Summary

"We own 23% of our own company?"

This is the story of a lot of founders discovering quite late that the startups they created and poured their hearts and minds into, are more of the investors than their own team.

TL:DR. Every messy cap table tells a different story, hasty decisions, unclear agreements, and equity given away too freely while capital raising. It might look like an accounting headache to many of you, but more than that it's what separates funded founders from those watching investors walk away.

Your cap table is like the deed to your house. Get it messy, and nobody wants to buy in.

What Is Cap Table Management and Why Does It Matter?

Think of your cap table as your startup's family tree. Just like a family tree shows relationships across generations, a capitalization table maps exactly who owns what, founders, investors, employees with stock options, advisors, and anyone else holding equity.

Effective cap table management means maintaining crystal-clear records showing:

Ownership distribution

Share types (common versus preferred)Voting rights

Vesting schedules

How future fundraising impacts everyone's stakes.

The entire structure functions as the foundation of your entire business structure.

When startups launch, founders own 100%. Watch what happens as you fundraise:

After seed funding: ~56% founder ownership

After Series A: ~36% founder ownership

After Series B: ~23% founder ownership

This progression isn't random, but the trading equity for capital that fuels growth. Every dollar invested comes with ownership stakes. But here's the trap: One wrong move in managing your startup ownership structure, and you give away too much too soon, leaving nothing for future rounds or key hires.

Why Accuracy Is Non-Negotiable

Imagine selling your house when the deed has someone else's name on half the property. That's what a messy cap table feels like to investors. They absolutely need to see:

Clear share ownership preventing confusion and disputes

Precise allocation of employee stock options (typically 13-20%)

Complete vesting schedules showing who's earned what

Transparent projections of how funding rounds affect ownership

Wrong or outdated records create massive red flags during due diligence. Investors lose confidence when numbers don't add up or shareholder agreements contradict your cap table.

When you are capital raising to scale, managing a cap table is like protecting millions of dollars in potential investment.

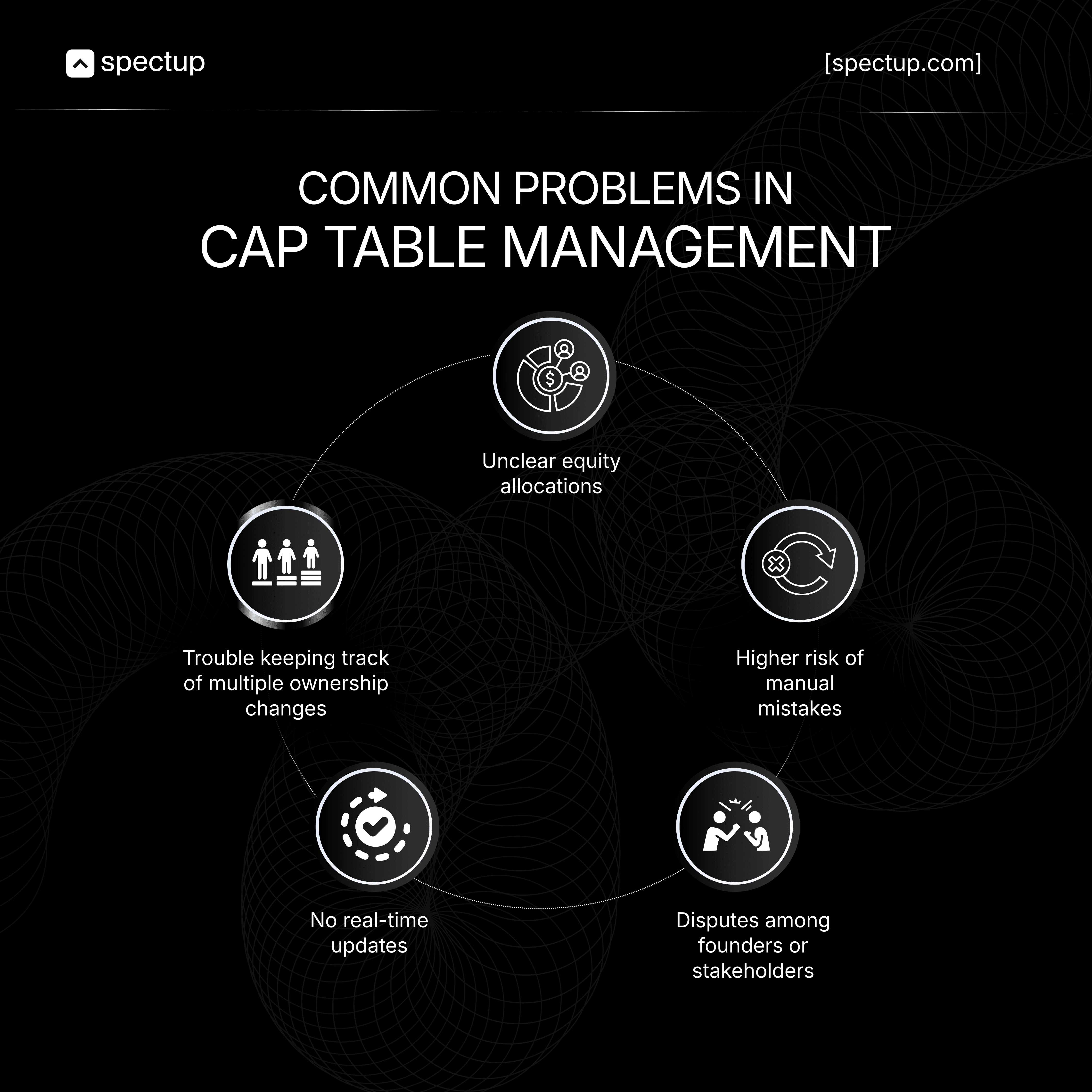

The Risks of Poor Cap Table Management

Picture applying for a mortgage with financial records scattered across napkins and envelopes. The banker shows you the door. That's exactly how investors react to disorganized cap tables.

What Investors Scrutinize through Cap Tables in Funding Rounds?

During funding rounds, investors dissect your cap table like forensic accountants:

Transparency Issues: Unclear ownership signals sloppy management

Over-Dilution: Too much equity already given away

Complex Structures: Multiple confusing share classes

Hidden Obligations: Undisclosed convertible notes or SAFEs

Poor shareholder management actively blocks investment.

Just like thinking of buying a used car when the seller can't provide a clear title. You won’t write the check. Neither will investors.

Consequences of 'Just leaving' the Cap Tables:

Research shows 85% of seed-stage startups fail to raise Series A within two years. While product-market fit matters most, messy cap tables add unnecessary obstacles. Ineffective management creates disasters:

Deterring investor interest due to perceived disorganization

Provoking bitter disputes among founders over equity

Creating legal nightmares when agreements don't match records

Making employee recruiting nearly impossible without clear stock options

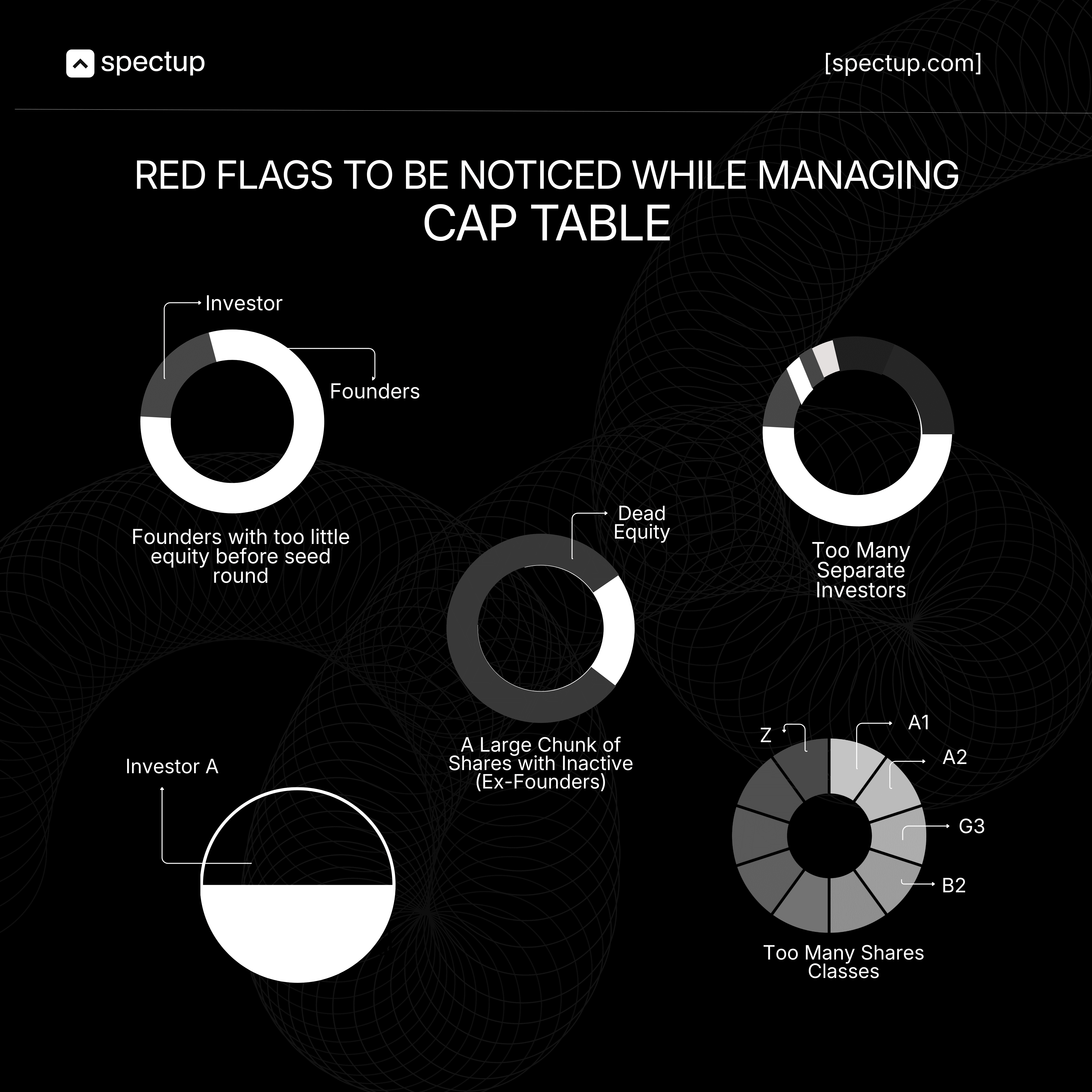

Common Early-Stage Equity and Cap Table Errors to Avoid Before Series A:

Imagine baking a wedding cake without measuring ingredients, just eyeballing everything. You might get lucky, but more likely you'll end up with something inedible that embarrasses you. Early-stage equity decisions work the same way.

The Deadly Mistakes:

Over-Granting Early Equity: Giving 40% to your first investor leaves almost nothing for Series A and beyond

Insufficient ESOP Pools: Reserving only 5% when you need 15% to hire talent

Ignoring Vesting Schedules: Not tracking when shares become owned creates chaos

Misclassifying Share Types: Confusing common with preferred stock

Missing Documentation: Forgetting liquidation preferences or voting rights

These aren't theoretical problems.

They're deal-breakers that surface during due diligence, creating doubts about your financial management and potentially killing your entire round.

But, there is always a fix.

Getting founder equity split and early stage equity allocations right from the start builds investor confidence:

Document everything in formal shareholder agreements

Implement 4-year vesting with 1-year cliff

Track voting rights clearly for each share class

Transition to cap table software as complexity grows

Think of your early-stage equity structure like pouring a foundation. Cut corners now, and cracks appear when you build higher. Get it right, and everything stands solid. If you are raising capital but unsure of how things work out, better to partner with top fundraising consultancy experts.

Key Elements of a Startup Equity Structure?

Building your startup ownership structure resembles assembling furniture from complicated instructions. Miss a step early, and pieces won't fit later.

Founder Equity Splits:

How you divide ownership among co-founders shapes everything that follows. Like dividing pizza, decide fairly upfront based on contribution, or someone feels shortchanged later.

Advisor Allocations:

Typically 0.25-1% keeps experienced mentors engaged. Think of advisors as seasoned guides helping navigate unfamiliar terrain.

Investor Stakes:

Equity grows with each funding round. They're putting cash into fueling your rocket, they deserve a share of where it lands.

Vesting Schedules:

Standard 4-year vesting with a 1-year cliff protects the company. It's like probation, stick around, contribute, and gradually earn your stake.

Employee Stock Options (ESOPs)

Stock options become your secret weapon for attracting A-players when you can't match big tech salaries. Understanding employee stock options transforms compensation from "just a paycheck" into "we're building this together."

Best practices for Employee Stock Options:

Reserve 10-15% of total shares for early-stage option grants

Use equity management system to track grants, vesting, exercises

Comply with Rule 701 and ASC 718 for legal stock option plans

Get 409A valuations to ensure fair pricing and avoid IRS issues

Managing these elements properly in your startup equity structure is how you build a company investors trust and employees want to join. If you are looking to connect with investors that are credible and pre-vetted, reach out to us and we will gladly partner with you to close deals.

Cap Table Management Best Practices for Startups

Cap table management for startups is just like maintaining that house, whose deed is at your name. Ignore the leaky roof and the foundation cracks, and suddenly you're trying to sell a property that scares off every serious buyer.

But if you are keeping up with the repairs, documenting everything properly, and when it's time to close that Series A?

The due diligence process is smooth, clean, and drama-free.

Small issues, like:

That convertible note you forgot to properly document

Or the advisor equity you promised but never formalized

These turn into expensive disasters when investors start asking questions. If you are still unsure how to do that, spectup is the right option for you.

1. Benefits of Restructuring:

Restructuring your cap table is smart spring cleaning every growing company needs:

Clarity: Making ownership distribution instantly understandable

Attractiveness: Tidy records immediately impress investors

Compliance: Ensuring you meet legal requirements with real-time accuracy

Strategic Planning: Aligning equity structure with long-term goals

2. When to Restructure Before Series A:

Timing matters. Update your cap table when:

Preparing for Investor Review: Clean records streamline due diligence dramatically

Bringing in New Investors: Recording stakes accurately protects everyone

Managing Dilution: Showing how funding affects ownership transparently

Leadership Changes: Updating immediately when key roles shift

Expanding Option Pools: Planning for post-funding hiring needs

Removing Dead Equity: Cleaning out shares from departed stakeholders

3. Tracking Secondary Transactions:

When employees or early investors sell shares, tracking becomes critical. It's like monitoring who's buying and selling in your neighborhood, you need to know who your neighbors are. Essential steps:

Document buyer, seller, share count, and transaction date

Update cap table immediately. Delays create confusion

Verify compliance with legal requirements

Communicate changes to stakeholders transparently

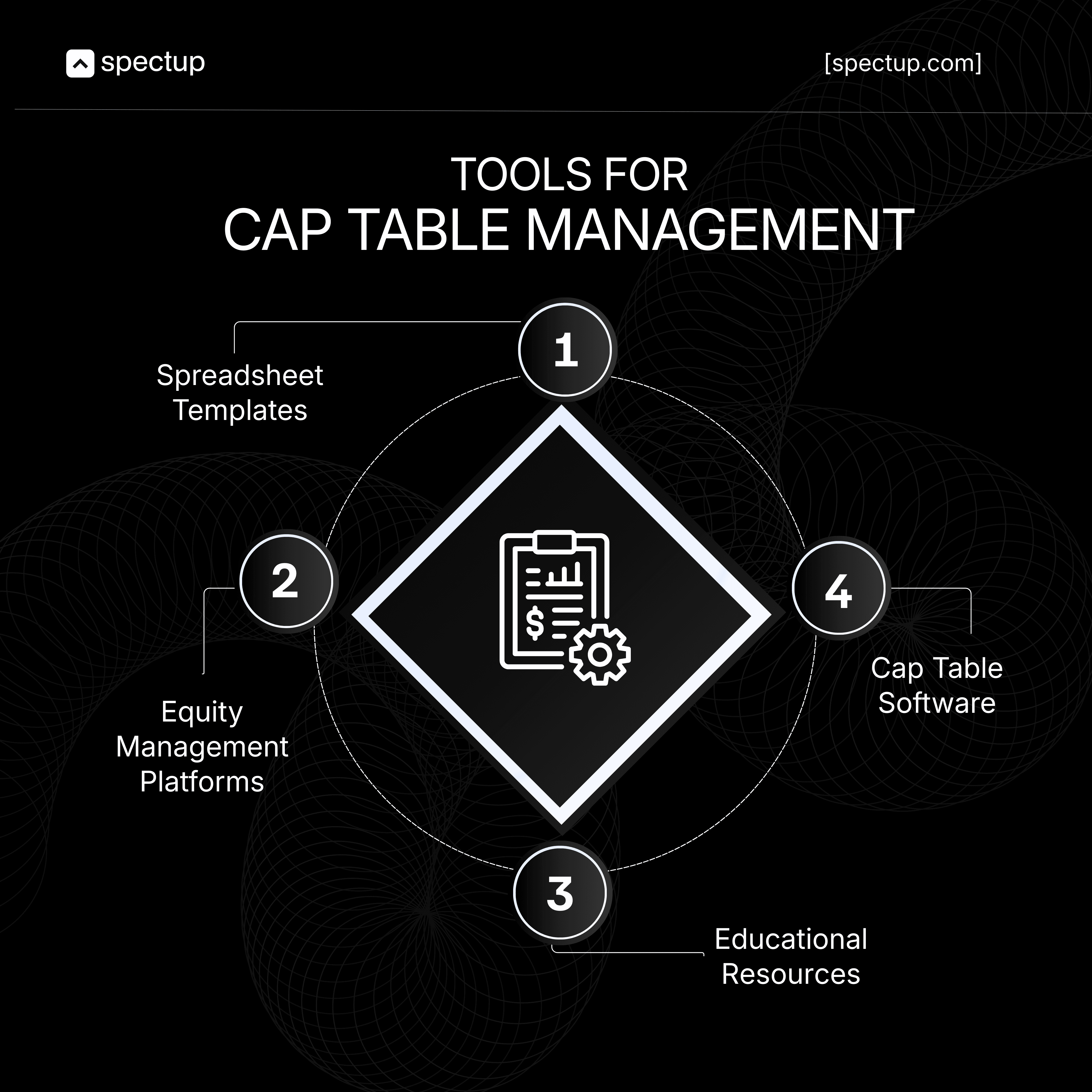

Using Cap Table Software

Remember paper maps for road trips? Spreadsheets for cap table management are today's equivalent, technically functional but painfully outdated once you've experienced the alternative.

Why Spreadsheets Fail:

Manual entry prone to errors

No real-time updates

Can't handle complex structures

No audit trails

The Cap Table Software Advantage:

Professional cap table software transforms equity management from tedious to automatic:

Automated Calculations: Eliminating formula errors and miscalculations

Real-Time Updates: Everyone sees current ownership instantly

Visual Clarity: Charts showing founder equity split and ownership distribution at a glance

Scenario Modeling: Preview how future rounds affect stakes

Compliance Support: Built-in tools for 409A valuations, ASC 718, Form 3921

Platforms like Eqvista provide comprehensive equity management system solutions. When investors see professional tools, it signals serious management.

Cap Table Management Pitfalls to Avoid

For seed rounds raised in early 2023, only about 15% progressed to Series A within two years by early 2025, aligning with the 15.4% noted for early 2022 cohorts.

Poor cap table management makes this worse by creating unclear ownership structures that trigger heightened investor scrutiny.

Common Landmines:

Over-granting early equity and leaving nothing for growth

Insufficient ESOP reserves for talent recruitment

Creating complex ownership structures that confuse everyone

Poor documentation of critical terms and preferences

Ignoring dead equity from departed founders

Avoiding these pitfalls requires discipline, proper tools, and professional guidance when needed. Minor preventive care beats major surgery every time.

Preparing for Fundraising with a Clean Cap Table

Would you leave dishes in the sink when selling your house? Yet founders approach fundraising with equivalently messy cap tables all the time.

Why Clean Cap Table Management Matters:

Transparency: Crystal-clear ownership distribution

Risk Reduction: Clean records minimize surprises

Alignment Check: Balanced ESOP pools and founder stakes

How to Simplify Your Structure:

Use professional software for real-time updates and clear visualization

Align founder splits, employee stock options, and shareholder agreements before due diligence

Prepare clear summaries of early stage equity allocations

Consider professional consulting to spot hidden dilution traps

A Berlin startup working with top fundraising consultant refined its cap table and secured Series A within months. Clean ownership distribution plus balanced ESOP pools gave investors confidence. That's a preparation meeting opportunity

It’s important to keep valuations realistic and ensure founders and key team members keep enough ownership for long-term success.

By following these best practices, startups can keep their cap table simple, clear, and attractive to investors, creating a strong foundation for steady growth and easier fundraising.

Your Cap Table Management tells your startup's story.

Effective cap table management builds investor confidence, prevents disputes, and supports growth. Key takeaways start with clear shareholder agreements and proper documentation. Further, if you are unsure how that might go, get a financial consultant or advisor specifically addressing this concern.

This definitely looks overwhelming and quite dry but if you are not updating records immediately after any ownership changes and reserving adequate employee stock options (10-15% minimum), your startup story can just be buried under 1000s of emails that a venture Capital might ‘just delete’

If you are still struggling, find yourself a fundraising consultancy expert to help you grasp it with impact and clear numbers.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.