The Founder-VC Relationship is a critical factor when starting a new venture. Founders often seek guidance from experienced investors who play the dual role of financial backer and trusted mentor. This relationship provides not only essential capital but also invaluable strategic insights that help startups navigate uncertainty and accelerate growth.

Beyond financial support, a strong founder-VC relationship fosters collaboration, open communication, and shared commitment to overcoming challenges. When this partnership clicks, funding processes become more efficient, strategic advice becomes a powerful asset, and both parties work together toward the startup's long-term success. However, Investor relationships can be tricky. Founders juggle with transparency without oversharing, keep communication consistent without spamming, and align visions. Many times, the Founder-VC relationship becomes hostile to each other. However, VCs shouldn't be seen as adversaries.

Here’s what you can expect from this article:

Why solid relationships with VCs fuel long-term success

Aligning visions around exits and future rounds

Showing appreciation to strengthen your partnership.

Why Founder-VC Relationships Matter?

Building a strong Founder-VC Relationship goes way beyond just signing a check. It is like a great partnership that requires more than numbers on a spreadsheet. When you keep your investors in the loop with clear progress updates, it builds trust and shows you’re steering the ship with confidence.

Here’s what VCs really want from founders:

Transparency and honesty: Don’t sugarcoat the challenges. Investors respect founders who share both wins and setbacks openly.

Progress updates: Regular check-ins that highlight milestones reached and lessons learned keep everyone aligned.

Long-term vision: Your plans should resonate with their investment thesis, showing that you’re thinking beyond the next quarter.

The value of these relationships compounds over time. Strong connections lead to ongoing support when things get tough. Your reputation benefits because investors talk, a good word can open doors to new partnerships and can sharpen your decision-making.

Think of your investor relationships as a partnership where trust is currency. The better you communicate and engage, the more likely you are to unlock resources beyond just capital, like advice, networks, and credibility. This foundation sets the stage for scaling your startup successfully.

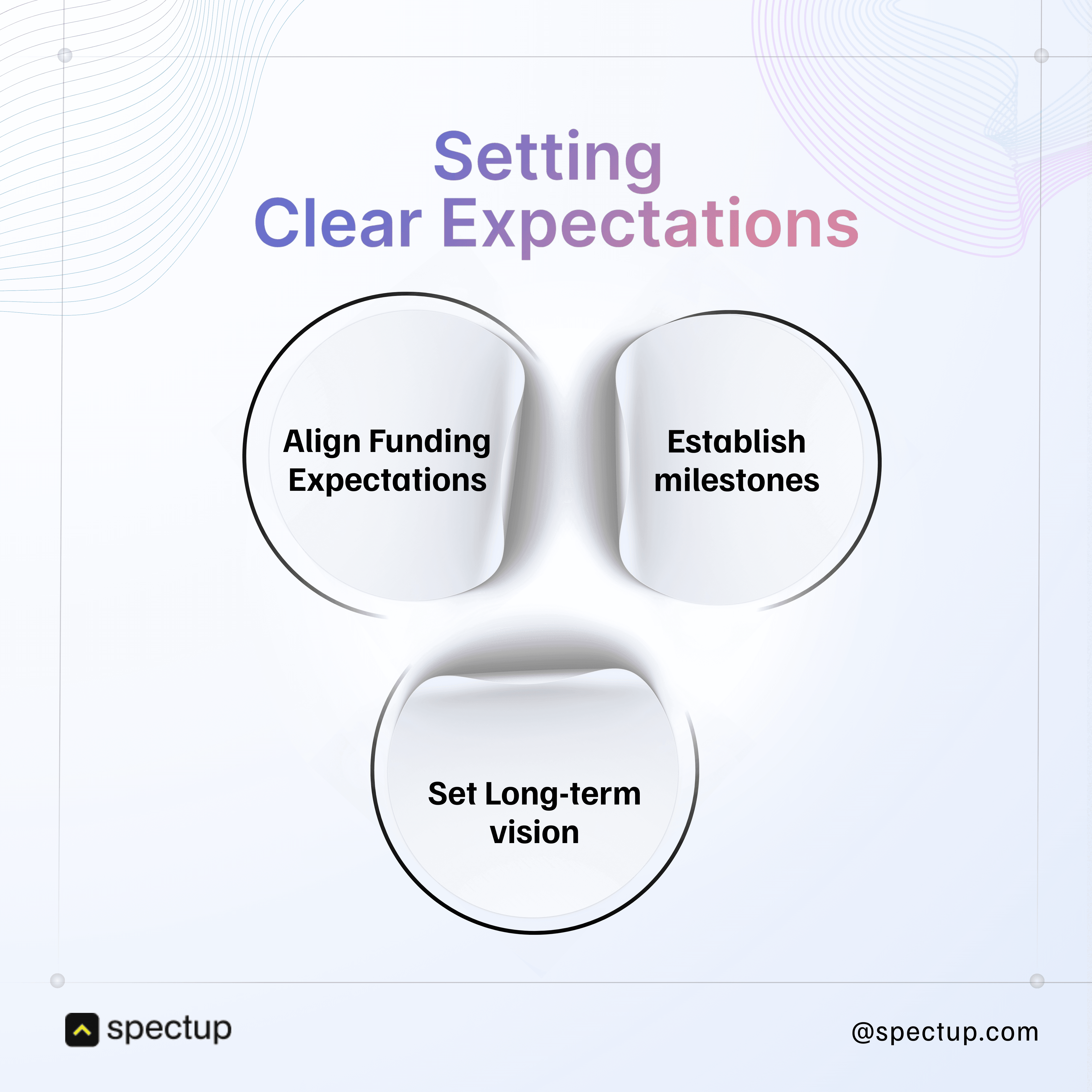

Step 1: Set Clear Expectations from the Start

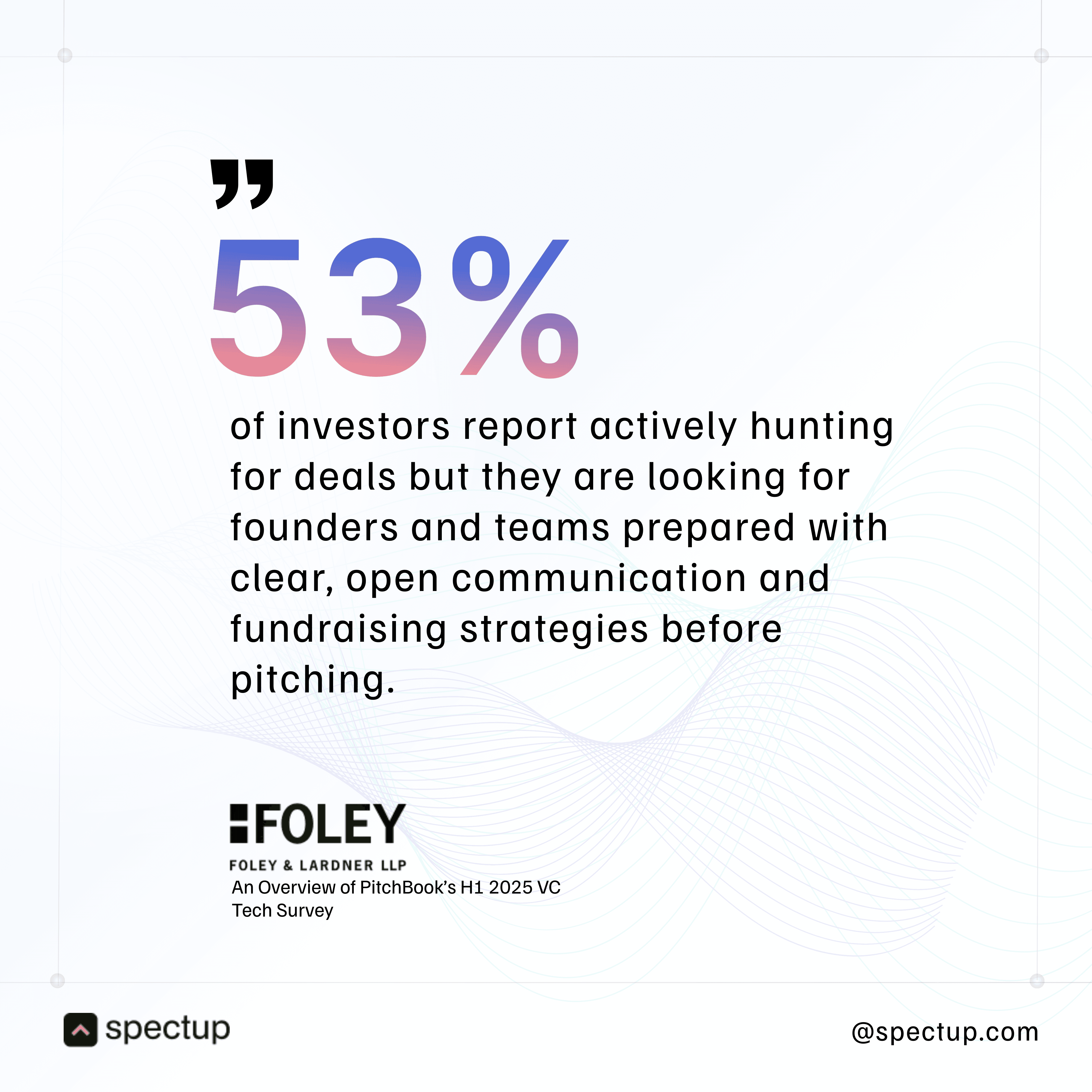

The foundation of every great partnership requires clarity in expectations and aligning the outcomes. When you kick off your collaboration, getting on the same page about goals and communication sets a solid foundation for trust and smooth sailing ahead. VCs want to back startups that know where they’re headed and can clearly articulate the path.

Discussing Goals and Milestones

Before diving into funding, work together to:

Establish milestones that mark your startup’s critical progress points. Keep a check on product launches, revenue targets, user growth, or key partnerships. These are the checkpoints where both sides see tangible momentum.

Ensure your long-term vision aligns with their investment thesis. If your VC believes in rapid scale but you’re aiming for steady organic growth, friction will creep in fast.

Set realistic funding expectations. Don’t promise unicorn-level growth overnight; be honest about what each funding round can achieve and how it fits into your bigger picture.

Agreeing on Communication Style and Frequency

Moreover, the pivotal point of every milestone is communication. Trust builds when everyone knows how and when to connect. To keep things aligned for both parties, founders should:

Decide on regular check-ins, monthly calls, quarterly reports, or informal updates, that keep investors engaged without overwhelming them.

Pick communication methods that suit both parties, email summaries, dashboards with metrics, or video calls can all work depending on preferences.

Commit to transparency at all times. Sharing information openly, even when things aren’t perfect, strengthens investor confidence in your leadership.

Setting these expectations upfront helps avoid surprises and creates a partnership where both founders and VCs feel informed, respected, and ready to tackle challenges together. This clarity is essential for a healthy Founder-VC relationship.

According to various studies, startups that provide regular, transparent updates to investors are 3 times more likely to secure follow-on funding from existing backers.

Despite this, only 10% of founders feel comfortable sharing their stress and challenges with investors, often fearing that bad news will change perceptions. This reluctance can strain the Founder-VC relationship, as most founders prefer to share struggles with family or co-founders, leaving investors somewhat in the dark.

Step 2: Build Trust Through Transparency

Building trust with VCs isn’t just about sharing the highlights reel of your startup journey. It means being real, sharing both the wins and the bumps along the way. When you keep your investors updated on good news, they celebrate with you. But when challenges arise, proactive communication shows you’re not hiding anything and are ready to tackle problems head-on.

Here’s what that looks like in practice:

Share Both Wins and Challenges: Don’t wait for investors to find out about obstacles from other sources. Instead, update them as soon as issues come up. Explain what happened, how it impacts your startup, and what steps you’re taking to fix it. Later, show how you learned and adapted by reporting progress on these challenges.

Regularly Provide Updates: Consistency builds confidence. Send quarterly updates that are clear and metrics-driven. Numbers speak louder than vague statements. Highlight customer growth, revenue trends, or product milestones. If something big is on the horizon, a major partnership or funding round, give your investors a heads-up so they feel included rather than surprised.

Embracing the importance of transparency in corporate communications, such an approach not only turns investor relationships from transactional to trusting partnerships but also establishes a solid foundation of reliability and commitment, two qualities that pay off long term.

Step 3: Engage in Value-Add Communication

Every great partnership requires some value-addition, where both parties feel trusted and not just check writers. Your investor relationships thrive when you actively involve them in meaningful ways. That requires showing respect and value to the investors, who held your hand at the right time.

Involve Them in Key Decisions

Share updates on major strategic moves, like pivoting your business model or entering new markets.

When you’re hiring critical leadership roles, ask for their advice or feedback, their experience can be a game-changer.

Bring investors into early conversations about big changes. Their insights might reveal risks or opportunities you hadn’t seen.

Leverage Their Network

Investors often have extensive connections. Don’t hesitate to ask for introductions to potential clients, partners, or talent.

Use these connections strategically to build credibility and accelerate growth.

Cultivate these interactions so your investors become trusted advisors who are genuinely invested in your success.

Engaging in this kind of value-add communication deepens trust and shows that you see your investors as collaborators, not just funders. It also signals confidence in your leadership while tapping into resources that can open doors for your startup.

Consider this: How often do you engage with your investors beyond the standard updates? Could deeper involvement create unexpected opportunities and advantages for your startup?

Step 4: Align Your Vision with Your Investor’s Expectations

The success of any founder-VC relationship depends on how well their values align. While terms like short-term versus long-term thinking, direct communication versus board politics, and active support versus blame distribution may seem small, they can have a huge impact when given the right importance. Both sides need to understand not just the opportunities, but also the risks.

Building a solid founder-VC relationship means syncing up your startup’s big picture with what your investors expect. This alignment keeps everyone working towards the same goal and prevents any confusion or misunderstandings in the future.

Discussing Exit Strategies:

Every investor has their own take on how they want to see a return. Some dream of an IPO, others prefer acquisition routes, and some might be looking for alternative paths like secondary sales or strategic partnerships. You need to:

Understand their perspective on exits early. Ask them directly about their preferred outcomes.

Keep them informed about any acquisition offers or major opportunities that come your way. No surprises here.

Ensure your long-term goals mesh well, so you're not steering toward different destinations.

Managing Investor Expectations for Future Rounds:

Future funding rounds can shift ownership stakes and influence control dynamics.

Have a clear vision of your upcoming funding needs and timelines.

Be upfront about how additional rounds could lead to ownership dilution. Discuss how these changes impact both your role and theirs in the company.

Aligning expectations here builds trust and shows you’re thinking ahead, which investors appreciate. After all, strong Founder Communication with VCs is the cornerstone of sustainable partnerships.

To facilitate this process, consider leveraging an Investor Outreach Service. Such services can connect you with leading investors and VCs, helping secure the funding your startup needs while ensuring that both parties' expectations align seamlessly.

Step 5: Keep the Lines of Communication Open During Fundraising

The best investors treat founders like elite athletes, knowing when to push for maximum performance and when to provide support. This balance is crucial for sustainable growth. Fundraising is like a match that requires a push from investors and also a critical moment to strengthen your founder-VC relationship. Transparency here can make or break trust with your investors. When you're preparing for the next round, don't keep your plans a secret. Let your investors know:

When you’re planning to raise

How you intend to approach it

Why you might be considering other investors

Sharing your fundraising strategy openly shows respect and keeps everyone aligned. It helps them understand that you took them more than just a "partner" or a "board member". If you’re talking to new VCs, explain the rationale behind it. This avoids surprises and reinforces that you value their partnership.

Inviting your current investors into the process is smart. They bring valuable experience and networks. Here’s how to tap into their insights:

Ask for advice on which VCs fit your stage and sector

Leverage their connections for warm introductions to potential partners

Think of this as building a trusted advisory circle around your startup. Investors who feel involved tend to become champions. You want them rooting for you and ready with the right contacts when opportunity knocks.

To navigate this complex process effectively, consider seeking guidance from a leading startup advisor who can assist you through every stage, ideation, fundraising, and growth.

Additionally, understanding the different types of investment mindsets is crucial. Our comprehensive guide on startup investors delves into the risks and returns associated with various investments, along with tips for negotiating with investors.

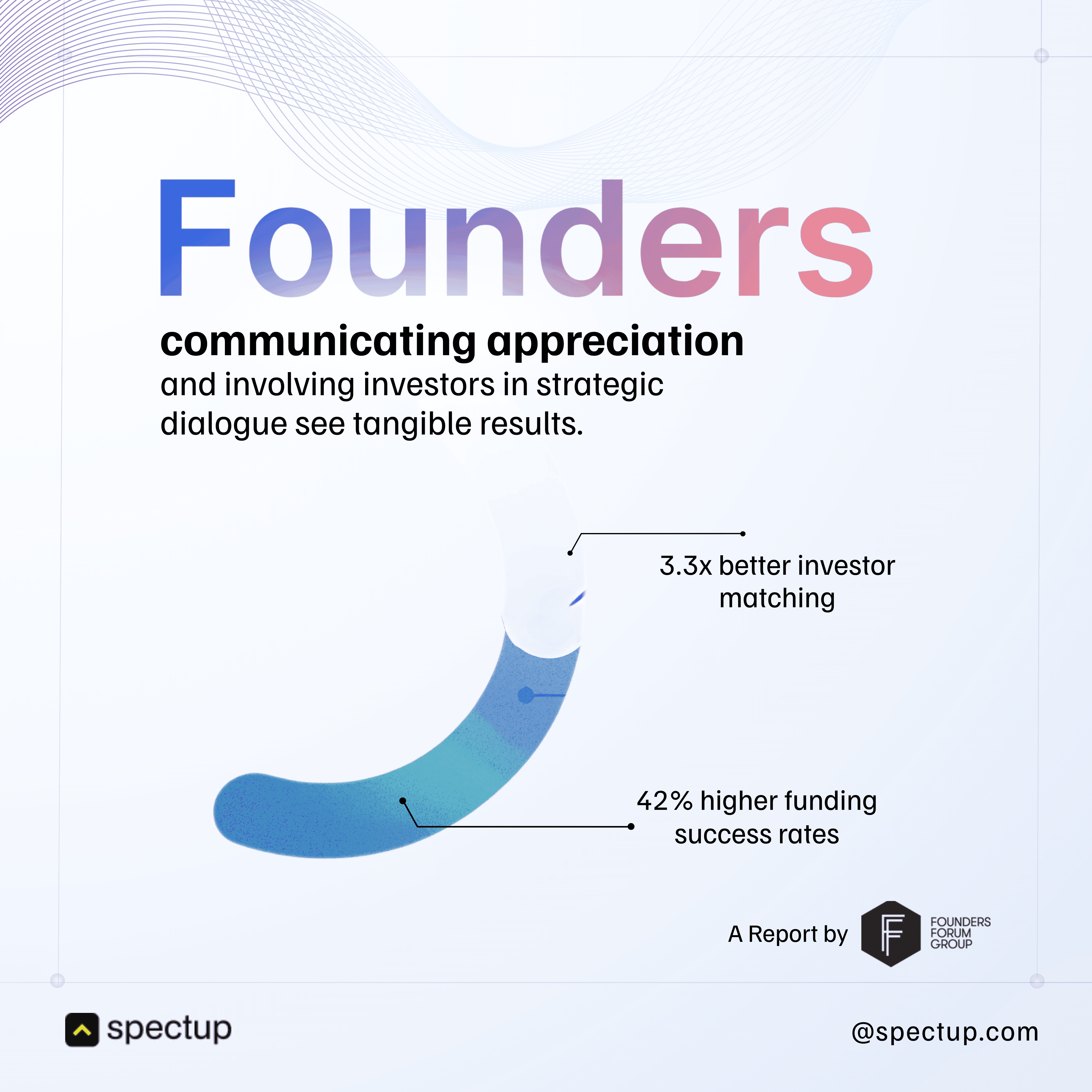

Step 6: Show Appreciation and Acknowledge Their Contribution

Building a strong Founder-VC Relationship is about recognizing the human side of Investor Relationships, the support, advice, and trust your investors bring to the table. When you actively show appreciation, you’re not just being polite; you’re reinforcing the foundation of Building Trust with VCs.

Here are some practical ways to keep that bond solid:

Thank Them Thoughtfully: Whether it’s an introduction to a key partner, a piece of advice that shifted your strategy, or their funding commitment, say it out loud (or in writing). A simple thank-you note can work wonders.

Send Personal Updates: Reaching milestones? Don’t just send a generic email. Personalize your updates so investors feel connected to your journey. It shows you value their role in your success.

Celebrate Together: Launching a product, hitting revenue targets, or closing a big deal? Invite your investors to celebrate these wins with you. Shared victories deepen relationships.

Making investors feel like part of your team fosters loyalty. This means:

Including Investors in Reviews: Quarterly or annual updates aren’t just about reporting numbers. Use them as opportunities for meaningful dialogue.

Involving Them in Decisions: When appropriate, ask for their input on strategic choices. It signals respect for their expertise and strengthens collaboration.

How have you shown appreciation to your investors recently?

Integrating gratitude into Founder Communication with VCs transforms transactions into true partnerships.

Conclusion: Nurturing Long-Term Founder-VC Relationships

Building a strong Founder-VC relationship goes far beyond securing funding, it’s about cultivating a long-term partnership rooted in mutual respect, trust, and shared vision. By prioritizing transparent and consistent communication, founders can build the trust needed to navigate both opportunities and challenges with confidence.

Like any meaningful relationship, investor partnerships thrive on honesty and proactive engagement. It’s not enough to share only the good news; openly communicating challenges demonstrates resilience, adaptability, and a commitment to sustainable growth. This level of openness strengthens investor confidence in both you as a founder and in your startup’s trajectory.

Effective founder communication with VCs should feel like an ongoing dialogue rather than a one-off transaction. The art of nurturing investor relationships lies in balancing professionalism with authenticity, ensuring every interaction contributes to a partnership designed to last.

If you’re looking to strengthen your fundraising approach and build meaningful, lasting Founder-VC relationships, contact spectup today to learn how we can support your journey.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.