In 2025, securing capital remains a significant challenge for startups, further complicated by rapid shifts in the venture capital environment and the growing impact of artificial intelligence (AI) technologies. Non-dilutive funding is gaining considerable traction among startups. Recent data indicate that global venture capital funding declined by 51% in the first half of 2023 compared to the previous year, intensifying capital scarcity for many emerging companies. In response, spectup emphasizes funding strategies designed to help startups maximize market impact while preserving ownership stakes.

Non-dilutive funding offers a crucial alternative for founders seeking to retain control over their companies while obtaining necessary financial resources. Unlike traditional equity financing, which reduces founders’ ownership stakes, non-dilutive funding options provide capital without diluting equity. This approach promotes capital efficiency and supports sustainable growth, particularly in an environment where investor scrutiny has increased and startups are under greater pressure to demonstrate profitability and scalability.

This article explores the fundamentals of non-dilutive funding, details key types and their associated benefits, and offers guidance on determining whether this funding approach aligns with your startup’s strategic objectives. Furthermore, a comparative analysis of venture debt versus equity financing is provided to facilitate informed decision-making for your business.

What Is Non-Dilutive Funding?

Non-dilutive funding refers to the process of obtaining capital for a startup without requiring the founders to relinquish any ownership stake in the company. This approach contrasts with traditional equity financing, in which equity is exchanged for investment capital, resulting in dilution of ownership. Non-dilutive funding enables founders to retain full control over their shares while still securing necessary financial resources.

Venture debt allows startups to borrow funds that must be repaid over time, thereby preserving equity ownership but introducing repayment obligations. In contrast, equity financing involves selling a portion of the company to investors, which dilutes the founders’ ownership but may provide access to valuable strategic partners.

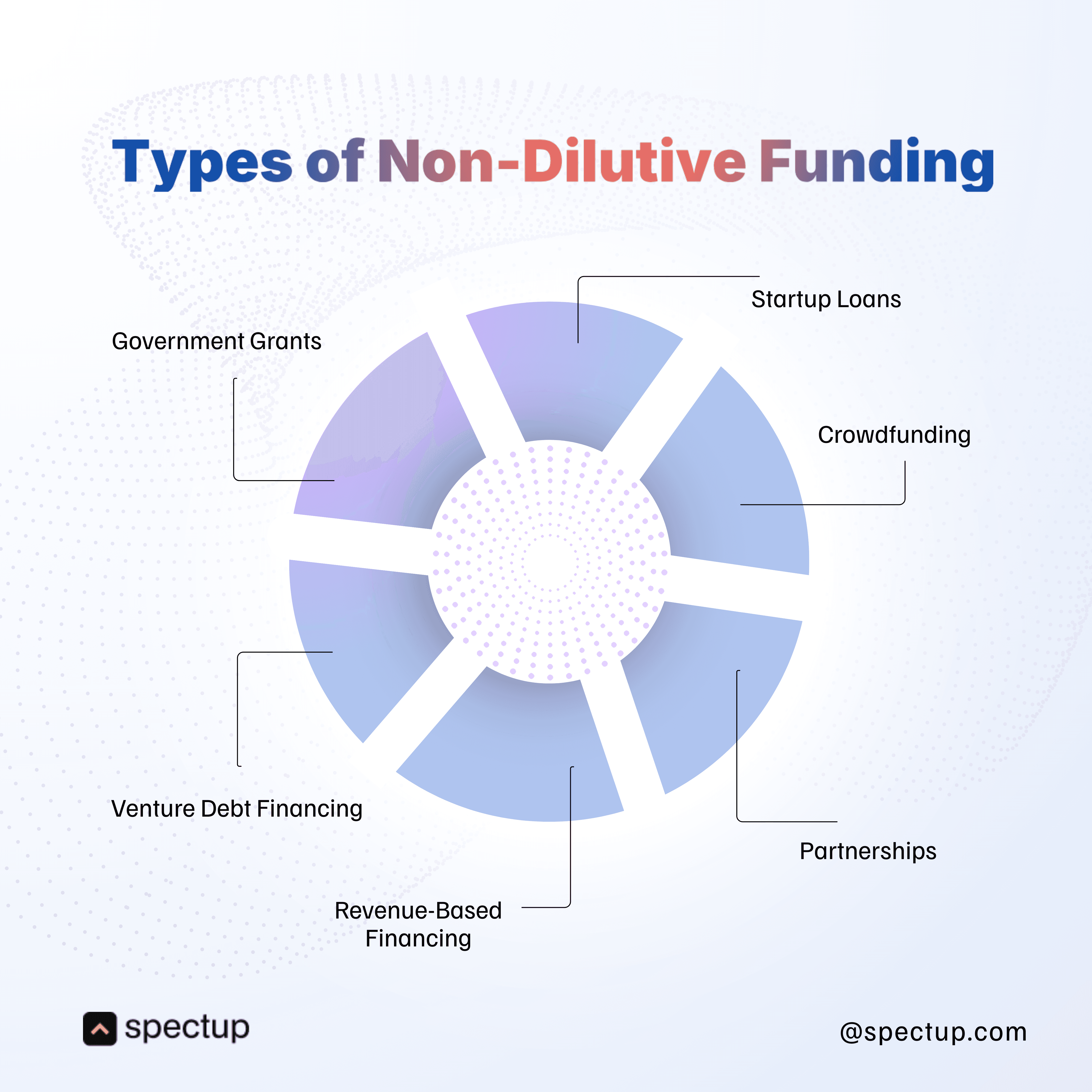

However, non-dilutive funding encompasses a diverse range of sources, including government grants, startup loans, and revenue-based financing. These alternative mechanisms provide founders with opportunities to finance operations and growth without ceding early control or significant equity stakes. As a result, non-dilutive funding can be an effective strategy for startups seeking traction and scalability while minimizing loss of ownership.

Why does this matter?

Non-dilutive funding is expected to play an increasingly vital role in startup financing strategies in 2025. The following key points are shaping this approach:

Preserves founder and employee equity: Non-dilutive funding enables founders and employees to retain their ownership stakes, supporting the accumulation of long-term wealth.

Demonstrates financial discipline to future investors: Startups that effectively manage their finances without recurrent reliance on equity financing are often viewed more favorably by prospective investors.

Offers financial flexibility without compromising governance: Access to capital is provided without requiring the relinquishment of voting rights or board seats.

For startups seeking to accelerate growth while maintaining ownership, non-dilutive funding presents a viable alternative. Nonetheless, navigating the complexities of non-dilutive financing can be challenging. Fractional CFO services can address these challenges by delivering scalable financial leadership tailored to the evolving needs of your startup.

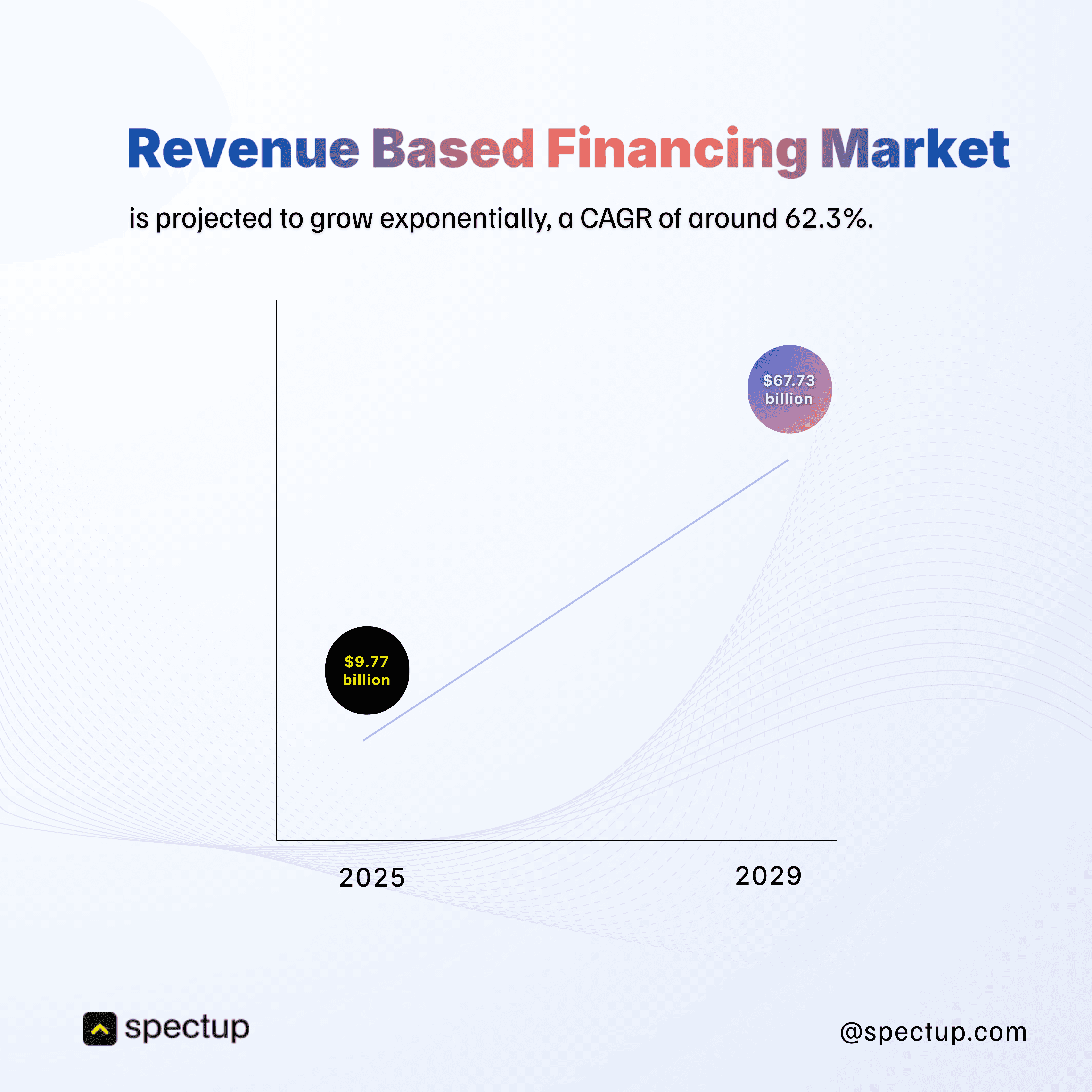

The global revenue-based financing (RBF) market was valued at approximately $5.8 billion in 2024 and is experiencing an annual growth rate of nearly 70%. This rapid expansion underscores the increasing adoption of non-dilutive financing solutions. For instance, equity funding for climate technology startups declined to $23.5 billion in the first half of 2025. However, the significance of non-dilutive capital, such as debt instruments and grants, continues to rise, providing essential support for scaling infrastructure and fostering long-term innovation.

Types of Non-Dilutive Funding Sources

When considering startup funding without equity, it is essential to evaluate a variety of non-equity funding sources. Each funding option presents distinct advantages and disadvantages, making it important to select the approach that aligns best with your startup’s specific stage and objectives.

Government Grants and Subsidies:

These types of funding are given based on the value of your innovation or research. Well-known examples include the SBIR/STTR programs in the U.S. and Horizon Europe in the EU. Grants are non-dilutive, meaning you don’t have to pay them back or give up any ownership in your company. Winning a grant can boost your startup’s reputation since the process is very competitive. However, applying for these programs usually involves complicated paperwork and significant administrative work.

Startup Loans:

There are several loan options designed for new businesses, such as microloans, Small Business Administration (SBA) loans, and financing from fintech companies. Loans give you fast access to funds but must be paid back over time and often require good credit history, which can be tough for early-stage startups to prove.

Venture Debt Financing:

This option is mainly for startups that already have venture capital backing and want to raise more money without giving up more ownership. Venture debt lets you get extra capital while keeping control of your equity, but it does require steady cash flow for regular repayments. Missing payments can put serious financial pressure on your business.

Revenue-Based Financing:

With this model, repayments are tied directly to your monthly revenue, so you pay more when business is good and less when it’s slow. This flexibility is helpful for startups with fluctuating income, but the total cost is often higher than with traditional loans, so careful cash flow planning is important.

Each of these non-equity funding options provides unique pathways for fueling your startup’s growth without sacrificing ownership. A thorough understanding of their respective requirements and implications is critical for making informed financial decisions.

It is essential to consider innovative strategies that can optimize your startup’s growth potential while leveraging available funding options. For example, implementing the Lean Startup model can fundamentally transform your approach to business development and management. By incorporating such methodologies into your funding strategy, startups will be better positioned to address the inherent challenges of startup operations and enhance the likelihood of long-term success.

Difference between different types of financing:

Choosing the right startup funding path depends on where you are in your journey and what you aim to achieve. Non-dilutive funding and equity financing both play strategic roles but differ fundamentally in ownership impact and financial obligations.

Equity Funding

Offers long-term risk capital.

Involves selling part of your company, which means diluting ownership.

Investors become partners with a say in governance.

Often suits startups looking for large growth capital and willing to share control.

Non-Dilutive Funding

Preserves your full ownership, no equity given up.

Comes with repayment or performance conditions like loan paybacks or revenue shares.

Includes startup grants and loans,

venture debt, and other non-equity funding sources.

Best for founders wanting to keep control while still raising capital.

Venture Debt

A form of non-equity funding tailored mainly for VC-backed startups.

Accessed faster than equity rounds because it’s a loan rather than a sale of shares.

Requires steady cash flow to handle repayments, adding financial discipline.

Equity:

Usually takes longer due to investor due diligence and negotiation.

Dilutes founder ownership but supports long-term growth through strategic partnerships.

Understanding these distinctions enables startup founders to effectively evaluate the advantages and disadvantages of startup grants, loans, and equity financing. For example, grants and loans provide quick capital without giving up ownership, while equity rounds trade ownership for potential growth funding. The financing method chosen affects governance, financial runway, and investor relations long term.

To make good decisions, it’s important to understand all the ways startups can get funding, such as using your own money (bootstrapping) or getting investment from venture capitalists. Each option has its own rules and results. It’s also important to know the difference between a business plan and a business model, since this helps shape your strategy and guides how you look for outside funding.

Venture Debt vs Equity: A Clear Comparison of Venture Debt and Equity in 2025

In 2025, the U.S. venture debt market is projected to reach approximately $27.83 billion, reflecting rapid growth driven by startups' demand for non-dilutive capital in sectors like biotech, AI, and climate tech. Major deals such as OpenAI securing $300 million and Rivian obtaining $500 million in venture debt highlight investor confidence in high-growth companies.

Globally, venture debt deal activity continues to rise, with strong inflows from institutional investors seeking portfolio diversification and higher yields.

In parallel, global venture capital investment saw a 10-quarter high of $126.3 billion in Q1 2025, though deal volume declined to 7,551 deals, indicating a market concentrating on larger, more substantial investments.

European venture funding held steady at $12.6 billion in Q1, showing resilience despite economic uncertainties.

The bifurcation of the venture equity market reflects selective investment in standout sectors and companies amid a context of elevated inflation and market volatility. Together, these stats underline venture debt's expanding role as a strategic complement to equity, enabling companies to optimize capital structure while venture equity remains essential for foundational growth and long-term investor partnerships.

What's growing in 2025?

Venture debt accounts for more than 50% of global deals in fintech and SaaS verticals, favored for their recurring revenue models and predictable cash flows.

Fintech leads in emerging markets such as India, Southeast Asia, and GCC, with models like BNPL driving demand for venture debt.

Equity financing remains the dominant form for early-stage startups in sectors requiring heavy R&D such as deep tech, biotech, AI, and consumer tech.

Investor preferences are shifting toward hybrid financial instruments combining debt and equity features, reflecting a trend to tailor capital structures flexibly.

Non-bank lenders and fintech funds have expanded in the venture debt space, offering faster deal cycles but often at higher costs.

This synthesis highlights the evolving landscape of venture debt and equity financing in 2025, underscoring their complementary roles in startup capital strategies.

Benefits of Non-Dilutive Funding for Startups

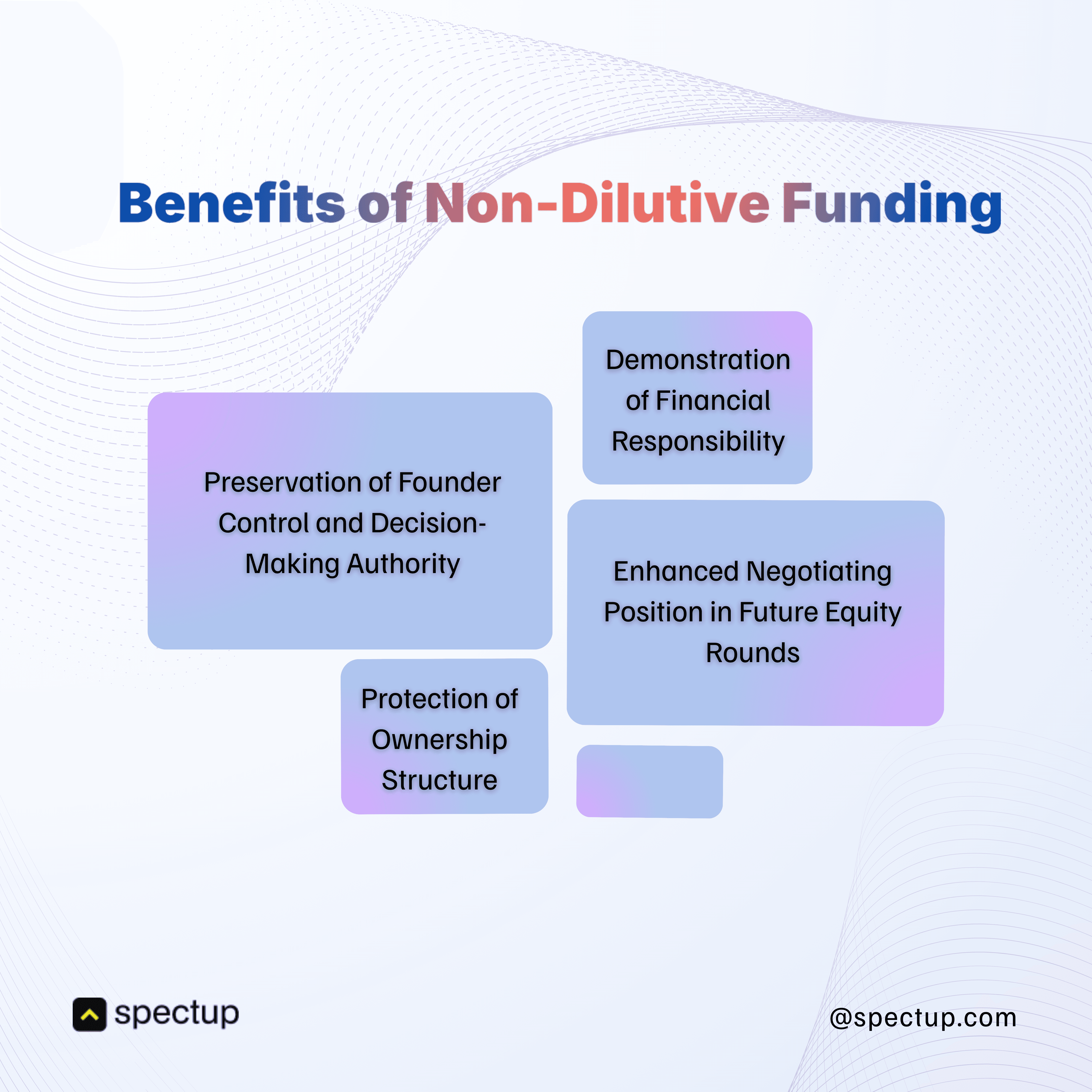

Non-dilutive funding lets startups get money without giving up any ownership or control of their company. Unlike traditional funding, where founders have to give investors a share of the business, non-dilutive funding allows entrepreneurs to keep full control and protect the long-term value of their company. This type of funding is especially helpful for those who want to grow their business while staying in charge of how it’s run.

Startups often prefer non-equity funding sources for the following reasons:

Preservation of Founder Control and Decision-Making Authority: By avoiding the introduction of new shareholders, founders maintain full control over strategic decisions without external influence.

Protection of Ownership Structure: Maintaining existing equity allocations ensures that founders and early employees receive the maximum benefit from their contributions. This approach also aids in talent retention by offering more substantial equity incentives to employees.

Enhanced Negotiating Position in Future Equity Rounds: Demonstrating the ability to secure capital through non-dilutive means signals financial discipline to potential investors and reduces perceived investment risk, thereby strengthening the startup’s leverage in subsequent equity negotiations.

Demonstration of Financial Responsibility: Effective use of grants, loans, and other non-dilutive funding sources showcases prudent resource management, further increasing investor confidence.

Additionally, non-equity funding options such as venture debt or government grants can serve as bridge capital between equity rounds. These instruments extend the financial runway and provide operational flexibility while preparing for larger fundraising efforts.

If you're weighing venture debt vs equity, remember startup funding without equity provides cash without immediate ownership trade-offs. It's an alternative financing for startups that want growth with flexibility.

Risks and Limitations of Non-Dilutive Funding:

Non-dilutive funding offers an attractive way to raise capital without giving up ownership, but it’s not without its challenges. Understanding the risks and limitations helps you make smarter decisions about whether this type of startup funding without equity fits your business model and growth stage.

Key challenges include:

Repayment obligations can strain cash flow. Unlike equity, which doesn’t require monthly payments, forms like venture debt or startup loans expect principal and interest repayments. If your revenue fluctuates or growth slows, these obligations can create tight cash flow situations.

Limited amounts compared to large equity rounds. Non-equity funding sources such as grants and loans generally provide smaller sums than venture capital rounds. This means you might need multiple non-dilutive deals or combine them with equity financing to meet bigger capital needs.

Competitive grant application processes. Startup grants and subsidies sound great because they don’t need repayment, but getting one is often a lengthy, complex process with fierce competition. Some grants require detailed proposals, milestones, and regular reporting that demand dedicated time and resources.

Not always suitable for pre-revenue startups. Many non-dilutive options depend on having some revenue or traction to qualify, especially venture debt or revenue-based financing. Early-stage startups still in product development may find it tough to secure this type of alternative financing for startups.

Navigating the balance between venture debt vs equity or choosing among various non-equity funding sources requires a clear picture of your startup’s financial health and growth trajectory. Non-equity funding sources can be a powerful tool, but only if aligned with your operational realities.

Case Studies: Scaling with alternative financing for startups

Examining real-world case studies provides a comprehensive understanding of how non-dilutive funding enables startups to secure capital without relinquishing equity. These examples illustrate various approaches, including the utilization of startup grants and loans, the implementation of revenue-based financing models, and a comparative analysis of venture debt versus equity financing options.

Case Study 1: SaaS Startup with Revenue-Based Financing

A SaaS company partnered with Spectup to raise capital through revenue-based financing. This allowed them to significantly boost marketing initiatives while avoiding equity dilution. By aligning repayments with monthly revenue, the startup comfortably managed cash flow and retained full ownership until their Series A round, exemplifying Spectup’s focus on non-dilutive, founder-friendly funding solutions.

Case Study 2: Healthcare Startup with Government Grants

A healthcare company used non-dilutive funding, like government grants and philanthropic investments, to support growth and innovation while minimizing financial risk. When aligning their go-to-market strategy, spectup focused on preserving full ownership and control, aligning founders, and enabling long-term decisions. This validated the technology for later investors and reduced development risks, allowing efficient scaling with sustainable capital and demonstrating how mission-aligned financing can speed up healthcare innovation without dilution.

Case Study 3: E-commerce Startup with Venture Debt

During collaboration with an e-commerce business seeking to rapidly scale inventory during peak demand periods, venture debt was utilized as an alternative financing strategy. This approach extended the startup’s operational runway without immediate equity dilution. Subsequently, the company transitioned to equity funding at a higher valuation. This case illustrates that strategically combining non-equity funding sources, such as venture debt, with subsequent equity rounds can effectively optimize a startup’s capital structure.

Each example underscores the strategic use of non-equity funding sources tailored to specific startup needs and stages, offering valuable insights into balancing growth and ownership preservation.

These success stories are not achieved in isolation. The progress of these startups was notably shaped by the involvement of startup advisors, who offered strategic guidance that enhanced their likelihood of success. Advisors of this caliber are instrumental in assisting startups to navigate the complexities associated with fundraising and business growth.

Moreover, the importance of emotional intelligence in startup leadership is widely recognized. Implementing targeted strategies to enhance emotional intelligence can substantially improve decision-making processes, thereby contributing to more favorable outcomes for startups.

When Should Startups Consider Alternative Financing for Startups?

Non-dilutive funding provides startups with an opportunity to secure capital without relinquishing equity or ownership stakes. This financing approach is particularly advantageous for entrepreneurs seeking to maintain control over their companies while supporting business growth. However, as with any funding method, non-equity funding is most effective under specific circumstances and may not be suitable for all business models or stages of development.

Appropriate Startup Situations for alternate financing:

Founders prioritizing equity retention: For entrepreneurs who consider maintaining ownership a top priority, non-equity funding options such as grants or loans are highly suitable. For example, obtaining startup loans, even with minimal initial capital can provide essential financing while preserving founder equity.

Startups with predictable revenue streams: Revenue-based financing or venture debt is particularly effective for businesses with consistent cash flow, as these models enable manageable repayments aligned with income generation.

Businesses making substantial investments in R&D: Government grants and subsidies are specifically designed to support companies engaged in significant research and development activities, allowing them to pursue innovation without the pressure of immediate financial returns.

VC-backed companies seeking growth capital: Venture debt serves as a strategic complement to equity financing by extending a company’s operational runway without further diluting ownership. This option is advantageous for startups preparing to scale while remaining mindful of equity preservation.

When Alternative Financing for Startups is not a Good Fit:

Startups with unpredictable or extended revenue generation timelines may encounter difficulties in meeting repayment obligations associated with non-dilutive funding options.

Companies lacking robust repayment management strategies should proceed with caution, as missed payments can adversely affect both operational continuity and creditworthiness.

Founders seeking long-term capital support often find equity financing more appropriate, as it does not require repayment and is better aligned with prolonged growth objectives.

When considering startup grants, loans, or evaluating venture debt versus equity financing, a thorough understanding of the business model, revenue predictability, and growth targets is essential. An informed selection among alternative financing options requires careful evaluation of control, cost, and risk factors throughout the fundraising process.

Top venture providers offering startups funding without equity:

2025 has been the year with the highest number of startups securing non-dilutive funding, with a significant increase in venture debt financing. This trend can be attributed to the growing interest from investors in supporting early-stage companies without diluting their equity. Here are a few Top Venture Providers offering startups funding without equity.

First Citizens Bank (formerly Silicon Valley Bank): Leading venture debt provider focused on tech startups with flexible loan structures.

Hercules Capital: Specializes in venture debt and growth capital for technology, life sciences, and sustainable tech companies.

TriplePoint Venture Growth (TPVG): Offers tailored debt financing primarily to venture-backed startups across various sectors.

InnoVen Capital: Asia-Pacific focused venture debt fund supporting late-stage startups with non-dilutive capital.

Stride Ventures: Provides venture debt with custom terms for high-growth enterprises, including fintech and SaaS verticals.

Kreos Capital (BlackRock): Major European venture debt player backing scale-ups like Klarna and Babylon Health.

European Investment Bank (EIB) / European Investment Fund (EIF): Support innovation-driven startups through guarantees and backing of venture debt funds.

Conclusion

Navigating the landscape of non-dilutive funding presents a strategic alternative to traditional equity financing. Non-dilutive capital enables startups to drive growth without relinquishing ownership, thereby supporting founder control and maintaining employee motivation. Various options, including startup grants, loans, and comparisons between venture debt and equity, provide a range of non-equity funding sources suitable for different business needs and stages.

To facilitate decision-making, the following checklist may be useful:

Preserve founder and employee equity

Demonstrate financial discipline to potential investors

Select an optimal mix of debt, grants, or revenue-based financing

Assess cash flow implications and repayment terms

If you are seeking alternative financing solutions for startups, spectup offers expertise in securing the right combination of non-dilutive funding and equity capital. This approach allows founders to accelerate growth without compromising ownership. Contact spectup today to access funding solutions tailored to your startup’s unique journey.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.