Here's a question that'll hit you right in the runway anxiety: Your startup is crushing it. Metrics are up, customers are happy, your team is firing on all cylinders. But your bank account? Yeah, that's heading in the wrong direction. You've got maybe six months left before you're having very uncomfortable conversations. So what do you do?

(A) Raise another equity round, dilute yourself into oblivion, and explain to your co-founders why you now own 12% of the company you built from scratch?

(B) Slam the brakes on growth to conserve cash, watch your competitors zoom past you, and pray that "slow and steady" actually wins this particular race?

Or (C) explore that mysterious third option everyone whispers about at founder dinners but nobody really understands?

And if you clicked on Option C, you got the right answer. Welcome to venture debt financing.

If you just thought "Wait, startups can actually take out loans?", Congrats, you're in good company. Most founders don't even know this exists

Now, if you want a quick answer. Here you go: Imagine you're renovating your house to increase its value. You could sell a room to your neighbor for immediate cash (equity financing), or you could take out a home improvement loan that you'll repay over time (venture debt financing). With the loan approach, you keep your whole house intact but commit to making monthly payments. That's venture debt in a nutshell.

If you are going to stick, let's find out how this works.

The Myth Every Founder Believes (Until They Don't):

There's this assumption baked into startup culture that debt is only for boring, established companies with predictable revenue and actual assets to pawn off if things go sideways. Startups burn cash, swing for the fences, and fund growth with equity. That's just how it works, right?

Not quite.

While you were busy perfecting your pitch deck and obsessing over your CAC payback period, the venture debt market quietly grew into a massive $50+ billion industry designed specifically for high-growth startups that are already backed by equity investors.

Just sitting there, waiting for founders who know how to use it.

But here's the thing (and you knew there was a thing):

Venture debt isn't some magic money tree you shake whenever your runway gets tight. It's a powerful financial tool that can genuinely extend your life, preserve your equity, and give you breathing room to hit the milestones that make your Series A inevitable.

Or it can become a financial anchor that drags you straight to the bottom if you don't know what you're doing.

This guide cuts through the confusion. We're going to explain exactly what venture debt financing actually is, how it's fundamentally different from selling equity (spoiler: very different), when it makes perfect sense for your startup, and, just as importantly, when you should absolutely run the other direction.

Because knowing your options is step one. Knowing which option to pick? That's what separates the startups that make it from the ones that become cautionary tales.

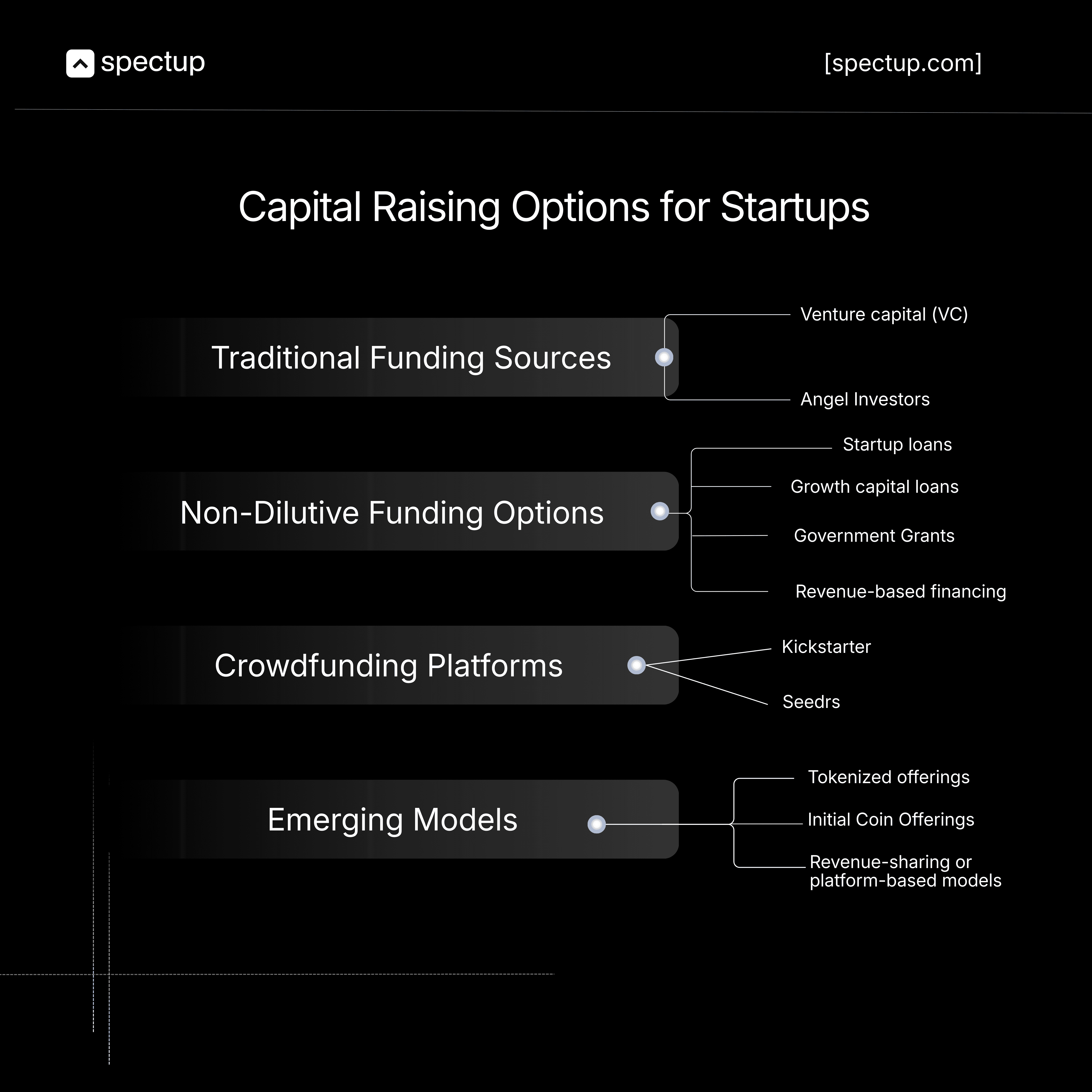

Capital Raising Options for startups moving onwards:

Picture a buffet with different dishes, each serving a unique purpose for different dietary needs. That's the funding landscape in 2025. Founders have more capital raising options than ever before, but choosing the wrong one is like loading your plate with dessert when you actually need protein for the marathon ahead.

Traditional Funding Sources:

Venture capital and angel investors remain the bread and butter for fast-growing startups looking to scale rapidly. But moving onward with the digital economy and traditional economic uncertainty has made VCs considerably pickier.

Let’s say they're laser-focused on clear paths to profitability, not just growth-at-all-costs narratives.

Average Series A rounds in the U.S. currently hit around $18 million, while later-stage investments often exceed $50 million.

They're serious investments demanding serious returns.

For instance:

Series A examples: Airbnb, Stripe

Later-stage examples: Robinhood, SpaceX

Non-Dilutive Funding Options:

To keep more ownership and stretch runways further, founders are increasingly turning to non dilutive capital sources:

Startup loans specifically designed for growing companies that don't touch your equity

Government grants targeting specific industries or sustainability initiatives

Revenue-based financing with repayments tied directly to monthly income

Growth capital loans specifically designed for expansion without any equity trade-offs

Crowdfunding Platforms:

Crowdfunding sites like Kickstarter and Seedrs are still popular ways to raise funds, especially for startups selling consumer products or working on environmental and social projects.

Kickstarter: Popular for creative and product-based startups like Oculus Rift

Seedrs: Widely used in Europe for equity crowdfunding, e.g., startups like Crowdcube campaigns

These options let you raise necessary capital without handing over pieces of your company, think of it like borrowing your neighbor's lawnmower instead of selling them part of your house just to cut the grass.

Newer models like tokenized offerings are gaining real traction, offering unprecedented flexibility and access to diverse investor pools globally.

Meanwhile, artificial intelligence alone attracted an astounding $89 billion in VC investment, clearly showing where smart money is flowing.

The smartest founders now strategically blend these approaches, mixing equity, startup debt financing, and alternative options to grow faster while maintaining meaningful control and using capital far more efficiently.

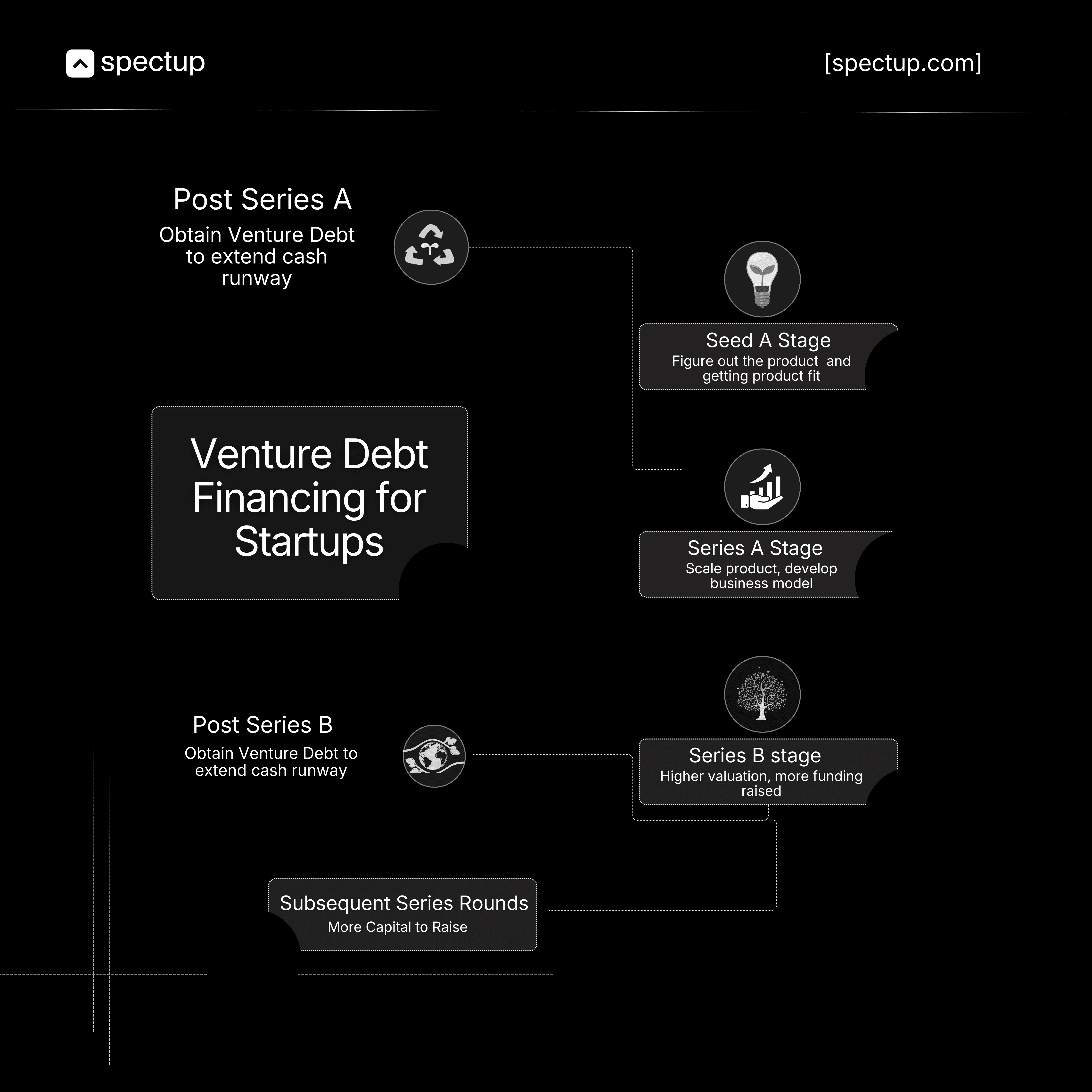

What Is Venture Debt Financing?

Venture debt financing is a specialized loan product designed specifically for fast-growing startups and scale-ups. Unlike traditional bank loans that demand substantial collateral or proven steady cash flow, venture debt providers primarily bet on your company's potential and, critically, your backing from reputable equity investors.

The major benefit that attracts founders? Extra funding without forcing you to immediately dilute your hard-earned ownership stakes.

Key Features of Venture Debt Financing:

Short- to Medium-Term Facility: Typically structured for 12-36 months, giving you a meaningful runway boost without the decades-long commitment of traditional debt

Usually Paired with Equity Rounds: Venture debt almost always follows or accompanies an equity raise, helping extend the critical time between major funding milestones

May Include Small Equity Warrants: While mostly non-dilutive in nature, some providers ask for tiny equity slices (typically 1-2%) to sweeten their deal and align incentives

This unique blend of features makes venture debt financing a genuinely powerful tool in your startup's financial toolkit.

Think of it like having both a credit card and savings account working together strategically rather than relying on just one.

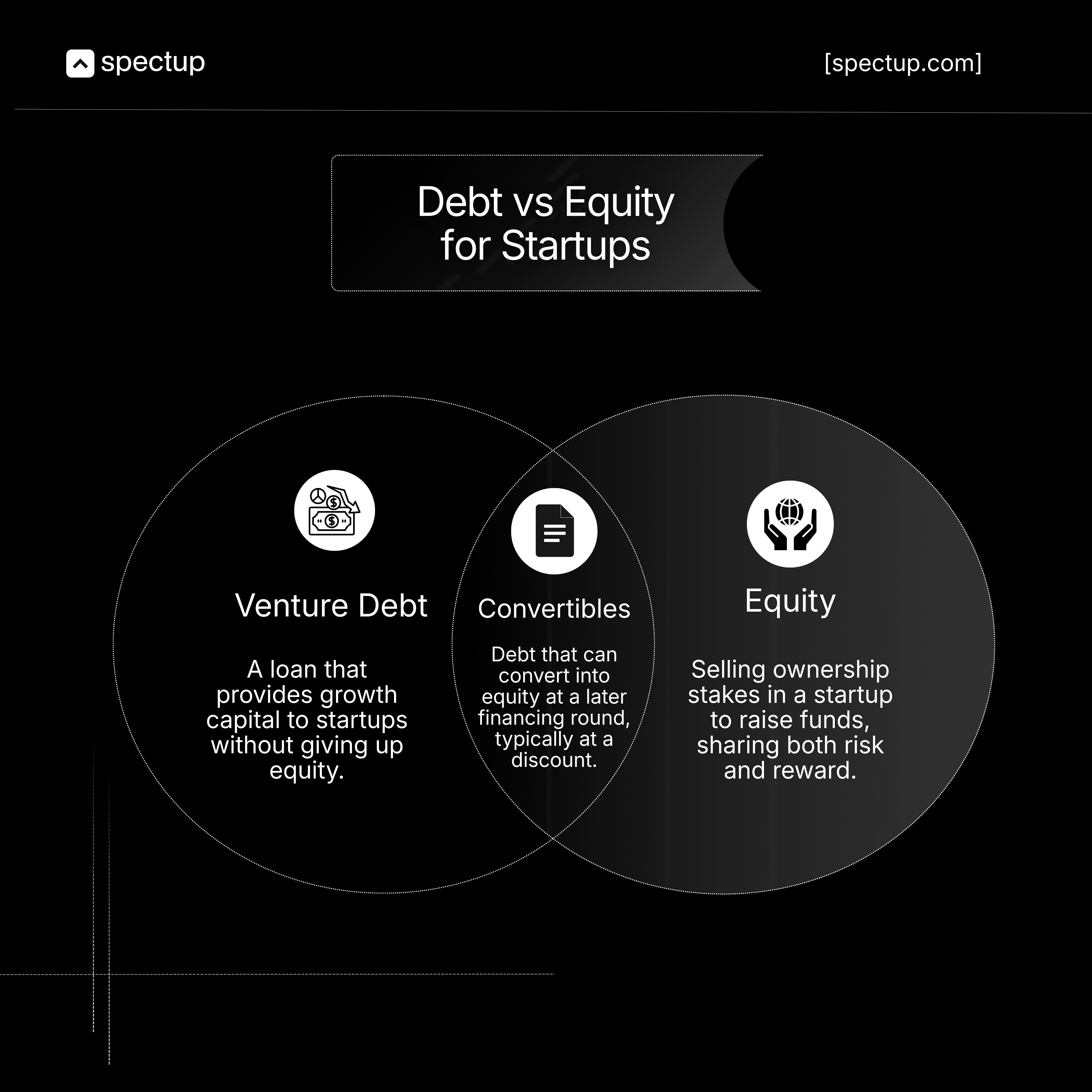

Venture Debt vs Equity Financing for startups:

Think of equity financing like selling off pieces of your house. Each time you raise money by selling equity, you're handing over another room, the kitchen, the garage, that nice upstairs bedroom. Eventually, you're living in what used to be entirely yours, but now you're just renting space in your own home.

Venture debt?

That's more like taking out a mortgage from a neighbor who trusts you're good for it. You pay them back with interest over time, but when it's all said and done, the house is still yours. Every room, every square foot, you didn't give up the deed to your master bathroom just because you needed some working capital.

Here's the breakdown that might choke you (due to its dry nature, but at the same time, is very important to understand):

Ownership: Venture debt keeps ownership mostly intact, while equity financing shrinks it as new investors claim shares

Control: Debt means repaying loans without giving lenders decision-making power. Equity investors often want board seats and voting rights

Risk: Venture debt must be repaid regardless of performance, creating fixed obligations. Equity investors share risk, they only win if you win

Cost: If your business grows as planned, debt might cost less overall since you're not surrendering future upside or ownership.

How Non-Dilutive Capital Supports Startup Growth?

Now, imagine you signed up training for a marathon. Equity financing is like selling shares of your future prize money to fund training. Non dilutive capital is taking a loan for running shoes, you keep all your winnings but commit to repayment.

These loans typically accompany recent equity funding, helping companies operate longer before needing additional investment.

Common Venture Debt Terms:

Loan Size: Usually 20-30% of your most recent equity raise. Raised $10M in Series A? Expect $2-3M in offers.

Interest Rates: Fixed or variable, generally higher than traditional loans because startups carry more risk.

Warrants: Lenders typically ask for 1-2%, giving them rights to buy small company portions later.

Covenants: Loan agreements include rules like cash usage limits or financial milestone requirements.

To get the most out of these advantages, using fractional CFO services can help you make smarter decisions, keep your business running smoothly, and scale your finances as your company grows.

Types of Venture Debt Products:

Growth Capital Loans: Fund expansion, hiring, marketing without additional equity sacrifice

Equipment Financing: Purchase critical equipment needed for growth

Revenue-Based Loans: Repayment amounts adjust with monthly revenues

Why Venture Debt Actually Makes Sense (When It Makes Sense)

More startups are treating venture debt as strategic capital rather than just "that thing we do when we're desperate." Here's why smart founders are adding it to their playbook:

1. It buys you time without costing you ownership

This is the big one.

Venture debt gives you capital without immediately handing over another chunk of your company.

Think about it: You're six months from hitting that critical milestone that'll 3x your valuation.

Do you really want to raise equity now at a mediocre price

Or would you rather bridge the gap, hit the milestone, and raise at a valuation that doesn't make you want to cry into your morning coffee?

Venture debt extends your runway so you can get to those inflection points before your next equity round.

In other words: less dilution when it actually matters.

2. You (and your team) keep more of what you built

Every equity round doesn't just shrink your slice, it shrinks everyone's slice. Your co-founders, your early employees who bet on you when you were nobody, that engineer who took a pay cut to join you.

Venture debt keeps your cap table stable.

Your ownership percentages stay the same.

Your employee stock options don't get watered down.

When exit day comes (and it will come), everyone who helped build this thing gets their fair share.

3. It gives you actual leverage in your next raise

Here's something most founders don't think about:

Showing up to Series A conversations with 18 months of runway hits is different from showing up with 4 months and a prayer.

That extra cash from venture debt? It's leverage.

You're not desperate.

You're not taking the first term sheet that doesn't insult you.

You can negotiate from a position of strength, push for better valuations, and choose investors who actually add value instead of just whoever says yes first.

4. You can move fast when opportunities show up

Growth doesn't wait for your fundraising timeline.

Maybe a competitor just imploded and you can grab their customers, but only if you hire three salespeople this month.

Maybe there's a perfect acquisition target available at a fire-sale price.

Maybe your CAC just dropped by 60% and you need to pour gasoline on your marketing spend right now.

Venture debt gives you the flexibility to seize these moments without spending six months raising an equity round while the opportunity evaporates. You move fast, you capitalize, you win.

That's the upside. And it's real.

But (and you knew there was a but coming), venture debt isn't free money, and it's definitely not right for every startup.

Let's talk about when it makes sense and when it absolutely doesn't.

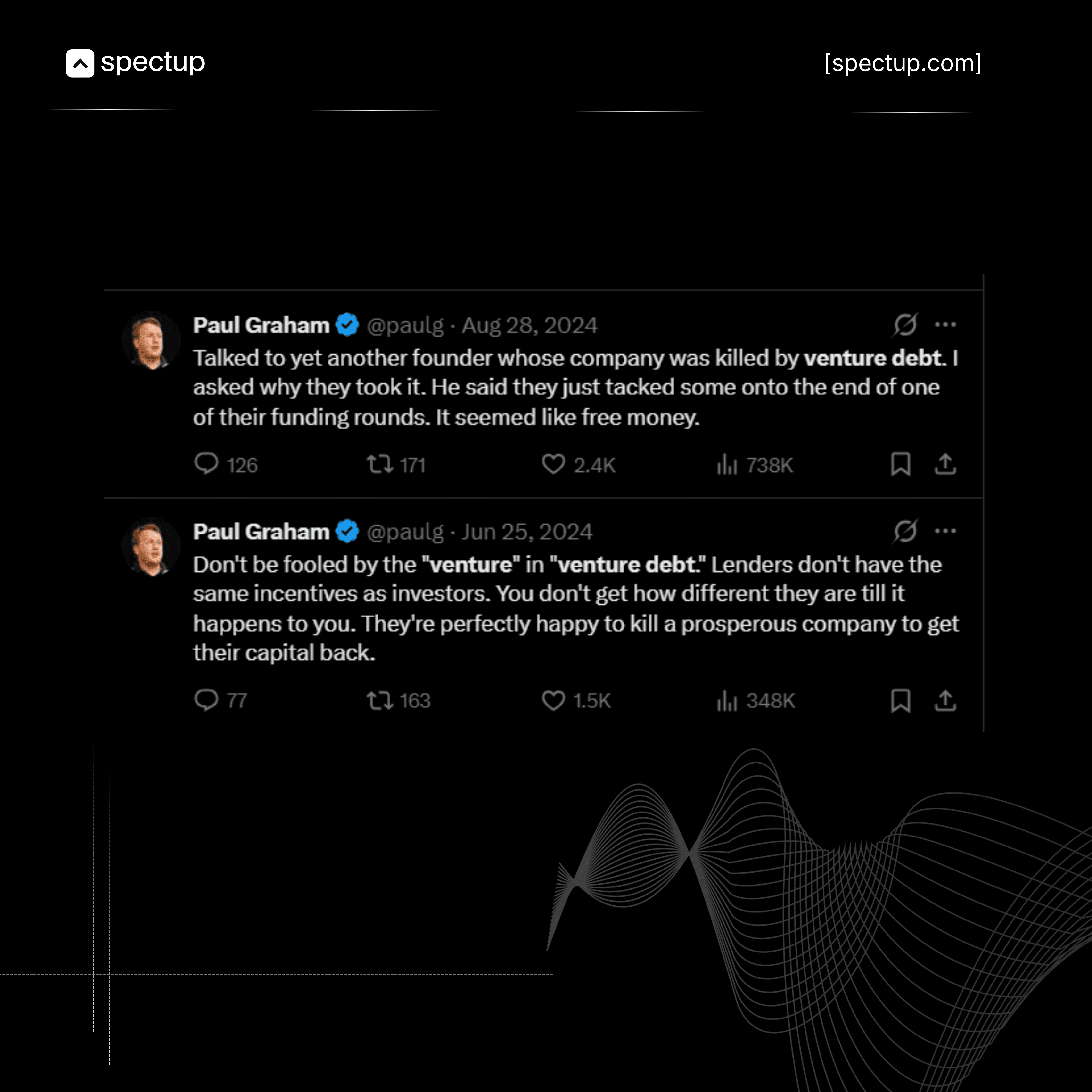

The Risks Nobody Mentions Until It's Too Late:

Look, venture debt sounds amazing on paper. Non-dilutive capital, extended runway, keep your equity, what's not to love?

Here's what: venture debt isn't free money. It's a loan.

And loans come with strings attached that can strangle you if you're not careful.

Think of it like this:

You just committed to fixed mortgage payments on your house, except your income isn't a steady paycheck, it's a rollercoaster of startup chaos.

Some months you're crushing it.

Other months your biggest customer churns, your product launch flops, or the market decides to take a collective nap.

Your mortgage payment? Still due.

And you have to pay it every single month. There is no exception and no excuse.

So what will happen?

Fixed repayment schedules don't care about your feelings (or your revenue)

You owe what you owe when you owe it.

Revenue down 40% this quarter because your enterprise sales cycle took longer than expected? Tough.

Burn rate higher than projected because you had to pivot? Also tough.

That payment is coming out of your account whether you're celebrating record growth or frantically extending payables to make payroll.

Restrictive covenants are the fine print that bites

Venture debt lenders aren't just handing you cash and wishing you luck. They're protecting their downside with covenants, basically rules about what you can and can't do with their money.

Some are reasonable: "maintain at least 3 months of cash" or "don't go acquire another company without telling us." Others can box you in: hitting specific revenue targets, maintaining certain financial ratios, or getting lender approval for major decisions.

Break a covenant? Now you're having very uncomfortable conversations about defaults, penalties, or worse.

Cash flow pressure when you can least afford it

Here's the nightmare scenario: you take venture debt to extend the runway and hit milestones. Growth doesn't go as planned (it rarely does). Suddenly you're making debt payments and burning through your operational budget.

Your runway just got shorter, not longer. And now you're raising your next equity round from a position of weakness. Exactly the opposite of what you wanted.

The small print: warrants aren't free either

Venture debt lenders typically want warrants, the right to buy equity at a set price later. It's usually 1-2% dilution, which sounds tiny compared to raising a full equity round.

And it is tiny. But it's not zero. You're still giving up a piece of the company, just a smaller one. Don't let anyone tell you venture debt is "completely" non-dilutive. It's mostly non-dilutive, which is still way better than equity, but let's be honest about what you're signing up for.

So, venture debt financing is powerful when your cash flow is predictable enough to handle fixed payments and you're confident you'll hit your milestones. It's dangerous when you're already on thin ice, desperately hoping things turn around, and treating debt as a Hail Mary instead of a strategic tool.

Be honest with yourself about which camp you're in. Your future self will thank you.

When Should Startups Consider Venture Debt?

Venture debt financing isn't one-size-fits-all. It's like prescription medication, incredibly effective for specific conditions but potentially harmful if misused.

When Growth Capital Loans Makes Sense:

Extending Runway Between Rounds: Bridge Series A to Series B while reaching key milestones

Covering Working Capital: Fund operations or campaigns without ownership sacrifice

Financing Expansion: Grow while keeping control through non dilutive capital

Steady Revenue: Lenders prefer predictable cash flow and proven economics

When to Avoid Venture Debt:

Pre-Revenue Startups: Without revenue, meeting regular payments becomes nearly impossible

Unpredictable Cash Flow: Variable income makes fixed repayments tough

Already Carrying Debt: Additional loans increase financial pressure and default risk

Match your startup's stage with appropriate funding types for steady growth and avoiding unnecessary risks.

Choosing the Right Startup Debt Financing Provider

Choosing the right partner resembles selecting a business partner, as before money, it's tapping into a relationship. The best venture debt providers bring industry experience, flexible terms, and valuable networks.

When evaluating startup venture debt financing options:

Industry Experience: Lenders understanding your industry grasp your challenges better. Verify they've supported similar startups successfully

Flexible Terms: Seek lenders offering tailored terms, grace periods, revenue-adjusted rates, instead of rigid contracts.

Reputation: Choose providers known for transparency and fairness, without hidden fees or overly strict conditions.

Additional Support: Some lenders provide introductions to investors, customers, mentors, plus valuable advice strengthening your position beyond funding.

Choosing the Right Startup Debt Financing Provider

Choosing the right partner for venture debt financing is an important decision that goes beyond just getting money. The best lenders provide not only funding, but also industry experience, flexible deal terms, and access to helpful networks. Unlike equity financing, which usually means giving up some ownership and having more people involved in your company’s decisions, venture debt providers typically don’t ask for shares or direct control. Their main focus is on making sure the loan gets repaid.

When you’re looking at options for startup debt financing, keep these points in mind:

Industry Experience and Proven Success: A lender who understands your industry will have a better grasp of your unique challenges and opportunities. It helps if they’ve supported similar startups with growth loans or other forms of financing.

Flexible Repayment Terms: Every startup grows differently, so repayment plans need to fit your situation. Look for lenders who can offer customized terms, like grace periods before payments start or interest rates that adjust based on your revenue, instead of one-size-fits-all contracts.

Reputation with Founders and Investors: A lender’s reputation in the startup community says a lot about how they operate. Choose someone known for being transparent and fair, without hidden fees or overly strict loan conditions, to help ensure smooth business operations.

Additional Support (Connections and Advice): Some lenders go further by introducing you to investors, customers, or mentors, and by offering valuable advice. These extras can strengthen your company’s position well beyond just providing funds.

Selecting a lender with these qualities puts you in a stronger position to negotiate favorable venture debt terms and helps you balance debt with equity when raising future capital. Use these criteria to find a lender who matches your startup’s goals for long-term success.

Conclusion:

Stick from start?

Here is the secret sauce coming for someone reading this far. The real answer isn't A, B, or C, it's knowing when each option makes sense. Venture debt financing isn't better or worse than equity; it's different, with its own ideal use cases and risks.

Smartest founders don't see venture debt vs equity as either-or. They see both as tools in their fundraising toolkit.

Need to extend the runway without diluting? Venture debt.

Want strategic partners with governance input? Equity.

Pursuing aggressive growth requiring substantial capital? Probably equity.

Financing specific equipment? Consider growth capital loans.

The venture debt market has matured significantly, offering sophisticated startup debt financing options that didn't exist a decade ago. Whether it's right depends on your circumstances, revenue predictability, growth stage, risk tolerance, and objectives. Understand the venture debt terms thoroughly, and make the choice aligning with where you are today and where you're headed tomorrow.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.