Summary

Many founders approach Series A as if they’re still testing a prototype. Least they understand that Series A is a commercial flight, where, every traction will just pull the pressure in and make the mistakes highlighted.

The biggest mistake of all times is: Building systems that only work when founders are personally involved.

This might look like a minute aspect but given the Capital Raising and cash flow involved, these Series A mistakes aren't obvious until it's too late.

Short on time? Here is the Executive Summary.

Series A rounds often stall because the fundamentals aren't quite there yet. It's a shift that catches many founders off guard. Common challenges include focusing too heavily on valuation at the expense of fit, pitching before the story is crystal clear, approaching investors who aren't aligned with your stage or sector, and missing key signals around timing and team readiness.

Series A investors are really looking for proof that you've found something that works and are ready to scale it systematically. Potential got you through the seed stage, however, now they require evidence of traction, discipline in execution, and a clear path forward.

You can avoid these Series A mistakes, however, you need to actively work on and improve before you start the raise. Or you just need a fundraising consultant, acting as Partner for your capital raising and investment outreach.

If you have come so far, let’s dig a bit deeper and see all these Series A mistakes in detail and how we can avoid crash landing on these.

Mistake 1: Over-Optimizing Fundraising Process and Terms

Chasing a unicorn valuation while your fundamentals crumble is like renovating your kitchen while the roof leaks. The granite countertops look impressive, but what happens when it rains is all that matters.

We have seen founders obsessing over negotiating sky-high valuations and perfect terms, forgetting that investors are betting on your business health. When you prioritize optics over substance, you risk:

Unrealistic expectations leading to painful down rounds

Team morale tanking when inflated projections meet reality

Sophisticated investors walking away from obvious smoke and mirrors

And to fix these Series A mistakes, founders need to:

Build ironclad fundamentals first.

Nail product-market fit

Demonstrate consistent revenue growth

Prove customer retention with data.

Master startup financial modeling with transparent projections.

This aspect is often overlooked by the founders. However, when your metrics shine, valuation becomes a natural outcome and not like any forced negotiation on the table.

Mistake 2: Failing to Create a Competitive Investor Environment

While selling, every buyer dreams of selling things to big sharks, who are not only eager to buy but also ready to provide as much capital as needed. Now, if they keep on selling it to interested buyers, you will more likely be stuck. However, if you are more leaned towards eager buyers, that changes the whole scenario. That is the first aspect of selling.

Yet founders treat fundraising like speed dating, one investor at a time, waiting weeks for responses, and killing all leverage.

Without competitive dynamics, you're stuck:

Accepting whatever terms appear

Watching timelines stretch indefinitely

Losing the momentum that makes investors act.

Out of all these, the last one is the most damaging and crucial common Series A mistake because it fundamentally weakens your position.

Fixing hack to build Investor-Competitive Ecosystem:

Pinpointing all these Series A mistakes surely looks cool, however, the hack is simple while selling:

Create urgency by timing outreach so multiple investors hear about your raise simultaneously.

Set clear deadlines for term sheets.

Selectively share (without specifics) that other serious parties are interested.

Build a compelling go-to-market strategy startup investors can rally behind.

This is to build FOMO around the narrative. As we are living in digital mode and anything that is creating a climax becomes the secret weapon, compressing timelines and improving terms dramatically.

Mistake 3: Poor Pitching and Lack of Clear Vision

Only 1% pitch decks get funded annually.

But, that’s not the case when it comes to pitch deck submissions.

Over 1,000 pitch decks are created daily worldwide, equating to more than 365,000 annually. This figure primarily reflects activity in major hubs like San Francisco, though global startup ecosystems contribute far more

So, your pick deck is competing against every other founder's forgettable presentation.

Now, given the competition that is rigorous here, most pitches die because founders:

Deliver unclear storytelling

Recite scripts without passion

Or drown investors in generic jargon about "disrupting markets."

A compelling pitch deck narrative connects dots between problem, solution, market opportunity, and why your team wins.

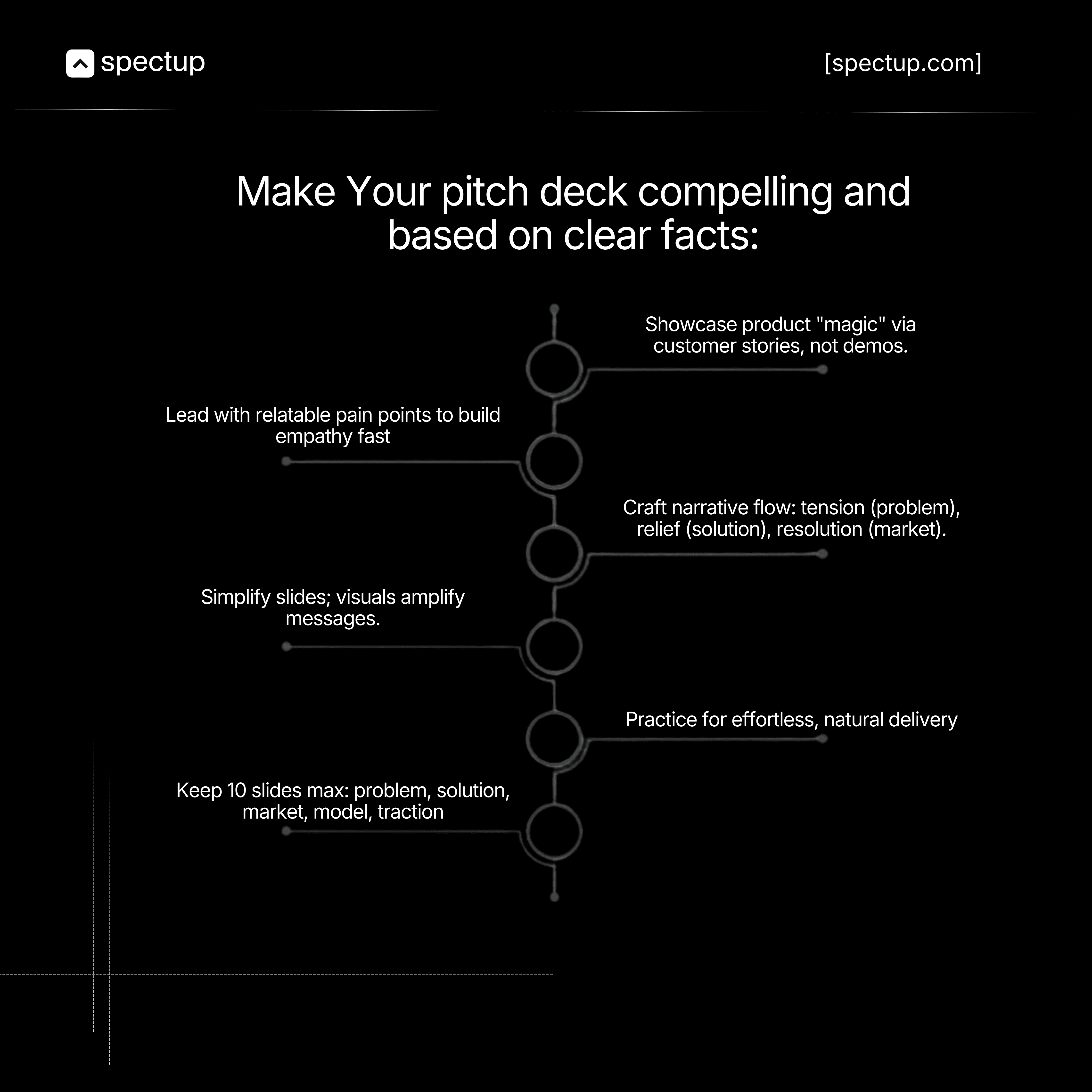

To make your pitch deck compelling and based on clear facts:

You need to

Craft your story like you're sharing exciting news with a friend

Lead with a relatable problem that hooks attention immediately

Showcase your unique insight others completely miss.

Paint a vivid future with your product at the center

Keep slides simple and let visuals support your message.

Practice until delivery feels natural.

Moreover, it is necessary for founders to:

Validate your startup idea thoroughly before pitching.

Align your narrative with a clear go-to-market strategy.

This transforms how investors see you, from "just another startup" to "the one we can't miss."

Mistake 4: Using Unready or Template-Based Pitch Decks

Showing up to a black-tie event in cargo shorts screams "I didn't prepare." Generic pitch decks signal the same indifference. They blend into the sea of identical presentations investors see daily, lacking personality and failing to capture attention.

A critical mistake: presenting your MVP as your long-term vision.

Understanding MVP vs scalable product is essential.

Your MVP proves the concept.

But, that’s not the case when it comes to scalable vision that shows the empire you're building.

Series A investors need both, but they're betting on your future, along with the prototype.

Building a Customized Pitch Deck for Series A:

To make sure that you are presenting yourself as a premium startup, you must

Build a customized deck addressing what what investors look for Series A funding:

Show why this Market Opportunity explodes NOW and how you'll capture it

Demonstrate how you generate predictable revenue for Series A evaluation through your Business Model

Highlight milestones proving product-market fit through clear traction Metrics

Articulate what's truly defensible about your position through Competitive Advantage

Sure, we live in the digital era and AI can provide us with ready-to-use templates for pitch decks. However, your job is adding the personality and vision that make investors remember you days later.

Mistake 5: Targeting the Wrong Investors and Poor Pipeline Management before Series A

Asking a paint specialist about roof repairs wastes everyone's time. Just like that, founders pitch investors whose focus doesn't match their stage, sector, or check size, burning through precious network introductions on dead-end conversations.

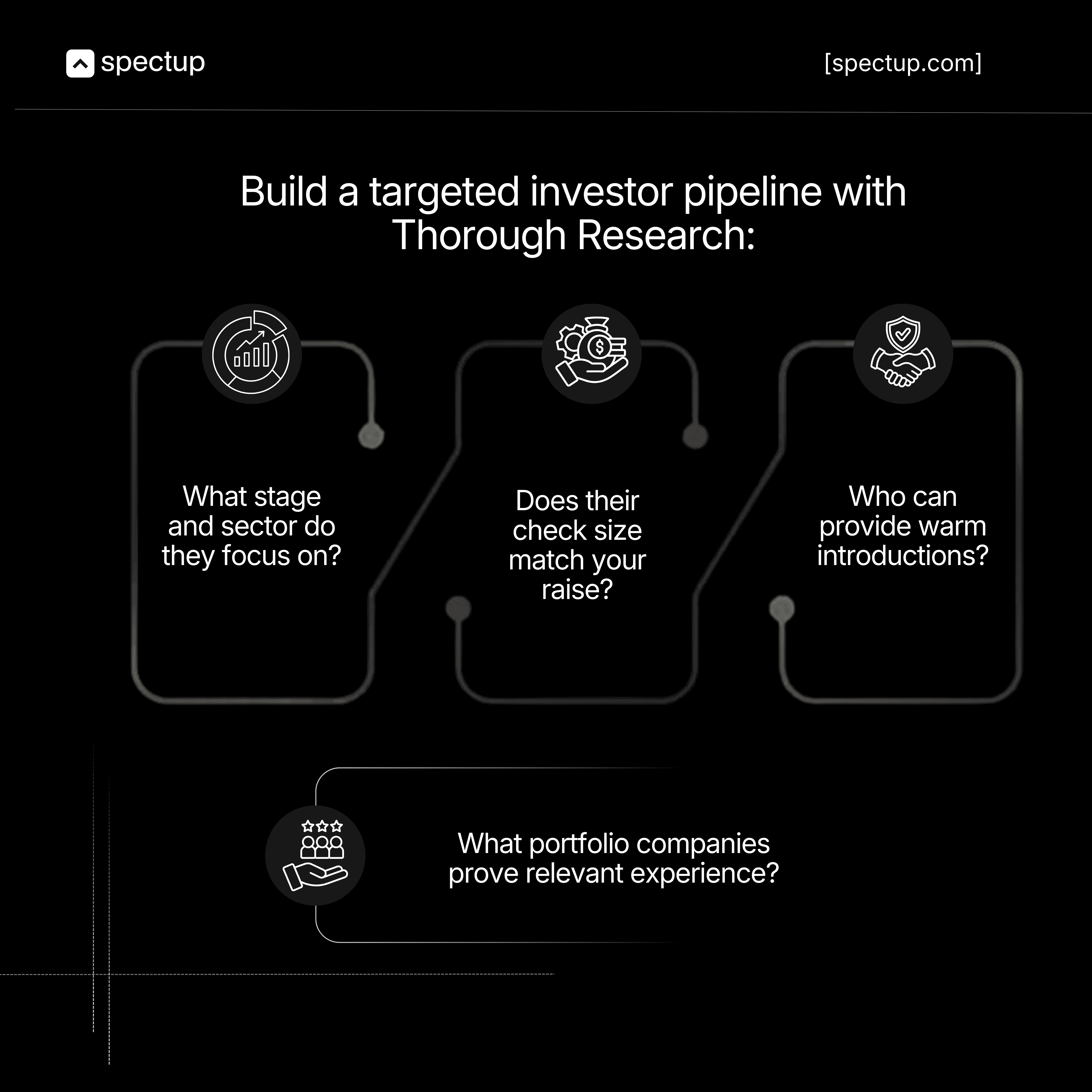

Poor targeting means you miss perfect-fit investors while damaging your reputation in the tight-knit VC community. When preparing for Series A funding, research is non-negotiable.

Build a targeted investor pipeline like curating a premium guest list, only people genuinely invested in your success.

Further, use CRM tracking to manage every interaction professionally. This systematic approach transforms fundraising from scattered outreach into strategic relationship building.

Mistake 6: Misunderstanding Venture Capital Timing and Psychology

Timing is very important. If you are waiting for the perfect time, you might just end up being in your 30s or 40s and still struggling to figure it out. Just like that, launching your raise in December means watching momentum die during holiday vacations. Your idea was excellent but it just got buried in 1000 promotional Christmas emails.

Just like that, for July, half the investor outreach is either turned off or they are fully occupied, due to mid summer vacations. Timing in fundraising parallels comedy, get it wrong and even brilliant material bombs.

To avoid this Series A Mistake, find the optimal time for fundraising:

Avoid December-January holidays and July-August vacations.

Run a focused six-week raise instead of dragging it out for months.

Think New Year's resolutions, sprints work (Dry January), vague year-long goals fail.

Compressed timelines create urgency, tap into investor FOMO, keep teams energized, and ensure diligence stays fresh. Psychology matters:

Create scarcity and exclusivity around your round

Social Proof: Other reputable backers validate investment decisions powerfully

Strategic timing combined with psychological awareness dramatically improves your fundraising success rate.

Mistake 7: Ignoring Investor Reference Checks and Lacking a Lead Investor

Accepting investment from strangers without vetting them is like signing a lease without reading terms. You might discover too late that values clash, they micromanage relentlessly, or their fund struggles financially.

Without a lead investor, your raise resembles organizing a group trip where nobody commits, everyone waits for someone else to book, and nothing happens. A strong lead:

Sets terms

Provides credibility

Streamlines communication

Brings strategic expertise beyond capital.

Therefore, it is advised to conduct thorough reference investor checks:

Talk to at least three founders they've backed (successful and struggling companies)

Verify support beyond money (advice, network, operational help)

Confirm alignment on vision and timeline

Prioritize investors who actively lead deals

Choose partners who accelerate growth with trust and shared ambition, along with capital.

Additional Common Series A Mistakes to Avoid:

The Honesty Crisis:

Fabricating data or inflating metrics is using a credit card to pay another credit card, temporarily effective but ultimately destructive. Investors spot dishonesty instantly, and word spreads fast in tight VC networks. Transparency builds trust; deception destroys it permanently.

Choose at your own risk.

Financial Modeling:

Present realistic Series A projections demonstrating predictable revenue growth, clear unit economics, and believable assumptions. Think weather forecasts, you can't predict exact conditions months ahead, but you can show credible trends based on data. Transparent startup financial modeling proves your model isn't smoke and mirrors.

Cap Table Issues:

Messy cap tables with unclear ownership or complicated option pools raise immediate red flags. Clean, organized cap table issues signal operational maturity and readiness for growth.

Ask yourself:

Are my financials investor-friendly?

Does my cap table reflect fair structure?

Can I demonstrate predictable revenue backed by real data?

Leadership Scaling:

Series A evaluates whether you can scale operations, not just products.

Demonstrate capability in hiring talent

Building systems independent of you personally

Making strategic decisions with incomplete data

Maintaining culture during rapid change.

Scaling startup leadership separates founders building companies from those just building products.

How to Fix These Brutal Series A Mistakes Fast?

Knowing the mistakes is step one. Fixing them quickly is what determines whether your Series A moves forward or stalls.

So let's get real about what actually trips founders up when they're trying to close that crucial first institutional round.

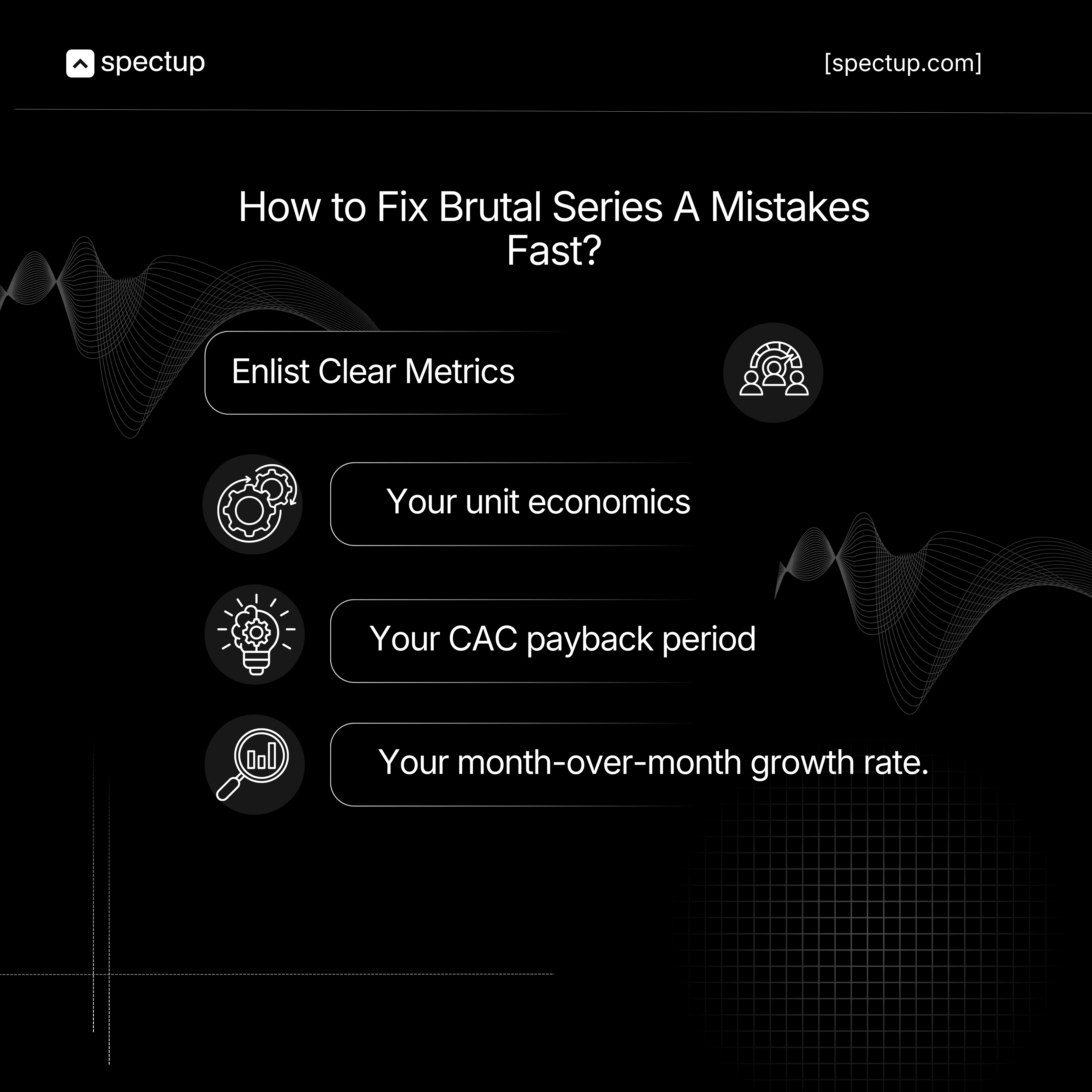

1. You're pitching vision when investors want metrics

Look, we get it. Your pre-seed deck was all about the dream, the market opportunity, the "what if." That worked when you were raising from angels who bet on your passion and a napkin sketch.

Series A? Different ballgame entirely.

VCs at this stage aren't impressed by your TAM slide anymore (sorry). They want to see:

Your unit economics

Your CAC payback period

Your month-over-month growth rate.

If you can't rattle off your retention cohorts or explain why your LTV:CAC ratio makes sense, you're not ready for this conversation.

2. You waited too long to start fundraising

Here's a painful truth: If you have six months of runway left, you're already late. Series A rounds take 6+ months on average to close. You need to get your maths ready and clear.

Smart founders start warming up investors when they have 12-18 months in the bank.

This is not because they are not desperate, but because they have leverage, and they can afford to be picky about their lead. Wait until you're down to fumes and every conversation reeks of urgency. You would surely get eaten up by unimaginable equity ratios.

3. Your story hasn't evolved past the seed stage

You know what's worse than having no story? Having the exact same story you told 18 months ago.

Your narrative needs to mature with your company.

You've learned things.

The market has shifted.

Your product has evolved.

Your customers have taught you lessons.

Series A investors want to hear what you've discovered, not what you hoped would happen back when you were just getting started. Those mistakes, ups and downs are your strength.

If your pitch deck still looks like your seed deck with updated numbers slapped on top, you're doing it wrong.

4. You're going after the wrong investors

Not all VCs are created equal, just like no human is like others and here's where founders waste months of their lives.

Some funds only write seed checks.

Some do Series A but only in specific verticals.

Some want to lead, others only follow.

Some need to see $100K in MRR minimum, others want to see $1M+.

If you are looking to close the round impactfully and efficiently, do your homework.

Use platforms like spectup to research who actually invests at your stage, in your industry, at your check size.

Sending your deck to 100 random VCs is not a strategy but a cry for help.

5. You don't have a lead investor locked

Here's a secret that's not really a secret: most VCs won't commit until someone else commits first. It's the investing equivalent of standing outside a restaurant wondering if it's any good.

- You need a lead. Someone who's excited enough to set the terms, anchor the round, and give other investors the confidence to pile in. Without a lead, you're herding cats. With a lead, you're managing a waitlist.

Focus your energy on finding that one true believer. 20 Maybes won’t take you far but maybe just around the corner, that too ‘maybe’.

6. Your metrics are growing, but they're the wrong metrics

Vanity metrics will kill your fundraise faster than no metrics at all.

Yes, you added 10,000 users last month. Cool. But, wait,

How many are still active?

How many paid you?

What's your churn rate looking like?

Investors have seen too many startups optimize for downloads, signups, or GMV without any underlying business model. They're looking for the metrics that actually predict whether you'll be a billion-dollar company or a cautionary tale.

Revenue growth, retention, gross margins, CAC payback, these are the metrics that matter. Everything else is just a side character that can support you, but can not be leading one.

7. You're drowning in 'no's but not learning from them

Rejection is part of the game. What's not part of the game? Making the same mistakes 30 times in a row.

It’s okay to fall once, but it’s never okay to not stand straight after tripping.

After every pass, dig deeper than "they said it wasn't the right fit."

What was the real objection?

Was it your traction?

Your market size?

Your team?

Your unit economics?

Most investors won't tell you the truth, but some will, if you ask the right questions.

Treat your fundraise like a product iteration cycle. Test, learn, adjust, repeat. Just like every life’s decision.

The Path Forward:

Now, if you are one of those founders, who is still reading to this end, you need to know that you have to regroup, fix your fundamentals, rebuild your pitch with authentic storytelling, target the right investors strategically, and run a compressed six-week raise.

The difference between funded founders and frustrated ones is mostly awareness and clarity. Understanding these common Series A mistakes and actively sidestepping them puts you miles ahead. Series A rounds are hard, but it doesn't need to be mysterious. The roadmap exists. The landmines are known. You just need to be curious enough to find partners who believe in your vision enough to bet millions on it.

Now go show them why missing your round would be their biggest regret. If you are looking for the perfect partner, make sure to recah out to spectup and we can help you get the personally vetted investors in our system to close this round impactfully.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.