Summary

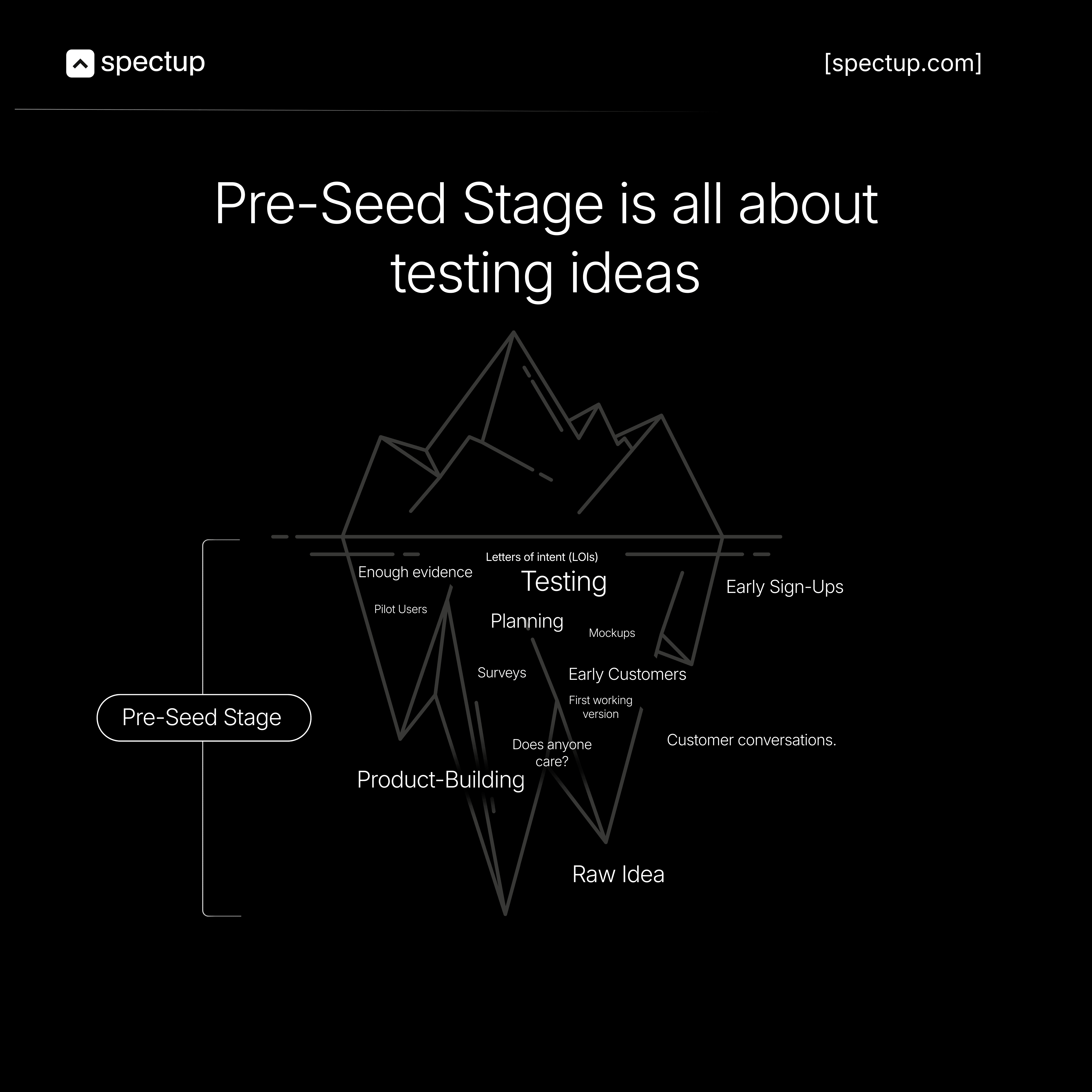

What pre-seed funding actually means and why it's the "soil testing" phase before you build anything

[01]

How much startups typically raise at pre-seed ($500K-$2M) and the funding instruments used

[02]

Who invests at pre-seed stage of startups?

[03]

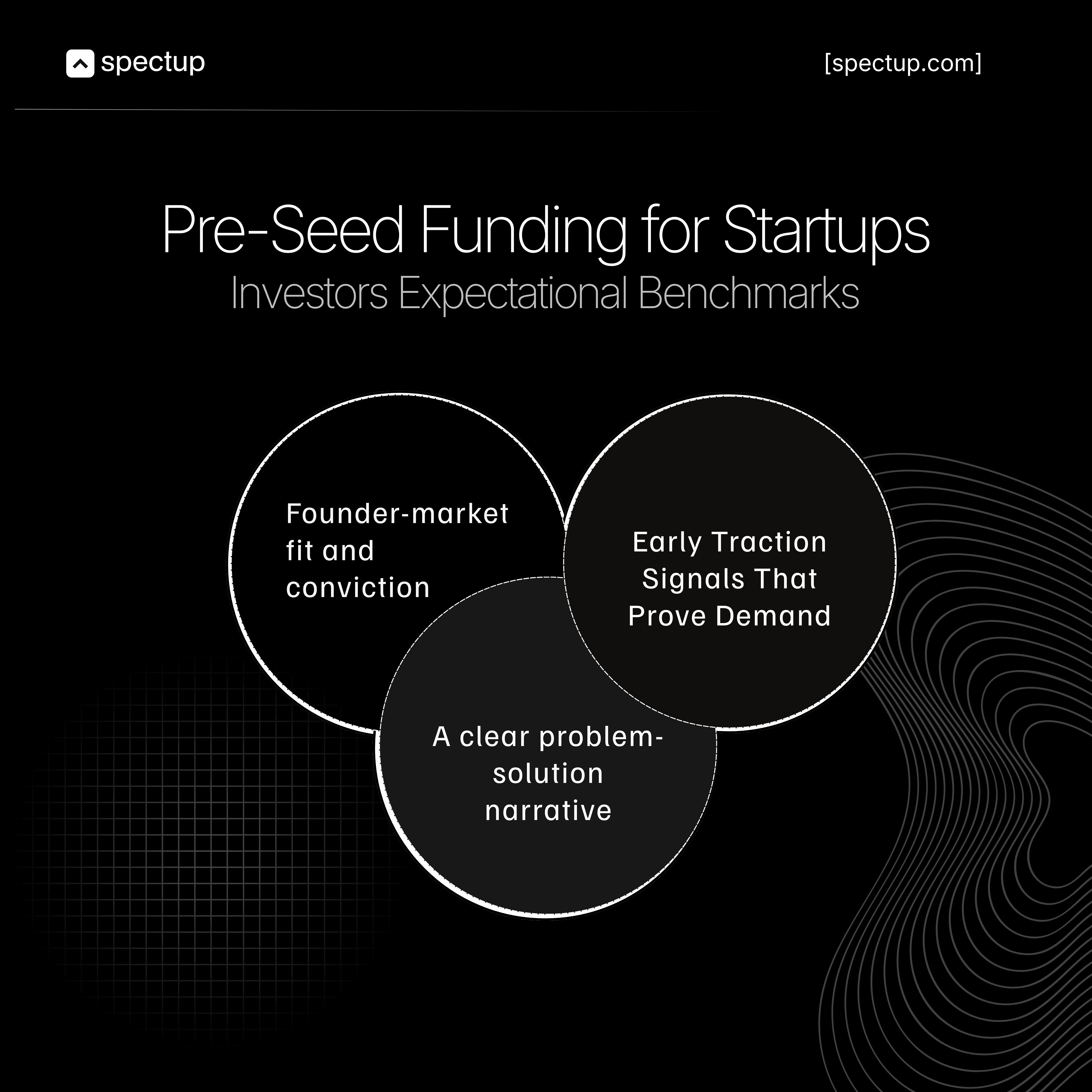

What pre-seed investors actually look for? (hint: it's not revenue or hockey-stick projections)

[04]

How to know if your startup is ready for pre-seed or still in the idea phase?

[05]

Most founders rush to raise money before they know what they're building, or if anyone wants it. They chase checks, pitch investors, and burn months wondering why they are hitting rock bottom. It's more likely chasing the wrong trend and ending up in the pitfall.

For such startups, Pre-seed stage exists. It's not a smaller seed round. It's a completely different stage with a completely different purpose. More likely, to make you understand that before capital raising, your focus should be building the base.

TL;DR: Pre-seed stage of startups is about proof. You're testing if the ground holds before pouring any foundation. Typical raises sit around $700K via SAFEs. Investors want founders who learn fast, not revenue machines but making sure that founders are learning on their way to scale up. Nail the fundamentals now, or watch your house collapse later.

Pre-Seed Funding Stage for startups is like testing the Soil

Let's think of this as owing the house. Pre-seed is where you test if the ground can hold anything at all. You're not building yet, instead it is more like you're figuring out if building here even makes sense.

Typical pre-seed raises sit around $700K

Usually through SAFEs.

Investors aren't expecting revenue machines.

They're betting on founders who learn fast, adapt faster, and don't mistake a pitch deck for a product.

Understanding what is pre-seed funding power for Early-Staged Startups Growth:

The goal here is simple and quite evident:

Gather enough evidence to prove this is worth building.

Early users.

Customer conversations.

Data that shows the problem is real and your solution clicks.

Don't scale yet.

Don't hire ahead of traction.

Just answer one question - Is this worth building?

If you are sure of that, go ahead with grit. Once you have proved it, you walk into seed conversations with proof. And if you are looking for the difference between pre-seed vs seed funding of startups, we have got you covered for this as well.

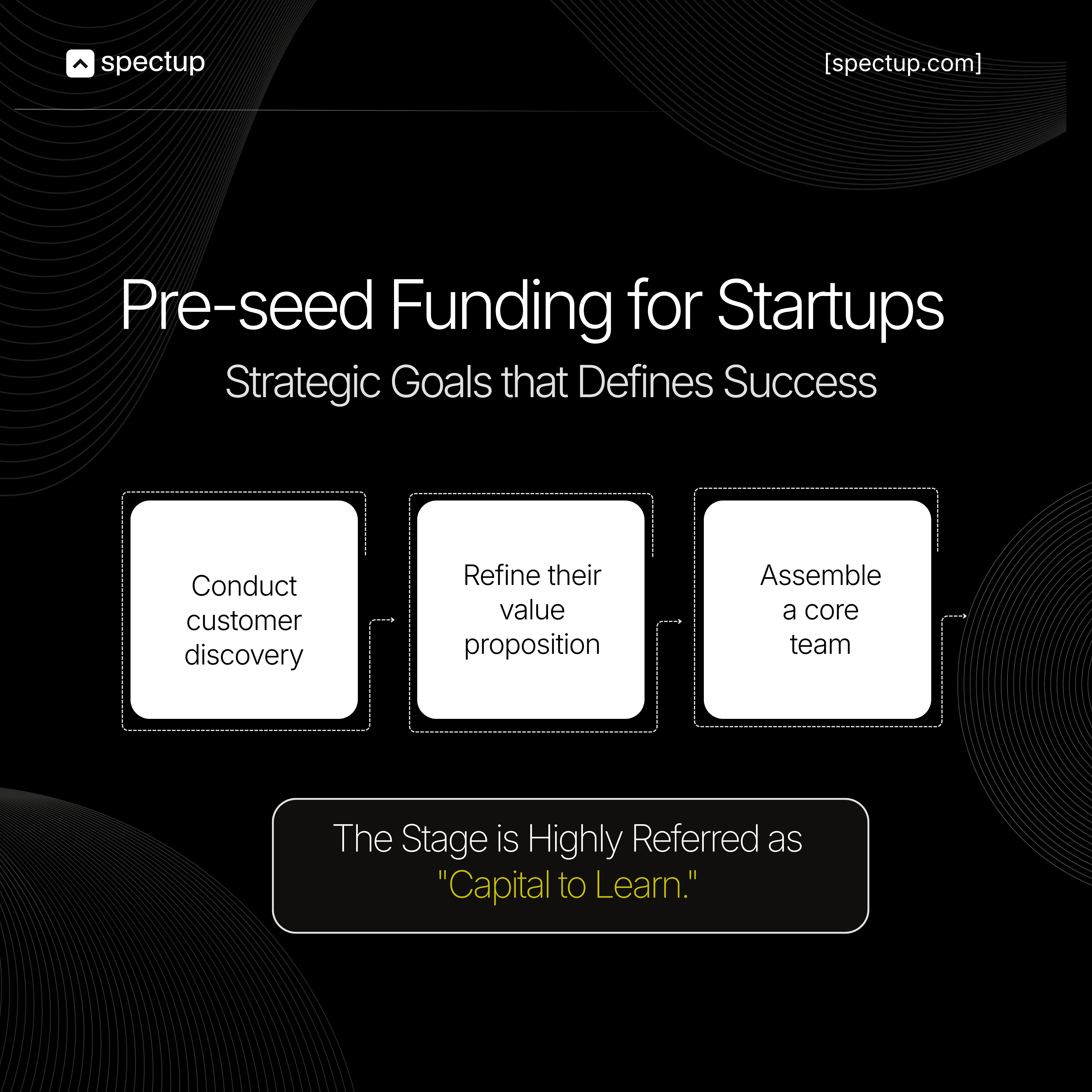

With nearly a decade of experience in startup fundraising, spectup recommends approaching pre-seed funding as "capital to learn."

This stage should finance essential experiments and validation activities before pursuing growth capital, thereby reframing investor discussions from a position of need to one of partnership.

It is noteworthy that only 3% of applicants secure pre-seed funding, typically raising approximately $700,000 through Simple Agreement for Future Equity (SAFE) notes.

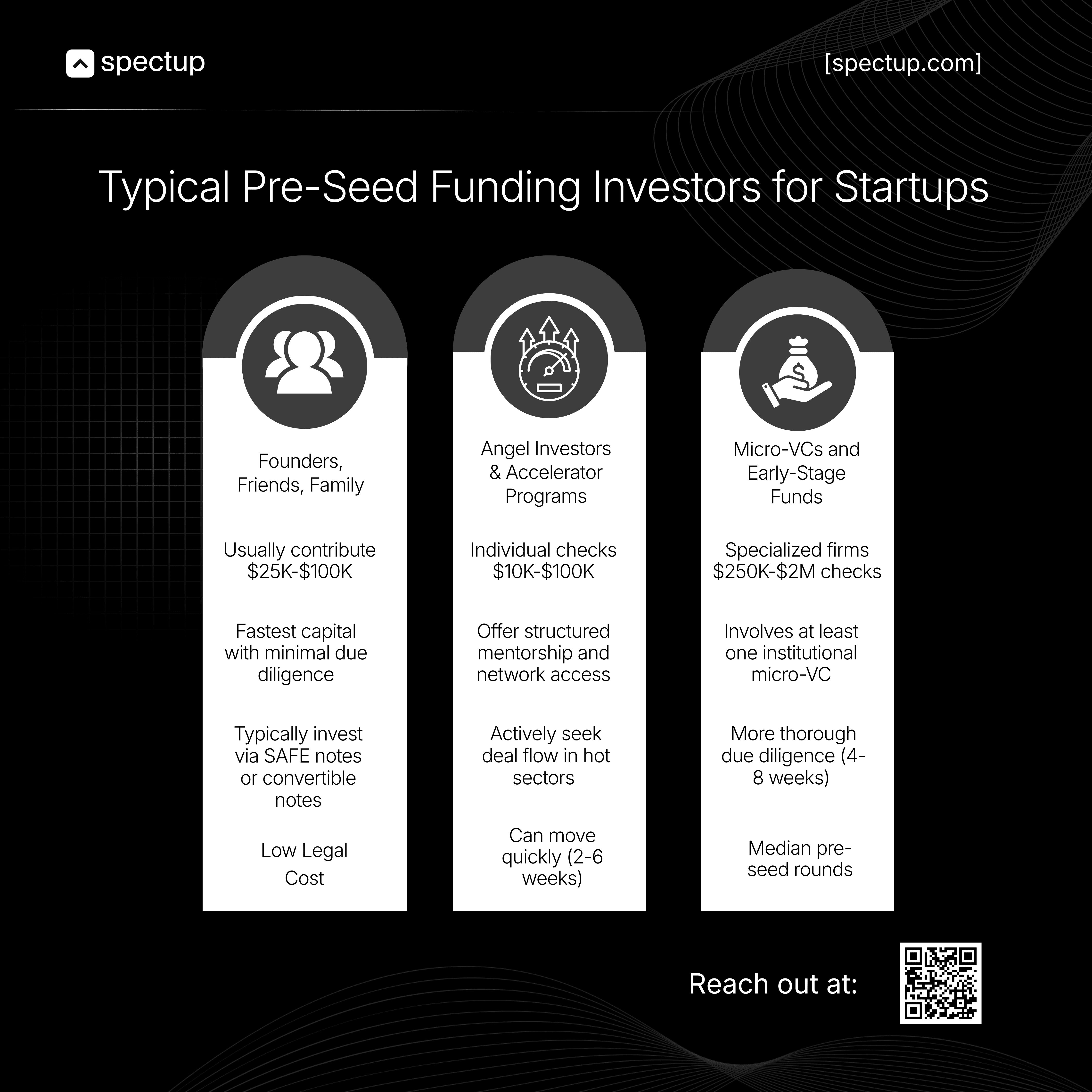

Pre-Seed Investors: Who Actually Writes These Checks?

Pre-seed stage and seed investors aren't the same people. Miss this, and you'll spend months pitching funds that don't touch your stage.

Pre-seed investors embrace chaos. They're not expecting clean metrics or hockey-stick charts. They're betting on you

The founding team's ability to figure it out when nothing is figured out yet.

That's a fundamentally different bet than seed stage or Series A.

Competition is fierce.

You need to be on top of personal branding.

The founders who win aren't blasting every investor on LinkedIn. They're targeting the right profiles before sending a single email.

Looking for pitch deck design service to stand out in the deal competition, make sure to connect with us.

Know who actually plays at pre-seed:

For this, the formula is simple.

3-F's ruling the ground.

3-F's are like the original venture capitalists before venture capital existed.

Founders

Friends

Family.

The first believers. They're not investing in your TAM, they're investing in you. Often the fastest money you'll raise, with minimal due diligence, often within days or weeks.

Usually contribute $25K-$100K

Typically invest via SAFE notes or convertible notes to keep legal costs low

Angel investors and accelerators.

Individuals and programs built to spot promise before proof exists. They've seen enough raw startups to bet on potential, not performance.

Writes idividual checks ranging from $10K-$100K

Often brings industry expertise alongside capital

Accelerators like Y Combinator or Techstars offer $100K-$500K plus structured mentorship and network access

Can move quickly (2-6 weeks) once they see founder-market fit and early validation

Micro-VCs and early-stage funds.

Smaller firms that specialize in the earliest, riskiest bets. They expect most investments to fail, but they're hunting for the ones that won't.

Match your stage to the right investor type.

Clear categories. Right length. Keeps moving.

Specialized firms writing $250K-$2M checks.

Conduct more thorough due diligence (4-8 weeks) but bring credibility that attracts follow-on seed investors

Focus on specific these:

Geographic (supporting regional ecosystems)

Sector-specific (fintech, healthtech)

Stage-obsessed funds

Match the Money to the Moment

Only 3% of pre-seed applications get funded.

You need precision.

Just take it as Dating.

Don't propose on the first coffee. And don't stay casual when someone's ready to commit.

Here isthe cheat code:

Still building your MVP with napkin sketches? Friends and family money.

Don't waste micro-VC intros when you've got nothing to show.

But once you've got traction. maybe early users, real data, something moving, don't stay stuck in your personal network. That's when institutional pre-seed investors make sense.

Wrong investor at the wrong time burns intros you can't get back. Match the ask to where you actually are, not where you hope to be.

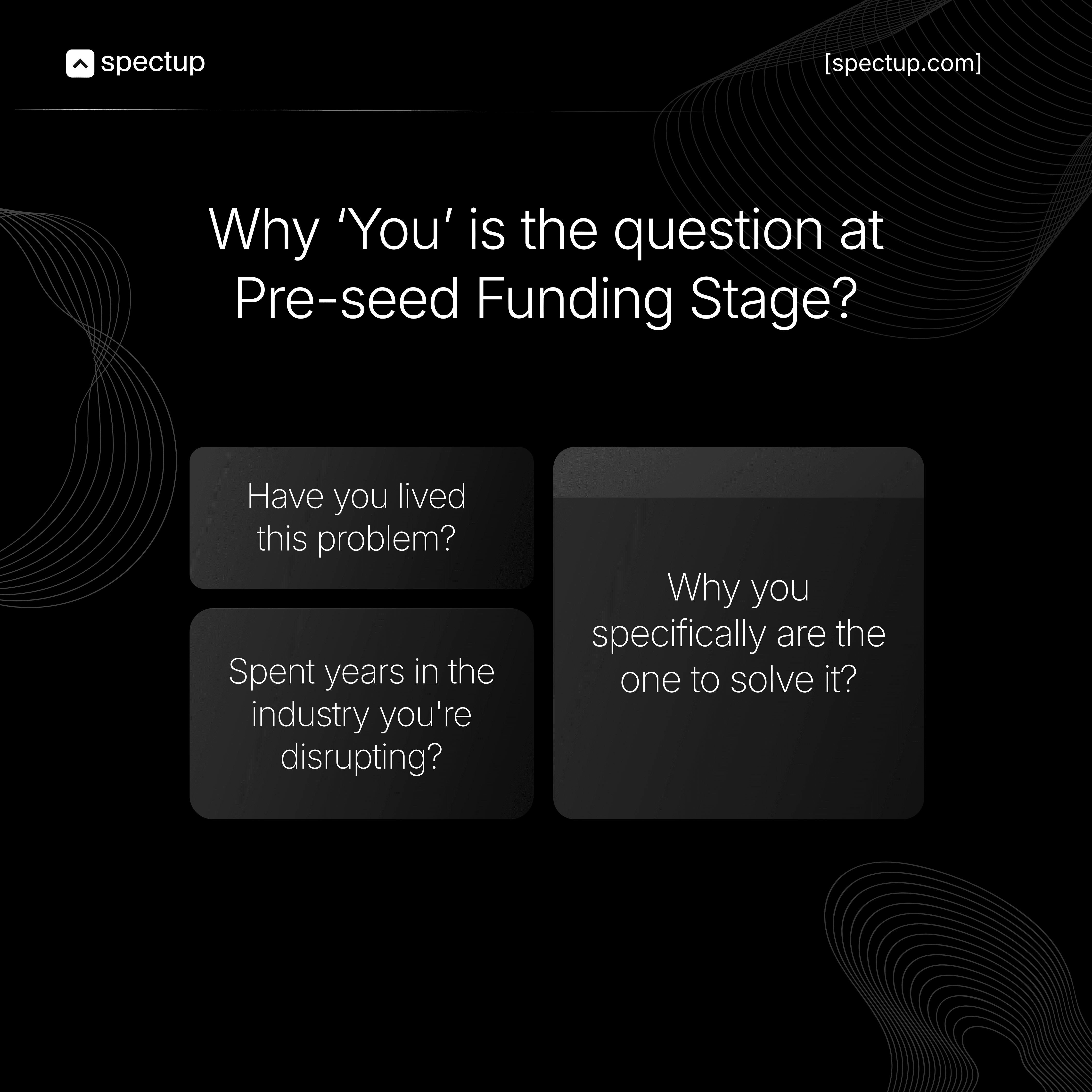

What Pre-Seed Investors Actually Want

Forget what works at seed.

Detailed financial models?

Hockey-stick projections?

At pre-seed funding stage, that stuff backfires. It signals you don't understand what stage you're at.

Pre-seed investors aren't buying your spreadsheet. They're buying you:

Your insight

Your resilience

Your ability to adapt when everything breaks. And it will break.

Here is the data that keeps them hooked:

Founder-Market Fit:

Just like before the launch of any product in market, it goes through different trials and errors stages, the product at pre-seed is highly likely You - As a Founder.

Why 'You' is the question at Pre-seed Funding Stage?

Have you lived this problem?

Spent years in the industry you're disrupting?

Can you explain why you specifically are the one to solve it?

Investors want founders who'll pivot the solution a hundred times but never abandon the mission.

97% of applications get rejected. They need to believe you'll outlast the nos.

Problem-Solution Clarity

Explain the problem in one sentence. If it takes a paragraph, you don't understand it well enough. It needs to be as simple as the clear water that anyone who look at it grasp the notion.

Is your solution a painkiller or a vitamin?

Painkillers get funded. Vitamins get polite passes.

We have seen while moving with founders that the perfect founders exists and they close deals because:

Razor-sharp problem clarity. Every single one had this trait that made them shine.

Early Traction Signals

No revenue? Fine. But show something.

Waitlist signups.

Pilot participants.

LOIs from potential customers.

Users returning to your prototype.

Inbound interest that proves people are actively hunting for what you're building.

It's not like deals will not be closing at $0 revenue. They does, but the validation signals must be undeniable.

Vision Without Fantasy while pitching for Pre-Seed Stage:

It more like you are being handed over the magic wand, but you need to write the perfect spell that would make it work.

Where's this going in 3-5 years?

What has to be true to get there?

Can you talk go-to-market even if the numbers are directional?

Investors want strategic thinking, not spreadsheet gymnastics projecting $100M ARR by year three. They've seen that movie. It always bombs.

Nail these four, and you're not just another application.

You will be among the Top 3% getting chance to show the grit in real-time.

Test the Soil Before You Build

As described earlier, pre-seed stage for startups is the foundation test that determines whether everything you build next stands or collapses. Think of it this way: every skyscraper starts with soil samples, not steel beams. Architects don't guess if the ground will hold, instead they prove it. So, if you have enough capacity prove the ROI, go all in for capital raising. You've earned it.

If not, stay in the soil-testing phase. It's the smartest investment you'll make.

Ready to Build on Solid Ground?

At spectup, we help founders know exactly where they stand and what to prove next. we are fundraising advisors helping startups with investor outreach and provision of pitch deck design service that helps them lock investor deals.

Connect with us and let's lock venture capital to grow!