Summary

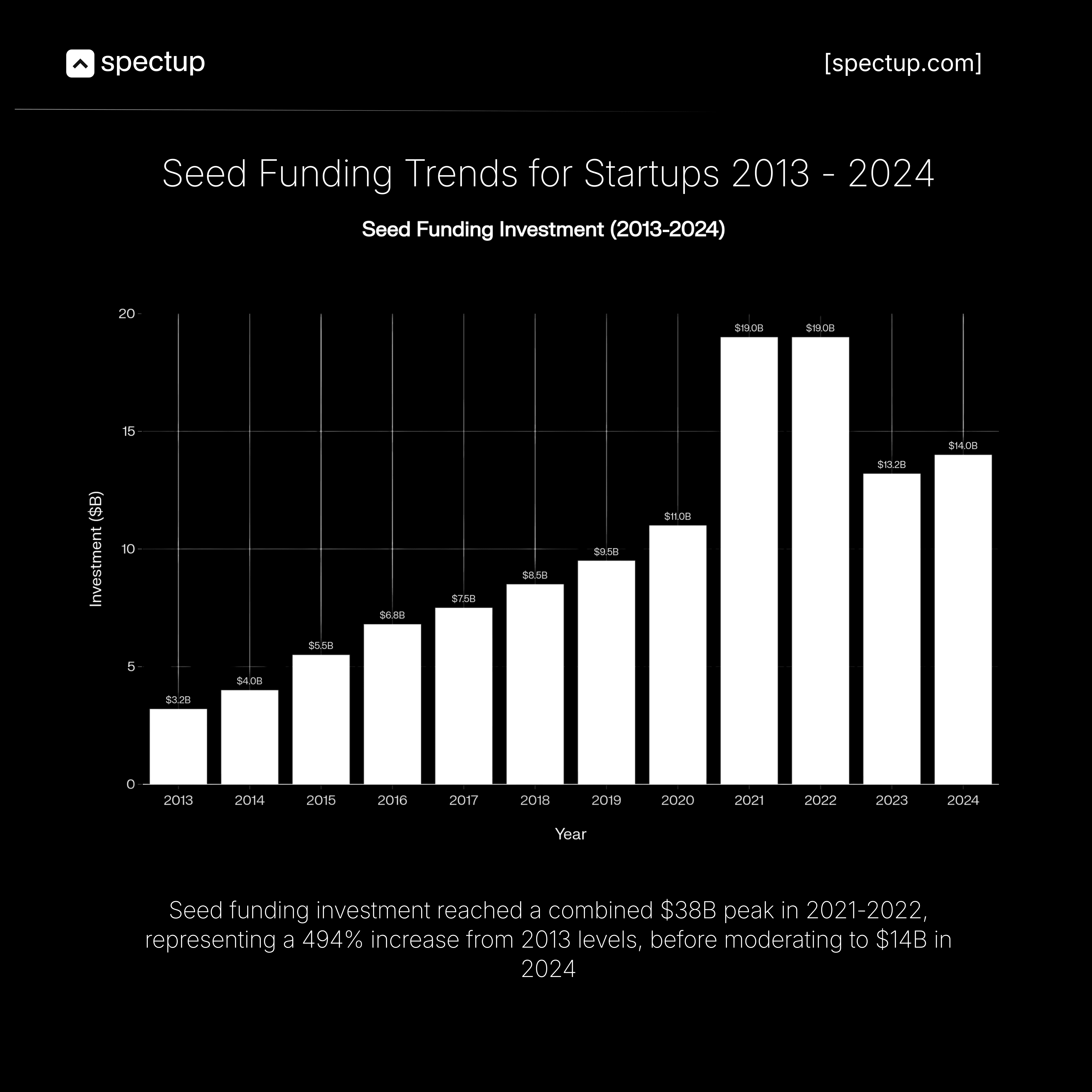

Most founders think seed funding is just pre-seed with a bigger check. It's not.

It's a completely different game with completely different rules. The investors change. The expectations shift. The questions get harder.

You will trip at one point, and you'll walk into rooms pitching vision when investors want metrics. You'll chase checks from funds that don't touch your stage. Ultimately, you'll burn months and credibility, wondering why term sheets never materialize. You need to connect with investors that are right fit for your startup stage.

Only 3% of pre-seed funded startups make it to seed.

TL;DR: Seed funding (€1-3M) isn't about validation anymore. Rules have transitioned fast enough to make it acceleration stage. You need product-market fit, consistent growth, repeatable customer acquisition, and financial discipline. Investors are buying your dashboard. This guide breaks down who invests at seed funding, what they expect, how to build your syndicate, and how to position for Series A during capital raising

Seed Funding: Time to Pour the Foundation

Pre-seed funding stage tested the soil. Seed is where you pour concrete and frame the walls. You've proven the ground holds. Now prove you can build something that stands.

Seed funding is a fundamentally different bet.

Pre-seed asks: Can this work?

Seed asks: How fast can this scale?

Seed rounds run $2M to $5M. That gap exists for a reason.

Seed money fuels a different machine entirely.

What Seed Funding Actually Does?

Five goals and All interconnected. Miss one, and the others wobble.

1. Scale What's Working

Build features customers are requesting and paying for.

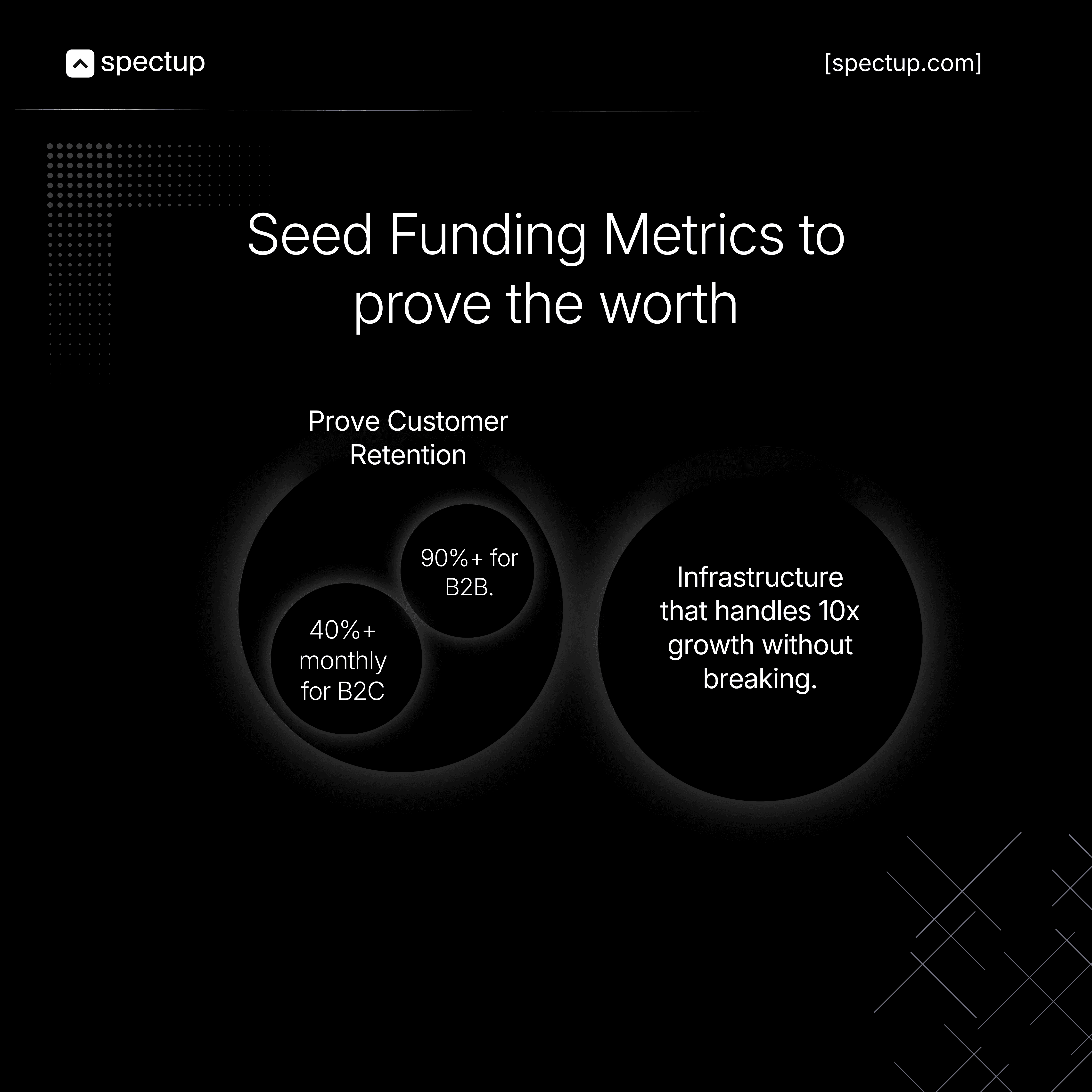

Infrastructure that handles 10x growth without breaking.

Engineering velocity that ships weekly, not monthly.

You're not asking "does it work?" anymore. You're asking "does it scale elegantly?"

The transformation is real and the FOMO of being at the edge or missing it starts hitting hard.

2. Prove the Go-to-Market

Retention metrics that prove customers stick:

40%+ monthly for B2C

90%+ for B2B.

Repeatable sales processes where you know exactly how to acquire and convert.

Revenue milestones showing real willingness to pay: $10K-$100K MRR depending on sector.

Case studies that de-risk Series A conversations.

3. Build the Team

Hire the executives you lack. This is the stage where you need people from diversified backgrounds to stand beside you and keep it running, until it makes sense and is not just a logic anymore.

This is where founder-does-everything breaks down.

Remember, you are not One-Man Army and you can never be. It will break your infrastructure to the core.

Hire people, either its sales, marketing, or product.

Establish culture and processes before scaling introduces chaos.

Create systems for hiring and onboarding as you grow from 3 to 25 people.

Build the machine that runs without you in every room.

Once you have done that, your actual working process starts. And if your being in the room is still valid, take a deep breathe and start over. See where it started going wrong and fix it.

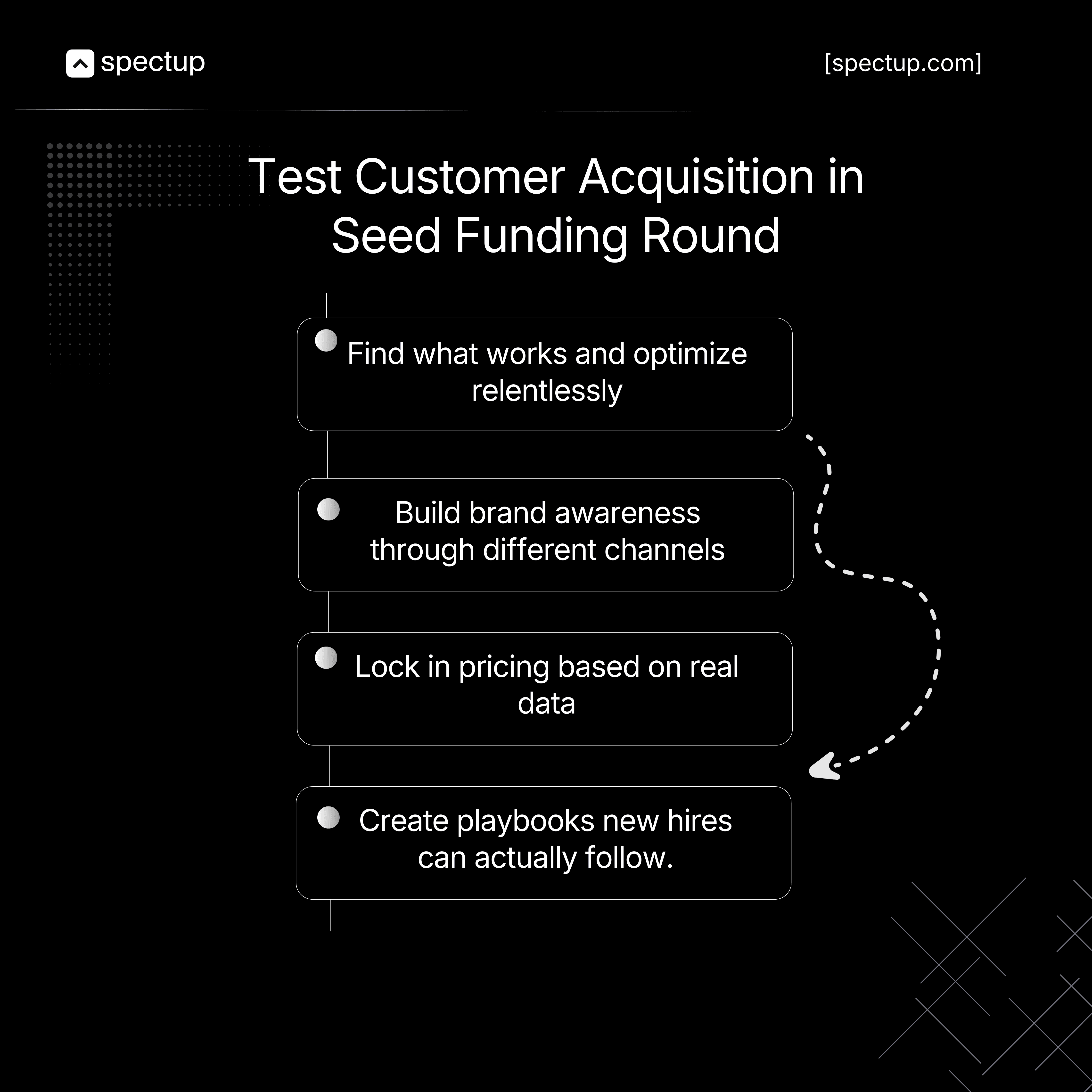

4. Execute Customer Acquisition

While building and making sure that the system is aligned and well-organized, start testing channels.

Find what works.

Optimize relentlessly.

Build brand awareness through content, partnerships, community.

Lock in pricing based on real data, not guesses.

Create playbooks new hires can actually follow.

This is the way that starts helping people to acquire customers. You, as a Founder, have to take the lead and ship it from your personal accounts as well.

If you are not visible, no matter how hard your team is trying, your brand will stay broken. This is the era, where people trust what they see and when it comes to Founders being on ground, the trust level starts multiplying.

5. Set Up Series A

While you are working on Seed Stage, your goals must go beyond Seed Stage, so youcan get the real-time stats locked in while making sure that your targets are achievable. Don't go too high but also don't go much low.

Month-over-month growth of 15-25%+ showing momentum, not flatlines.

Financial systems tracking unit economics, CAC, LTV, burn rate.

Investor relationships warming up now.

Do this, so Series A is a conversation, not a cold pitch. Position yourself as category leader or fast follower with something defensible.

The Real Transition happens with the 'Action'

Pre-seed funding stage buys you time to learn. Seed buys you time to execute.

By seed stage, investors aren't buying your vision anymore. They're buying your:

Metrics.

Traction.

Retention.

Revenue.

Growth rate.

The pitch deck matters less. The dashboard matters more.

If you are lookinf for fundraising advisory services, make sure to reach out to us.

Seed Investors: Different Money, Different Rules

The investor game changes at seed. Pre-seed investors bet on you over coffee and gut instinct. Seed investors manage institutional capital. They answer to LPs. They run real diligence. They need data, not just conviction.

Know who plays at this level:

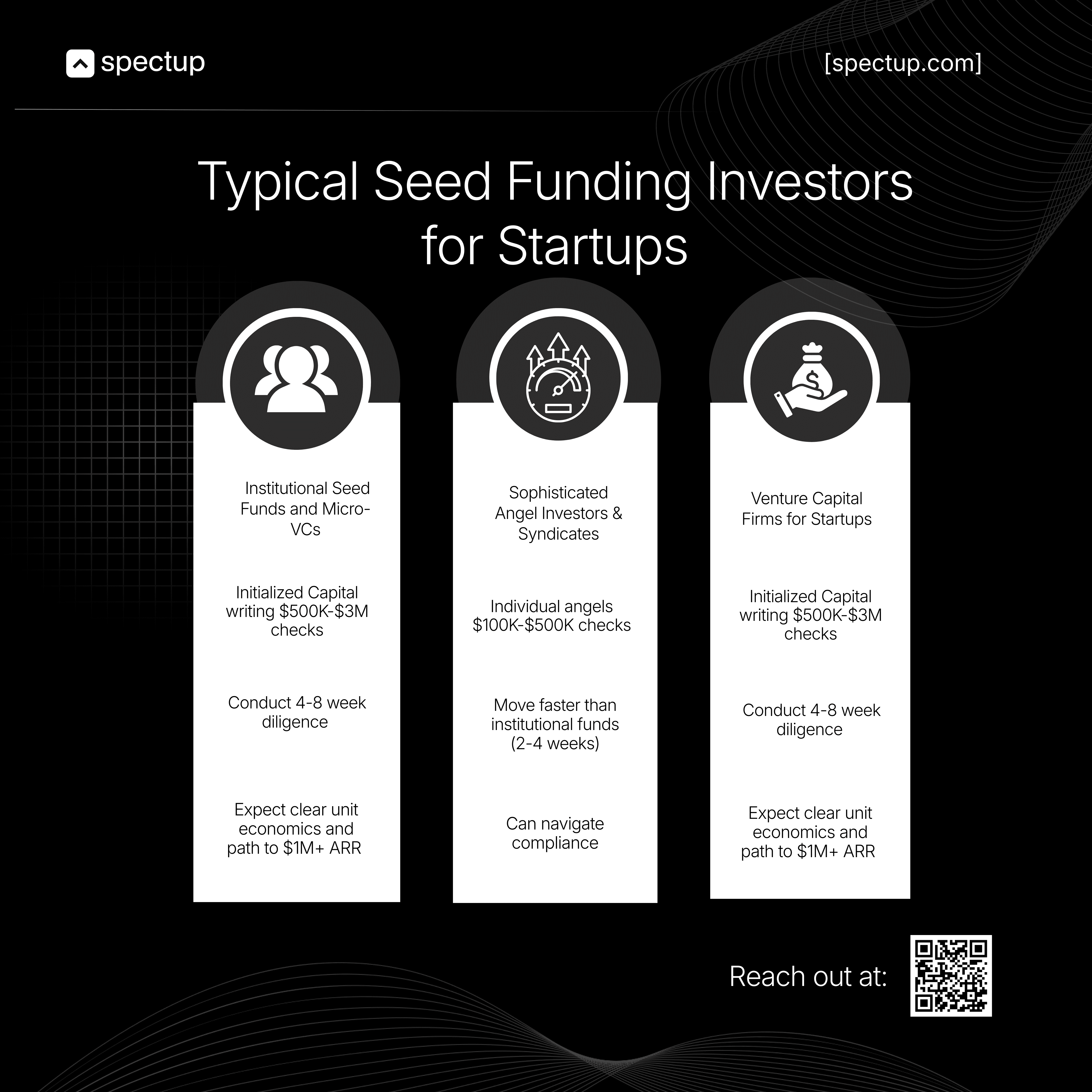

1. Institutional Seed Funds and Micro-VCs

Firms like First Round, Initialized, Benchmark's seed program.

They lead rounds, set valuations and Often take board seats.

Checks range $500K to $3M.

Expect 4-8 weeks of diligence.

Customer references.

Technical audits.

Market deep-dives.

It starts reflecting through their Actions that they're buying a portfolio position.

Seed Investors have clarity on their Goal:

They are more leaned and focused on your:

Clear unit economics

Repeatable GTM

A path to $1M+ ARR within 12-18 months.

Chek out the upcoming and ongoing trends predictions. Whatever is the hot topic, that's where seed capital flows next.

2. Sophisticated Angels and Syndicates

Often ex-founders who've built and exited in your space. They've seen the movie before, they know which scenes matter.

Individual angels writing $100K-$500K.

Syndicates on AngelList pool 20-100 investors for combined checks of $250K-$1M.

Faster than institutions — 2-4 weeks, but they still want traction and validation.

They rarely lead at seed. But they fill rounds, provide mentorship, and open doors to Series A. Sector fit matters here. A fintech angel wants proof you understand regulatory hell, not just product-market fit.

If you are looking to connect with investors, make sure to get in touch with us, as we have a pool of pre-vetted investors that are ready to lock deals.

3. Early-Stage VC Firms

Traditional VCs with $50M-$500M funds reserving 20-40% for seed bets.

Checks run $1M-$5M.

They can lead your seed and reserve capital for Series A.

The brand helps. Top talent notices. Media notices. Series A investors take the intro call.

But diligence is intense.

Market analysis.

Competitive mapping.

Financial modeling.

They expect board seats, regular updates, and input on big decisions.

What Early-Staged Venture Capitals are looking for?

Their hunt is more focused on making sure that if they are betting on evidence provided by you, they are getting as much return as possible.

Category-defining companies.

Not just good businesses, companies that could return their entire fund. 10x minimum. 100x preferred.

Choose carefully. This partner sits on your board for 7-10 years. That's more like a marriage, where you have to compromise, compensate and curate aspects accordingly.

Building Your Seed Funding Syndicate

Smart founders don't just go for capital raising. They construct a syndicate.

The ideal mix:

One institutional lead (50-60% of round), sets terms, provides governance, anchors credibility

2-3 operational angels (20-30%), hands-on expertise, customer intros, pattern recognition

One strategic investor (10-20%), Series A relationships, future leverage

This isn't just cap table math. It's building the team behind your team. These people contribute time, networks, and reputation.

Position your seed round as a logical step in your trajectory. Not another ask. An obvious next move.

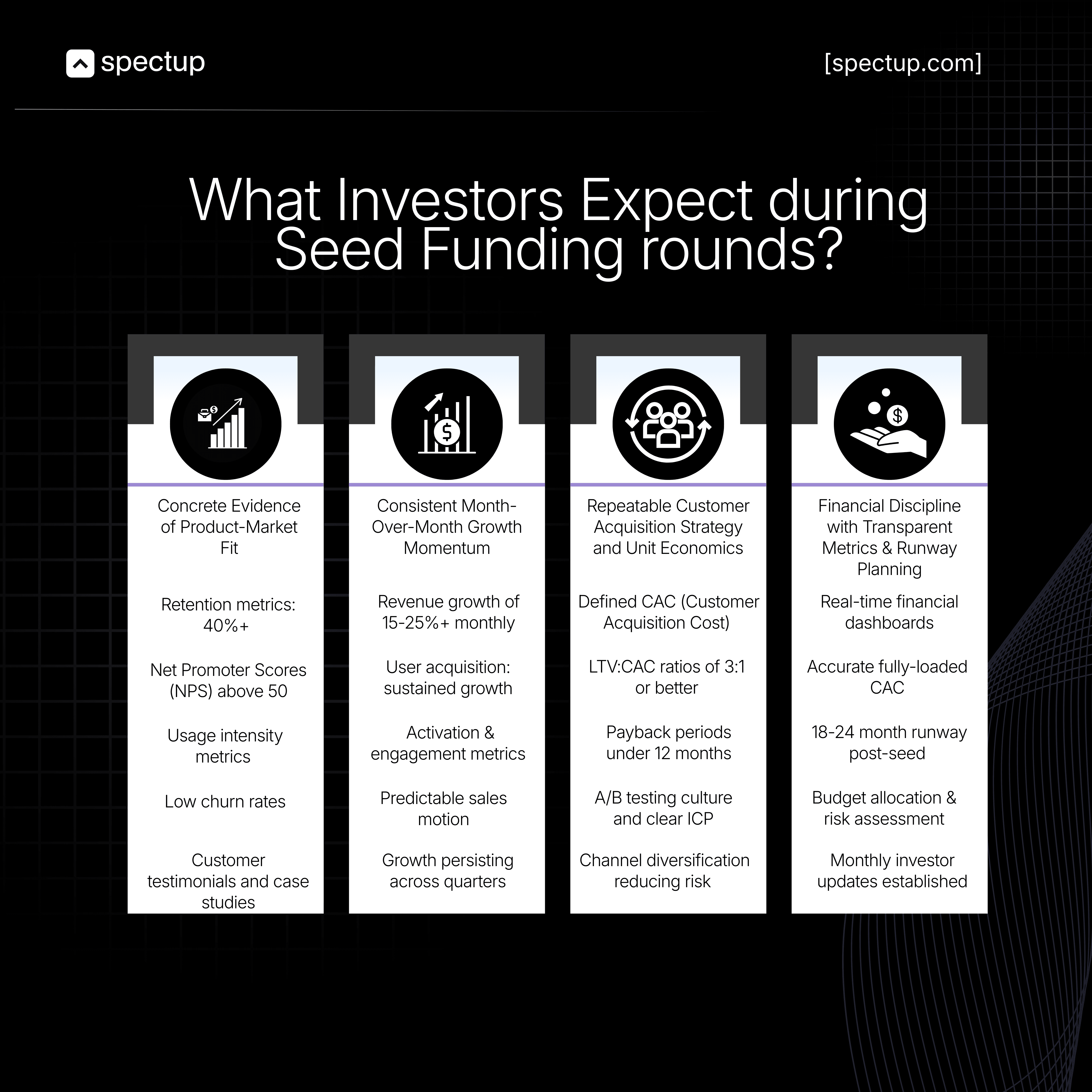

What Seed Investors Actually Expect:

Seed isn't pre-seed with a bigger check. The bar shifts completely. What impressed pre-seed investors, like:

Scrappy hustle, fast learning, raw potential, becomes table stakes at seed.

Seed investors aren't betting on what could work. They're evaluating what already is working. And whether it can scale.

Not sure if you're ready?

Here's the honest filter: if you can't prove the four dimensions below, spend another 6-12 months building traction. Going out too early burns credibility you can't rebuild.

Still confused? Get in touch with top fundraising consultancy firms.

1. Concrete Product-Market Fit

Not "people like the idea." Proof they need the product.

Retention that proves users come back:

40%+ monthly for consumer

90%+ for B2B SaaS.

NPS above 50

Customers actively recommending you, not just tolerating you.

Qualitative feedback where users say "can't live without it," not "nice to have."

Usage intensity matters. Daily or weekly engagement, not sporadic monthly logins. Low churn proving you've solved a problem worth paying for continuously.

The shift: you've stopped asking "what should we build?" and started answering "how do we build it faster?"

2. Consistent Growth Momentum

Investors want trajectories, not snapshots.

You need to show investors Trend Lines of Revenue Growth

Revenue growth of 15-25%+ monthly for 3-6 consecutive months.

User acquisition showing sustained curves, not one-time PR spikes.

Activation metrics improving as you optimize onboarding.

Pipeline growth for B2B showing predictable conversion.

Prove your solution works beyond early adopter niches. Understand seasonal patterns. Growth should persist across quarters.

If you are looking for B2B lead generation services, connect with us.

3. Repeatable Customer Acquisition

You need a machine to make sure that customers are coming back to you.

Defined CAC across multiple validated channels.

No single-source dependency.LTV:CAC ratio of 3:1 or better.

Payback periods under 12 months for B2B

Under 6 for consumer.

Make sure to test different channels and while you are on itL

Document playbooks showing how activities convert to revenue predictably.

A/B testing culture must be there.

Channel diversification so one algorithm change doesn't kill you overnight.

Clear ICP. You know exactly who your customer is and how to find them systematically.

4. Financial Discipline and Runway Clarity

Real-time dashboards tracking:

Burn rate

Runway

KPIs.

Further, while you are capital raising for Seed stage, make sure you have accurate CAC including salaries, tools, and overhead, not just ad spend.

Gross margins showing path to profitability at scale

50%+ for SaaS

Scenario planning for 18-24 months post-seed to reach Series A milestones.

Monthly investor updates already happening. This doesn't need to be formal. Further, honest risk assessment, not hockey-stick fantasies. Every dollar deployed mapped to expected return must be clearly stated.

The Mindset Shift during Seed Funding Round

Pre-seed: Believe in what we could become.

Seed: Look at what we've already done.

You're not selling vision anymore. You're presenting evidence and inviting investors to accelerate a trajectory that's already moving. The pitch changes from "promising startup with potential" to "proven business with traction."

Make that shift happen or wait as long as you can.

Seed Funding Round is all about Execution

Seed funding isn't a milestone to celebrate. It's a commitment to execute. You've tested the soil. You've proven the ground holds. Now, it's entirely on you to make sure every strategy is there and you are working to expand the idea.

Only 3% of pre-seed startups make it here. If you're reading this, you're either in that group or fighting to join it. Either way, the playbook is the same: show product-market fit, prove growth momentum, build repeatable acquisition, and run your finances like someone's watching, because they are. Seed funding isn't the finish line. It's the foundation for everything that comes next. Pour it right, and Series A becomes a conversation. Pour it wrong, and the cracks show up fast.

Ready to Build on Solid Ground?

At spectup, we help founders navigate the jump from validation to scale. Everything you need to walk into seed conversations with proof is accessible through our fundraising consultancy service

Stop guessing. Start building.

[Book your seed funding strategy session with spectup] and turn traction into your next term sheet.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.