Summary

TL;DR: Corporate Venture Capital (CVC) in 2026

Corporate Venture Capital Firms are the mix of Traditions Venture Capitals and Corporate Superpowers embedded in one. Large firms (Google, Intel, BMW) invest $20B+ annually into startups with the vision that goes beyond ROI, like expansion of pilots, distribution, and M&A pipelines. Due to high focus of CVC Firms, these are the 5 Key Trends observed:

Early-Stage Shift – CVCs now fund pre-seed to shape tech (Intel Capital example)

AI Diligence – ML cuts eval time 60%, scans 1000s of startups daily (Google Ventures)

ESG Priority – Battery recycling, carbon tracking for regulatory wins (BMW i Ventures)

Cross-Border Boom – 20-40% funds target India SaaS, Israel cyber, SEA fintech

R&D Integration – Co-development halves time-to-market (Intel chips in 18mo)

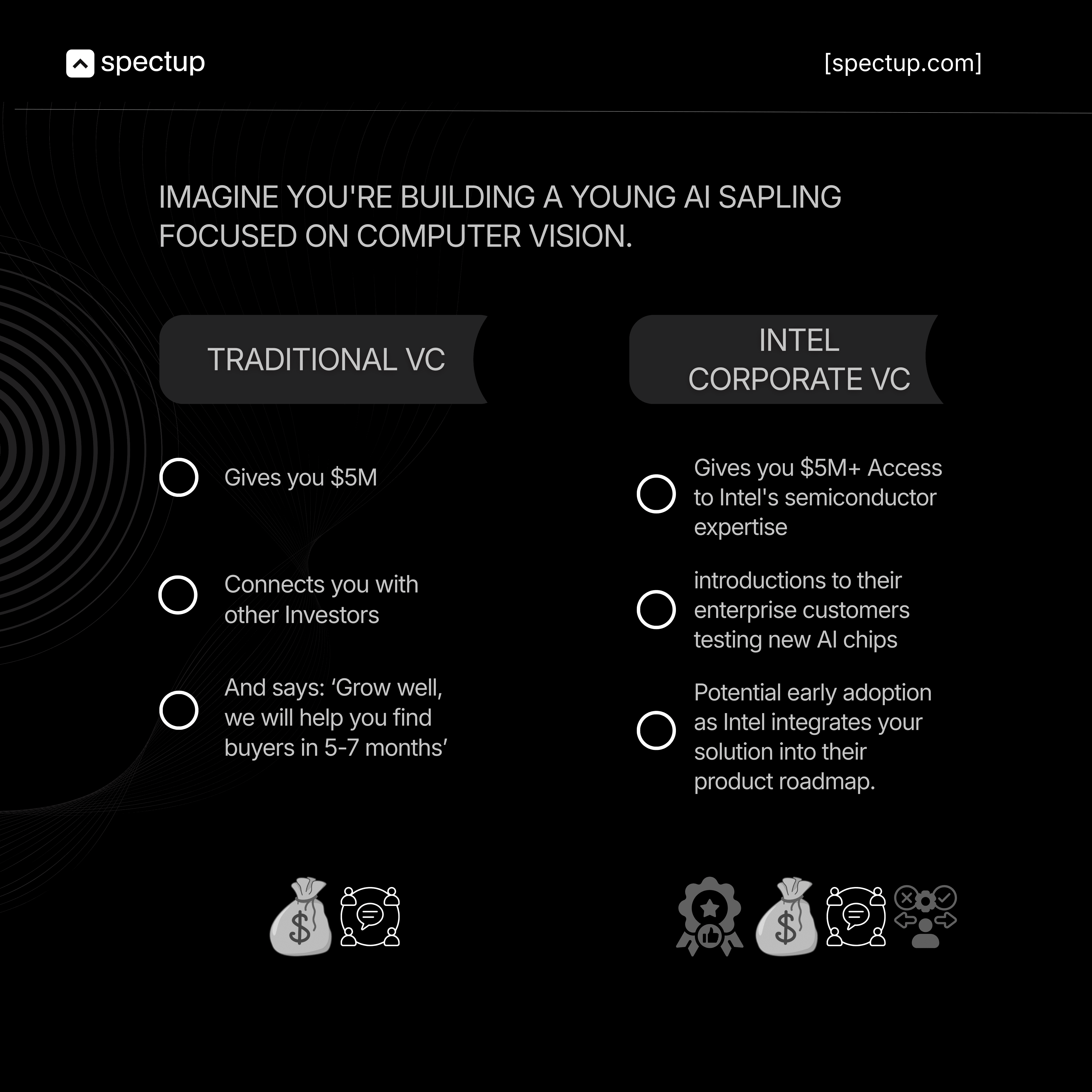

If we talk about CVC vs Traditional VC, its like patient capital + pilots/distribution vs 7-10yr fund pressure.

At spectup, this evolution has been observed firsthand through our work supporting startups in their fundraising efforts. As a result, a comprehensive understanding of corporate venture capital has become critical for founders seeking way to connect with investors. Here is an advice from us: Pitch CVC if you have efficient Product Market and strategic fit. Skip if you are pre-revenue.

Here is a flowchart to help you understand in more precise way.

What Is Corporate Venture Capital?

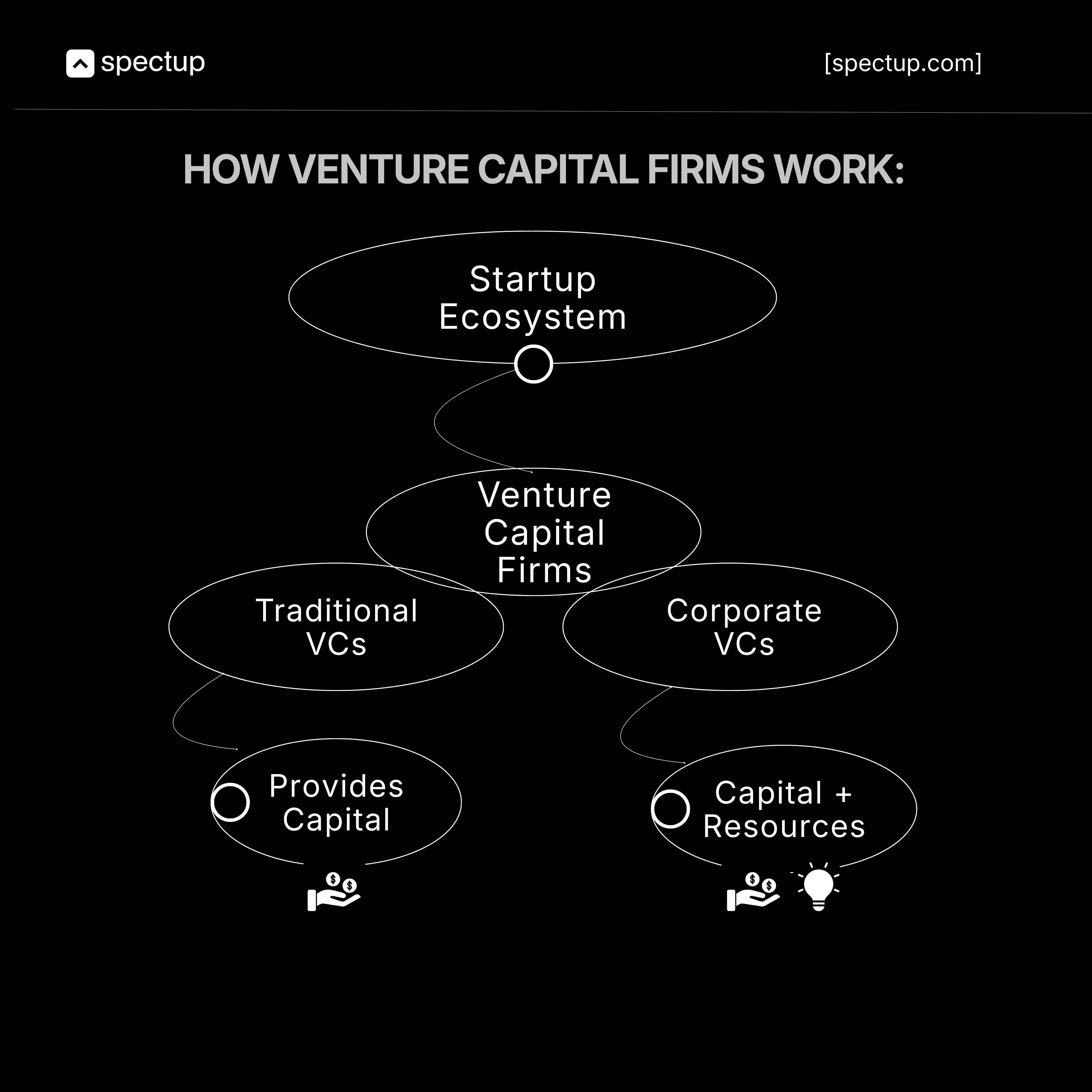

Corporate venture capital (CVC) represents big corporations investing directly in startups for strategic goals (tech acquisition, pilots, M&A pipelines) alongside financial returns. Here's what's happening in the startup ecosystem right now:

Corporate Venture Capitals are the 20%+ of global VC deals (up from 12% in 2023).

Corporate giants like Google Ventures, Intel Capital, Amazon, and BMW i Ventures deployed $22-25B in CVC in 2025, representing 22% of global VC, up from 15-20% in early 2025. 2026 forecasts predict $28B+ as M&A accelerates and AI/climate tech heats up.

Sources: SVB State of CVC 2025, CB Insights Q4 2025, Dakota Marketplace 2026 predictions.

How Corporate Venture Capital Firms Function?

Think about what happens when a traditional VC invests in your startup:

They give you capital and guidance. Their goal is straightforward:

Watch you grow as fast as possible

You get acquired or go public so they can collect their share from the ROI.

The relationship is transactional, focused, and time-bound.

Now picture what happens when a Corporate Venture Capital Firm invests:

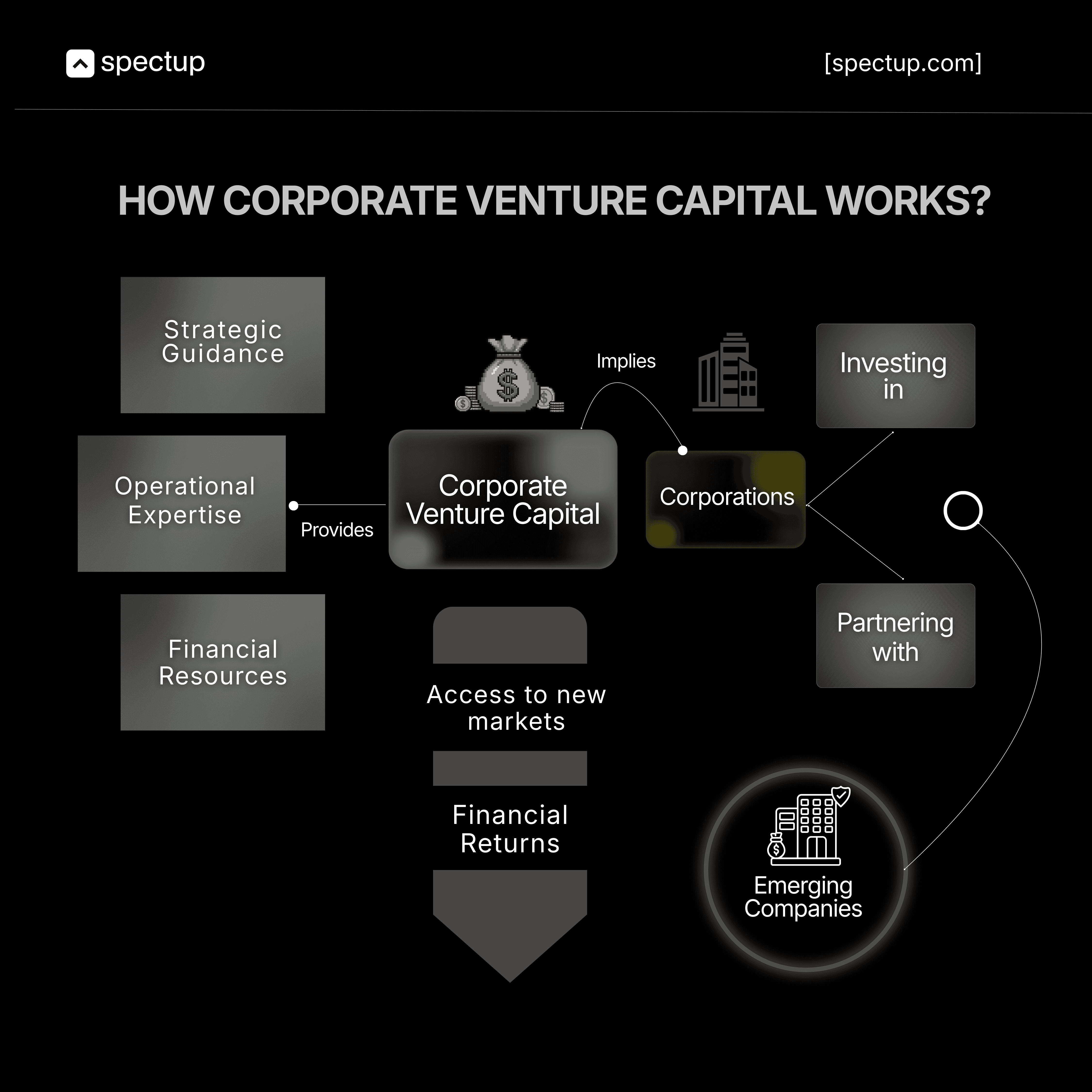

Corporate venture capital (CVC) firms function as strategic extensions of their parent companies, delivering:

Capital plus industry expertise

Distribution channels

Brand credibility

Pilot opportunities that traditional VCs can't match.

While traditional VCs focus purely on financial returns through rapid growth and 5-7 year exits, CVCs pursue dual goals, ROI + corporate innovation. Thus, offering patient capital, co-development pathways, and M&A pipelines that integrate startups into corporate ecosystems (e.g., BMW pilots → suppliers).

CVC now represents 22%+ of global VC with larger checks and longer horizons, but requires tight strategic alignment between startup agility and corporate roadmaps

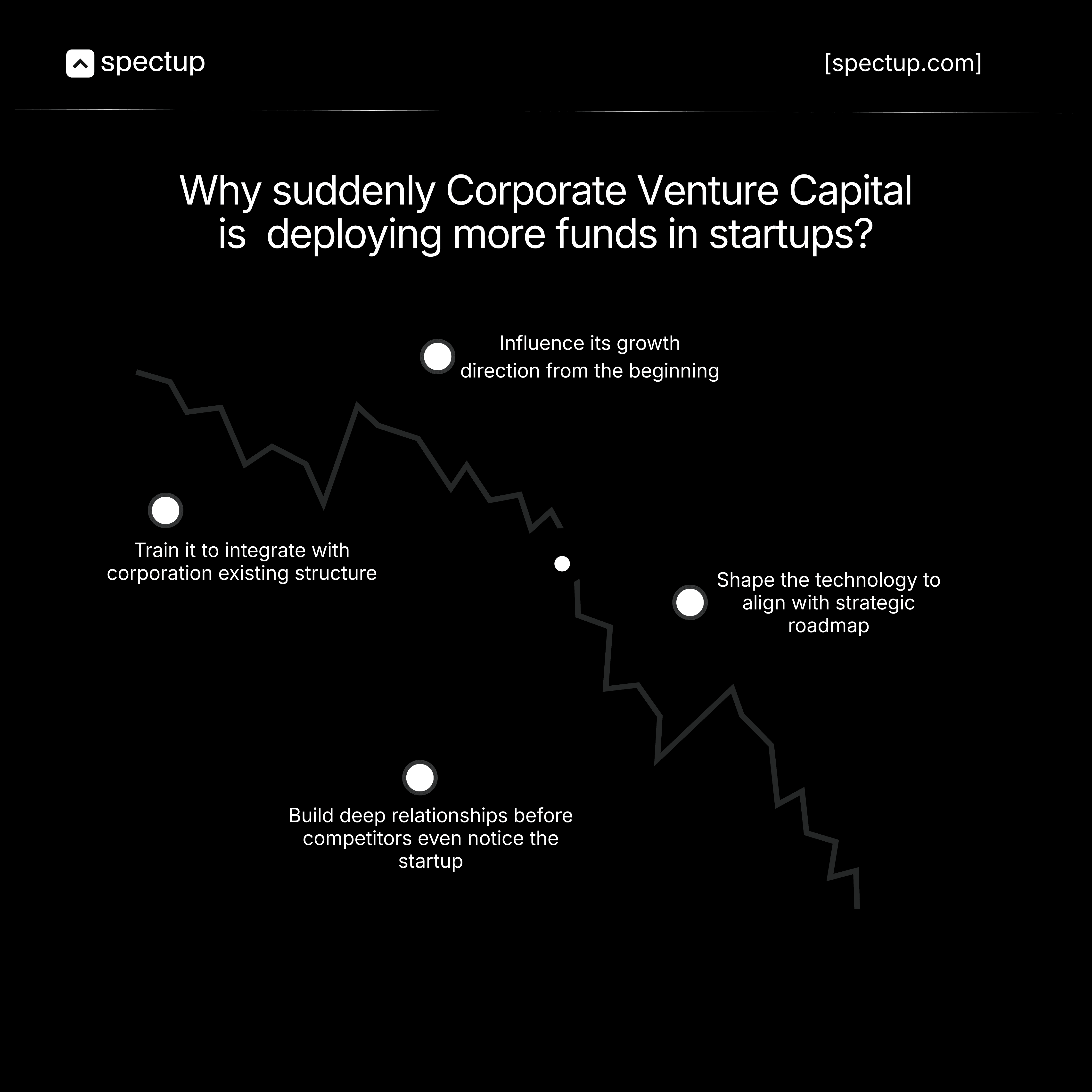

The goals of these Big Corporations behind Corporate Venture Capital Firms are clear:

They invest with a unique, purpose-driven approach.

They deliver more than capital alone.

This symbiotic relationship continues to reshape the startup funding landscape.

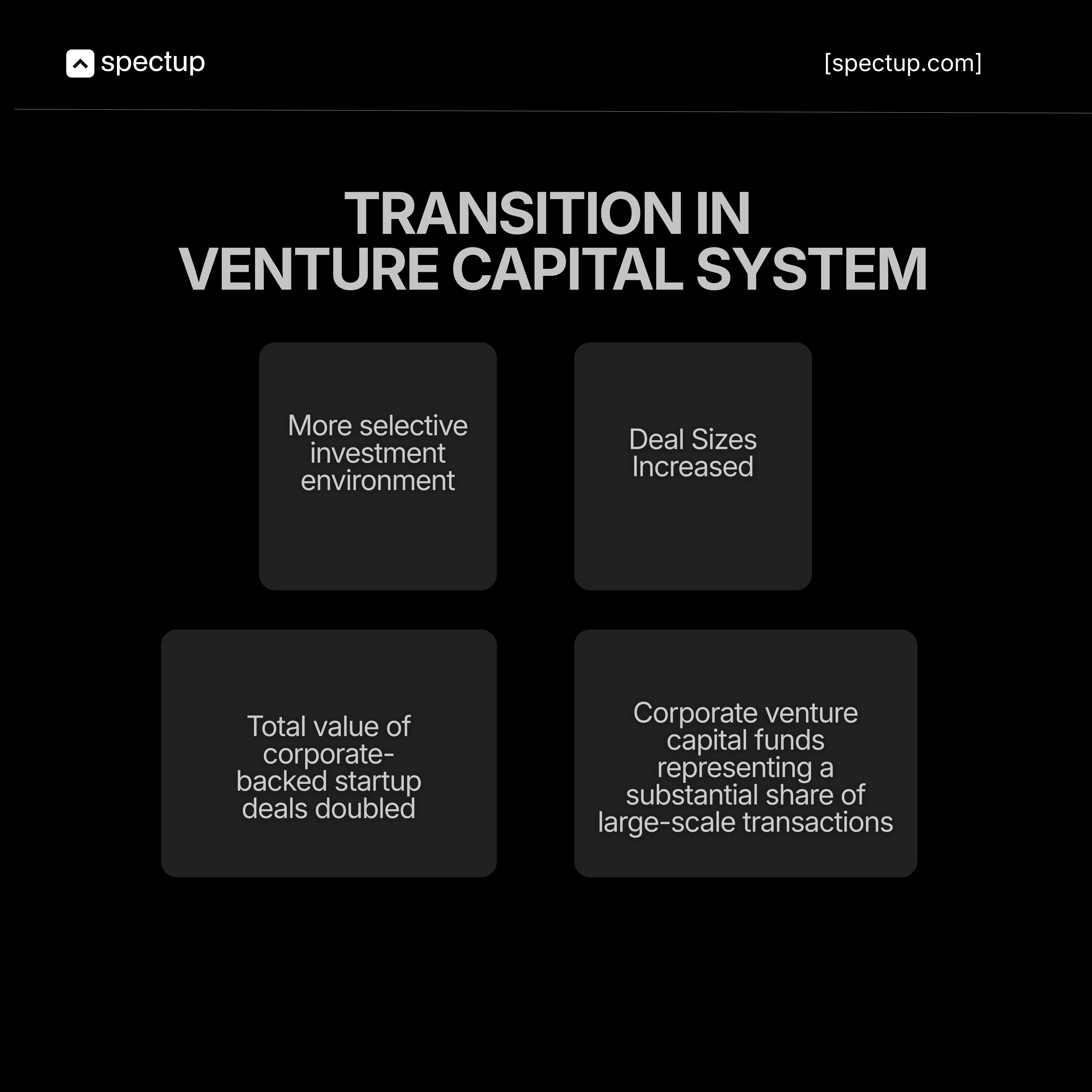

Increasing Trend of Corporate Venture Capital in Startup Fundraising:

Corporate Venture Capitals showed resilience in 2025. According to data from CB Insights and Aranca,

Q1 funding hit $18.7B (-22% QoQ but 2x deal values vs 2024)

With 2,500+ rounds by mid-year and 22% global VC share (up from 15%).

Key 2025 shifts driving 2026:

Bigger, selective deals in AI/robotics/climate tech (70% Americas, Anthropic/xAI targets)

Off-balance-sheet CVC arms for speed + independence

Patient capital (10+yr horizons vs traditional VC's 7yr funds)

2026 outlook:

$28B+ projected as M&A/secondaries boom, per SVB/Dakota forecasts.

Deal sizes will increase markedly

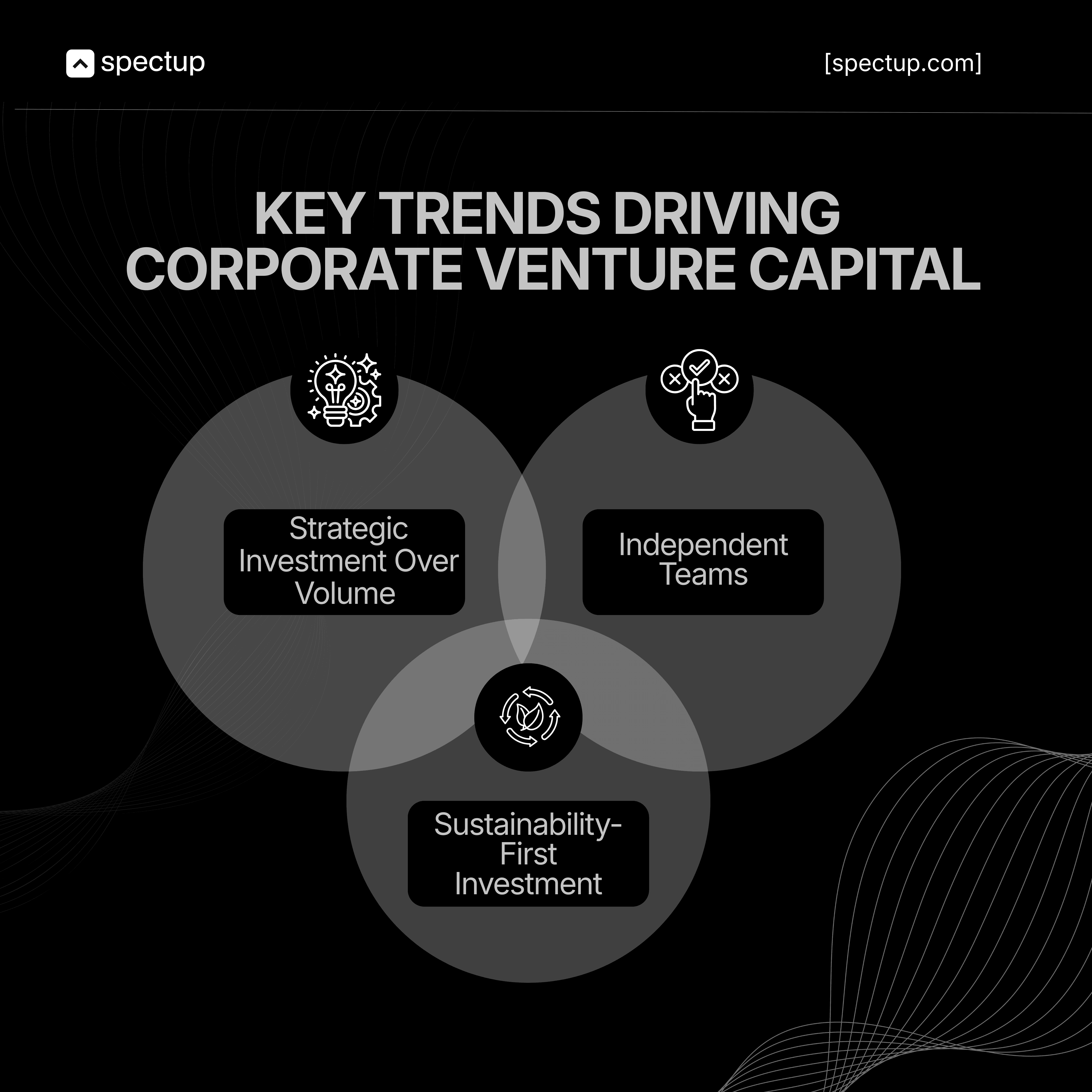

Key Trends Driving Corporate Venture Capital:

Corporate Venture Capital (CVC) evolved from volume investing to strategic precision, with $24B+ deployed in 2025 (22% global VC share, per CB Insights/SVB). Here are the top shifts:

Selective Deep Dives

Old: 50 scattershot bets.

New: 15 high-alignment startups matching 5-year corporate roadmaps.

Result: 35% higher deal success rates.

Off-Balance-Sheet Independence

Old: Bureaucratic corporate teams.

New: Dedicated CVC funds operating like mini-VCs with strategic guardrails.

Example: Intel Capital's regional autonomy.

Early-Stage Tech Shaping

CVCs fund pre-seed/semiconductors (Intel) to influence tech from inception vs waiting for Series B validation.

AI-Powered Diligence

ML cuts eval time 60-70%, scanning 1000s of startups daily for strategic fit (Google Ventures model).

R&D Co-Development

18-month market chips via Intel/startup fab collaboration vs 4-10 years solo development.

More Focus on ESG Solutions

Corporate Venture Capitals are increasingly prioritizing startups developing environmental, social, and governance (ESG) solutions that enrich the soil for future generations.

They're asking: "Does this seedling just generate profit, or does it also improve the entire ecosystem's health and sustainability?"

This represents evolution from extraction-focused to regenerative cultivation practices.

These trends signal a maturing ecosystem where corporate venture capital vs venture capital debates miss the broader point. Both models now coexist and complement each other, creating a richer funding landscape for entrepreneurs at every stage.

What This Looks Like in Practice while Corporate Venture Capital Firms deploy Funds in Startups?

Early Stage Deals are Preferred

Pre-2025 Old Approach

"Series B startup with $10M ARR. Let's acquire at 10x multiple."

Startup Risks:

Tech stack doesn't integrate with our infrastructure

Team culture clashes with corporate environment

Competitors already bidding (valuation spikes 50%)

New CVC approach (post-2025)

Pre-seed AI startup with strong founding team.

Let's invest early

Co-develop the model, and ensure seamless integration with our cloud infrastructure from Day 1

By the time, startup will start giving ROI, it will already be integrated with the coporation,so big gains.

Case Study - How Intel Corporate Venture Funds work?

Intel Capital now actively invests in pre-seed and seed-stage semiconductor startups developing next-generation chip architectures. Rather than waiting until these companies prove market traction (when valuations skyrocket and strategic influence diminishes), Intel cultivates them from inception, shaping their technical development to complement Intel's long-term hardware roadmap.

AI-Driven Investment Analysis and Portfolio Management

CVCs use ML to scan 1000s of startups daily, cutting diligence from weeks to days. On the other side, traditional VCs still manually review 10-15 deals/month.

This results in 60% Faster Evaluations at corporate venture end.

AI Applications in CVC (2026 standard):

Predictive scoring: Spots strategic-fit startups 18 months early

Automated diligence: Reduces eval time 60-70%

Risk models: Quantifies integration risks pre-investment

Portfolio tracking: Real-time KPI monitoring across 100+ companies

Startup Impact:

Traditional: 10-15 deals/month resulting in Weeks per diligence

AI-CVC: 300+ opportunities, thus focus humans on top 15-20

How this resulted in analyzing Millions of Data Points for Google Ventures?

Google Ventures uses machine learning to analyze millions of data points across their portfolio, identifying startups whose technologies could integrate with Google Cloud infrastructure 18-24 months before traditional VCs recognize the opportunity. By the time competitors start bidding, GV has already cultivated deep strategic relationships.

Founder takeaway: AI-CVCs know your strategic fit before you pitch. Align early with their tech roadmap (cloud infra, enterprise SaaS, industry verticals).

3. Corporate–Startup Partnerships for Sustainability and ESG Impact

It's more like Regulatory + ROI Driver focused

CVCs shifted from short-term ROI to ecosystem-building investments, 35% of 2025 CVC deals targeted ESG/climate tech (up from 18% in 2023).

Old mindset: Max returns, ignore externalities

New reality: Regulations + stakeholder pressure demand carbon-neutral supply chains

BMW i Corporate Venture Capital Firm invests heavily in:

Electric vehicle charging infrastructure (preparing the ecosystem for their EV future)

Battery recycling technologies (creating circular sustainability loops)

Smart city mobility solutions (reducing urban carbon footprints)

These investments bring in financial returns as well as they build the infrastructure BMW needs for their long-term sustainability strategy while advancing global environmental goals.

Just like that Salesforce Venture Capital Firm backs climate tech startups that help their customers:

Track and reduce carbon emissions

Implement sustainable supply chain practices

Achieve circular economy transformations

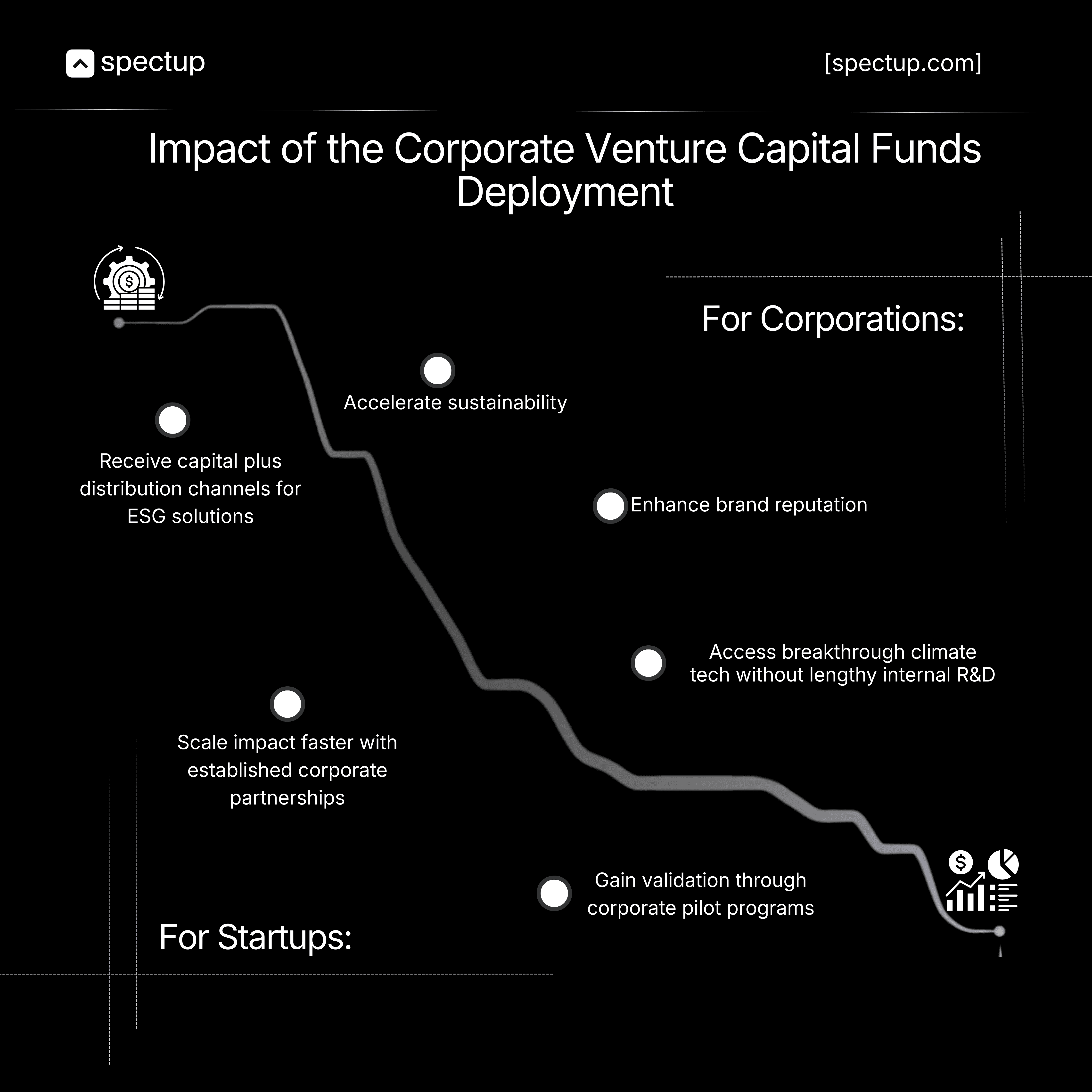

Impact of the Corporate Venture Capital Funds Deployment:

Here is what makes it a win-win situation:

For Corporations:

Accelerate sustainability goals and meet regulatory requirements faster

Access breakthrough climate tech without lengthy internal R&D

Enhance brand reputation with consumers, investors, and regulators

Mitigate risks from environmental regulations and market shifts

Build resilient supply chains and business models for a changing world

For Startups:

Patient capital + corporate pilots = 3x faster scale vs traditional VC

Receive capital plus distribution channels for ESG solutions

Gain validation through corporate pilot programs

Access technical resources and operational expertise

Scale impact faster with established corporate partnerships

Attract additional ESG-focused investors and customers

Beyond Greenwashing: Real Ecosystem Enrichment of Corporate Venture Capital Funds:

The best corporate ESG cultivation goes beyond symbolic tree-planting. It involves:

Deep integration – ESG startups embedded into corporate operations, not isolated showcase projects

Measurable impact – Quantified carbon reductions, waste elimination, or social improvements

Long-term commitment – Patient capital supporting 10+ year sustainability transformations

Ecosystem thinking – Recognizing that planetary health and business success are interdependent

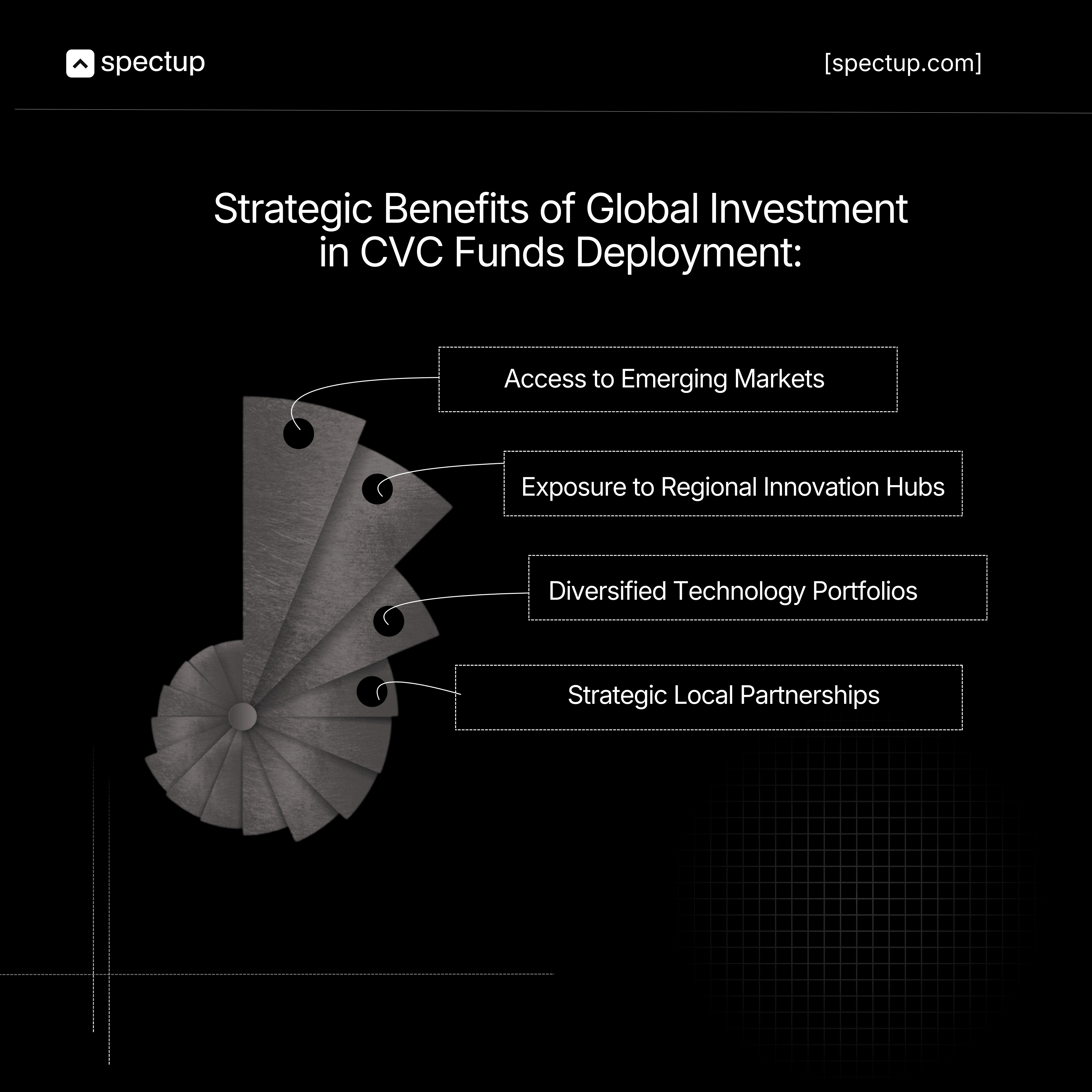

4. Rising Interest in Cross-Border CVC Funds

Globalization continues to drive corporate expansion strategies. Consequently, cross-border corporate venture capital funds have emerged as powerful tools for accessing innovation beyond domestic markets. Corporations now actively seek transformative ideas from diverse international ecosystems to maintain competitive advantages.

CVCs allocate 20-40% of capital to non-US ecosystems as innovation hubs diversify beyond Silicon Valley.

Why cross-border matters:

Regional Strengths:

Israel: Cybersecurity, defense tech (Intel security chips)

India: SaaS, AI services (700M digital consumers)

SEA: Fintech, logistics (Grab, Gojek models)

Brazil: Agtech, renewables (ethanol/biofuel leaders)

Old approach: "German CVC leading to only EU mobility startups"

New reality: "Global BMW resulting in Korea batteries + Israel AV + India fleet SaaS"

Access to Emerging Markets

Corporate Venture Capital provides, access to innovations optimized for markets you haven't penetrated yet.

Example: A U.S. fintech corporation investing in Southeast Asian payment startups gains:

Direct access to 680M consumers in a fast-growing digital economy

Understanding of mobile-first financial services innovation

Relationships with local partners who navigate regional regulations

Early positioning before Western competitors recognize the opportunity

Impact on Startups:

US CVC: 70% → 55% of total deals

Non-US CVC: 30% → 45% (2026 projection)

Diversified Technology Portfolios:

The biological principle: Monoculture orchards are vulnerable to single diseases or climate shifts. Diverse ecosystems survive disruptions.

Cross-border corporate Venture capital firms build technologically diverse portfolios that hedge against:

Regional regulatory changes

Economic downturns in specific markets

Technology cycles that favor different geographies

Currency fluctuations and geopolitical risks

Strategic Local Partnerships:

Smart cross-border Corporate Venture Capital Firms partner with local gardeners (regional VCs, accelerators, innovation hubs) who understand:

Cultural business practices and negotiation styles

Local regulatory environments and government relationships

Talent pools and recruitment strategies

Customer behaviors and market entry tactics

Now, if we look across the globe, we can see real-world impact:

Intel Capital operates dedicated teams in:

Americas (Headquarters: Silicon Valley)

EMEA (Europe, Middle East, Africa)

APAC (Asia-Pacific)

Each regional team cultivates startups optimized for local ecosystems while identifying innovations that can integrate into Intel's global strategy.

This leads to massive impact in terms of ROI and growth.

Integration of Internal R&D with Startup Innovation

More companies now merge their internal research and development efforts with startup innovations sourced through corporate venture capital activities. Consequently, this integration enhances organizational agility while maintaining the disciplined rigor of established corporate processes.

Case studies under Corporate Venture Capital Firms:

Intel Capital + Portfolio Company Collaboration:

Intel invests in an AI chip startup developing novel architectures for edge computing. Rather than just providing capital:

Intel's R&D teams share fabrication process insights and semiconductor design tools

The startup develops specialized architectures using Intel's manufacturing feedback

Joint development projects create chips optimized for Intel's foundries

Both parties benefit: Intel gains breakthrough designs; startup gains manufacturing scale

Result: A chip reaches market in 18 months that would have taken Intel 4+ years internally and the startup 10+ years independently.

BMW i Ventures + Automotive Tech Startups:

BMW invests in autonomous driving sensor companies, then:

Provides test vehicles for real-world sensor validation

Shares regulatory compliance knowledge from decades navigating automotive safety standards

Offers pilot programs deploying sensors in BMW's fleet for market validation

Co-develops integration specifications ensuring sensors work seamlessly with BMW systems

Result: Startups overcome the "credibility gap" (automotive companies won't adopt unproven technologies) while BMW accesses innovations faster than internal development allows.

Why Founders Chase CVC in 2026

CVC is not like Traditional VC: Patient capital + pilots + distribution beats 7-year fund pressure.

Pitch CVC if you have:

PMF + corporate synergy (cloud, auto, energy)

Ready for pilots (3-6 month integration)

12+ month runway post-investment

Skip CVC if you are:

Pre-revenue, no tech alignment

Need fast exits, pure financial VC

Why This Trend Matters?

Corporate Venture Capitals pursuing R&D integration understand something crucial:

The future belongs to organizations that combine startup speed with corporate scale.

Pure corporate R&D moves too slowly in fast-changing markets. Pure startups lack resources to navigate complex industries. Grafted hybrid models create competitive advantages neither can achieve independently.

The unique corporate venture capital strategy sets it apart from traditional venture capital models. Furthermore, this strategic approach explains why startups increasingly seek corporate partners alongside conventional investors. Hence, understanding corporate venture capital structure helps founders make informed decisions.

Additionally, it clarifies why this funding model continues reshaping the startup ecosystem. Corporate venture capital trends show accelerating growth in this space. Consequently, more entrepreneurs now prioritize strategic fit alongside financial terms when evaluating investment opportunities.

Looking forward to connect with investors? Many founders bring in fundraising advisors to help negotiate terms, protect autonomy, and avoid costly mistakes.

Niclas Schlopsna

Partner

Ex-banker, drove scale at N26, launched new ventures at Deloitte, and built from scratch across three startup ecosystems.