As Q4 approaches, founders increasingly face pressure around investor outreach amid a shifting angel investment landscape in 2025. At Spectup, we have observed a notable trend: angel investors are placing greater emphasis on ESG (Environmental, Social, and Governance) criteria when evaluating early-stage opportunities. For founders, this means investor readiness extends beyond growth potential to building sustainable, responsible businesses aligned with contemporary investment priorities, a factor contributing to founder challenges.

However, when you prepare in advance, refine your go-to-market strategy with Spectup, align your documentation, and sharpen your messaging, your outreach becomes more effective. Your team stays motivated, and instead of pursuing investors, you engage in meaningful conversations that open doors. This exemplifies the value of being truly investor-ready.

Now, consider which steps you will take to advance your fundraising efforts.

As a startup founder, staying informed about evolving priorities, technologies, and investor behaviors is essential, as these factors significantly influence your funding journey. Understanding the future direction of angel investing enables you to tailor your pitch, strategy, and growth plan to align with current investor preferences, rather than relying on outdated practices from years past. Awareness of these shifts is not merely advantageous, it is critical for securing the appropriate angel funding in 2025 that can accelerate your startup’s growth.

This article examines the key trends transforming angel investing, offering practical insights designed to help you stay ahead and attract the support your venture merits.

Angel Investment Trends Aligning with Social Good

2025 is expected to be a year of significant growth in the global venture capital market. Considering this, investments are projected to be between USD 286 billion and USD 364 billion, depending on the source and metrics used. Moreover, the capital in the first quarter of 2025 alone was strong, reaching about USD 126.3 billion, which was a 10-quarter high.

Not only this, but the trends for Angel Investment alone 2025 shows a powerful surge toward impact investing, where early-stage investors seek more than just financial returns, they want to make a difference. Keeping all this in consideration, the future of angel investors is deeply intertwined with social good, driven by several key forces reshaping funding decisions.

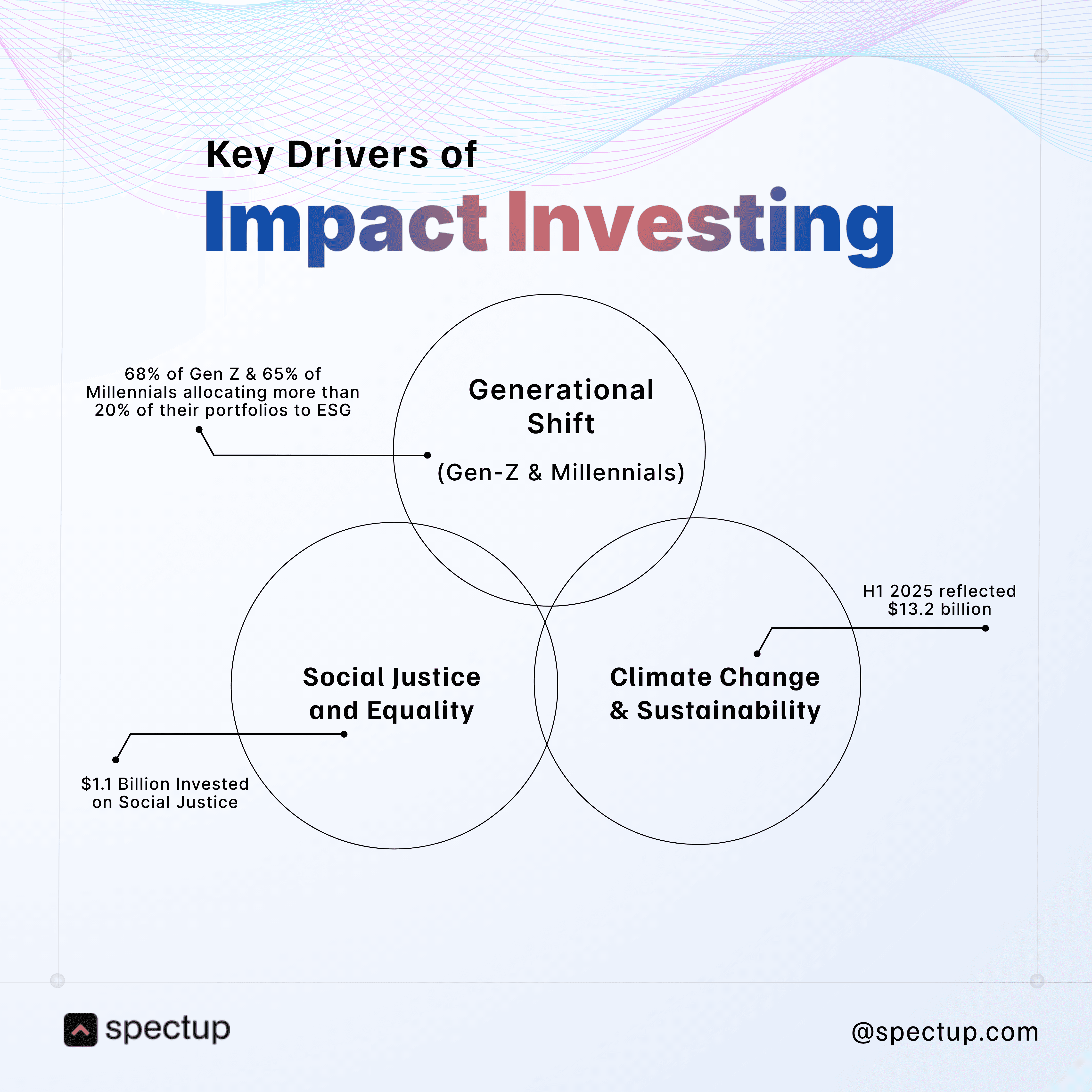

Key Drivers of Impact Investing

Generational Shift: Millennials and Gen Z are stepping up as both founders and investors, prioritizing purpose alongside profit.

Climate Change and Sustainability: Startups tackling environmental challenges attract angel funding focused on long-term planetary health.

Social Justice and Equality: Investors increasingly support ventures promoting diversity, equity, and community upliftment.

Founders can tap into this trend by:

Articulating Your Mission clearly. This means not to just pitch your product but also share the positive change you’re driving.

Highlighting ESG (Environmental, Social, Governance) factors in your business model to demonstrate responsibility.

Engaging with impact investors who align with your values, building relationships that go beyond money.

The major question that is driving the impact in 2025 is how a startup is changing impact and bringing in the solutions that can make the world a better place to live.

The Integration of AI and Data-Driven Decision Making in Angel Investment

The growth in 2025 is primarily fueled by the rise of AI and data-driven methods. According to trends in angel investment, technology is becoming the key ingredient for making smarter, quicker, and more assured funding choices. Therefore, early-stage investments now heavily rely on automated valuation tools and predictive analytics to identify potential successful ventures before they become widely recognized.

This shift indicates that startups are not only focused on AI but also that various industries such as healthcare, green technology, defense, financial technology (fintech), and biotechnology (biotech) are integrating AI into their operations. AI startups represented 20% of all investment deals, with the amount of capital invested in generative AI already exceeding the total funds raised in 2024. Some notable large funding rounds include OpenAI's $40 billion raise, Anthropic, and other similar companies.

Benefits of AI and Data-Driven Investment:

Better Investment Decisions: Algorithms analyze vast amounts of data beyond human reach, reducing bias and uncovering hidden opportunities.

Automated Valuation Tools: Startups get quicker, more objective assessments of their worth.

Predictive Analytics: Patterns in market behavior help forecast startup success with greater accuracy.

Some of the biggest deals across all of these sectors so far in 2025 have been:

According to the report by Silicon Canal, German energy management proptech Reneo secured around €600 million (approximately $624 million) in funding. This was through multiple rounds led by Eurazeo and Lakestar with participation from family businesses and business angels, aiming to decarbonize residential real estate in Germany and Europe.

Moreover, as per AI drug discovery firm Isomorphic Labs, they raised $600 million in its first external funding round. The round was led by Thrive Capital with participation from GV and Alphabet, intended to further develop its AI drug design engine and advance therapeutic programs.

Moreover, as per KPMG Report, Chinese cleantech SE Environmental secured $688 million in funding in Q1 2025, making it one of the top deals in Asia’s cleantech sector.

The Shift Toward Diversified Angel Investor Networks

Angel investment trends in 2025 reveal a growing preference for diversified angel investor networks. These networks bring together multiple investors, pooling capital and expertise to tackle early-stage investments with a collective mindset. Thus, this shift is changing the landscape of angel funding in 2025, creating new opportunities for startups.

Why are these networks gaining traction?

Risk Mitigation: Sharing investment risks among several angels reduces the burden on any single investor.

Increased Capital for Startups: More investors mean larger funding rounds, fueling growth faster.

Broader Expertise: Diverse backgrounds and skills contribute to better decision-making and mentorship.

Founders looking to tap into this trend should:

Join Angel Networks: Get listed or introduced to active groups that match your industry.

Target Syndicates: Align with syndicates specializing in your startup’s stage or sector.

Leverage the Network: Use connections for advice, partnerships, and follow-on funding.

Engaging with diversified networks can elevate your fundraising game, giving you access to more than just money—it’s about gaining a village behind your vision.

The year of the ‘Megadeals':

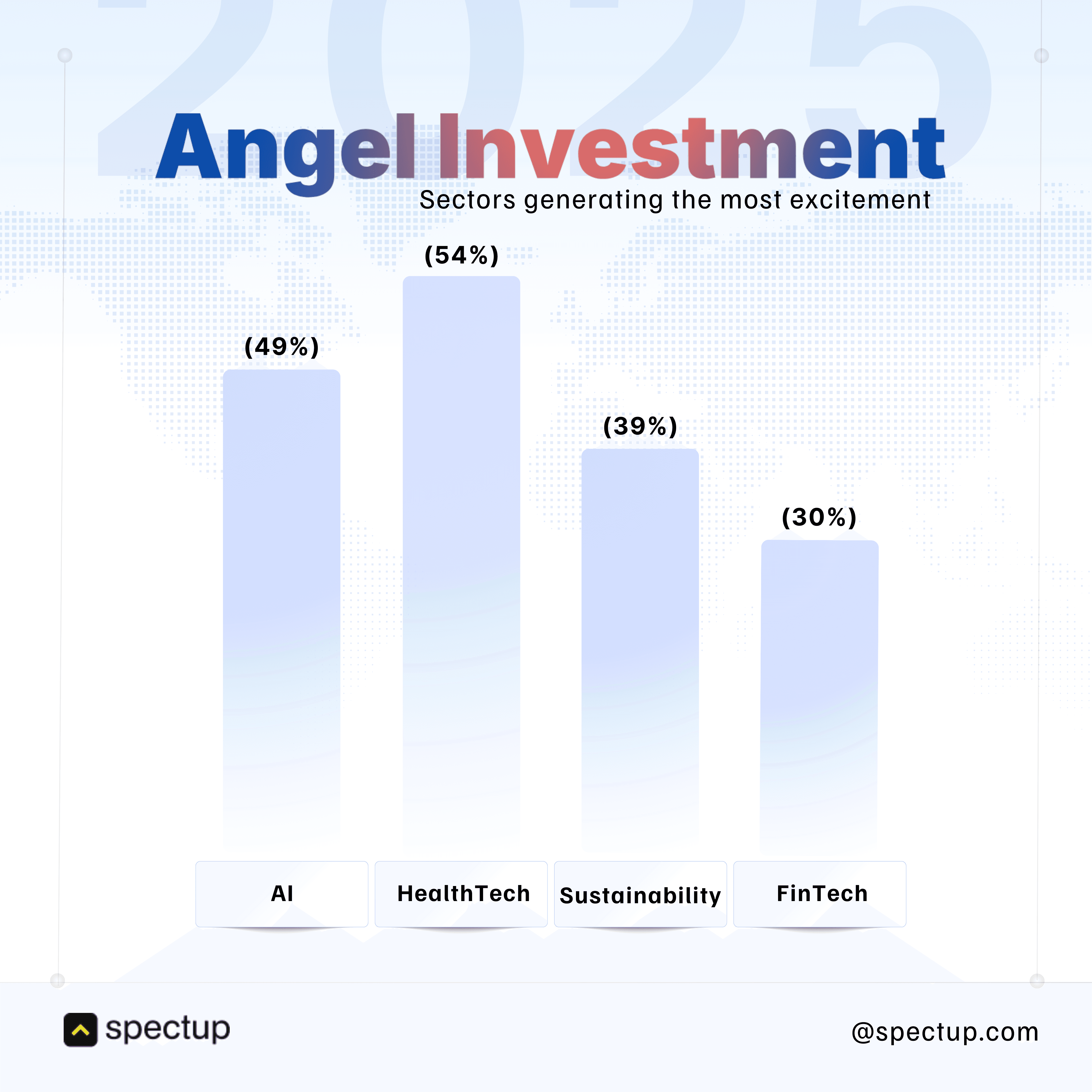

2025 is known as the strongest wave of optimism despite the global economic challenges. While megadeals exceeding $1 billion are more common in later VC stages, angel investments in 2025 have focused on smart, strategic bets often in high-potential sectors like AI, HealthTech, and Sustainability.

Key stats about Angel Investment in 2025 includes:

40% of surveyed angel investors plan to increase their investments in startups compared to last year

Another 39% are planning to maintain their previous investment levels.

For early-stage founders, angel investments usually come in smaller ticket sizes, often around £25,000 or less per investor. Instead of chasing a single big backer, focus on building relationships with multiple angels and diversified networks who are collectively driving most early-stage deals.

Angel investing platforms such as AngelList and SeedBlink continue to facilitate connections and early-stage funding rounds, enabling startups to quickly raise capital from diverse angel networks.

While true "angel megadeals" exceeding $1 billion remain rare due to the typically smaller investment sizes at this stage, the cumulative impact of angel investment is significant in fueling early-stage innovation in 2025.

Active and Influential Angel Investors of 2025:

Some of the most active and influential angel investors in 2025 include:

Hesham Zreik, Edward Lando, Paul Buchheit (creator of Gmail and co-founder of Y Combinator), and Chris Adelsbach who focus on technology startups and AI-related ventures.

Other notable angel investors in the HealthTech space are Sue Siegel, who has extensive experience in the healthcare industry, and Esther Dyson, an early investor in numerous health startups.

Angel investing has evolved significantly over the years, moving beyond just providing capital to startups. Many angels now offer mentorship, industry connections, and strategic guidance to their portfolio companies. This approach not only enhances the chances of success for these startups but also adds value to the entire ecosystem.

As we move further into 2025 and beyond, it is expected that angel investment will continue to be a crucial driver of early-stage innovation, supporting promising entrepreneurs and fueling the growth of transformative technologies across various sectors.

The Growth of Angel Investment in Non-Traditional Industries

The world of angel investment is changing quickly. Angel investors are now looking at industries beyond just technology and consumer goods. This change shows a growing interest in new ideas where there is untapped potential and urgent global needs. Understanding these can help founders attract angel funding in 2025.

Industries Attracting More Angel Investment:

Technology, Healthcare, and Fintech: These three sectors accounted for about 67% of total angel investments in 2023 and remain the top focus areas in 2025. AI startups are especially prominent within technology investments.

Clean Energy and Sustainability: Attracted $3.5 billion in angel funding in 2023, reflecting 20% growth over the previous year. This sector is increasingly important amid climate concerns.

EdTech (Education Technology): Experienced a 35% increase in angel funding, supported by the shift toward online learning platforms and AI-driven educational tools.

Mental Health and Wellness: Received $1.1 billion in angel investments, highlighting societal emphasis on health equity and wellness innovations.

Gaming: A 15% surge in angel investments was observed in the gaming sector, particularly mobile gaming startups, indicating robust interest in interactive entertainment.

Agritech: Captured $750 million in funding fueled by innovations in food sustainability and precision agriculture.

Cybersecurity: Experienced a 30% increase in angel investment, primarily in North America and Europe, driven by rising global security concerns.

Founders can benefit from this angel investment trends by:

Exploring Non-Traditional Sectors that align with global challenges or emerging consumer behaviors.

Showcasing Growth Potential with data-backed market insights that demonstrate scalability.

Tailoring Pitches to highlight industry-specific impacts, appealing directly to investors’ evolving priorities.

This strategic approach positions startups to tap into new sources of funding that are eager for innovative ideas outside of the mainstream.

Angel Investment trends 2025: The Rise of Micro Angel Investors

Angel investment in 2025 is undergoing a significant transformation, marked by the emergence of micro angel investors. These are individuals who commit smaller capital amounts yet provide substantial value beyond financial support.

Key Advantages of Micro Angel Investors

Personalized Engagement: Micro angels tend to build close relationships with founders.

Tailored Advice: You can expect tailored advice, introductions to valuable contacts, and active mentorship that aligns closely with your startup’s immediate needs.

Flexible Investment Structures: Unlike traditional angel investors who may require strict terms or larger equity stakes, micro angels often offer more negotiable deal terms. This flexibility empowers founders to retain greater control over their vision while still securing essential funding.

Diverse Funding Sources: The rise of micro angels means startups can attract support from a broader pool of backers, including professionals from varied industries, not just veteran investors. This diversity brings fresh perspectives and niche expertise into your business.

How Micro Angels Are Reshaping Early-Stage Investment

Lower Barriers for Startups: By pooling multiple small checks rather than relying on a single large investor, startups can minimize risk and avoid over-dependence on one backer.

Faster Decision-Making: With fewer bureaucratic layers, micro angels can move quickly, giving you faster access to funds when timing is critical.

Broader Network Effects: Multiple micro angels mean access to wider professional networks, opening doors to new markets, partnerships, and talent pools.

Characteristics of Micro Angel Investors

1. Smaller Capital Commitment: Unlike traditional angels who might write hefty checks, micro angels typically invest modest sums. This lower entry point opens doors for more investors to participate and for startups to access multiple smaller investments rather than one large round.

2. Personal Involvement: Micro angels often take an active role beyond just funding. They bring hands-on guidance, mentorship, and industry connections that can accelerate a startup’s growth

3. Diverse Backgrounds: These investors come from various industries and life experiences, not just typical Silicon Valley veterans. This diversity enriches the startup ecosystem with fresh perspectives and innovative ideas.

Ask yourself: Are you ready to connect with these emerging players? Their enthusiasm and adaptability could be just what your startup needs to thrive in the evolving landscape of angel funding in 2025.

Top 15 Angel Investing platforms to look into:

1. AngelList

AngelList is a key player in the world of angel investing. With its easy-to-use interface and powerful features, it helps startups connect with a wide range of investors, including angel investors, syndicates, and early-stage funds. Some of the important features of AngelList are:

Automated compliance

Streamlined fundraising processes

Integrated tools for managing cap tables

AngelList is perfect for tech startups in the US who want to raise large amounts of money quickly and effectively, especially those seeking support from angel investors.

2. SeedBlink

SeedBlink is Europe’s leading angel investing platform, connecting startups with over 110,000 verified investors across the continent. Startups looking to raise between €500K and €3M can benefit from SeedBlink's minimum investment requirement of €2,500. Therefore, it makes it an attractive option for those aware of current angel investment trends.

One of the key advantages of using SeedBlink is:

Ability to maintain a clean cap table through the use of a Single Partner Vehicle (SPV).

Post-raise management is much simpler.

Pan-European reach.

Designed to attract investors from all over Europe

Offers comprehensive compliance support.

This is particularly important for startups looking to navigate the complex legal and regulatory requirements associated with raising capital

3. Republic

Republic is a versatile platform that combines equity crowdfunding with traditional angel investing, allowing startups to raise funds from a broad investor base, including the general public. This flexibility makes it an excellent choice for B2C startups with a strong community presence, especially in light of emerging angel investment trends. Further Republic’s transparent process and regulated campaigns ensure compliance and investor trust.

Why Choose Republic:

Access to a broad investor base

Suitable for community-driven startups

Regulated crowdfunding campaigns

4. StartEngine

StartEngine offers startups the ability to raise funds ranging from $100,000 to over $50 million through a wide range of tools and compliance infrastructure. With more than 1.5 million investor accounts, including many angel investors, StartEngine is especially effective for companies with a strong brand presence and customer momentum. However, this aligns well with current angel investment trends, as more investors are looking for opportunities in established brands with active customer bases. Additionally, the platform's secondary trading feature provides liquidity options for early investors.

Why Choose StartEngine:

Large investor network

Secondary trading opportunities

Scalable fundraising options

5. OurCrowd

Based in Jerusalem, OurCrowd bridges traditional venture capital with equity crowdfunding, providing startups with access to over 230,000 accredited investors globally. The approach is ideal for startups seeking institutional credibility alongside angel investment. As one of the leading platforms in the industry, OurCrowd is well-positioned to navigate emerging angel investment trends.

Hybrid VC and crowdfunding model

Global reach

Active participation in funding rounds

6. WeFunder

WeFunder is known for its fast and flexible fundraising options, allowing startups to raise up to $5 million from a wide range of investors, including angel investors. The platform is especially friendly towards mission-driven and consumer-focused businesses, providing a simple SPV structure that keeps the cap table straightforward even with hundreds of investors. This makes it a great choice for those wanting to stay ahead of new angel investment trends.

Why Choose WeFunder:

Quick fundraising process

Perfect for mission-driven startups

Keeps cap table integrity

Conclusion: How Startups Can Position Themselves for Angel Investment in 2025

Navigating the changing world of Angel Investment Trends means startups must stay flexible and knowledgeable. The Future of Angel Investors is leaning toward impact-driven, tech-savvy, and networked approaches that require founders to be just as adaptable and strategic. As angel investors increasingly prioritize these trends, startups must align their strategies accordingly.

Here’s your startup’s plan to attract Angel Funding in 2025:

Clarify Your Mission: Investors are drawn to startups with a clear social or environmental impact. Make your why shine, not just the what.

Harness Data: Embrace AI tools and transparent reporting to showcase traction and potential with hard numbers.

Build Connections: Don’t just seek individual investors; tap into diverse angel networks and syndicates for broader support.

Explore New Frontiers: Look beyond traditional sectors. Healthtech, fintech, agtech, these areas are buzzing with opportunity.

Engage Micro Angels Early: Smaller checks often come with hands-on mentorship. Their involvement can be a secret weapon.

Think of these trends as more than buzzwords, they’re signals of how early-stage investment is evolving. Position yourself not just to survive but to thrive by aligning your startup with these shifts. You want angel investors not only to fund you but also to champion your vision.

Ready to get started? Let’s make 2025 the year your startup catches the right eyes and the right funds with spectup

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.