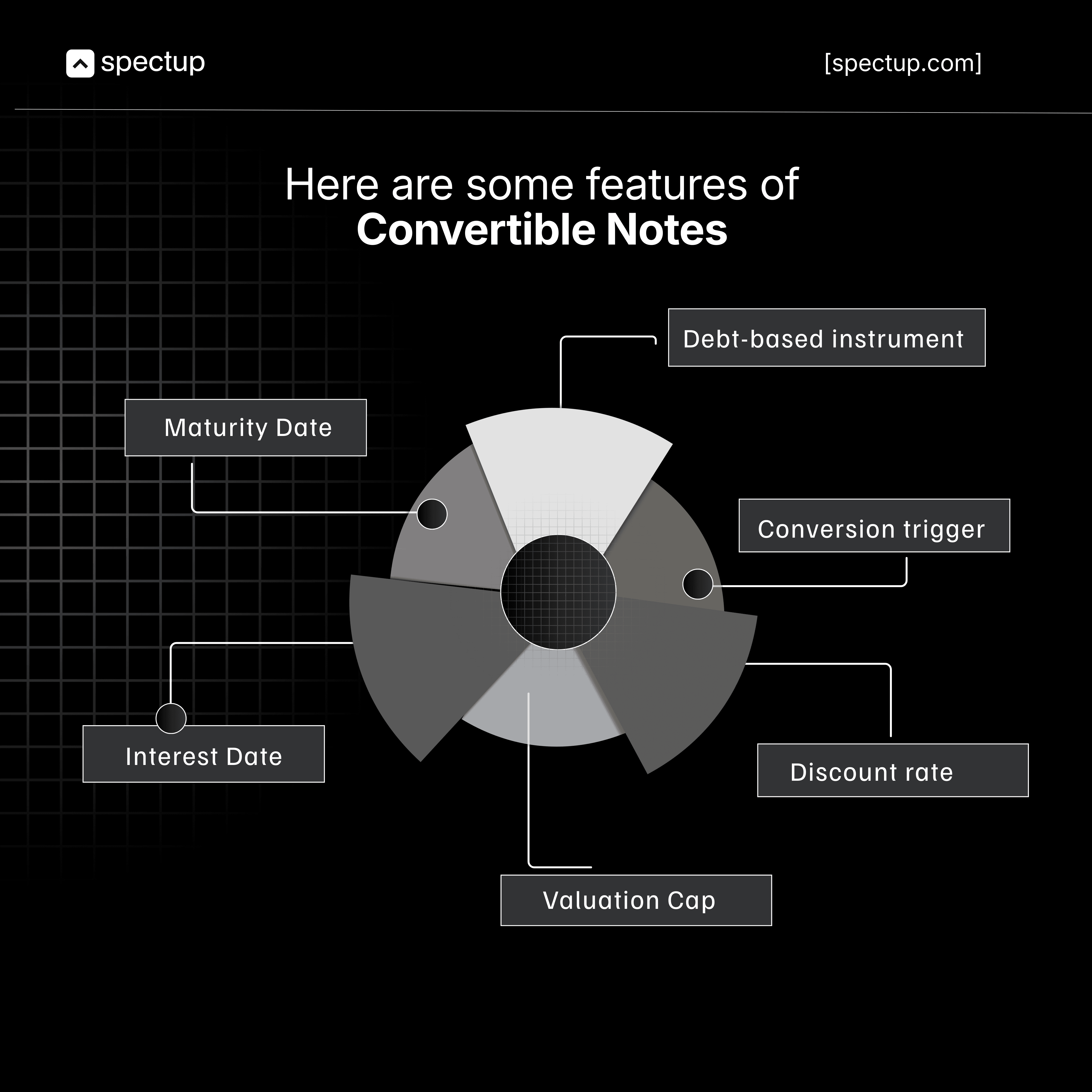

1. It Starts as Debt

Think of it like a HELOC (Home Equity Line of Credit), but for your startup.

Just like a HELOC lets you borrow against your house without selling it, a convertible note lets:

Investors loan you money against your company's future value

Without giving up equity today, you are utilizing it.

2. Conversion Trigger (When Debt Becomes Equity)

This is like a caterpillar turning into a butterfly.

Convertible note starts as one thing (debt) and transforms into something else (equity), when the right conditions happen (Series A funding).

Example: You raise $500K on a convertible note. Six months later, you close a $3M Series A. Metamorphosis time, the note automatically converts to equity in that round.

3. Discount Rate (The Early Bird Special)

Think of it like Amazon Prime Day pricing, but permanent.

Remember when everyone who pre-ordered the iPhone got it for less than launch day price?

That's a discount rate.

How Discounted Rate works in Convertible Notes:

If new Series A investors pay $10 per share (like Black Friday shoppers), and your note holders have a 20% discount (like Prime members who get early access), they pay $8 per share.

Why it exists: Rewards people who bought tickets before the show sold out.

Typical range: 15-25% discount

Still confused?

Contact us for capital advisory services.

4. Valuation Cap in Convertible Notes for Startups (The Price Lock)

This is like Costco's "we'll refund the difference" policy, but in reverse and way better.

Imagine you bought a house for $500K.

A year later, it's worth $2M.

A valuation cap is like having a contract that says: "Even though this house is now worth $2M, you get to buy additional shares as if it's still worth $500K."

This matters in terms of Protection.

Protects early investors from getting screwed when your company goes from "interesting idea" to "holy shit, this is huge."

Example scenario:

You raise $500K on a convertible note with a $5M valuation cap (the price lock).

Later, you raise Series A at a $10M valuation (actual market price).

Without a cap: Like buying stock at today's inflated price

With a $5M cap: Like having a time machine to buy stock at last year's price

This is massive.

It's the difference between getting 5% ownership vs 10% ownership for the same investment.

5. Interest Rate in Convertible Notes (The Money Grows Like a Savings Account)

Think of it like compound interest at a bank,except you're the bank, and you're paying the interest.

What it is: Annual interest that accrues on the note until it converts.

Typical rate: 2-8% per year (way better than a savings account, way worse than credit card debt)

How Interest Rate Works for Startups acquiring Convertible Notes?

Like a snowball rolling downhill, getting bigger over time.

If you borrow $100K at 5% interest and convert after 1 year, the investor actually converts $105K worth of debt into equity.

A simpler visual would be like:

Year 0: $100K

Year 1: $105K

Year 2: $110,250

Founder impact: That growing snowball means more dilution when the note converts. Keep this in mind.

6. Maturity Date of Convertible Notes for Startups (You can also say it 'The Expiration Date')

Think of it like milk, it has an expiration date, and ignoring it leads to problems.

What it is:

The date by which the note must convert or be repaid.

Typical timeframe:

18-24 months (like a carton of milk, but less likely to cause food poisoning)

What happens at maturity date of Convertible Notes?

Best case: The milk turned into cheese (note converted months ago into a nice equity round)

Common case: You bought more time (extended the date because you're making progress)

Worst case: The milk spoiled (investor demands cash repayment and you're scrambling)

Founder tip: Don't wait until the milk smells funny to deal with it. Check expiration dates early.

How Convertible Notes for Startups Actually Work (A Real Example)

Let's tell this like a story about buying a food truck:

Chapter 1: The Handshake

The deal: You need $50K to upgrade your food truck from "health code violation waiting to happen" to "Instagram-worthy taco spot."

Your friend Sarah says: "I'll loan you $50K. When you open your second location and bring in real investors, my loan turns into ownership. And because I'm risking it when you're still figuring out if people actually like your tacos, I get 20% off whatever price the new investors pay. Also, if your business explodes and gets valued at $10M, I get to convert as if it's only worth $500K."

What happens: Sarah wires you $50K.

You sign a note.

No ownership changes hands yet.

You're still 100% owner of a slightly better food truck.

Chapter 2: The Clock Ticks (Interest Accrual)

12 months pass. You're crushing it, lines around the block, Instagram influencers posting your burritos.

Behind the scenes: Sarah's $50K is now worth $52,500 (original $50K + 5% interest). It's like a garden growing while you sleep.

Chapter 3: The Big Moment (Series A)

18 months after Sarah's loan, a restaurant group wants to invest $300K to help you open 3 new locations. They value your business at $1M.

Now Sarah's note converts. That is the sweet spot, where magic will happen.

Option A: Use the 20% discount

New investors pay $1/share (based on $1M valuation)

Sarah gets 20% discount → she pays $0.80/share

She gets 65,625 shares ($52,500 ÷ $0.80)

Option B: Use the $500K valuation cap

Sarah can convert as if the business is worth $500K (even though it's actually $1M)

This means she pays $0.50/share instead of $1/share

She gets 105,000 shares ($52,500 ÷ $0.50)

Sarah chooses Option B (cap gives more shares. It's like having a coupon that's better than the sale price).

Now, here is the snapshot that happened:

New investors put in $300K and get 30% ownership

Sarah's $52,500 converts and she gets 10.5% ownership

(double what she'd get without the cap)You went from owning 100% to owning 59.5%

Looks dry?

Sure it is. But imagine, Sarah bet on you when you were still burning burritos. Now she owns a meaningful chunk of your growing empire. That's the deal.

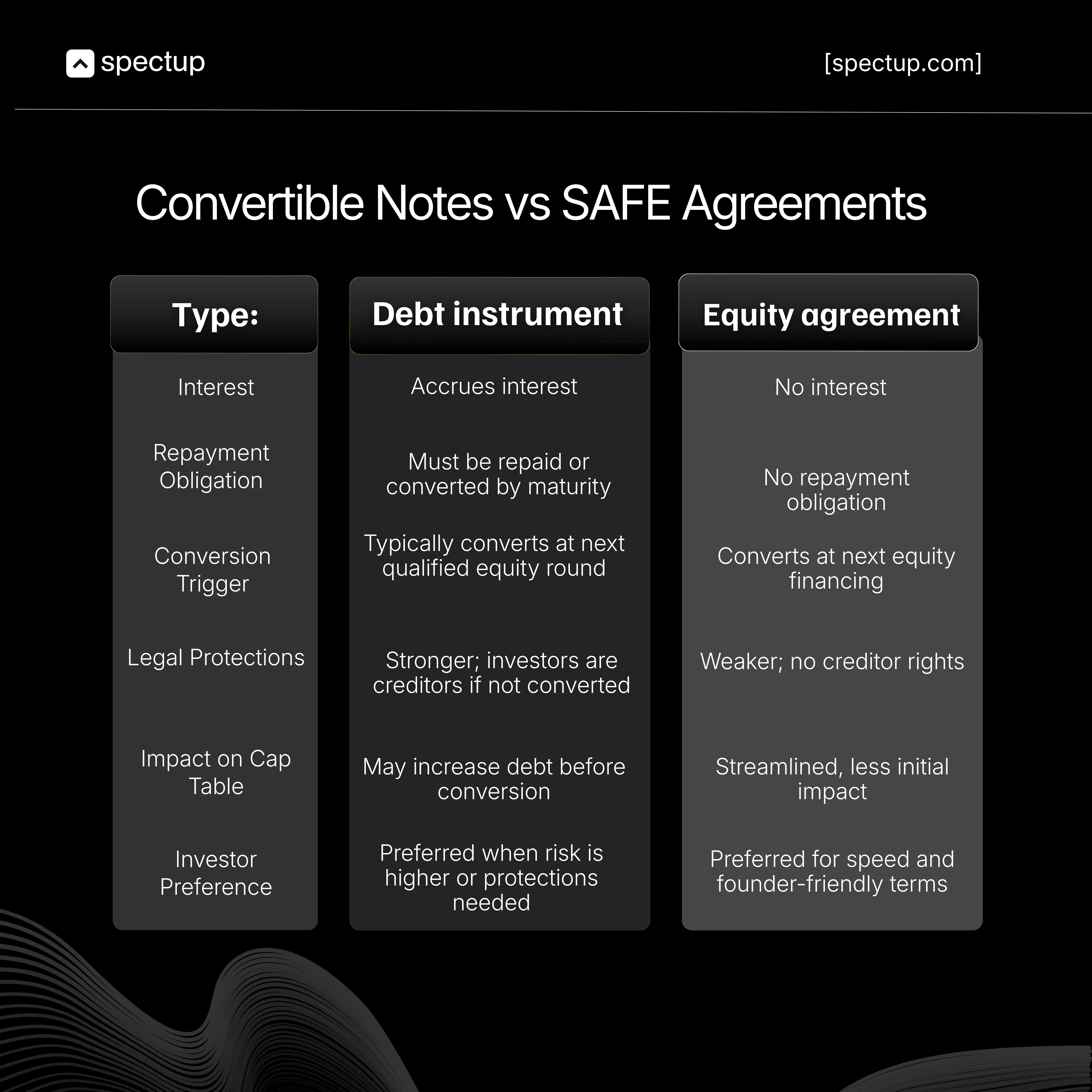

Convertible Notes vs SAFEs vs Priced Rounds for Startups

Now, let's say fundraising instruments are like relationship commitment levels. Every level is different. Every level carries its own scar, pros and cons. Here is a glimpse of the Fundraising Rounds for startups:

Instrument | Relationship Level | What It Means |

|---|---|---|

SAFE | Casual dating | Quick, simple, no strings attached. |

Convertible Notes for Startups | Engaged | More serious commitment with a timeline (maturity date). |

Priced Equity Round | Married | Full commitment. |

When to Use Each (Fundraising Rounds Smart Guide):

SAFEs (Casual Dating):

✅ You're raising <$500K

From people who already like you (friends, family, angels who've seen you win before)

✅ You want to move fast

Like "let's grab coffee" fast, not "meet my parents" fast

✅ You're pre-product

(you're still figuring out if you even want to be in this industry long-term)

Convertible Notes for Startups (Engaged):

✅ You need $500K-2M to prove you're ready for the big commitment (Series A)

✅ Investors want some protection (a timeline, a plan, a backup if things don't work out)

✅ You're doing a bridge round (you're engaged to Series A but need a few months to plan the wedding)

✅ Timeline is clear (12-18 months until "I do")

Priced Equity Round (Married):

✅ You're raising $3M+ and ready for full partnership

✅ You have traction (proof this relationship works)

✅ Investors want governance rights (joint decision-making on big stuff)

✅ You're okay with the time/cost (wedding planning takes months and costs a fortune)

We're Your Fundraising Partners (More like Sous Chefs)

At spectup, we don't just hand you a recipe and say "good luck." We're your fundraising full go-to Partners helping you from financial modeling consultancy services (We measure ingredients so your recipe works, researches and make sure we are aligned and balanced) to Capital Raising Advisory (We make sure you're not accidentally poisoning yourself with too much dilution and meeting right investors.

We've helped hundreds of startups close successful raises. From the first dollar to Series A, we're with you. Let's make sure your convertible notes work for you. That is our USP.

Knowing your ingredients and following a proven Successfully Closed Round.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.